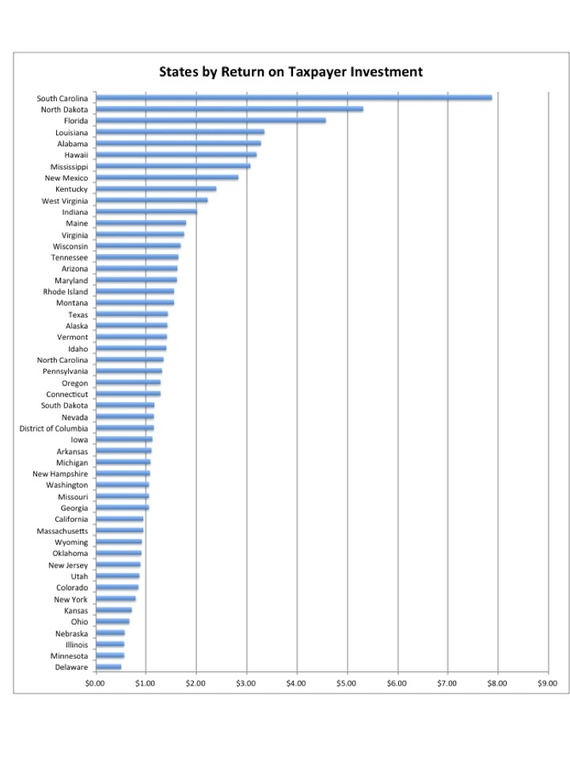

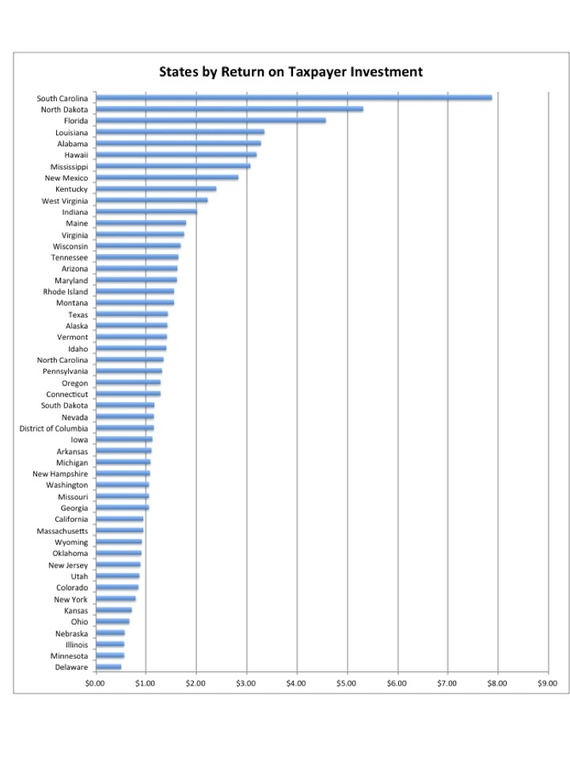

Helpful chart...

Posted on 11/03/2017 9:40:15 AM PDT by mtrott

House Republicans claim the tax plan they introduced Thursday keeps the top individual rate unchanged at 39.6 percent—the level at which it’s been capped for much of the past quarter-century. But a little-noticed provision effectively creates a new band in which income is taxed at over 45 percent.

(Excerpt) Read more at politico.com ...

That’s a good point. Tax rates are not hard to change in the future. It’s the underlying structure of the tax code that only seems to change once every few decades.

The same can be said for all states. All states send more in than they receive back. How else could the Federal Government pay for the military, congress and all other federal programs. If the blue states vote for "stuff" that causes them to pay more state taxes why should states like Texas that live within there means have to subsidize them?

Helpful chart...

CA is only a net payor because of Hollywood and/or Silicone Valley. If it lost either of those two, I bet CA wouldn’t be even close to paying in more than it receives.

That’s not the fine print. That is someone’s interpretation and general summary of the issue that they suppose exists in the administrations plan. The important details are the proposed legislation (which may not exist quite yet as an initial draft) or a detailed position paper released by the administration. Until you see something like that, and preferably a draft or specific bill (or amendment) language, you never know if this is actually in the administration’s proposed plan or is just noise generated by the media with the intention of fragmenting support for tax reform.

The sad fact of the matter is there just aren’t enough down-the-line Conservatives in this country to win elections anymore. Particularly on economic issues. The GOP did this largely by linking Free Trade to all of the other supply side issues. The voters have rejected Free Trade and are in the process of rejecting the rest.

What’s the source of that chart? Some of those numbers seem way off.

I see — thanks for that clarification!

There never were. Even so-called "conservatives" have been the biggest defenders of Federal entitlements for years.

I’ll also point out that my post may not be completely correct. I’m trying to interpret what seems (to me) to be a very confusing description of this “hidden bracket.” LOL.

Yup, and I’m sure they write it to be confusing and allow gray areas they can slip through themselves.

But it sounds like yes, from $1M to $1.2M, you will be “taxed” at a rate of 45%. But, your cumulative tax rate over all income at that point is still less. Ultimately, it’s not really a separate tax bracket, it’s simply a $12k drop from where in your income you start paying taxes.

The chart is from a 2014 article from the Atlantic (updated this March...

Here is a more in depth article from this year with lots of charts that show basically the same thing...

https://wallethub.com/edu/states-most-least-dependent-on-the-federal-government/2700/

Don’t get me wrong, this is a messed up state and I am going to take my money and leave when I retire in a few years. My point is the portrayal of CA as a state dependent on other states for survival is wrong and this tax bill will make CA much more of a “giver” state.

Ok, reading the article more thoroughly (on phone so I just skimmed it earlier), it looks like this has nothing to do with the increased standard deduction, even though the article mentions it. This tax increase is weird. I think they’re going to 4 brackets, with rates of 12%, 20%, 30%, and 39.6%, or something like that. What this does, is it slowly changes just the first bracket ($0-45k) into the highest bracket once you reach $1M in taxable income.

So, at $1.2M+, your tax brackets’ rates would be 39.6%, 20%, 30%, and back to 39.6% again.

See #33 please. It was meant for you, but I replied to wrong comment.

I think a lot of the griping you hear would be covered by a return of personal exemptions- but they need to not “pay” for them. All the “pay for them” requirement means is that Congress picks winners and losers.

The s8mple fact is that Congress wants to keep the paper revenue levels because they get Uber-wealthy from kickbacks and bribes from dolling out that revenue to special interests in government spending.

you mean the economically productive parts of California?

I suspect a lot of this may be a function of how Social Security and Medicare relate to the numbers -- both in terms of taxes paid as well as benefits received. These numbers are misleading for densely populated states with high state taxes like New Jersey and Connecticut. These states have a lot of working-age people who pay Social Security and Medicare taxes, but Federal outlays to SS and Medicare recipients are probably very low because our retirees get chased away due to the high cost of living.

CA doesn’t send anything to the Feds, CA’s taxpayers do. CA’s taxpayers get to deduct our ridiculously high income taxes from their federal returns, which I’d bet isn’t factored into that dollars sent vs returned. It essentially masks ~35% of the state income tax burden by returning it off the top of the taxpayers federal tax liability.

You’re right (semantics). It is our money they send. Even with being able to deduct the high state taxes, CA is not a dependent state as someone above stated. That ratio will likely rise under this new tax plan. This is redistribution and the 46% bracket should make it even less supportable by conservatives.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.