Skip to comments.

Exchange Traded Funds, Pros & Cons --Investor Thread April 19, 2015

Weekly investment & finance thread ^

| 04/19/2015

| Freeper Investors

Posted on 04/19/2015 7:39:38 AM PDT by expat_panama

| [from IBD: Should ETFs Be In Your Investment Portfolio?] While ETFs have existed for several decades, their popularity and diversity have exploded in recent years. But many investors are just learning about them.

Those looking for tips on how to invest in ETFs just need some basic information to get started.

In basic terms, ETFs can be thought of as mutual funds that trade like stocks. But their portfolios can contain U.S. and foreign stocks, bonds, futures, physical commodities or currencies.

And ETFs choose the securities for their portfolios with an investment objective in mind. These investment goals include growth of capital through price appreciation and income generation through stock dividends or bond interest.

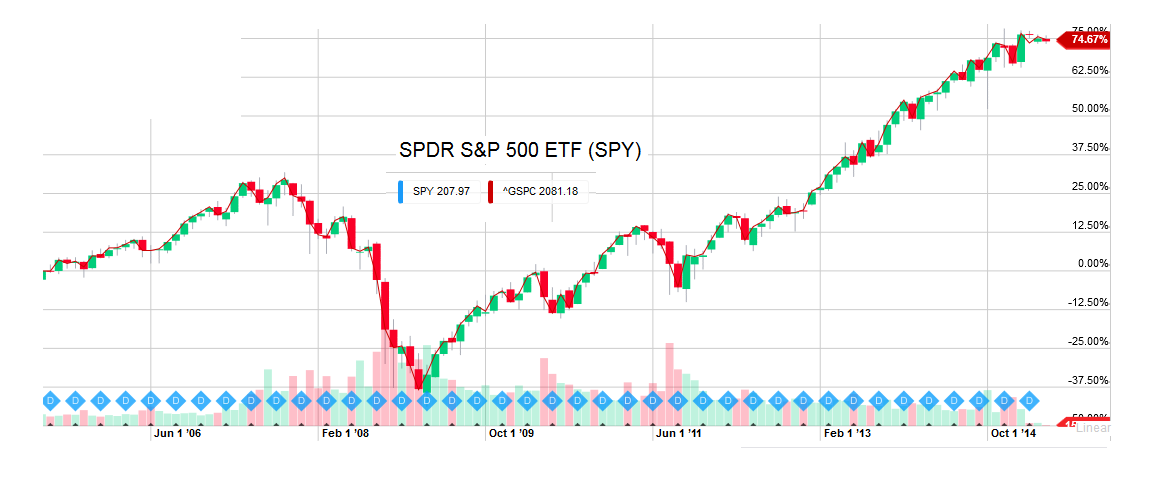

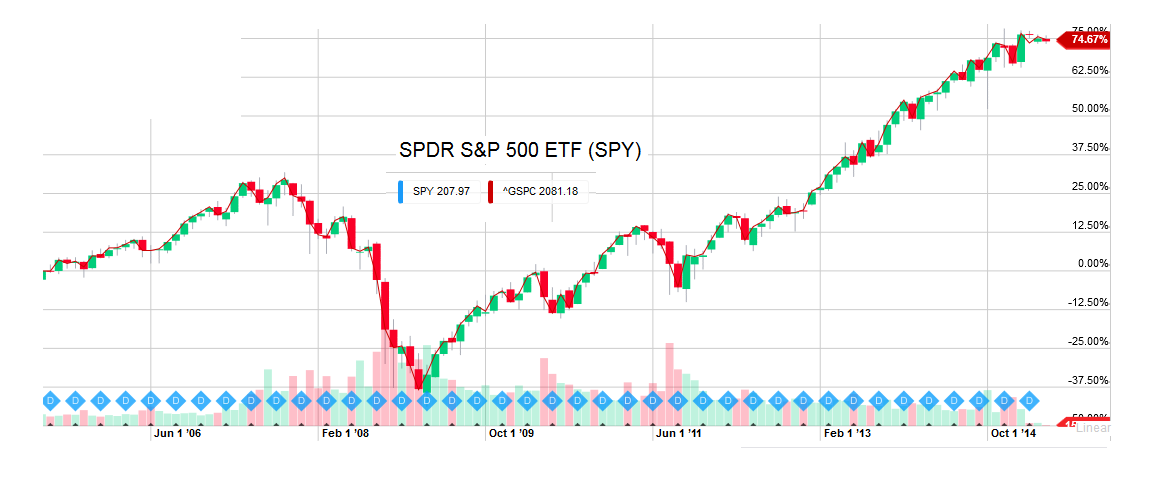

And ETFs pursue these objectives in a variety of ways. These include exposure to the broad stock market through such ETFs as SPDR S&P 500 (ARCA:SPY) and PowerShares QQQ (NASDAQ:QQQ). Or they can focus on narrow segments of the market, like high-yielding stock funds. That's an area covered by Vanguard High Dividend Yield (ARCA:VYM).

ETFs tend to have lower fees and better tax efficiency compared with mutual funds. They have the flexibility to be traded on a short-term, even intraday basis, but can also be held for the long term as part of an asset allocation plan.

How can you find the best ETFs for your portfolio? "We like to use ETFs to track a broad-based index or sector, and will typically use mutual funds when we feel that an active manager can provide a benefit either from a performance, risk reduction or strategy standpoint over what we expect from the index," says Michael Ball, lead portfolio manager of Weatherstone Capital Management.

With thousands of ETFs to choose from, it can seem overwhelming to pick ones out that are right for you. How to cope? Start with the end in mind. ... [snip] |

| --and: Exchange-Traded Funds (ETF) Center - Yahoo Finance Exchange-Traded Fund (ETF) - Investopedia Best ETFs (Exchange Traded Funds) | US News Best Funds --and from our leaders always there to help us: What is an ETF?...

...Like mutual funds, ETFs offer investors a way to pool their money in a fund that makes investments in stocks, bonds, or other assets and, in return, to receive an interest in that investment pool. Unlike mutual funds, however, ETF shares are traded on a national stock exchange and at market prices that may or may not be the same as the net asset value (“NAV”) of the shares, that is, the value of the ETF’s assets minus its liabilities divided by the number of shares outstanding. investment pool. Unlike mutual funds, however, ETF shares are traded on a national stock exchange and at market prices that may or may not be the same as the net asset value (“NAV”) of the shares, that is, the value of the ETF’s assets minus its liabilities divided by the number of shares outstanding. Things to Consider before Investing in ETFs

ETFs are not mutual funds. Generally, ETFs combine features of a mutual fund, which can be purchased or redeemed at the end of each trading day at its NAV per share, with the intraday trading feature of a closed-end fund, whose shares trade throughout the trading day at market prices... [snip] |

|

That was the pros, here's the con's side: Should Mutual Funds Be Made Illegal? - Matt Levine, Bloomberg Why Hillary Clinton is going after hedge funds ETFs May Be Moving Stocks in Unseen Ways The Hidden Risks and Costs of ETFs - US News Exchange-traded funds: Too much of a good thing ... * * * * * * * * * *

|

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: economy; etf; sandp; spychart; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-50 next last

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

[multiple proof reading completed] Investor ping for April 19, 2016:

To: expat_panama

I put $1500 into SLV (silver ETF) for the heck of it. So far I’m about $20 ahead of my transaction fees if I sell.

Fidelity only charges $7 or $8 to buy or sell, so it doesn’t have to move up much to cover that.

3

posted on

04/19/2015 7:49:34 AM PDT

by

ChildOfThe60s

(If you can remember the 60s, you weren't really there....)

To: expat_panama

You have to understand how EFTs actually work. If they are freely traded by buyers and sellers, how can the market price always be the NAV of the the underlying securities?

The answer is that the sponsor appoints Authorized Participants to create and destroy shares. When the market price is too low, these large financial institutions buy shares, turn them in, and sell the underlying securities. When the market price is too high, they buy the underlying securities, turn them in, and receive new shares.

Why do they do this? They make money on the difference in price. Where does this money come from? The end investors who actually buy and sell the shares. Is it a large cut? Not in normal circumstances with liquid underlying securities.

Now let’s have a big market crash. The securities will plummet, and the EFTs will plummet even faster. Will the APs be able to perform their arbitrage functions, or will they consider it too risky in a volatile market? If they don’t act, the EFT price will get seriously out of whack with the NAV. Retail investors selling at a hard bottom will get less than the NAV of the underlying securities.

Now what happens when an EFT holds illiquid securities like junk bonds? In a crisis, there are often no bids at all for these securities. What will happen to the EFT that is built on them? It has to trade, but no one knows what its NAV really is. It won’t be pretty.

To: expat_panama

Here's the difference

Lets say you have $100,000 available and on a Sunday the Saudis announce that they will cut pumping oil by 1 million barrels per day. You can be 100% sure that on Monday the price of oil will go up quite a bit.

Now here are the differences between the EFT and Mutual Fund.

If you put in a 100K order in an Energy Mutual Fund the price you'll get it at will be the price at the end of the day at closing on Monday. So if there's a 5% increase you don't get it at $100,000 you get your shares at $105,000.

With an Energy EFT you can put in your order on Sunday and get your shares at the Monday open for $100,500 or whatever then ride it up all day then sell at 3:59 EST and make $4500 (4.9%) profit or whatever it is.

With the mutual fund you are always a day behind and it's recommended to never day trade a mutual fund or trade it at all.

I've simplified this quite a bit but it will give you a general idea what the differences between the two are?

To: proxy_user

a big market crash. The securities will plummet, and the EFTs will plummet even faster. Will the APs be able to perform their arbitrage functions, or will they consider it too risky in a volatile market? If the AP's for SPY did just fine in '08--

--then probably a crash big enough to mess up the AP's would probably be big enough to make ETF's the least of our worries.

To: ChildOfThe60s

A etf for silver —NEAT! That was a question that I hadn’t gotten around to, how to use etf’s for the precious metals component. IMHO trading etf shares beats the hell out of carting coins around...

To: america-rules

For me the interday trading is part of the etf advantage the other being lower fees. Something I'm trying to get into now is

Factor Investing that etf's are making possible.

To: expat_panama

Since the stock market crashes every once in a while, and daily collapses of 100 points or more in the Dow are becoming commonplace, such as Friday’s 279-point nosedive, it seems like a good idea to sell the market short to some extent as insurance.

Bearish ETFs therefore serve as insurance policies for those with lots of money in the market, just like flood-insurance policies serve those with expensive homes located on coastlines.

Some of the lowest-priced bearish ETFs are TZA, TECS, and FAZ. When the financial hurricanes that are predicted to happen virtually every week by respected economists finally come, it’s good to know that with a few bearish ETFs your portfolio won’t end up a complete disaster area.

To: expat_panama

the table is wrong and seems to be guided by an over-generalization that all mutual funds are actively managed. Not so. Vanguard and others have index funds that have low expense ratios and can be tax efficient as well. The main benefit of ETFs IMO is that you can trade them during the day like a stock. There are also benefits of having certain mutual funds in that not all of them are available as an ETF — so I have probably 2/3 ETFs and 1/3 funds.

To: Bluestocking

seems like a good idea to sell the market shortWhile that very well may end up being the case, I'd have thought that the best strategy depends on a combo of time frame and risk tollerance. For my planning last Friday's 1 to 1-1/2 % drop is still within the range we've been seeing over the past half year, and personally I'm just looking to see how tomorrow goes before I agree to join in with the selloff.

To: plain talk

...an over-generalization that all mutual funds are actively managed...Yeah, I had a problem w/ that too. The IBD writer that put it together also was saying that ETF's were not managed, but some how he didn't get the word from the other writer in the office that was posting the next piece: Actively Managed ETFs Grow Quickly But Face Hurdles. What the heck, it's still a good 'beginner/intro tool.

To: expat_panama

Thanks expat_panama!

I like the leveraged ETFs. Direxion has a number of them from which to choose.

13

posted on

04/19/2015 1:19:03 PM PDT

by

NonLinear

(Giving money and power to government is like giving whiskey and car keys to teenage boys.)

To: expat_panama

I finally came around to a interesting strategy and perspective of owning high dividends ETFs and funds (and some bonds) on solid blue-chip companies that have paid consistent dividends for 30 years or more. The idea is if it all crashes and burns I want to be holding blue-chip stocks that have weathered many, many storms. As a retiree I am focused more on income than growth. Sure I care if the value craters but if it represents solid companies they will likely bounce back as has been demonstrated over and over again. In meantime I still get the dividends. Much different perspective now than I had for years trying to grow investments.

To: plain talk

...meantime I still get the dividends...Sure is a lot to be said for that; I remember reading in there about high dividend funds and it does make a lot of sense.

To: expat_panama

I woke up this morning to learn of Jon Corzine will probably be starting his own hedge fund. From Seeking Alpha.

Anyone else would be barred from the securities industry. Crony Capitalism??

16

posted on

04/20/2015 5:33:55 AM PDT

by

MichaelCorleone

(Jesus Christ is not a religion. He's the Truth.)

To: expat_panama

I mean my information came from Seeking Alpha.

They have nothing to do with him.

17

posted on

04/20/2015 5:35:01 AM PDT

by

MichaelCorleone

(Jesus Christ is not a religion. He's the Truth.)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

To: expat_panama

My husband bought his first ETF last week. He has an IRA at Scottrade and wanted to invest in a healthcare fund, so he bought Vanguard’s Health Care Index Fund ETF (VHT).

Additionally, we just opened an TDAmeritrade account. Apparently they have 100 ETFs for which they don’t charge a commission. We’ll see how that works out.

19

posted on

04/20/2015 8:28:17 AM PDT

by

ConstantSkeptic

(Be careful about preconceptions)

To: MichaelCorleone

That term "hedge fund" is beginning to take on a lot of new meanings. Yesterday I was surprised to learn that the SEC has decided that there is something that the call "hedge fund", they won't say what it is, but they suggest that it's something bad (

http://investor.gov/news-alerts/hedge-funds). Here's the closest I've come to finding a definition (

from here):

Legally, hedge funds are most often set up as private investment limited partnerships that are open to a limited number of accredited investors and require a large initial minimum investment. Investments in hedge funds are illiquid as they often require investors keep their money in the fund for at least one year, a time known as the lock-up period. Withdrawals may also only happen at certain intervals such as quarterly or bi-annually.

The impression I'm getting is that hedge funds are for folks that have more money than they're willing to bother with. While that's usually a temporary situation it's something Corzine's made a career of.

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-50 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

investment pool. Unlike mutual funds, however, ETF shares are traded on a national stock exchange and at market prices that may or may not be the same as the net asset value (“NAV”) of the shares, that is, the value of the ETF’s assets minus its liabilities divided by the number of shares outstanding.

investment pool. Unlike mutual funds, however, ETF shares are traded on a national stock exchange and at market prices that may or may not be the same as the net asset value (“NAV”) of the shares, that is, the value of the ETF’s assets minus its liabilities divided by the number of shares outstanding.

--and a very merry Monday morning to everyone!

--and a very merry Monday morning to everyone!