Posted on 02/20/2015 4:33:23 AM PST by thackney

STAGE one of Saudi Arabia’s plan—or perhaps hope—to restructure the oil market is taking longer than expected. By refusing to rein in production while prices fell, the Saudis permitted a big surplus to grow and served notice on higher-cost rivals (Russia, Venezuela, American shale-oil producers) that they would not prop up other people’s profit margins at the expense of their own market share.

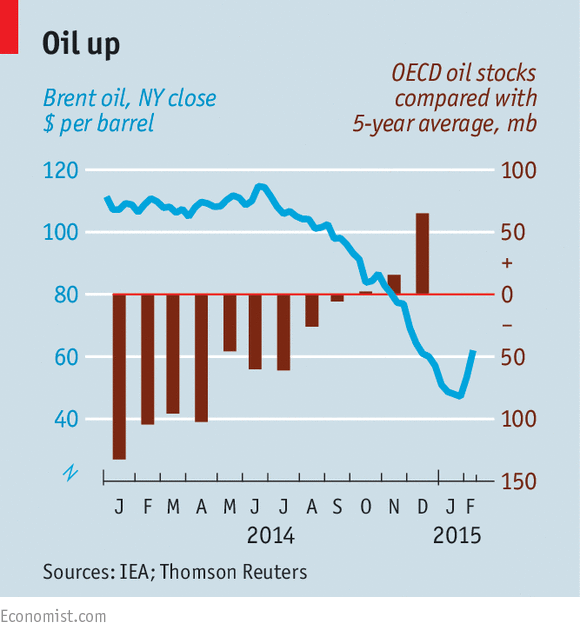

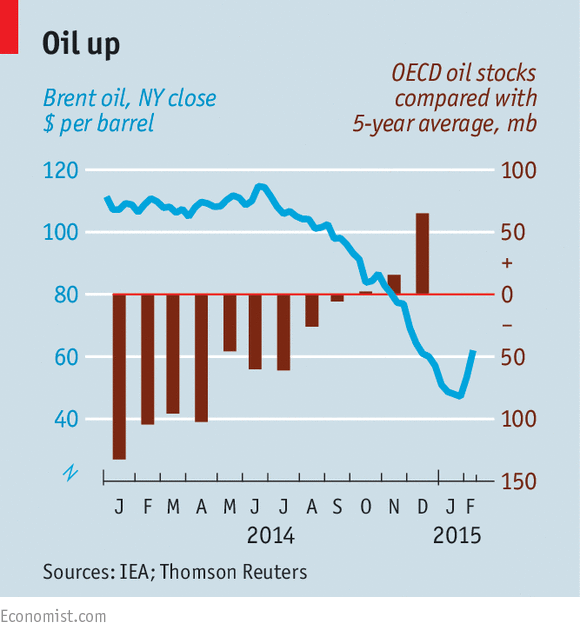

That signal has been weakened by the growing amount of oil in storage, which is absorbing most of the glut. World oil stocks rose about 265m barrels last year and Société Générale, a French bank, reckons they will increase by a further 1.6-1.8m barrels a day (b/d) in the first six months of this year, adding roughly 300m barrels to the total. At the moment, global oil output is exceeding demand by about 2m b/d, so the build-up of stocks is enough to take most of the glut off the market. Oil is being stored in the hope that demand and prices will pick up later. So stocks, plus renewed political worries (flows from Libya’s largest oilfield were disrupted again this week by apparent sabotage), have pushed the price of oil back over $60. After having fallen by more than 60% since June, the price of a barrel of Brent crude closed above $62 on February 17th.

The restocking cannot continue for long. Storage facilities in Europe and Asia are already 80-85% full. Much more and they will overflow. As it is, companies are renting tankers to keep oil in. If storage space runs out, prices could tumble again.

Whether that happens depends on how quickly phase two of the Saudi plan gets under way. This is to force high-cost producers out to increase the influence of Gulf countries. At the moment, this is happening only slowly. Oil types have recently become obsessed with the so-called “rig count”—the number of drilling rigs operating in America and elsewhere. Analysts think that as the rig count declines, shale-oil output will fall, hurting profits and investment. That seems dubious.

Figures from Baker Hughes, an oil-services company, showed that the rig count in America in mid-February fell to its lowest since 2011, and was 35% below its peak in October 2014. That is a big fall. But most of the idled rigs are in marginal areas; the fall has been only 9% in the main shale-oil areas, in North Dakota and Texas, which accounted for four-fifths of the increase in American oil output in the past two years. Moreover, productivity is rising in the remaining wells. Citibank reckons that even a 50% fall in the rig count would allow output to rise this year and turn the average shale firm’s cashflow positive, encouraging investment.

More broadly, says Antoine Halff of the International Energy Agency, an inter-governmental body, “The market sentiment may have changed but the fundamentals have not.” The Organisation of the Petroleum Exporting Countries (OPEC) says its members’ output will rise by 400,000 b/d this year; others think the increase will be greater. Non-OPEC supplies are likely to rise by twice that. Thanks partly to cheaper oil, world demand is rising, but not by much. The IEA reckons demand will be flat in the first half of 2015, before rising by 2m b/d in the second. By most estimates, the market will be oversupplied for a while.

In the long run, there are signs that a restructuring of the market is starting, which could eventually lead to high-cost producers going bust or marginal areas being abandoned. Large oil firms have announced cuts in capital spending of over 20% for this year. BP, for example, will spend $20 billion in capital projects in 2015, compared with $23 billion in 2014. New discoveries are down even more steeply. According to IHS, a research firm, new finds of oil and gas were the equivalent of 16 billion barrels last year, the lowest for 60 years. That will cheer the Saudis.

Oil Prices Hit The Snooze Button For The Next Year Or Two

http://www.forbes.com/sites/chipregister1/2015/02/19/oil-prices-hit-the-snooze-button-for-the-next-year-or-two/

Oil bulls and bears need to stop talking their books and get real. Crude isn’t going back above $100 a barrel – at least not anytime soon. Nor is it falling to $20.

How can I be so sure? A confluence of political, economic, and, most importantly, technological changes are having a major impact on the way we produce and consume oil, making it both cheaper and more abundant. Barring some major international conflict, oil prices will most likely be range bound for quite a while, with a floor of somewhere around $40 a barrel (where we have seen massive rig count and CAPEX reductions) and a top around $80 a barrel, above which production really ramps up.

The sharp drop in oil prices last year managed to catch pretty much the entire market off guard. West Texas Intermediate crude (WTI) has fallen from a high of over $100 a barrel in June to a low in the mid-$40’s last month. But the recent rebound in oil prices, which sent WTI to as high as $58 a barrel, has oil bulls ready to tell the market, “I told you so.” They believe that, even though WTI prices have weakened slightly from their highs in the last week to around $52 a barrel, the overall trajectory of oil prices is up and we will be testing $100 a barrel again in short order.

The oil bulls and bears

So who are these oil bulls and should we listen? They come in all shapes and sizes, ranging from Big Oil executives to small day traders. For example, John Hofmeister, the former head of Shell’s operations in the U.S., has publicly come out as an oil bull. He recently said he thought crude would rebound this year to around $80 to $90 a barrel and could even hit the triple-digits by early next year. Legendary Texas oilman T. Boone Pickens is another oil bull. He hasn’t been shy about telling pretty much anyone who’ll listen he believes oil will breach $100 a barrel in the next 12 to 18 months. He blames domestic shale oil drillers for the recent slump in prices and thinks that they will stop pumping and constrict supply in short order.

But we really need to consider the sources here. Hofmeister is retired and Pickens has a record of straight talk, so they seem like trustworthy folks. But it turns out that both men have vested interests in projects (or “plans“) that promote the use of natural gas as a transportation fuel alternative to gasoline, which of course is made from crude oil. The case for the use of natural gas as a transportation fuel makes a lot of sense when oil is above $100 a barrel, but it is a really hard sell to investors when oil is sitting at around $40 to $50 a barrel. It could be these men, and many others like them, are just talking their books.

excerpted for Forbes:

It seems that if oil prices are coming back this quickly ... then it shouldn’t have much of an impact on these shale oil producers, going forward. It was more of a hiccup than any long-term problem!

He really did not bet his own ranch.

Wind, prior to the hydro frac’ng expansion here in the US, was his method to sell his natural gas as fuel for vehicles including trucking. That was always his goal and where his dollars still remain.

Since the wind is no longer needed to free up a portion of the Nat Gas market from the power companies, he has dropped that portion. But before he started pushing wind, he already had Clean Energy fuels set up:

https://www.cleanenergyfuels.com/about-us/history/

You mean after they cut thousands of jobs, slashed their budgets, it won’t have much of an impact to only be down 40% in price instead of 50%?

Isn’t the problem with the Saudi plan the fact that the survivors will pick up the assets of the non-survivors in liquidation for a song? And resume pumping at those properties? The Saudis could short-circuit that by bidding on those properties, but I believe oil leases require continued production, failing which they are terminated and auctioned out again to the highest bidder. Am I way off base here?

Not in going forward ...

It’s like those I know in the construction trades ... they work like crazy for a while, and then, they’re dead out of work ... and then ... it picks back up again.

This isn’t like working in a grocery store and picking up your paycheck every week, 52 weeks a year. These guys in this business should be well aware of how it goes.

I believe the mistake lies in claiming this is a Saudi plan.

I see their only “plan” was recognizing that $100 oil in the current economy was unsustainable. They did not cause the crash in prices, but they did prepare for it building up ~$750 billion cash reserves and they did not try to stop it.

“So who are these oil bulls and should we listen?”

The only “Oil Bull” I listen to anymore is the Quick Trip in town. if the price is higher today than it was yesterday, Crude prices are up. If it is lower, Crude prices are down and adjust any market decisions accordingly.

Works a lot like my Weather Rock.

I think it won't have a long term impact on the industry, but we will certainly see individual companies fold up and sell their assets to companies in stronger financial position (meaning less debt).

I'm also skeptical that there's any Saudi plan. Let's just call it the bullish case for oil prices in the next several months - it seems to be based on output cuts that won't happen, because the weak sisters will be picked off for peanuts, after which production growth will resume at lower rates, but even that will be enough to keep oil south of $50 for several years.

I hate making predictions but I see that being true only if the demand side stays in the tank.

Global economy is not strong. Oil isn't the only thing down in price. So is ethane, propane, steel, copper, lumber, etc.

As we all know, Obama’s administration takes credit for the increase in US oil and gas production on private lands, although the truth is that he’s done everything in his power to hinder it, particularly on public lands. Look at his land grab in Alaska just a couple of weeks ago to prohibit drilling by declaring 12 million acres of ANWR a national monument (contrary to the intent of Congress when that law was established).

Maybe some time soon he’ll boast about how far-sighted he was, and just was acting to protect an inevitable glut and boom/bust in the oil sector.

How about imposing a sanctions regime on Saudi oil for about six months?

Let those the wahabbis pound sand for a while until the oil glut dissipates.

The demand side has mainly been a China story. And that bubble is starting to deflate, taking materials demand growth with it. Just how massive has Chinese demand growth been? I think GDP per capita growth is a good proxy. Since 1979, when markets were reintroduced after a 30-year hiatus, Chinese GDP per capita has gone up ~67x. The comparable number for India is ~7x. That is why Chinese light vehicle sales are ~20m a year compared to India's ~2m. But Chinese growth is starting to sputter, because the government put the pedal to the metal for way too long.

I'm frankly astonished that the party leadership feels that 8% per capita GDP growth is somehow a let down, but that's the way they've been running the economy, and the piper has just come to collect. The past decade of hyper-growth is gonna have to be paid for with a major slow-down. Hopefully, the worst case (for global demand) will be low single-digit GDP per capita growth. If it turns negative, as it did for a number of countries during the Asian crisis of the late 90's, including S Korea, Taiwan, Singapore, Malaysia, Thailand, Indonesia and the Philippines, Katy, bar the door.

why?

Twenty five years ago I scraped together $200 and bought shares of Exxon through its dividend reinvestment plan. A few months later I did the same with Texaco, which was later bought by Chevron. Whenever I had extra money at the end of the month I sent a check to be deposited in those dividend reinvestment plans which are run by the companies. The deposits became stock and the quarterly dividends were continuously reinvested in more shares of stock. In 2 1/2 decades I’ve accumulated a much larger ownership position in these two companies than I could have ever imagined when I started, all from periodic investments of $25 to $50 and reinvestment of dividends.

During this time period oil prices have gone up and gone down, and the stock market has crashed a few times, but these two companies continued to increase their dividends and over time the share price continues to rise. Together the dividend checks I receive annually from these two companies far exceed what I will draw annually from social security, even though my out of pocket investment in the stock was less than 5% of what I’ve been forced by the government to put into the social security Ponzi scheme over 45 years.

One thing I have learned is the big players in the oil industry manage the business with a vision spanning decades. I have little concern with the daily price of oil or what the Saudi’s are up to on a given day. I do worry about a US government that seems intent on destroying the US oil industry through environmental regulations, taxpayer subsidies of uneconomical green energy, and high taxation.

To protect American oil producers for one...

To break American dependence on foreign oil for two...

To force changes in the way the wahabbis conduct themselves for three.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.