Skip to comments.

Reality Check: The Facts vs. the Left's Top Two Lies About Tax Reform

Townhall.com ^

| November 30, 2017

| Guy Benson

Posted on 11/30/2017 3:43:33 PM PST by Kaslin

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-28 last

To: morphing libertarian

If it gets on the Ballot, I’ll Vote for it.

My comment is based on what I see, nobody cares. It’s the same old, same old and as long as the Rats have a Super Majority here they will figure out another way IF the Ballot Proposition passes.

Ten to one a Liberal CA Judge will invalidate the Proposition if it ever sees the light of day anyway.

21

posted on

11/30/2017 7:12:09 PM PST

by

Kickass Conservative

( Democracy, two Wolves and one Sheep deciding what's for Dinner.)

To: Kickass Conservative

It won’t be on the ballot if people don’t sign the petitions.

22

posted on

11/30/2017 7:42:32 PM PST

by

morphing libertarian

(A proud member of the Ruthie Bader Afternoon Nap Club)

To: Mariner

23

posted on

11/30/2017 7:56:00 PM PST

by

lightman

(ANTIFA is full of Bolshevik.)

To: Kaslin; Mariner; SkyPilot

In the interest of intellectual honesty and transparency, let's begin with a few important concessions to skeptics of the GOP tax reform bill: First, not every single American would be a winner under the plan. A small percentage of US taxpayers would see a tax increase (disproportionately, these would be higher-income itemizers from high-tax states), and a number of deductions that help certain people with heavy medical expenses and student loan debt would be eliminated (proponents say much or all of the resulting blow would be mitigated by lower rates and a doubled standard deduction). In the interest of FRee discourse and full disclosure, as one of that unfortunate minority in the People's Republic of Pennsyltucky I'm looking at a 30 - 50% tax INCREASE.

And that will change my vote from GOP to Libertarian forever.

24

posted on

11/30/2017 8:00:42 PM PST

by

lightman

(ANTIFA is full of Bolshevik.)

To: ProtectOurFreedom

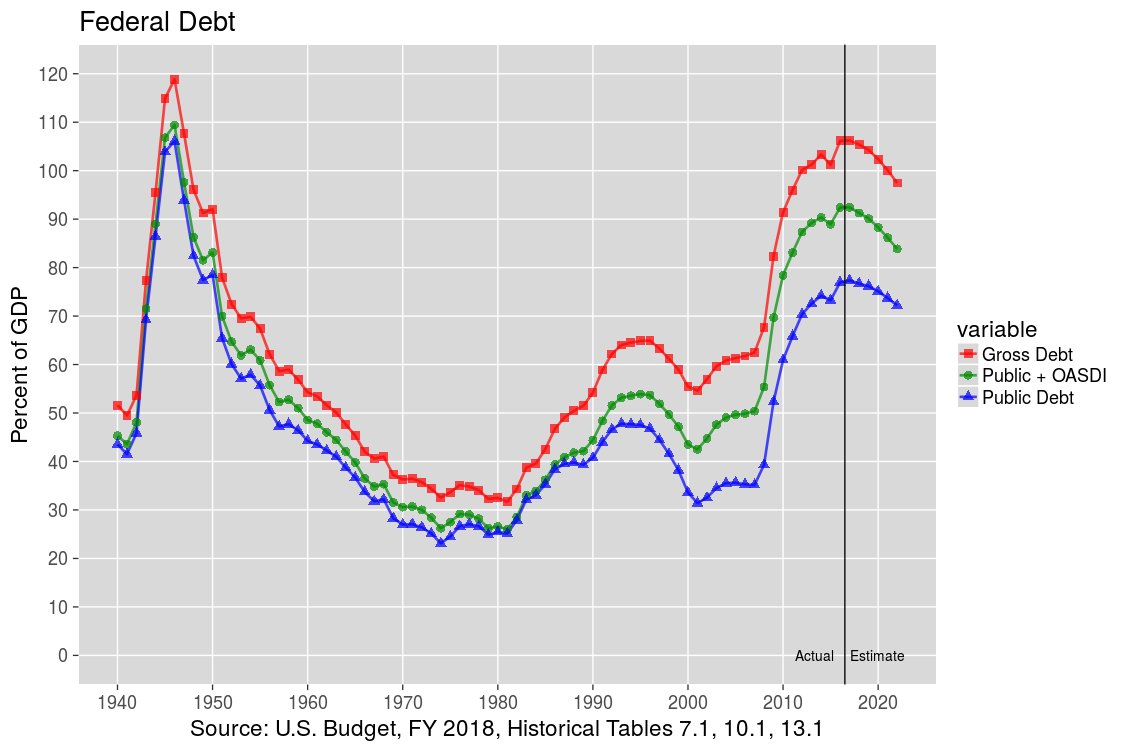

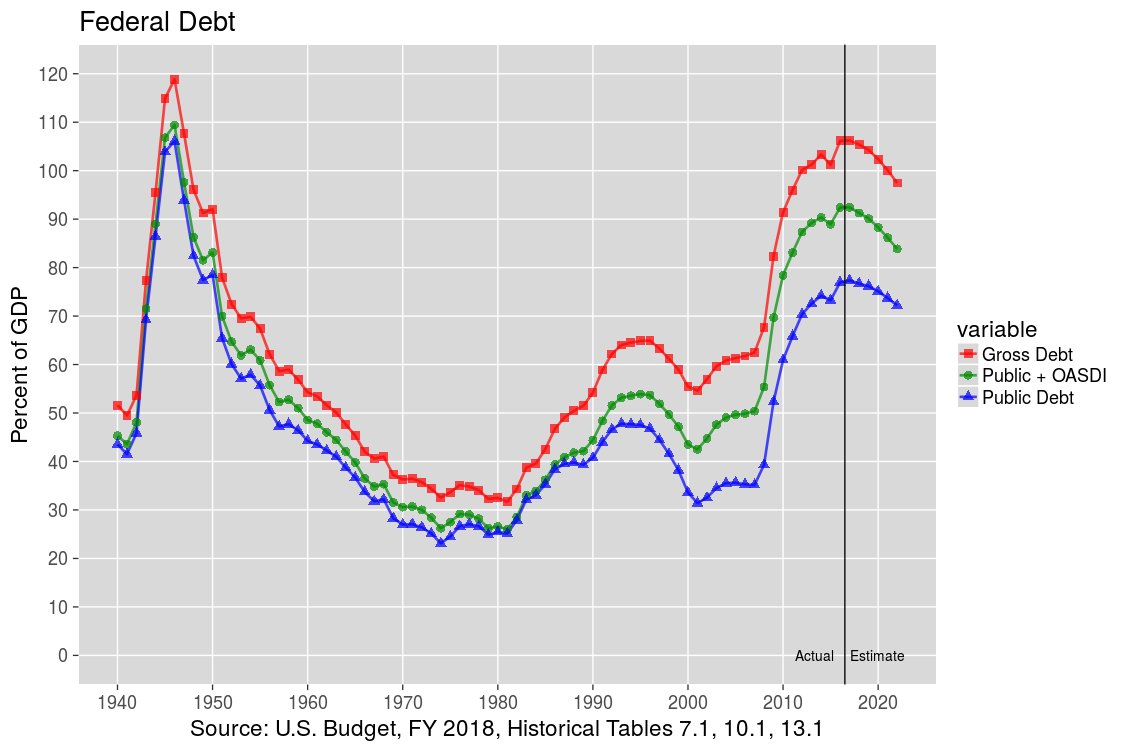

Same with me. 45 years of retirement financial planning thrown out the window by Republicans in the very same year I retire. Many thousands of dollars in tax hikes I was not planning for. Yes, it seems very unconservative to ram through radical changes in the tax law. I guess that they don't believe in letting people adjust to any of the changes by phasing them in. The only way to be safe is to save every penny that can since you never know when they're going to change all the rules in Washington. That's especially the case judging by the following graph of the federal debt:

You can find the numbers at this link. As you can see, at 106 percent of GDP, the gross debt is much higher than it was during Reagan's 1986 tax reform (46.7% of GDP) or even Bush's 2001 tax cut (54.6% of GDP). Now we're tacking on another $1 trillion of debt according to the latest JCT report, even under dynamic scoring. All just in time for the Boomer retirement, nine years into an expansion when we have historically had recessions every 10 years or so. But maybe this time it's different.

25

posted on

12/01/2017 2:45:51 AM PST

by

remember

To: RKBA Democrat; SkyPilot; All

Here is a quick analysis of the senate tax plan. With last years tax return in hand you can figure out about where you’ll come out in about 5 minutes. There's also an up-to-date calculator at https://econdata.shinyapps.io/taxcuts/ that can give your tax cut and change in your after-tax income for the House and Senate bills. It gives the same results as examples put out by the House, the Senate, and the Tax Foundation.

26

posted on

12/01/2017 2:53:41 AM PST

by

remember

To: remember

What might happen?

1.High tax states reduce their taxes. Ha, ha, ha, ha...

2. People leave high tax states for low tax states. Real estate prices in high tax states drop; in low tax states, real estate goes up.

3. Companies can no longer get talent in high tax states because housing prices are still way too high and residents can not deduct SALT. Companies relocate to low tax states. This reinforces housing price adjustments.

4. High tax states are eventually forced to reduce taxes and taxes get some control on their spending. This will be difficult with huge public employee pension costs.

Re-establishing equilibrium will take years.

To: ProtectOurFreedom

This relieves the other states from subsidizing the high tax states.

28

posted on

12/01/2017 4:31:00 AM PST

by

Neoliberalnot

(Marxism works well only with the uneducated and the unarmed)

Navigation: use the links below to view more comments.

first previous 1-20, 21-28 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson