Skip to comments.

If The Fed Is Always Wrong How Can Its Policies Ever Be Right?

Forbes ^

| 8/15/2015

| Ralph Benko

Posted on 08/16/2015 6:02:38 AM PDT by expat_panama

One of the most curiously persistent surrealisms of Washington, DC is the reflexive deference given the Federal Reserve System. The Washington elite tends to accord more infallibility to the Fed than do Catholics the Pope....

[snip]

The big question is whether Fed officials can get it right after years in which they have regularly predicted a stronger economy than the one that materialized...

[snip]

...let’s be blunt. If NASA suffered from comparable inaccuracy the manned spaceflight program would have been shut down by an endless series of Challenger-type catastrophes many years ago. With forecasts this bad is it any wonder the American economy continually crashes and burns?...

[snip]

[M]acro-economics is now [astrology’s] modern incarnation: Only instead of stars, macro-economists look at “aggregates” gathered religiously ...

[snip]

...criticism, while apparently alien to the Fed, is nothing new. Hayek, in his Nobel Prize acceptance speech The Pretence of Knowledge tartly observed: We have indeed at the moment little cause for pride...

[snip]

Thus it falls to me, in my role as the simpleton on this beat, to declare: The Emperor has no clothes...

[snip]

If clad, high time to parade its exceptional beauty. Pass the Centennial Monetary Commission. Let’s see the Emperor’s clothes.

(Excerpt) Read more at forbes.com ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; fed; investing

Navigation: use the links below to view more comments.

first previous 1-20, 21-35 last

To: expat_panama

where’s the edit button? That should read “historically high labor force NON participation number”

21

posted on

08/16/2015 4:43:59 PM PDT

by

Nep Nep

To: Nep Nep

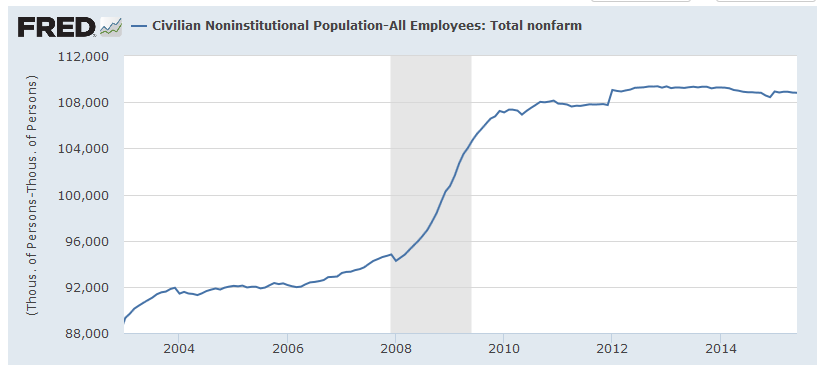

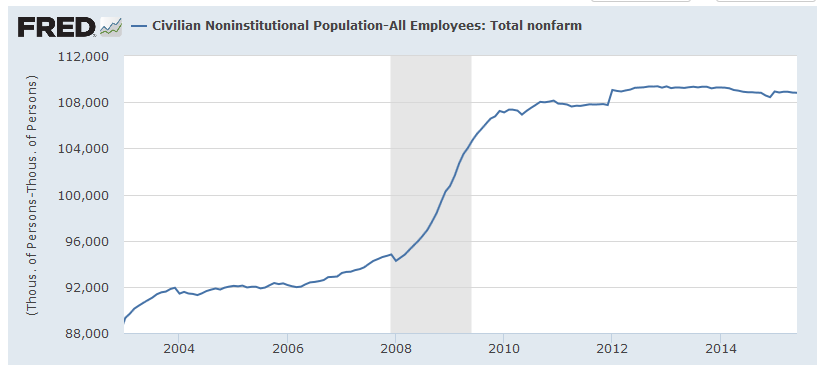

What explains a decade worth of stagnant wages better, the historically low unemployment number or the historically high labor force participation number?Personally, I prefer just subtracting "employed" from "population":

Too many folks are oblivious to the fact that "hope'n'change meant 14 million would lose their jobs and not get them back. There's more BLS records showing that another 3 million suddenly went from full to part time too, but of course all these figs are are from the BLS and census.gov and your take is they're all liars --wait a sec, where are you getting your laborforce participation numbers?

To: expat_panama

Your own favorite chart shows that job creation is lagging population growth.

I’m getting the labor force number from the BLS, of course. But there’s a huge difference between that number and the unemployment number, in that the labor force number is raw, unadjusted data, whereas unemployment is a witches’ brew of adjustments and manipulation and reclassification.

The labor force number represents 10 million jobs lost since Lehman that haven’t come back. You won’t see evidence of that in the politically manipulated unemployment rate.

BLS fraud in the unemployment number may have made the difference in Obama’s second election - and it’s not subjective that fraud occurred. Not sure why you are so intent on defending it.

http://www.forbes.com/sites/peterferrara/2013/11/27/did-the-bls-give-obama-a-major-election-2012-gift/

23

posted on

08/16/2015 7:05:20 PM PDT

by

Nep Nep

To: Nep Nep

Given that BLS has been caught red-handed multiple times putting out completely fraudulent data, I’d say that looking for alternative metrics is completely reasonable.I’m getting the labor force number from the BLS, of course.

We really can't trust numbers from folks that we consider to be frauds and liars. Billy Clinton and Obama are liars. The NYT lies Hillary lies. When those clowns say something all I can tell is that they said something and I look elsewhere to find out whether what they said was true or not. While I personally don't consider the BLS to be a bunch of liars, I have noticed that political hack liars love to pervert good BLS numbers beyond all recognition.

To: expat_panama

Seems it would make a heck of a lot more sense to tie monetary policy to prices and not production. In what world are prices not tied to production? You might take a look at the basic equation involved: MV = PQ and point out where Milton Friedman went wrong.

25

posted on

08/16/2015 7:26:22 PM PDT

by

econjack

(I'm not bossy...I just know what you should be doing.)

To: expat_panama

Do you happen to work at BLS?

With wage and participation and all sorts of other metrics confirming a horrible employment picture, have you any sustainable argument for regarding the unemployment numbers as meaningful?

26

posted on

08/16/2015 7:55:12 PM PDT

by

Nep Nep

To: econjack

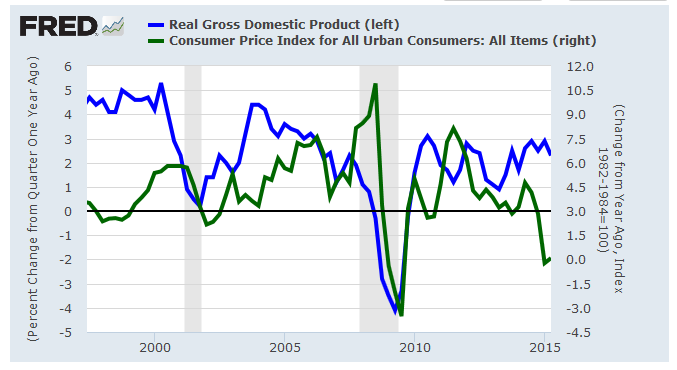

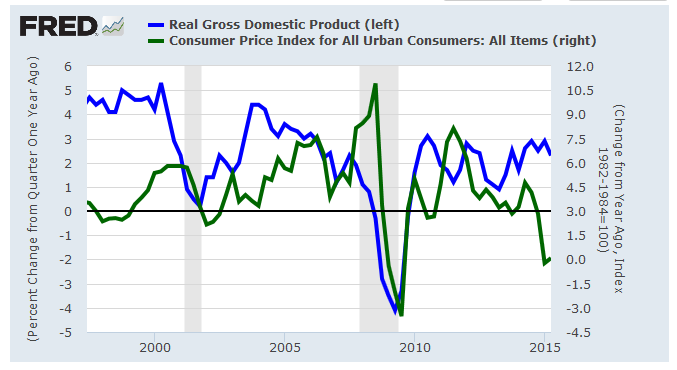

I lean towards Friedman's view of Monetary Policy which ties monetary policy to real changes in GDP..more sense to tie monetary policy to prices and not production.

In what world are prices not tied to production? You might take a look at the basic equation...

If prices are "tied" to production then--

--they're sure not tied very well. OK I know this is where the econ scholars say "your idea may look just fine in real life but how's it going to stack up when it meets cold hard theory?" So my problem's not w/ understanding various models' equations, it's in understanding why we need to watch something that supposedly "tied" to prices instead of just watching well, prices.

To: expat_panama

So where is the money supply plot? You’ve shown nothing but a correlation between GDP and the CPI. That’s not the same at the equation I presented.

28

posted on

08/17/2015 9:13:32 AM PDT

by

econjack

(I'm not bossy...I just know what you should be doing.)

To: econjack

where is the money supply plot?

Hey, you're the one saying our monetary policy should be tied to gdp and I'm the one asking for your reasoning. The fact that you didn't think MZM was important enough for posting here is good for me.

You’ve shown nothing but a correlation between GDP and the CPI

Is there one? It's easy enough to verify this by taking the numbers and running them thru a regression analysis, but once again you're one saying stuff about monetary policy and if it's not important to you then I'm not asking you about it.

To: expat_panama

Hey, you're the one saying our monetary policy should be tied to gdp and I'm the one asking for your reasoning. If you could do the math, you'd see I already gave it to you in the equation. Also, take a look at your MZM plot. Given the steady increase in Ms since 1985, why are prices stable for the past decade?

30

posted on

08/17/2015 11:49:42 AM PDT

by

econjack

(I'm not bossy...I just know what you should be doing.)

To: econjack

asking for your reasoning.If you could do the math,

--and the fact that you keep changing the subject from your reasoning to something you don't like about me indicates that there is no reasoning. That's all I was asking. Thanks and cheers.

To: expat_panama

...the fact that you keep changing the subject from your reasoning to something you don't like about me ... I don't dislike you...I don't even know you, nor did I change the subject. What I said was if you understood what the equation MV = PQ says, you'd understand my reasoning. M is the money supply, V is the velocity of money, P is the price level, and Q is output. My initial statement was that prices and output are tied together and directly relate to the money supply. Friedman says if PQ increases by X percent, then MV should increase by a matching percent if you want to maintain stable prices. (V is very stable over time.) Now go back and read my earlier comments and you'll understand what I said.

32

posted on

08/17/2015 12:59:55 PM PDT

by

econjack

(I'm not bossy...I just know what you should be doing.)

To: citizen

I want to change my prediction on the Fed’s September action. You may be right that they don’t even raise for the year.

33

posted on

08/24/2015 10:08:08 AM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

Yes, I think September is out. I tend to doubt December too because the 1st quarter has been so bad the last couple of years and the winter will be extreme again.

But Yellin is itching to raise because of bubble fears so who knows?

34

posted on

08/24/2015 4:51:29 PM PDT

by

citizen

(America is-or was-The Great Melting Pot. JEB won't even speak American in his own home. NO Bush!!)

To: citizen

http://www.wsj.com/articles/feds-dudley-says-new-york-economy-is-a-bright-spot-1440597601

Fed’s Dudley: Case for September Rate Increase Now ‘Less Compelling’

New York Fed Chief says he hopes Fed can raise rates this year, but wants to see how data unfolds

By Michael S. Derby

Aug. 26, 2015 12:27 p.m. ET

NEW YORK—Federal Reserve Bank of New York President William Dudley said Wednesday that prospects of a U.S. central-bank rate rise next month have dimmed amid rising concerns about events happening outside of U.S. borders.

In light of market volatility and foreign developments, “at this moment, the decision to begin the normalization process at the September [Federal Open Market Committee] meeting seems less compelling to me than it did several weeks ago. But normalization could become more compelling by the time of the meeting as we get additional information” about the state of the economy, he told reporters.

Mr. Dudley is an influential voice on the FOMC, serves as its vice chairman and is a close ally of Fed Chairwoman Janet Yellen. He has been an infrequent voice on monetary-policy issues over the summer, however. His comments Wednesday come just ahead of the Kansas City Fed’s annual research conference in Jackson Hole, Wyo., where questions of what’s next for the Fed will be at the forefront.

snip

35

posted on

08/26/2015 10:42:33 AM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

Navigation: use the links below to view more comments.

first previous 1-20, 21-35 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson