Posted on 01/21/2016 7:59:13 AM PST by Sgt_Schultze

A measure of international trade often seen as a bellwether for the global economy has crashed to its lowest level ever, fueling fears we could be heading for another 2008-style crash.

Back in November, the Baltic Dry Index dropped below 500 for the first time in recorded history, and it has kept falling ever since. On Wednesday morning it fell to a low of 369.

To put that into perspective, the index was as high as 1,222 in August, and it has fallen 84% from a recent peak of 2,330 in late 2013.

The Baltic Dry Index measures how much it costs to ship "dry" commodities around the world — raw materials like grain and steel.

(Excerpt) Read more at businessinsider.com ...

Finally, the sea levels will lower from their lack of displacing sea water and Obama will be able to fulfill his 2008 campaign promise.

By Jimmy! You’ve got it. take all the heavy cargo off those ships and the water level will fall! It’s like a fat man getting out of a bathtub.

ping

Amen. Been there, done that.

Sponsoring FReepers are contributing

$10 Each time a New Monthly Donor signs up!

Get more bang for your FR buck!

Click Here To Sign Up Now!

From what I read at Baltic Dry Index Falls for Eleventh Straight Day, the index is collapsing for two reasons:

[snip]"The dry bulk sector has taken a beating from the slowdown in Chinese business at a time when the sector is struggling with huge overcapacity."

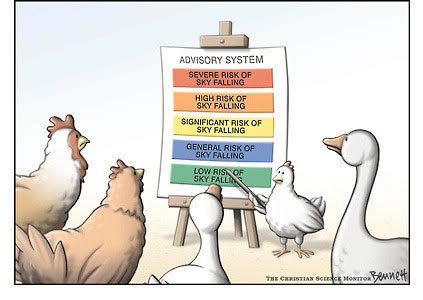

Overcapacity can be corrected by mothballing ships. The slowdown of demand is the proverbial canary in the coal mine.

Lived in a 42’ container for 3 years in Iraq. It was armored up to 7.62mm, had a bathroom in the middle, A/C units and full electricity. I made it airtight to keep the dust out. It was two 16 x 8 bedrooms and a full bathroom in between. We even had a generator across the road. It was pretty sweet, especially after we ran our own phones and ISP in them.

We went through this with the overbuilding of very large crude carriers for oil. It took a while for the market to absorb that capacity.

Yes, because it follows energy prices and those peaked in early 2008.

Only problem with things returning here is going to be the inflexible floor on labor rates. As it stands, they might work if the non citizen surplus is sent home...

I agree. And in 2008 the rise in oil was the straw that popped the debt bubble. There is some froth this time, but no giant bubble of fake securities. Moreover low oil will allow investment in the sectors that got hammered in 2008.

Sounds like hair splitting to me. He fell in or down a hole has the same meaning. I had no trouble determining his meaning. Your response was the one that was unclear. It made it seem that he did not understand the definition. I knew the meaning but I still looked it up to make sure there was not some bizarre other usage.

I remember having this convo with my broker in early 2008. I thought I was over shooting when i said the Dow would drop from 18300 to 9900. It went to 6600.

The problem is not knowing how much bad debt us going to unwind. Especially sovereign debt.

I post as contrast to the position of this administration trying to spin the yarn of a booming recovery.

Best wishes in your retirement. That will leave you more time to post and to write more books.

Yeah, if I’m not working at Taco Bell to stay alive :)

The term is “canary in a coal mine”

I have never once heard “canary DOWN a coal mine” and that led me to wonder if he knows what it means.

There are too many illiterate writers these days. It’s a simple mistake a good editor would have caught too.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.