Posted on 12/19/2016 3:11:10 AM PST by expat_panama

If you’re looking for reasons to be bullish on stocks, check out the technicals.

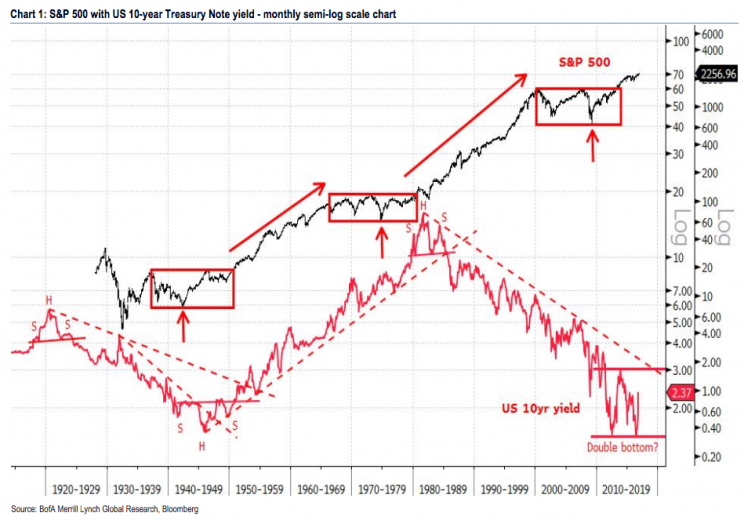

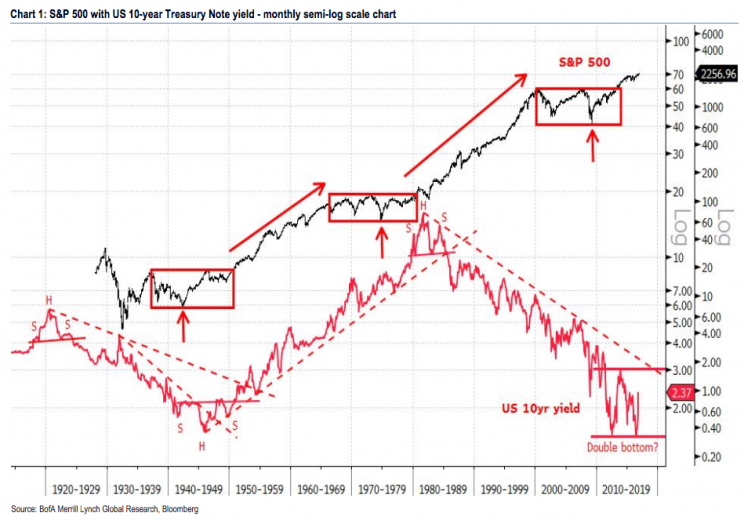

In a note to clients out Thursday, Stephen Suttmeier, a technical research analyst at Bank of America Merrill Lynch, outlined the case for why stocks look set to begin a “1950s-style” secular bull market.

And for those of you who don’t remember the 1950s bull market, it was a big one. View photos

“Given the post-Brexit capitulation on ‘rates lower for longer’ and the seismic shift to ‘a rising rate environment,’ the current secular bulltrend best fits the 1950-1966 secular bull market,” Suttmeier writes.

“The 1950s was a period of higher stock prices and higher US interest rates. The US 10-year yield bottomed near 1.5% in late 1945 and the S&P 500 remained firmly within its secular bull market until yields moved to 5-6% in the mid 1960s. The S&P 500 rallied 460% over this period.” (Emphasis added.)

The near-term implications for stocks within this framework make the S&P 500 look set to rise towards 2,400 next year, and potentially towards 3,000 within just two years.

The quick run to 3,000, in Suttmeier’s outline, could come as investors accept that we’re looking at the beginning of a new trend in markets not merely seeing the final days of a bull run set to expire.

“Secular bulls start slowly given investor disbelief but build momentum over time as disbelief turns into acceptance,” Suttmeier writes.

“We believe that 2017 could be the year of acceptance for the secular bull trend that began on the April 2013...

(Excerpt) Read more at finance.yahoo.com ...

Yeah? What do bonds say? Yellen’s replacement?

Run for the exits when this claim is being made.

Why, the guy who shines my shoes tells me he’s convinced to go all in on stocks.

The dumb a$$ed politicians have set it up for the biggest financial crash in history. The US financial situation is pathetic and whether Republican or Democrat, they worked overtime to be irresponsible.

The house of cards will one day collapse rapidly and it ain't going to be pretty.

When they bring back the Saturday trading session, look out below.

--and a very merry last shopping week before Christmas!

OK, so last week ended w/ stock prices falling in soaring volume. Well... Prices sure didn't fall a heck of a lot (S&P500 less than 1/5%) and the only reason volume jumped was because options expired. Today we got stock futures mellow at +0.16% in contrast to metals futures at -1.18%.

No econ reports (flood warning for GDP Thursday), but we got lots of neat threads:

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.