Skip to comments.

The Tax Bill: Placing a Dagger in the American Dream of Home Ownership

Huffington Post ^

| 11 Nov 17

| Miles Zaremski

Posted on 11/12/2017 3:50:03 AM PST by SkyPilot

As we now know, both chambers of Congress have introduced their versions of legislation to overhaul our tax system, or, rather, the tax code. Some say it is reform, others more properly say it is merely a tax cut for the wealthiest and most powerful of American persons and corporations at the hands of those less fortunate, the middle class. But to give the rich their largesse, the middle class is being looked to as the sacrificial lamb by having certain deductions stripped away from them. Among the most critical of these deductions are the ones that make home ownership——the American “dream”—-more impossible to achieve. They are state and local taxes and property taxes (”SALT”) which promises to become a real lightening rod in passing any tax legislation in the weeks and months ahead (Senate Tax Plan Diverges From House Version, Highlighting Political Pressures). Lessening the mortgage interest deduction, as House Republicans are wanting to do, is also a problem (How The Republican Tax Plan Could Change Mortgage Interest and Property Tax Deductions).

In recent days, Congressman Peter King (R-NY) said he will not vote for the removal of any such deductions since it will mean his constituents in NY (Long Island) will find their federal income taxes going up. He espouses a view in microcosm held by millions across the nation in middle class suburbia that pay high state and local taxes. Besides New York, other states like Connecticut, Illinois and California readily come to mind. But, who cares, so says Republicans in states that do not have high SALT; what is important is to “feed” the pocketbooks of the “uber” class——Republican donors and fatcats. This is the Robin Hood scenario but in reverse-take from the poor and give to the rich.

(Excerpt) Read more at huffingtonpost.com ...

TOPICS: Business/Economy; Extended News; Government; News/Current Events

KEYWORDS: 115th; mortgage; propertytaxes; senatetaxplan; taxbill; taxes; trumptaxcuts; trumptaxplan

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 141-146 next last

Rep. King also said that tax deductions impacting home ownership had their beginning 104 years ago. 104 years ago? Well, he was correct. The history of these deductions had as their genesis the Revenue Act of 1913, the post Sixteenth Amendment legislation creating the modern individual income tax (The State and Local Tax Deduction: A Primer). These deductions have had, to be sure, a colorful legislative history, most currently in the 1980s, which called for the complete elimination of them as part of discussions involving the Tax Reform Act of 1986. But, in the end, this most recent major tax legislation kept in place these deductions. It is thus not the purpose to explain why these deductions were created, have remained in place, or their purpose, but what has occurred for over a century that made these deductions valuable for home ownership. In a nutshell, taxes imposed by local and state taxing bodies have gone up considerably to finance public goods and services; the price of housing has gone up; and the ability for millions of Americans to attain this “American dream” has for millions hardened over the decades. So these deductions have had a valuable place to at least offset price increases in paying the tax collector; affording the cost of a home; and paying the interest charged by mortgage companies to finance mortgages on individual residences. Remember the days of double-digit mortgage interest for long time homeowners, many of whom are probably retired by now?

All true.

The House bill (HR 1, Sec. 1303(B)) caps the property tax deduction at $10,000.00, and reduces the mortgage interest deduction from $1.0M to $500K. SALT was to be eliminated entirely, but that is now being negotiated as part of amendments to the House bill. The property tax cap would apply for taxable years after December 31, 2017, but, critically, not only would it apply to new purchases, but to existing homeowners too!

Nice.

For those who still have blinders on, and think he way to prosperity is to screw over the 25% (and that percentage climbs each and every year of this bill) of the middle and upper middle class who are going to be "paying for" the massive tax cuts for corporations, you should realize that secret is out: the House and Senate bills are NOT written to lower your taxes. They are written to appease the donor class and lobbyists who want pay back.

House Republican: my donors told me to pass the tax bill “or don’t ever call me again”

Chris Collins is saying the quiet part loud.

/cdn.vox-cdn.com/uploads/chorus_image/image/57501545/3.22.3.0.jpg)

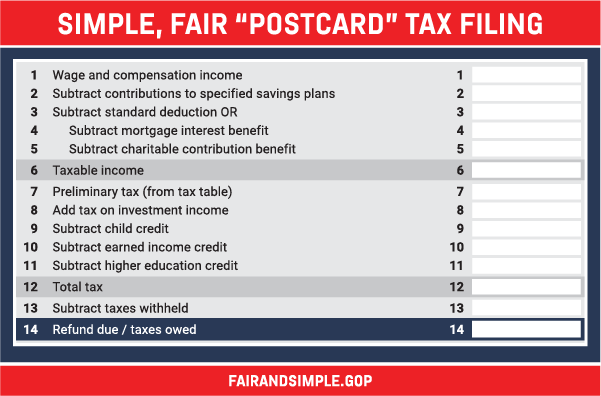

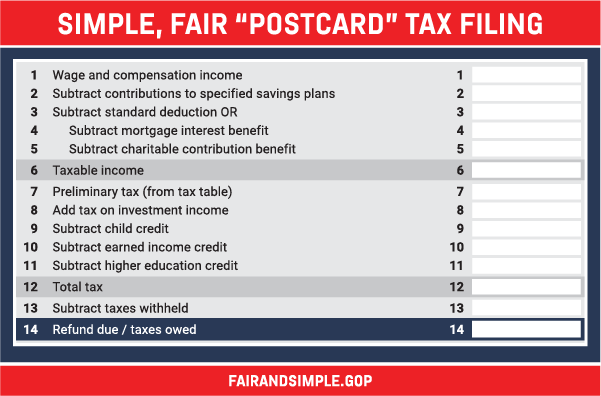

Oh, and Paul "Post Card Made By My Staffer Using Excel and PowerPoint Gimmick" Ryan's squawk about doubling the standard deduction - and how great that is?

What he isn't squawking about to the press is that they are also eliminating entirely the personal exemption.

http://freerepublic.com/focus/f-bloggers/3603755/posts

Do the math folks.

Whenever challenged with the reality that their proposal will result in a tax increase on many of their constituents, they exclaim, “Yes, but we are doubling the standard deduction!” Yet, not one of them ever mentions that they are, simultaneously, repealing the personal exemption deduction of $4,150, per person.

In 2018, the standard deduction for single filers will be $6,500, and for married taxpayers filing jointly $13,000, while the personal exemption will be $4,150 (per person). That means a single non-itemizer would already have received $10,650 ($6,500 standard deduction + $4,150 personal exemption) of tax exempt income before the proposal, versus $12,200 after. And, a married couple, without children and not itemizing, would already have received $21,300 of tax exempt income before the proposal, versus $24,400 after.

For single filers, the difference between $12,200 and $10,650 isn’t double, it’s only $1,550. For married couples, the difference between $24,400 and $21,300 is a mere $3,100. This isn’t a doubling of the standard deduction. It is effectively an increase to the standard deduction of $1,550 for single filers and $3,100 for couples without children. So, please stop lying to us.

And to the defenders of this garbage of a bill, I hope you enjoy the "Rob Peter To Pay Mark Zuckerberg Act." Because once it passes, it will screw over you, your kids, and your grandkids for decades to come.

1

posted on

11/12/2017 3:50:03 AM PST

by

SkyPilot

To: SkyPilot

“state and local taxes and property taxes “

The federal tax system should not be used to allow states and municipalities to raise their taxes.

These taxes are as high as they are partly because the federal tax system gives a break for having paid them.

The real reason for the dems opposing the changes is that to them, the tax system is sacred, up there with abortion and false charges of racism. The tax system takes money from those who earn it and gives it to those who vote democrat.

2

posted on

11/12/2017 3:58:06 AM PST

by

I want the USA back

(Leftism is an elaborate system for hiding shame behind a cheap mash of virtue. -Klavan.)

To: SkyPilot

If you look at the areas most impacted by this, you’ll quickly realize young Americans haven’t been able to afford homes there for years. Not that the prices are too high, but the McJobs available would prevent those people from making property tax payments - even if the homes were given to them outright. Here in northeastern NJ our property taxes are approaching (and in some areas have exceeded) the cost of a monthly rent for an apartment.

3/4 of those taxes go right to public schools; childless young Americans see little point if spending so much on foreign children.

3

posted on

11/12/2017 3:59:18 AM PST

by

kearnyirish2

(Affirmative action is economic warfare against white males (and therefore white families).)

To: I want the USA back

You’re parroting Ryan’s talking points. I already posted a couple of links you need to read more closely.

4

posted on

11/12/2017 4:01:26 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: I want the USA back

„state and local taxes and property taxes “

The federal tax system should not be used to allow states and municipalities to raise their taxes.

These taxes are as high as they are partly because the federal tax system gives a break for having paid them.

The real reason for the dems opposing the changes is that to them, the tax system is sacred, up there with abortion and false charges of racism. The tax system takes money from those who earn it and gives it to those who vote democrat.“

this is correct

5

posted on

11/12/2017 4:04:25 AM PST

by

vooch

(America First Drain the Swamp)

To: SkyPilot

So I guess health insurance deduction for small business owners is out

6

posted on

11/12/2017 4:12:46 AM PST

by

RummyChick

(I have no inside sources, media sources, or federal government employee sources. NONE)

To: SkyPilot

. . . caps the property tax deduction at $10,000.00, and reduces the mortgage interest deduction from $1.0M to $500K This limit makes sense, the change in personal deduction doesn't and is proof that the pigs in DC worship the "revenue neutral" golden calf whether the pigs claim they're democrat or claim to be republican.

7

posted on

11/12/2017 4:19:22 AM PST

by

Rashputin

(Jesus Christ doesn't evacuate His troops, He leads them to victory !!)

To: RummyChick

Many retirees live off dividends, why are dividends taxed her in USA and not in some other countries.

Dividends come to people who hold invested income that was taxed when it was earned initially.

Dividends therefore are double taxed. Obama raised the rate on taxing them. Why is there nothing about lowering the dividends taxes or eliminating them?

To: Zenjitsuman

I have a lot of qualified dividends. They get a small tax break. Probably going to throw that out too

9

posted on

11/12/2017 4:30:47 AM PST

by

RummyChick

(I have no inside sources, media sources, or federal government employee sources. NONE)

To: RummyChick

Reagan said “why can’t government learn to live with less money?”

To: SkyPilot

Blah blah blah - always folks who will be upset about anything and while they cry "NIMBY", they say OK as long as it's others who are affected and they manage to avoid any inconveniences.

Dram a Queen stuff "screw kids/grandkids for time..." does nothing to address the fact that we have all become our own personal welfare babies by becoming addicted to government handouts designed to make us beholden to the government. My wife and I bought withing our means and never paid enough to benefit from the tax breaks - others with a lot more money struggled because they bought at the top of their perceived means and even the breaks didn't give them enough slack to be comfortable and plan for retirement.

We have all become so accustomed to government "largess" (like a drug dealer hooks users) that any perceived "gonna take sumpin away" creates panic instead of a question about whether that sumpin is even constitutional and whether it actually helps or hinders for the long term...

11

posted on

11/12/2017 4:34:25 AM PST

by

trebb

(Where in the the hell has my country gone?)

To: SkyPilot

New home buyers will move to more tax favorable states.

12

posted on

11/12/2017 4:35:59 AM PST

by

Raycpa

To: kearnyirish2

““state and local taxes and property taxes “

The federal tax system should not be used to allow states and municipalities to raise their taxes.”

Agree. State and local deductions shift greater tax burden to states with no income tax. Some more gov perks I nominate to be eliminated are; ethanol, wind power generators, electric cars (I.e. tesla), the numerous stupid government grants to academics. The list is almost infinite. Drain the swamp, blue swamp creatures, red swamp creatures, get’em all, lol!

13

posted on

11/12/2017 4:41:22 AM PST

by

snoringbear

(,E.oGovernment is the Pimp,)

To: snoringbear

State and local deductions shift greater tax burden to states with no income tax.I have never understood that line of thinking at all. I've lived in both kind of states, some with state taxes some without . I never thought it was unfair. It all one big Federal Treasury. All tax cuts are good. Al deductions are good.

14

posted on

11/12/2017 4:45:59 AM PST

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: Raycpa

New home buyers will move to more tax favorable states. As I have paraphrased this quote on FR in recent days: the power to tax is the power to destroy.

Is this what we Conservatives have come to?

That people's homes, their lives, where they chose to raise their children, where they take care of their elderly parents, where they worship - all of that should be destroyed because we support a Federal tax raise on the middle and upper middle class?

Really?

If that is a "Conservative" position these days - count me out.

15

posted on

11/12/2017 4:57:10 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: Raycpa

New home buyers will move to more tax favorable states.The tax subsidies inflate the purchase price of homes. This primarily benefits mortgage lenders and realtors, whose income based on a percentage (of the mortgage and the purchase price respectively) and who therefore have a vested interest in higher prices. Remove the subsidies and purchase prices will decline, benefitting buyers.

But you have to be able to connect the dots to understand this. Few people will stop to think it through, and given the politics involved, the media will actively conspire against informing the public.

Now: a complication. The prospect of lowering purchase prices will scare current homeowners, for whom their home equity is likely a big part of net worth. The House bill grandfathered deductibility as a partial protection. As a practical matter, the political question will be whether the downward pressure on housing prices affects nominal prices. If it takes the form of housing prices rising more slowly than they would otherwise, existing equity would not be affected and the change would not be resented. If housing prices actually fell, there would likely be a reaction. This may very well vary from place to place.

But either way, this is a transitional issue. There is no public purpose served by artificially inflating housing prices to enrich realtors and mortgage lenders. We have a policy induced bubble in housing prices. The bubble should be eliminated.

16

posted on

11/12/2017 5:00:20 AM PST

by

sphinx

To: RummyChick

So I guess health insurance deduction for small business owners is out I suppose so. The House bill also eliminates the deduction for medical expenses. It also eliminates deductions for adoptions.

What has happened here is this: Congress wants to give all of the goodies to the corporations and the donor class. They are the only winners here.

In order to slash the corporate rate from 35% to 20%, Congress had to go through the Tax Deduction Sofa, looking for loose change.

As another Freeper pointed out, this isn't a "Tax Cut" bill. It is a Deduction Cut bill that is a massive de facto tax increase on millions of Americans. Even Mitch "I Got Thrown Out Of the US Army For Sexually Assaulting a Fellow Soldier" McConnell had to admit as much - and now the other Senators and Congressmen are angry with him.

17

posted on

11/12/2017 5:01:18 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: trebb

Blah blah blah Right back at you buddy.

Blah, blah, blah.

The next issue on FR that you post that you care about, and that burns you or ones you love - I hope all other Freepers just tell you to quit your whining. Blah, blah, blah.

18

posted on

11/12/2017 5:03:18 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: snoringbear; SkyPilot

snoringbear, your response directed to me seems to be intended for SkyPilot. FRegards!

19

posted on

11/12/2017 5:04:19 AM PST

by

kearnyirish2

(Affirmative action is economic warfare against white males (and therefore white families).)

To: SkyPilot

I find too many clients over estimate the value of the tax benefits of home ownership and therefore over extend themselves. They buy into the false assumption that they are loosing out if they are not buying the biggest most expensive home they can afford. It’s a lie and it puts massive stress on young homeowners. Less tax benefits to me means homeowners making more rational decisions. The result is a healthier economy particularly on downturns.

20

posted on

11/12/2017 5:05:22 AM PST

by

Raycpa

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 141-146 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

/cdn.vox-cdn.com/uploads/chorus_image/image/57501545/3.22.3.0.jpg)