Posted on 02/27/2019 8:52:34 AM PST by SeekAndFind

The tax season appeared to be off to a slow start when it opened last month, with initial statistics showing fewer returns filed and smaller refunds issued. While the numbers from the Internal Revenue Service (IRS) were down, expectations were still high. However, a few weeks later, the data is again raising eyebrows: across the board, fewer taxpayers have filed tax returns and refund numbers remain underwhelming.

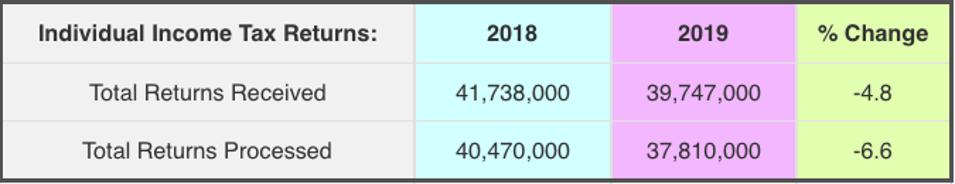

Tax season opened on January 28, 2019. Three weeks into the season (week ending February 15, 2019), the IRS has received 39,747,000 individual income tax returns. That compares with 41,738,000 individual income tax returns received by the same time last year, a drop of nearly 5%.

The IRS also reported a drop in the rate that individual income tax returns were processed. The IRS has processed 37,810,000 returns to date, or nearly 7% fewer returns compared with the same time last year.

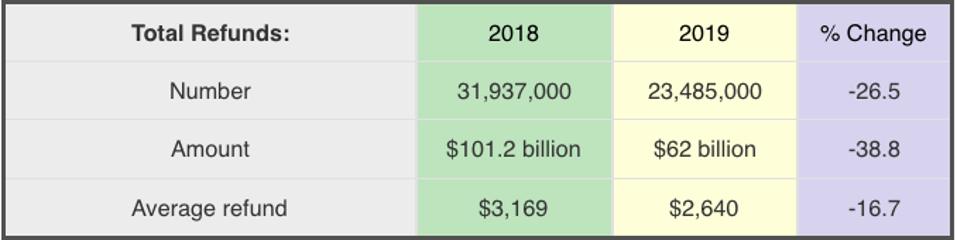

And what about those tax refunds? Tax refund numbers were initially sluggish, but most taxpayers expected those numbers to pick up as the tax filing season progressed. So far, that’s not the case. The IRS has issued just 23,485,000 tax refunds as compared to 31,937,000 for the same period last year. That’s a drop of 26.5% - a bigger drop than at the start of the season. The total amount of tax refunds issued is just $61.993 billion, nearly $40 billion (yes, 4-0, not a typo) off of the pace from last year. That’s a drop of almost 40%.

The math works out to smaller average refunds for taxpayers, too: $2,640 per taxpayer compared to $3,169 for the same period last year, a drop of just under 17%.

(Excerpt) Read more at forbes.com ...

It’s not just the filing and refund numbers that are down. Taxpayers aren’t flocking to the IRS website as much as they did in 2018. So far this year, taxpayers visited irs.gov 161,706,000 times, a 3.3% dip from last year, despite a push by IRS to encourage taxpayers to go online instead of picking up the phone.

There’s only one number that has moved the needle higher in 2019: the number of self-prepared tax returns which were e-filed. Professionally prepared e-filed tax returns fell by 8.5%, but self-prepared e-filed returns weighed in at 21,774,000, reflecting a .1% increase (okay, it’s tiny, but it’s still positive).

It’s not the size of the refund, it’s the amount of the tax paid.

But what the heck, as long as we can sour the public on Trump, right?

The whole point of the tax relief received last year was so that we would enjoy more of what we earned each and every payday, not once we filed a return of our rightfully earned monies loaned to the government.

It stands to reason, when a person pays less in Taxes, their return is less.

People have more take home pay weekly. That’s a Tax Cut!

Exactly. What does every tax professional advise year after year? To pay as little as possible in taxes otherwise you’re just giving the government what amounts to an interest free loan for the year.

I’m glad our refund went down this year. It’s more financially sound!

Logically, if you are getting more in your paycheck, as the result of a tax cut, then you obviously are not going to be getting more of a refund.

Oh, but - silly me - I forgot that logic no longer applies when it comes to you never-Trumper types.

The Democrat strategy is to convince the public that the tax refund represents the total tax paid. The lower your refund, the higher tax that you paid.

These reports are being fed to the media who are lapping it up. By the 2020 elections roll around, the American people will believe that Trump raised their taxes.

This will cost the Republicans if they don’t get out in front of it.

I think that for many this is a negative to the Trump tax cut. They may have noticed their paychecks being a little larger but were counting on their historical returns. There’s a perception for many that the tax cut really took their return and spread it out over the year and they’re not really ahead. I’m talking people in the $40k-$90k family income range.

Which means fewer no-interest loans are being made to the government.

I assume this means that there are less People getting the EITC (Earned Income Tax Credit, a Tax Refund that People get without having to pay any Income Taxes in the first place) because they are actually working now.

If you normally itemize and live in a liberal hell hole and pay high state property taxes like my wife and I do... this thing really bites you in the butt. Not to mention other deductions that have been altered and made very confusing. There is no way to convince people that paying more money in taxes is good for them. This change in the tax code was over-hyped and watered down.

I do not know how this all shakes out, but by the time the next election arrives there will be a plethora of negative statistical info collected regardless of the actual benefits. There are winners and losers in this change in the tax code and we all know who the media and the Democrats will focus on.

I am thrilled this year. The huge standard deduction helped us immensely. We only had to pay $18 this year, last year it was $600. About as close to $0 as we could get.

That’s good news. Fewer people over-paid and had more in their pocket to spend, or better yet, invest and earn a little interest on. A big tax return at the end of the year means you didn’t properly set withholding and your money was tied up a whole year doing nothing.

If I’m getting a refund, I file quickly to beat the rush. If I owe money, I don’t file until April. Kinda “well duh”.

Plus, the whole premise was you’d have less withheld so you’d keep more. It wasn’t so you’d have bigger refunds.

You are correct, but I am quite happy about the fact that I am no longer subsidizing your high state and local taxes. No sympathy from those out here in fly over country.

I'll owe a few hundred when I pay on April 15. But I saved a lot more during the year and put it in my 401k.

Smaller refunds? Is that the right question? Aren’t people paying less each pay period, thus have less to be refunded as they kept more up front?

President Trump needs to do some evening “fireside chats” with the American people. Simple 5-10 minute talks. Such as here, on why their refunds are smaller. BECAUSE LESS TAXES WERE SEIZED DURING THE YEAR!

Obviously, we are just flat out losing interest in filing taxes...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.