Posted on 10/05/2014 12:26:47 PM PDT by expat_panama

Investment & Finance Thread TOTAL Market Crash Wrap-up

Jeesh! The bond bubble, just popped (Bond market may be more fragile than you think),stocks'n'metals are in the terlet, all while unemployment plunges below the big 6! Big deal. This so-called 'recovery' may be a boom time for all the elites on Main Street but those of us middle class working stiffs on Wall Street know better.

On Friday's gold and silver punched new lows and now weekend trading's putting them clearly into prices from four years ago.

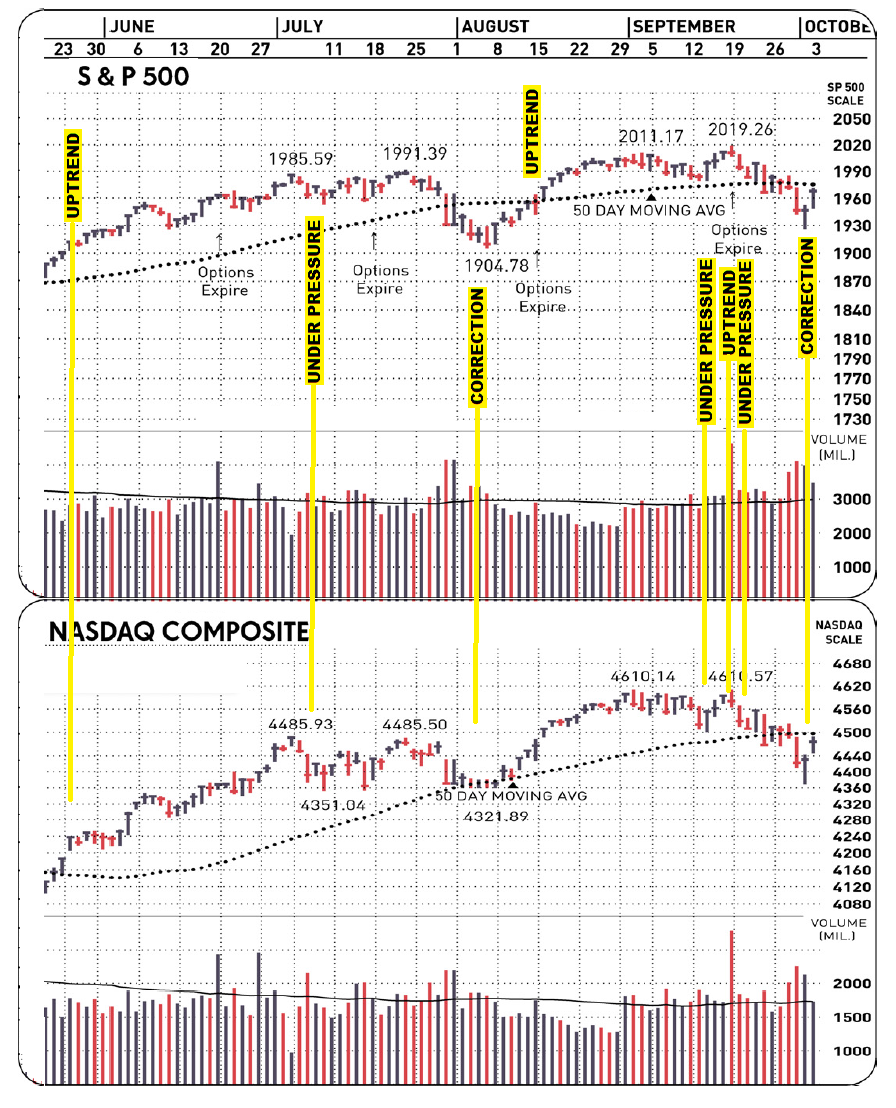

As for stock indexes we got IBD announcing Thursday that stock trends are now pegged "market in correction". Some how my inner 'wise-ass' wants to say this means it's time to buy back in, but past track records aside IBD's always been up front that the "market under pressure" is the yellow traffic light. Some drivers hit the gas when the light turns yellow but I'd rather slow down...

As for stock indexes we got IBD announcing Thursday that stock trends are now pegged "market in correction". Some how my inner 'wise-ass' wants to say this means it's time to buy back in, but past track records aside IBD's always been up front that the "market under pressure" is the yellow traffic light. Some drivers hit the gas when the light turns yellow but I'd rather slow down...

Bottom line though is I plan to watch this "red light" with a bit more enthusiasm than before.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

Yo!

so buy US stocks or sell US stocks right now?

In my experience when the market makes a “saw-tooth” pattern (big up days followed by big down days, repeatedly) it is time to sell. Adding to that is the strong dollar which will hurt the earnings of the multi-nationals.

I wonder how the mid-term elections will affect the market.

I suspect that the elections are already factored into the market. “Buy on the rumor, sell on the news.”

But wait.... we were suppose to buy gold and silver as a hedge against over valued equities?

Link does not work

Did you run that deflationary scenario by Helicopter Ben first...? Oh, wait, he’s gone ... But Larry Blankfein’s still got our Black Cards , right?

/s

Please add me to your ping list here.

You don't know either? Dang! Let's wait a bit; hopefully someone will show up who knows. fwiw, I've unloaded 80% of my holdings over the past couple weeks.

That's my thinking too. Market trends have signals and what we've been seeing for some time now are price trends that are short on stability. That tells me it's an environment I'd need to step back from.

Or maybe not. Sometimes elections have surprises, we saw a dip after the '12 election --back in '48 the upset saw a plunge big time. My personal guess is Nov. good news w/ a solid rally. Hope I'm right...

tx -—fixed!

done!

Gold and silver are a hedge against total economic collapse. Nice try though. You will be able to use your stock certificates and fiat currency for toilet paper.

China's thirst and ME upheaval leads me to believe that $90 oil, or lower, is a temporary thing. Even so, I'll probably continue waiting and watching......for now.

Correct me if this contradicts your experience, Pete, but it is my considered view that if a product/commodity/shares/investment vehicle (of whatever type) is actually ADVERTISED to the public, then the sane investor -- and even more so, the sane trader -- wants precisely NO part of the long side of what is being advertised.

A particularly vicious example of this you-don't-want-this-garbage philosophy was the presence of Tom Stolper on Goldman Sachs' currency trading desk up until last year. Would you believe that this clown (on orders from his masters, without doubt) issued 11 CONSECUTIVE EUR/USD TRADING RECCOS over 2 1/2 years...ALL of which were wrong; those who went opposite these reccos profited hugely (including, of course, Goldman).

Point is for the trader or investor, develop your own methods or stay the hell out of the mkt.

For my part, I'm trading ONLY spreads right now (have a new and conservative methodology in which you might have an interest, btw).

Good trading to you, and thanks for your efforts on these threads!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.