Skip to comments.

Why Are Democrats So Worried About A Fed Rate Hike?

Investors Business Daily ^

| 12/02/2015

| Editorial

Posted on 12/03/2015 4:16:20 AM PST by expat_panama

Monetary Policy: Fed Chair Janet Yellen thinks the economy is so strong that the central bank can start raising rates this month. So why are Democrats alarmed? Because they know that the "Obama recovery" is hollow.

It's true there have been marginal improvements in key economic indicators since 2008, as would be expected following the worst downturn since the Great Depression.

But the "recovery" that was touted so loudly by Democrats until last year has also been the worst ever†2% average growth. Now they're worried about the prospects of even a tiny hike in interest rates by the Fed.

[snip]

,,,a Politico headline bluntly asked, "Could An 'Accident' By Janet Yellen Derail Clinton?"

Yellen doesn't seem to think so.

[snip]

Contrary to what the Democrats say, the recovery was never that good to begin with. And contrary to Yellen, it's not that strong now. When the nation's top central banker touts a 5% jobless rate, she does so knowing virtually no economist treats that number as real anymore. Most agree the "real" unemployment rate is 10% or so.

Worse still...

[snip]

...for the future, things may not be so rosy.

-- Banking giant Citigroup says there's a 65% chance of a recession next year.

-- The Institute of Supply Management's manufacturing index has fallen to its worst level since 2009.

-- The Atlanta Federal Reserve's GDPNow index for the fourth quarter dropped to 1.4% this week, well below market forecasts of 2% to 3% GDP growth.

-- Brazil, Russia, India, China " the BRICs...

[snip]

Given so much doubt, now is not the best time for the Fed to start "normalizing" interest rates. And, no, we don't worry about "derailing" Clinton's presidential campaign. Voters will do that. We do worry about derailing what remains of the post-Obama economy.

(Excerpt) Read more at news.investors.com ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; fed; investing

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-62 last

To: usconservative

that's because the two most historically inflationary components have been REMOVED: those being FOOD and FUEL. No, both the PCE and CPI take food and fuel into consideration.

61

posted on

12/03/2015 10:02:42 AM PST

by

Mase

(Save me from the people who would save me from myself!)

To: Mase; usconservative

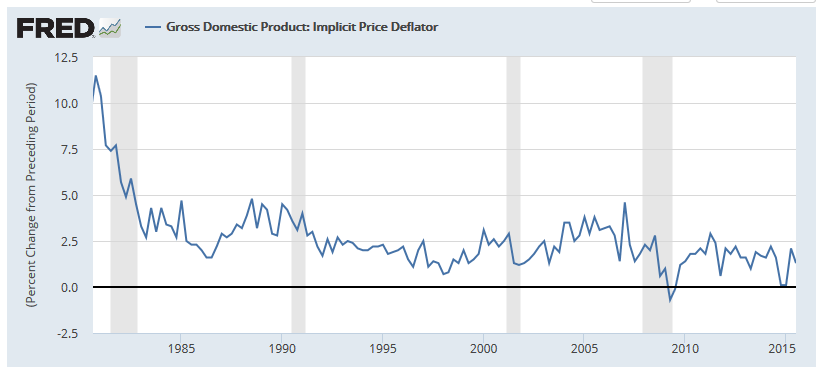

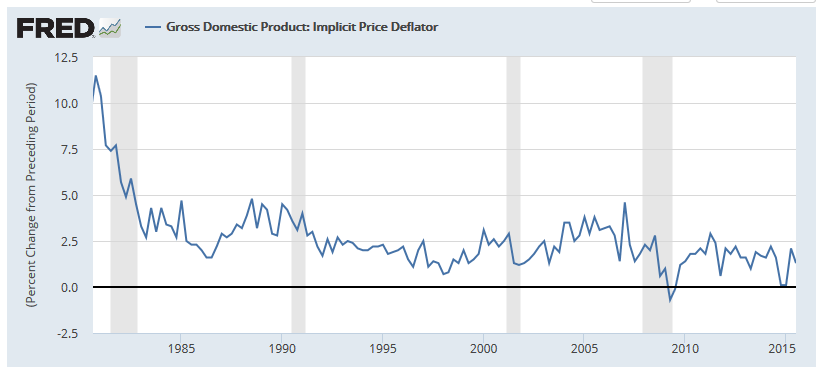

PCE and CPI take food and fuel Besides that though, Uscon had a point in wanting to remember wages in the mix which the PCE and CPI ignore. That's why I kind of prefer the GDP deflator which meassures price changes for every single thing in the entire economy for which money's used to buy.

Turns out that counting wages (along with factory construction and jet fighters etc.) that inflation actually is in fact a tad higher than just the CPI, it's 1.7% and going back down toward the 0.1% annual we had a year ago. Still way below the 2% limit the Fed says they watch out for.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-62 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson