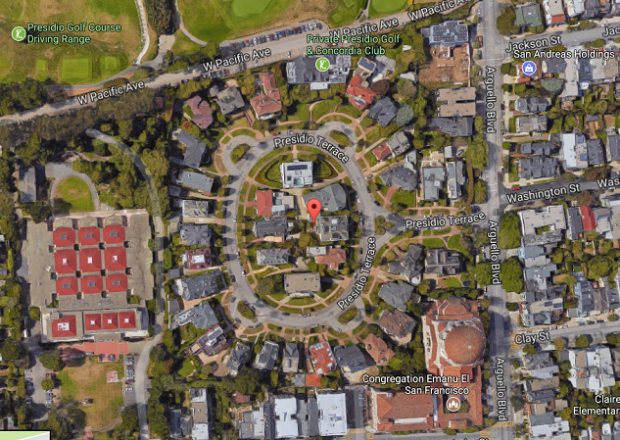

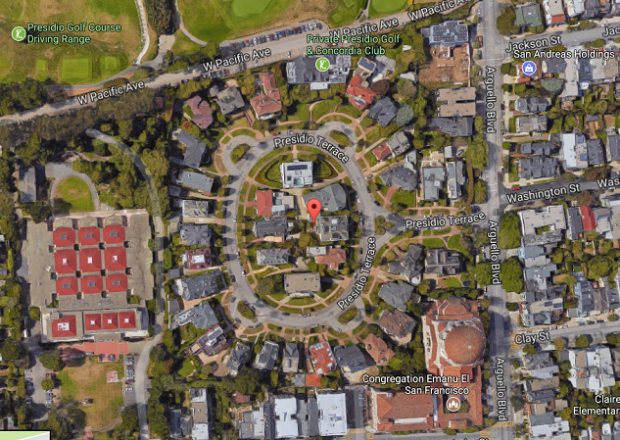

Exclusive, gated street on which Pelosi and Feinstein once lived.

Posted on 08/08/2017 1:09:49 PM PDT by servo1969

Exclusive, gated street on which Pelosi and Feinstein once lived.

The wealthy residents of San Francisco's exclusive, gated Presidio Terrace haven't paid a $14/year tax bill for three decades. This led the city to auction off the tony street that boasts among its former residents House minority leader Nancy Pelosi (D-CA) and Senator Diane Feinstein (D-CA). The auction was an attempt to recoup its delinquent tax losses valued at less than a thousands dollars (including penalties, interest, etc.).

Officials hit the jackpot when a young couple purchased the street at auction two years ago for $90,100. The new owners are reportedly toying with the idea of charging residents and even outsiders (gasp!) to pay to park on their shiny new street.

Now the current residents of the street are outraged and have filed formal complaints and even a lawsuit in an attempt to rescind the sale.

The San Francisco Chronicle reports:

Thanks to a little-noticed auction sale, a South Bay couple are the proud owners of one of the most exclusive streets in San Francisco -- and they're looking for ways to make their purchase pay.

The homeowners apparently only found out about the sale earlier this year, and they are moving to retake their street.

The San Francisco Chronicle continues:

The homeowners, however, are crying foul and want the Board of Supervisors to negate the sale.

. . . . They didn't learn that their street and sidewalks had been sold until they were contacted May 30 by a title search company working on behalf of Cheng and Lam, said Emblidge. The title search outfit wanted to know if the residents had any interest in buying back the property from the couple, the lawyer said.

"I was shocked to learn this could happen, and am deeply troubled that anyone would choose to take advantage of the situation and buy our street and sidewalks," said one homeowner, who asked not to be named because of pending litigation.

Last month, the homeowners petitioned the Board of Supervisors for a hearing to rescind the tax sale. The board has scheduled a hearing for October.

In addition, the homeowners association has sued the couple and the city, seeking to block Cheng and Lam from selling the street to anyone while the city appeal is pending -- a move residents fear could complicate their efforts to reclaim the land.

The residents say the city had an obligation to post a notice in Presidio Terrace notifying neighbors of the pending auction back in 2015 -- something that "would have been simple and inexpensive for the city to accomplish."

Treasurer-Tax Collector Jose Cisneros' office says the city did what the law requires.

"Ninety-nine percent of property owners in San Francisco know what they need to do, and they pay their taxes on time -- and they keep their mailing address up to date," said spokeswoman Amanda Fried.

"There is nothing that our office can do" about the sale now, she added.

Fried said that as far as she knows, the Board of Supervisors "has never done a hearing of rescission" -- and that because it's been more than two years since Cheng and Lam bought the property, it could be tough to overturn the sale now.

Curbed San Fransisco has more details on the suit filed.

In the complaint, homeowners note that the association has owned and maintained the O-shaped avenue since 1905. So why'd they drop the ball paying the tax man? According to the suit:

"The Association has not paid those taxes because the City has been sending the property tax bills to the Association at the following address: 47 Kearny Street. [...] Which is not the address of the association or any member.

"After research, the Association is informed and believes that this address was associated with an accountant who last performed work for the Association in the 1980s. [...No] member of the Association was aware that property taxes has not been paid."

Neighbors hope the court will rescind the 2015 sale and return ownership to them. Meanwhile, a spokesperson for the city's Treasurer-Tax Collector told the Chronicle's Matier and Ross that the office did everything required under the law and that everyone else in the city manages to keep their property taxes straight.

Curbed San Francisco continues, reporting on the couple's stated plans for the street:

In the meantime, the street's new owners are considering instituting a parking fee in the neighborhood. But if neighborhood residents aren't keen on paying a parking fee, that's no problem for the street's new owners.

Matier and Ross note: "[I]f the Presidio Terrace residents aren't interested in paying for parking privileges, perhaps some of their neighbors outside the gates--in a city where parking is at a premium--would be."

I don’t understand how the HOA has any chance of nullifying the sale...and to be fair, I’m not a lawyer, I don’t play one on TV and my knowledge of CA property tax law is, shall we say, pretty incomplete...

But we’re in an HOA in NC, and we have quarterly reports, an elected board that includes a treasurer (among others), an annual meeting and a CPA that certifies the books every year...the taxes are a line item on every report as the HOA owns the roads which have value and are taxed...and the HOA is not full of billionaire business people, politicians and investors...and yet, the taxes get paid every year...

And I’m sure there’s a market to rent out the security shack on Air BnB for frat parties, wedding receptions, porn shoots...the possibilities are endless...

From the SF Chronicle article (emphasis mine):

” “I was shocked to learn this could happen, and AM DEEPLY TROUBLED THAT ANYONE WOULD CHOOSE TO TAKE ADVANTAGE OF THE SITUATION and buy our street and sidewalks,” said one homeowner, who asked not to be named because of pending litigation.”

HAHAHAHAHAHAHA!!!! You can’t make this stuff up...

Said one of the detached elite that think nothing of using eminent domain to grow their business and line their pockets...spoken like a true spoiled entitled brat...

It's not the HOA, but the homeowners. The homeowners each have a recorded interest in the property and were not provided notice of any proceedings. Tumblindice figured this one out. There is a long line of legal cases on this - and you should be glad because due process is a fundamental part of our law.

You might, for instance, read this case: In re Ward

There are a lot more like it. The city clerk who did this was sloppy and vindictive since he could have called any one of the homeowners on the phone and the tax problem would have been taken care of immediately.

McMillian & Wife couldn’t afford to live there.

Can you say "McMansion"?

Not necessarily. Often with these these common areas, the homeowners portion/percentage is signed over to the HOA by some instrument similar to a quit claim. The HOA (LLC?) is responsible for maintenance, taxes, insurance and keeping contact info current. Otherwise all homeowners in the association could be sued for damages occurring in the common areas.

What I find hard to believe is the Tax Collector waited 30 years to auction the property.

Ten bucks says they don’t even have a board of directors for the HOA. It’s probably been running on “auto-pilot” since the 1980s. I’ve seen this sort of thing happen before.

And the requirement for joinder is invoked by the homeowners having an "interest" which does not require holding title.

They are doing the maintenance, mowing the lawn, oiling the gate lock, things like that.

Right. Someone is paying a management company or individual contractors to do that, but I’ll bet they haven’t had a formal board meeting since the 1980s.

” are tied together through restrictive covenants”

Of course.

In my case it went exactly as I describe. The common areas (a pond and wooded areas) were divided among the original homeowners who signed over their portions to the newly formed HOA. No interest in these areas transferred to subsequent purchasers.

Who knows what the covenants are for Presidio Terrace but they have certainly changed since 1905 when “only Caucasians are permitted to buy or lease real estate”. I’m betting the HOA ends up buying it back which is almost certainly what the new owners intended.

The suit list the plaintiff as The Association, the HOA formed by covenant in 1905 and is the “owner” of all non easement common areas.

Well that might be a problem, because the HOA was negligent it paying its taxes and, I am sure it will be argued has not stated a cause of action for which relief may be granted. I would think that the complainants are properly the individual homeowners who were deprived of a property interest without notice.

They still have an interest, which runs with the land, just not an "onwership interest" e.g. they do not hold bare title. But they have other interests, e.g. an easement interest in the common grounds and their own properties are burdened for the maintenance of the common grounds.

The common area also has its own parcel number which has been owned by the association since inception in 1905.

Sounds like the tax assessor did what is required. What the HOA will hang it’s hat on is the assessor’s office should have done more.

If the HOA doesn’t get this resolved, you can bet there will be a suit from the homeowners against the HOA.

If they are successful in getting their private driveway back they should have to settle with the new owners. When that is completed, they will have to pay a substantial penalty and all back taxes. Then have to pay a TRUE valve of the private driveway.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.