Posted on 12/30/2014 11:33:06 AM PST by blam

December30, 2014

John_Rubino

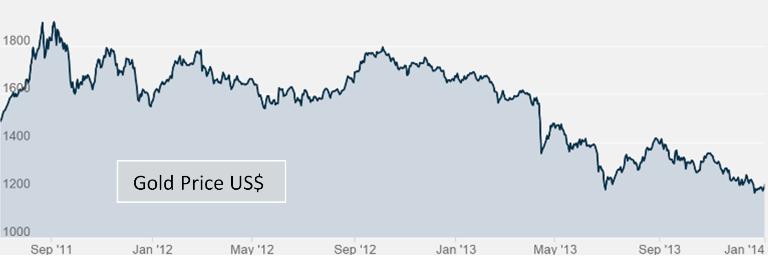

Twelve short months ago, the immediate future looked like a lock. Overvalued equities had to fall, ridiculously-low interest rates had to rise, and beaten-down precious metals had to resume their bull market.

The evidence was overwhelming. Debt in the developed world had risen to $157 trillion, or 376% of GDP, by far the highest level on record and clearly unsustainable. Long-term US Treasury rates had been falling for literally three decades and despite a recent uptick were so low that the only way forward seemed to be up.

Europe and Japan were drifting into recessions that could easily morph into capital-D Depressions. The eurozone would fragment, Japanese bonds and probably stocks would crater, one or more major currencies would implode. No way to know which event would come first and in what order the other dominoes would fall, but without doubt something had to give.

And gold, of course, had had its correction and was, at the beginning of 2014, perilously close to the mining industry’s cost of production. The last time that happened, in 2008, an epic bull market ensued — and gold-bugs were anxious for a replay.

Yet 2014 turned out to be a pretty good year for the powers that be and the economic theories that animate their behavior. Equities boomed, interest rates fell, the dollar soared, and gold ended the year below where it started. Gold miners, after a year of operating at an aggregate loss, have seen their market values crater.

(snip)

(Excerpt) Read more at marketoracle.co.uk ...

You're not doing the math correctly.

If oil production drops 20% or oil use increases 20%, do you feel the price will increase 20%?

The Federal Reserve has never been audited in over 100 years of operation.

They're audited every year.

Unfortunately 333 members of the current house voted for a bill in September asking for the Comptroller General to audit the Fed. They, obviously, were not happy with Deloitte's "audit".

As for the supply/demand "math" you refer to. I do not have the slopes of the supply and demand curves in front of me, such a chart would be theoretical at best. I believe that both supply and demand are fairly inelastic at these price ranges.

Toddster, if I may. I have answered all of your questions, you might not like the answers but I have answered them all. You have not answered a single question that I have posed. Can I look forward to that?

The Fed isn't owned by the banks.

Unfortunately 333 members of the current house voted for a bill in September asking for the Comptroller General to audit the Fed.

Congress did something stupid? I'm shocked.

You have not answered a single question that I have posed.

What would you like me to answer?

Ok, I’ll bite. Who owns the Fed? Who are the stockholders?

The government owns the Fed.

The Federal Reserve System fulfills its public mission as an independent entity within government. It is not "owned" by anyone and is not a private, profit-making institution.

As the nation's central bank, the Federal Reserve derives its authority from the Congress of the United States. It is considered an independent central bank because its monetary policy decisions do not have to be approved by the President or anyone else in the executive or legislative branches of government, it does not receive funding appropriated by the Congress, and the terms of the members of the Board of Governors span multiple presidential and congressional terms.

However, the Federal Reserve is subject to oversight by the Congress, which often reviews the Federal Reserve's activities and can alter its responsibilities by statute. Therefore, the Federal Reserve can be more accurately described as "independent within the government" rather than "independent of government."

The 12 regional Federal Reserve Banks, which were established by the Congress as the operating arms of the nation's central banking system, are organized similarly to private corporations--possibly leading to some confusion about "ownership." For example, the Reserve Banks issue shares of stock to member banks. However, owning Reserve Bank stock is quite different from owning stock in a private company. The Reserve Banks are not operated for profit, and ownership of a certain amount of stock is, by law, a condition of membership in the System. The stock may not be sold, traded, or pledged as security for a loan; dividends are, by law, 6 percent per year.

Who are the stockholders?

Any bank that is a member of the Federal Reserve system has to buy "stock". It would be more accurate and less confusing to have called it a bond, instead of stock.

So we have an "independent entity within government (whatever that means)" that, by their own statement, is not owned by anyone, BUT, it has private stockholders (ownership of stock implies ownership of the underlying entity). Those stockholders are the member banks. Do you doubt that the biggest stockholders are the money center banks, the previously mentioned TBTF banks? Do you know that the list of stockholders and how much they hold is a very closely guarded secret?

Friend, a few years ago I would be putting forth the exact arguments that you are making. I believed the markets operated legitimately and represented true price discovery. I thought that bankers caught rigging the markets or committing crimes were isolated incidents. I thought gold and silver were dusty relics of a bygone era. I thought politicians and business people played by the rules.

Now? I think there are no rules. And when there are no rules the only thing an individual can do is get back to basics. Look after yourself and your family and prepare for the future. The future I see is one in which the monetary authorities completely lose control and the currency blows away. I want to be invested in something else when that happens.

We have hijacked this thread. Let's agree to disagree.

Yes, within government. Does anyone own anything that is "within government"?

So we have an "independent entity within government (whatever that means)"

It explains what it means, "It is considered an independent central bank because its monetary policy decisions do not have to be approved by the President or anyone else in the executive or legislative branches of government, it does not receive funding appropriated by the Congress, and the terms of the members of the Board of Governors span multiple presidential and congressional terms"

BUT, it has private stockholders (ownership of stock implies ownership of the underlying entity).

But this "ownership" is different. However, owning Reserve Bank stock is quite different from owning stock in a private company. The Reserve Banks are not operated for profit, and ownership of a certain amount of stock is, by law, a condition of membership in the System. The stock may not be sold, traded, or pledged as security for a loan; dividends are, by law, 6 percent per year

The "owners" don't get to tell the Fed to raise rates, lower rates, distribute more of the profits or any of the things that the owners of stock of a private company could do.

Do you know that the list of stockholders and how much they hold is a very closely guarded secret?

That's another thing that you "know" that is not the case.

Ok, you win. The government owns the Fed even though the Fed itself says no one owns it and the member banks who are stockholders (owners) are really just bondholders, according to you. Read the last two paragraphs of my last post, Todd. I am not going to get into a semantic argument with you.

LOL

Oh please, who owns the FBI? It's inside the government. It's part of the government. LOL!

The US Treasury last year received about $78 billion of the Fed's earnings. The bank "shareholders" received $1.6 billion. Which number sounds like the owner's share?

Then you tell me the banks who are stockholders are really bondholders.

Well, they can't buy, sell or pledge it and they get 6%, every year, despite the higher or lower earnings of the Fed. Can you think of a security closer than a bond to describe it?

Ok, you win. The government owns the Fed

Obviously.

Bought cereal lately? Has at least doubled in price over the last few years.

Ummmmmm, the first bolded sentence in post #105 most certainly was this part which you accused me of leaving out.

Meanwhile, the prices of other important products, like a gallon of gas, have gone down. Thus aggregate measures like the Consumer Price Index and Producer Price Index have been risen little despite the massive money creation (quantitative easing) by the Fed and the value of gold has declined over the last year.

Not original. Niels Bohr. Famous physicist.

Can I chime in with a question?

If the Fed pays the US Treasury $78 billion, Why does the Treasury have to pay so much interest to the fed annually on $$$ the US Gov’t borrows from the Fed?

That $78 Billion sounds like a shell game to me...a slight of hand, smoke and mirrors....”Pay no attention to the man behind the curtain”

Perhaps the $78 billion is the money the Gov’t is borrowing from the Fed for that particular year and to the casual onlooker, it appears to be something other than what it really is?

Look at it this way.

The US Gov’t owes the Federal Reserve Bank $11 trillion.

Why would you pay someone who owes you 11 trillion dollars?

Perhaps the US Gov’t now owes the Fed $11,078,000,000 ?

https://www.youtube.com/watch?v=iFDe5kUUyT0&index=4&list=PLE88E9ICdipidHkTehs1VbFzgwrq1jkUJ

Don't worry if you don't understand all of it the first time through. I've watched it five or six times and I still don't get it all.

Gold, because it's malleable, useful to make tools.

A million dollars would last just one night as firewood. I think I would rather use soft leaves rather than crisp dollars as TP.

So show me a time in history when the price of gold went to zero.

Bought hamburger lately?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.