Skip to comments.

Government On Hiring Spree As Private Job Gains Fade

INVESTOR'S BUSINESS DAILY ^

| 10/08/2015

| JED GRAHAM

Posted on 10/09/2015 3:33:55 AM PDT by expat_panama

Government is again behind the curve in adapting to changes in the economy, ramping up hiring even as weakening global demand prompts private employers to tap the brakes.

If the trend continues, governments could find themselves with more staff than they can afford — and eventually a new cycle of budget shortfalls and painful cutbacks.

The slowdown in China and other economies has knocked the wind out of exports and commodity prices and slowed private-sector hiring to its weakest level in more than three years. But state and local governments are adding jobs at the fastest pace since the recession.

Government payrolls swelled by 115,000 over the past four months, with all of the gains at the state and local level, mostly in education. That's the best pace since the end of 2007. And it's nearly three times faster than any other period in the past six years.

Businesses Slow Hiring

Meanwhile, the private sector has downshifted...

[snip]

...the light at the end of the tunnel isn't getting any closer. A rebound in tax revenue has been met with increasing demands from a growing Medicaid population and higher outlays for public-employee pensions...

[snip]

Retiree Costs Crowd Budgets

For example, Los Angeles' public retiree costs absorbed 24% of the city's 2014 general fund...

[snip]

Teachers Wanted

The recent surge in hiring, including about 90,000 teachers over the past four months, reflects pent-up demand. There are still 236,000 fewer public education jobs than seven years ago, noted Elise Gould, economist at the liberal Economic Policy Institute. But she calculates that the real public-education job shortfall to keep up with enrollment is about 410,000.

In all, there are just over 22 million government jobs, including 2.7 million at the federal level. That's about 600,000 below the 2009 peak (excluding Census hiring in 2010).

(Excerpt) Read more at news.investors.com ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; government; investing; unemployment

Navigation: use the links below to view more comments.

first 1-20, 21-22 next last

There're

a lot of important facts here and our daily IBD is a must read for the econ savvy. Still, in this particular case the IBD battery may need some rechargin (imho) because it's misleading to pander to the low-infos on the right (there are a few, not nearly as many as on the left but a few).

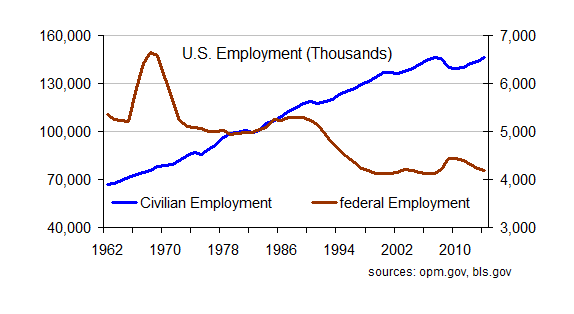

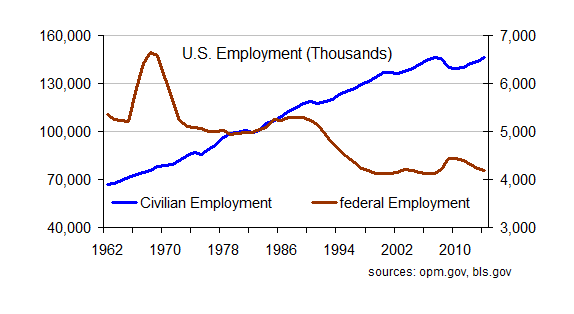

Myth: federal hiring is record high and way out of control. The hard numbers from the OPM and the BLS say otherwise (graph left). Rush gets this wrong too (but like IBD I'm still catching him every day because of all the other stuff that's right).

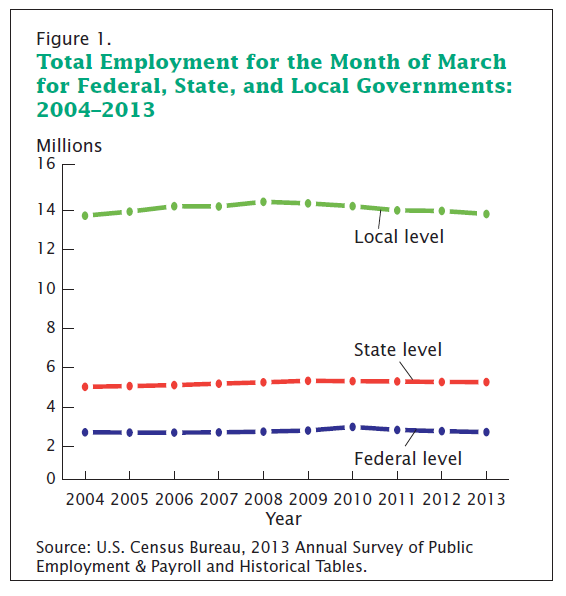

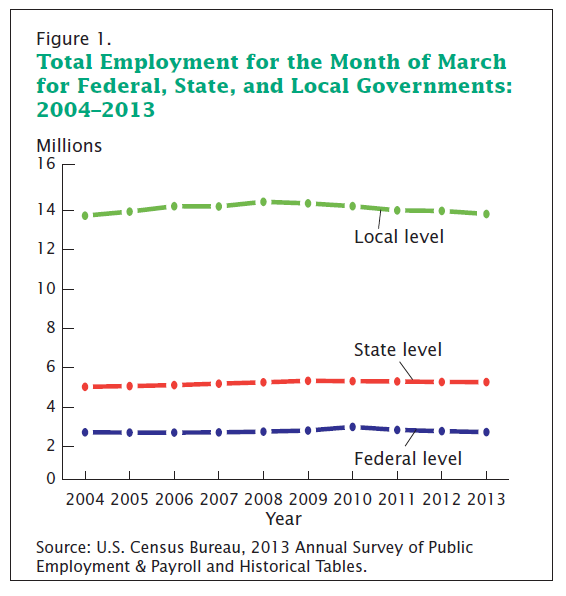

Compare the hard numbers to the graphic on the right --one that's set up to give the impression of our beloved "federal hiring is record high and way out of control".  This plot does more wrong that just center in on just the past couple years, they also changed the scales and shifted the ranges. If you look hard you can see that the graph does show that the private sector advance this past quarter was 400,000 compared to a total state, local, and federal hiring of just under 90,000.

This plot does more wrong that just center in on just the past couple years, they also changed the scales and shifted the ranges. If you look hard you can see that the graph does show that the private sector advance this past quarter was 400,000 compared to a total state, local, and federal hiring of just under 90,000.

Problem is that those numbers (imho agn) just don't justify the graphic's subtitle "Government is on a hiring spree even as private job growth has slackened". OK, it sort of does, but this is not the kind of quality of analysis that I can make money on.

To: expat_panama

Bring back jobs.

To America.

Just saying.. Bring them back. Stop buying everything imported.

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

A beautiful morning to all! It's Friday and yesterdays decent stock index gains --even in limp trade-- are now seen by futures traders holding steady (-0.01%). That, and our metals are ASTRONOMICAL! Yesterday's good showing (gold/silver now at $1,154.05 and $16!) is now being seen by futures traders as going up today +2.16%.

The Econ Report Calendar is winding down:

8:30 AM Export Prices ex-ag.

8:30 AM Import Prices ex-oil

10:00 AM Wholesale Inventories

--and there's soo much news I'm going to have to hustle to browse thru it all:

10 Signs That Stocks Are Way Overpriced - Doug Kass, TheStreet.com

Not So Rosy: A Very Junky Rally - Michael Batnick, The Irrelevant Investor

6 Reasons to Stop Panicking about Stocks - Jeff Reeves, MarketWatch

Recession? No Cassandra, It's Just a Correction - Jack Bouroudjian, CNBC

Why October Is the Worst Month for Investors - Dani Burger, Bloomberg

FOMC Minutes: Fed Feared Rate Hike's Impact on Inflation - Fox Biz

Global Economy's In Serious Danger - Lawrence Summers, Washington Post

If Markets Were Truly Stupid, We'd All Be Really Rich - Tad Rivelle, RCM

China Could Again Be Bad for U.S. Stocks - Tomi Kilgore, MarketWatch

Stock Markets Ahead of Pols on Climate Change - Jason Gold, U.S. News

To: expat_panama

“Teachers Wanted

The recent surge in hiring, including about 90,000 teachers over the past four months, reflects pent-up demand. There are still 236,000 fewer public education jobs than seven years ago, noted Elise Gould, economist at the liberal Economic Policy Institute. But she calculates that the real public-education job shortfall to keep up with enrollment is about 410,000.”

There is no better way to kill an economy than hiring teachers; they have bankrupted NJ. Even worse, the students increasingly are from populations that contribute nothing towards the tax base.

4

posted on

10/09/2015 4:02:27 AM PDT

by

kearnyirish2

(Affirmative action is economic warfare against white males (and therefore white families).)

To: kearnyirish2

no better way to kill an economy than hiring teachers; they have bankrupted NJimho if teacher hiring was NJ's only problem it would be in pretty good shape. This U.S. educationstinks myth is another one of my pet peeves.

To: expat_panama

I don’t understand “education stinks myth”.

My children describe getting higher grades for bringing in cans for food drives, and one teacher who openly stated that your grade was dependent on behavior in the classroom as opposed to any test results. Public education is a disaster; look at California giving high school diplomas out to people who couldn’t qualify for them. In the past that was reserved for blacks & Hispanics (social promotion); now it is universal.

6

posted on

10/09/2015 4:28:38 AM PDT

by

kearnyirish2

(Affirmative action is economic warfare against white males (and therefore white families).)

To: expat_panama

Well you are living in Panama.

Here in the states we are not getting our monies worth and most of many school budgets support retired teachers who have fat contracts.

There are terrific teachers. The system is poisonous.

7

posted on

10/09/2015 4:45:07 AM PDT

by

Chickensoup

(We lose our freedoms one surrender at a time)

To: expat_panama

I believe you are mistaken here. Federal hiring may be level or modest. But what is going on in government hiring on the state, county and city levels? You should try and find hiring stats for New York City. It must be way up under their current commie mayor.

How about hiring by states like Maryland, Virginia, Massachusetts? They must be up too.

Your two graphs do not contradict each other because one deals with Federal hiring and the other with ALL government hiring in America

8

posted on

10/09/2015 4:56:37 AM PDT

by

dennisw

(The first principle is to find out who you are then you can achieve anything -- Buddhist monk)

To: expat_panama

"...education stinks myth..."

Myth or not, Common Core will fix it all. We've been doing math wrong all throughout history. /s

I was in HS in the mid-60s in small town rural America. Even back then and there, the unqualified were hired as teachers to fulfill the minority quota hiring mandates.

9

posted on

10/09/2015 5:42:04 AM PDT

by

citizen

(America is-or wa5s-The Great Melting Pot. JEB won't even speak American in his own home. NO Bush!!)

To: All

My observation is most problems with education are union related.

10

posted on

10/09/2015 5:51:23 AM PDT

by

Lurkina.n.Learnin

(It's a shame enobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: citizen

unqualified were hired as teachers That's an anecdote.

Sure, add the anecdote from NJ and we not got "data" but while that may be great for political hacks when we get serious we always go w/ the "America's best" mode. Admit it. Say you need the best Doctor there is so you hire what, one educated in Togo? The whole world loves bashing America's ed system too but then they turn right around and come to the U.S. for a degree. Like, how many Americans you know send their kids away to college in say, Belarus? On top of all that the big thing being overlooked here is the fact that the great majority of American education is private and for profit. This wonderful hopenchange recovery has been terrific for my stocks in companies that retrain unemployed workers.

There's a lot more but I need to breath into a paper bag for a bit...

To: Lurkina.n.Learnin

To: expat_panama

13

posted on

10/09/2015 6:08:59 AM PDT

by

PGalt

To: Chickensoup

you are living in Panama.--and you're a scaredy chicken in need of a visit from Col Sanders.

baBAWK?

To: PGalt

We’re all working (directly) or not working (forced to support through taxation/confiscation) That's a very good important point. Gov't can be too big and intrusive w/o having a big payroll. It doesn't yet it is.

To: expat_panama

RETIREMENT FUNDS ARE underfunded

RECESSION WILL HIT IN 2016

financial crisis is looming due to trillions in unsecured corporate debt globally... banks again

stock market potential to drop 40% due to fall off in earnings and projected flatline of the economy..

dont worry folks

obama will start a nice little war and everyone will be happy happy happy

16

posted on

10/09/2015 6:15:46 AM PDT

by

zzwhale

To: zzwhale

stock market potential to drop 40% due to fall off in earnings and projected flatline of the economy.MAke that the projected flat line of worldwide the economy.

Let's see how much longer our governmental overseers can keep juggling all the fragile economic eggs in the air as gravity (the flat line) increases.

Total US unfunded liabilities is about $98.6 trillion per http://usdebtclock.org/

I don't concern myself whether or not that figure is accurate. At that amount, 25-30% one way or the other does not matter except perhaps as to the timing of the financial collapse events.

17

posted on

10/09/2015 6:49:51 AM PDT

by

citizen

(America is-or wa5s-The Great Melting Pot. JEB won't even speak American in his own home. NO Bush!!)

To: zzwhale

RETIREMENT FUNDS ARE underfunded RECESSION WILL HIT IN 2016 financial crisis is looming due to trillions in unsecured corporate debt globally... banks again stock market potential to drop 40% due to fall off in earnings and projected flatline of the economy..0:55Whoa NEAT!! I needed that little walk down memory lane...

To: dennisw

what is going on in government hiring on the state, county and city levels? ...try and find... ..It must be... ...How about... ...They must be... So you're not letting the fact that you don't know get in the way of having a firm opinion. Like most people (me included). Of course when it comes to money stuff I go and put in the effort to check things out before I start throwing my money in but when I'm just sitting back w/ political banter --aw hell, studies show that over 79% of that stuff in the past two years was totally made up.

fwiw [opening bell serious time]

To: expat_panama

—and you’re a scaredy chicken in need of a visit from Col Sanders.

baBAWK?

________________

HUH?

20

posted on

10/09/2015 8:41:42 PM PDT

by

Chickensoup

(We lose our freedoms one surrender at a time)

Navigation: use the links below to view more comments.

first 1-20, 21-22 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

a lot of important facts here and our daily IBD is a must read for the econ savvy. Still, in this particular case the IBD battery may need some rechargin (imho) because it's misleading to pander to the low-infos on the right (there are a few, not nearly as many as on the left but a few).

a lot of important facts here and our daily IBD is a must read for the econ savvy. Still, in this particular case the IBD battery may need some rechargin (imho) because it's misleading to pander to the low-infos on the right (there are a few, not nearly as many as on the left but a few).  This plot does more wrong that just center in on just the past couple years, they also changed the scales and shifted the ranges. If you look hard you can see that the graph does show that the private sector advance this past quarter was 400,000 compared to a total state, local, and federal hiring of just under 90,000.

This plot does more wrong that just center in on just the past couple years, they also changed the scales and shifted the ranges. If you look hard you can see that the graph does show that the private sector advance this past quarter was 400,000 compared to a total state, local, and federal hiring of just under 90,000.