Posted on 10/05/2014 12:26:47 PM PDT by expat_panama

Investment & Finance Thread TOTAL Market Crash Wrap-up

Jeesh! The bond bubble, just popped (Bond market may be more fragile than you think),stocks'n'metals are in the terlet, all while unemployment plunges below the big 6! Big deal. This so-called 'recovery' may be a boom time for all the elites on Main Street but those of us middle class working stiffs on Wall Street know better.

On Friday's gold and silver punched new lows and now weekend trading's putting them clearly into prices from four years ago.

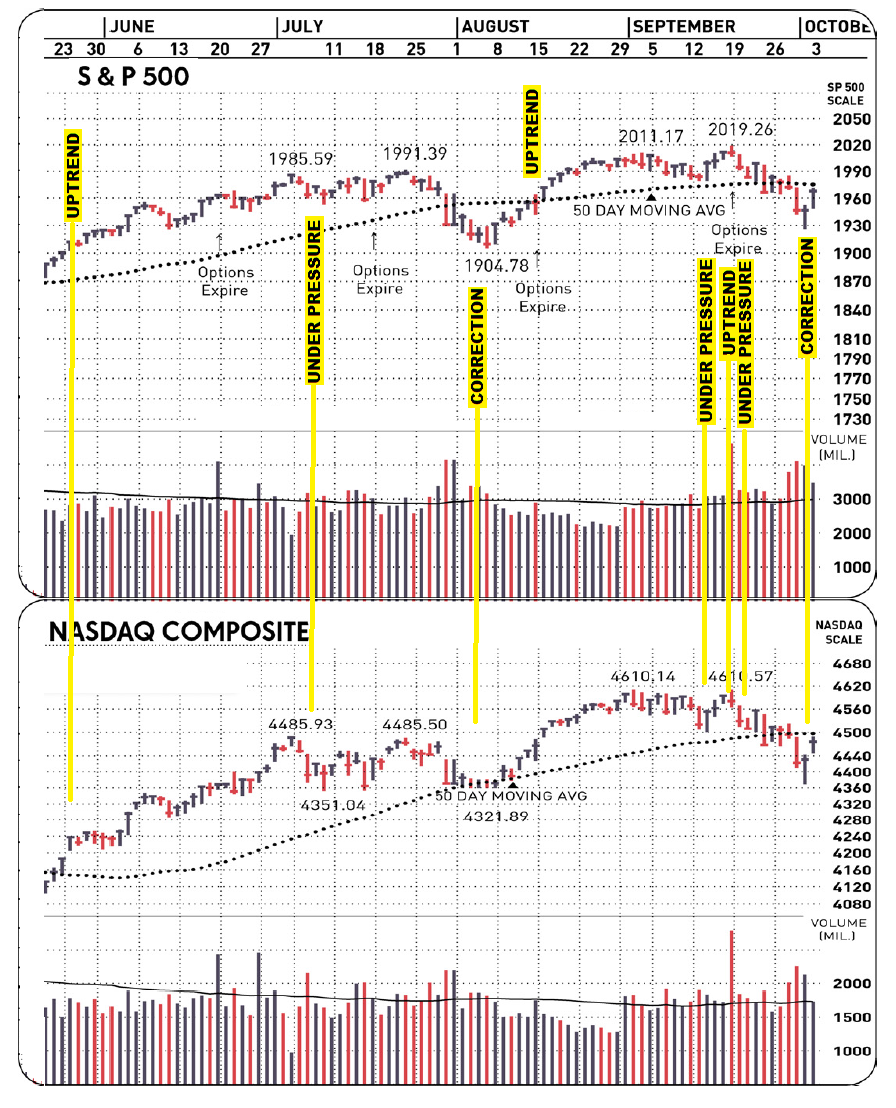

As for stock indexes we got IBD announcing Thursday that stock trends are now pegged "market in correction". Some how my inner 'wise-ass' wants to say this means it's time to buy back in, but past track records aside IBD's always been up front that the "market under pressure" is the yellow traffic light. Some drivers hit the gas when the light turns yellow but I'd rather slow down...

As for stock indexes we got IBD announcing Thursday that stock trends are now pegged "market in correction". Some how my inner 'wise-ass' wants to say this means it's time to buy back in, but past track records aside IBD's always been up front that the "market under pressure" is the yellow traffic light. Some drivers hit the gas when the light turns yellow but I'd rather slow down...

Bottom line though is I plan to watch this "red light" with a bit more enthusiasm than before.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

Good morning!

After Tuesdays stock hit and metals leap it now looks like Wednesday is "over the hump" day w/ asset prices too. Futures trades have calmed yesterday's jolts and are now seeing stock indexes a bit up and metals a tad off. That's probably going to be hard on the 'drama' crowd, over at Major Markets Close Sharply Lower, Dow Industrials Drop 272 Points (h/t to Aliska) --we had the required dose of "America's collapse" but seriously yesterday's stock dip had a bottom that was not as low as last Thursday's bottom.

Maybe Lurk's "Verbal Easing" (FORGET QE: The Next Move From The Fed Is Going To Be 'VE') shows just how touchy we've all gotten, but imho we really should be at a turning point...

Well looks like the Verbal Easing from the FED minutes is working for now.

CBO Estimate: Budget Deficit declines to 2.8% of GDP

Happy Thursday morning --with yesterday's solid rebound in both metals and stocks going into futures seeing more of the same! Supposedly thanks to the Minutes of the Federal Open Market Committee, September 16-17, 2014 promising less action (?!). Claims & Inventory reports this morning.

Lot's of weird talk out there:

Stone McCarthy - Trading Today

Trading Today - Claims, Inventories...Bond Auction...Speakers Galore

— Stone & McCarthy (Princeton) — Treasuries wound up mixed on Wednesday. The market meandered in the area of Tuesday’s closing levels for much of the day. The long-end led the way lower in the early afternoon through a weak 10-year auction, but the FOMC minutes were viewed in a dovish light, and the front-end led the way higher, steepening the curve.

Prices dipped at the outset of trading in London and Europe overnight as Asian banks and real money players took profits after the market ran into resistance late on Tuesday. The HSBC China Services PMI fell to 53.5 from 54.1, but that wasn’t enough to offer support, and a large sale of 10-year futures led the market to the lows shortly ahead of the open of trading in London and Europe.

Treasuries found their footing with the outset of trading in London and Europe, eventually fully erasing the damage done in Asia, but the market ran out of steam after edging above Tuesday’s closing levels. The bond once again found resistance just below 3.05%, and the 10-year just below 2.34%. With the 10-year and 30-year auctions on tap, the resistance attracted another round of profit-taking in addition to supply positioning. The German 5-year auction was technically uncovered as well, which weighed on the belly of the German curve, possibly generating some carry over pressure on Treasuries.

There was little on the calendar in the U.S. That left the front-end through the belly of the curve oscillating on either side of unchanged through the late morning. The long-end also moved back up to roughly unchanged through mid-morning, but led a weaker late morning/early afternoon trade, steepening the curve on supply concerns ahead of the 10-year note auction, with talk of real money and fast money selling in the sector.

The 10-year auction went quite poorly. The 2.381% stopout rate reflected a 1.3 basis point tail to the 2.368% 100pm bid side, and the 2.52 bid/cover was light. The bidding details were also not good. The buyside demand was quite poor, particularly as the Direct bid was the smallest since December 2009, and the takedown was the smallest takedown since August 2012.

The poor auction results slammed the long-end to new lows, further steepening the curve, both in response to the results and on concerns about what that might mean for Thursday’s bond auction. That left prices at the lows of the day when the FOMC minutes were released. The minutes were view much more dovishly than the FOMC statement or press conference following the meeting, causing a tremendous rally into the front-end, which proceeded to lift the rest of the curve higher as well, although bonds were still a touch lower to close, as supply concerns remained an issue.

The minutes did note that “several participants” were still concerned that the Fed’s forward guidance “suggested a longer period before liftoff, and perhaps also a more gradual increase in the federal funds rate thereafter, than they believed was likely to be appropriate given economic and financial conditions.”

However, the minutes also noted meeting participants’ discussion of the appreciation of the dollar, “particularly against the euro, the yen, and the pound sterling. Some participants expressed concern that the persistent shortfall of economic growth and inflation in the euro area could lead to a further appreciation of the dollar and have adverse effects on the U.S. external sector. Several participants added that slower economic growth in China or Japan or unanticipated events in the Middle East or Ukraine might pose a similar risk. At the same time, a couple of participants pointed out that the appreciation of the dollar might also tend to slow the gradual increase in inflation toward the FOMC’s 2 percent goal.”

Those concerns received the lion’s share of the markets’ attention, resulting in players pricing in a slightly slower removal of policy accommodation going forward, which not only sent Treasuries surging higher through the close, but stocks as well. The dollar, on the other hand, tumbled from the area of 85.85 down to 85.20 in search of support. The 2-year yield decline was the largest since August 1, and before that since January 10.

Overnight - Treasuries are higher, and the curve is generally a bit flatter this morning. The bond is lagging slightly though ahead of the auction this afternoon. The market was narrowly mixed throughout the session in Asia overnight. The belly of the curve was under-performing amid talk of real money moving in the curve from the belly, but there was little direction. The UK RICS House Price Balance was lower, falling to 30% from 39%, but Japanese August Machine Orders were stronger, rising 4.7%, compared to a +0.5% median estimate. The Australian employment figures were worse than expected though, and that appeared to help sovereign debt markets hold a steadier tone, even if it wasn’t enough to generate a new bid after yesterday’s rally. The Australian Employment fell 29,700, compared to a +15,500 median estimate, and there was a sharp downward revision to August to +32,100 from +121,000.

Treasuries were better bid from the outset in London and European trading, including real money demand for 10s after yesterday’s weak auction. The German Trade surplus was smaller than expected, including a larger than expected decline in exports, and the French Trade deficit was a little larger than expected. The IFO and some German economic think tanks released a research report which significantly cut estimates for German growth both this year and next year, offering support. There was a little profit-taking following the initial gains, but bonds and 10s have been better bid heading into the U.S., leading the market to new highs.

S&P futures are 4.2 points lower, NASDAQ futures are 7.5 points lower, and DJIA futures are 47 points lower. The 2-year/5-year spread is +108.9 basis points after closing yesterday at +109.8 basis points. The 2-year/10-year spread is +185.8 basis points after closing yesterday at +186.9 basis points. The 2-year/30-year spread is +260.9 basis points after closing at +260.8 basis points yesterday. The 5-year/30-year spread is +151.9 basis points after closing at +150.8 basis points yesterday. The Bund/Treasury 10-year spread is 142.0 basis points this morning vs. 141.4 basis points yesterday.

Back in the U.S. - The U.S. calendar is packed with central bank speakers, as detailed below. The data releases are likely to be of lesser importance. There is little chance of a significant reaction to either the Jobless Claims or the Wholesale Inventories release. That will keep the focus on the central bank comments as well as positioning ahead of the afternoon’s 30-year bond auction. The late day, last minute push higher on Wednesday finally bulled even the 10-year below the 2.337% closing low from August 28, which was the low yield since June of last year. At these levels though, the 10-year auction didn’t go particularly well, and we expect some related trepidation ahead of the bond auction should weigh on prices out the curve through mid-day, which is likely to limit any further gains at least until the supply is out of the way.

Technically - The benchmark 10-Yr note contract closed higher for the 3rd straight session, pushing the yield to the lowest closing level since mid June ‘13. In the process, the spread between 5Yr note and 30Yr bond yields steepened to the steepest levels since 09/22. In this past Monday’s Treasury Market Technicals update, we suggested that with the shorter-term 5-day and 10-day correlation cycles measuring stocks vs. bond yields reaching the high-end of the range, the correlation between these two markets could begin to ease a bit. Well, at least for yesterday, these two markets diverged completely after the release of the Fed’s September 16-17 meeting minutes. In the end, the benchmark S&P 500 reversed higher from the lowest intra-day levels since early August and at the best levels since 09/30, while the benchmark Treasury yield slipped to its lowest intra-day level since 08/15, and the lowest yield close since mid June ‘13.

For the 10-Yr yield, although slower daily momentum studies are starting to tickle historically resistive levels, we still do not see anything to suggest that things can’t extend even more. This will remain the immediate threat against 2.404%, where overshoot POTENTIAL, should the 2014 yield low of 2.301% fail to act as price resistance, extends to between 2.225% and 2.195%.

While a sell-off above the aforementioned short-term stop at 2.404% would turn things from bullish to neutral over the short-term, a reversal of the prevailing bullish post-09/19 trend will not occur until sellers come in beyond 2.481%.

Long-term, based primarily on the lack of an overly bullish CoT positioning profile so far this year, it has been our long-standing view that yields were poised to linger around the low-end of the range into year-end, rather than accelerate higher. Well, considering the extent of the recent Treasury rally and the breakdown in key equity-based interest rate proxies, this outlook has gained significant credence.

5s30s Spread: As we have been reinforcing for the past couple of months, a confluence of technical levels in the area of 136.7bps and several weeks of non-confirmation from momentum have been providing a theoretically supportive backdrop for spreads. While we are now looking at a countertrend steepening structure with potential to between 150.5bps and 156.2bps (valid against 142.7bps, we’d need to see a steepening move above 147.2 simply to be able to suggest that just the near-term trend is starting to transition away from flatteners.

Our long-term, 3-tier trend following model is now 3/3 long the Dec ‘14 30-Yr, 10-Yr and 5-Yr contracts, and 2/3 long the Mar ‘16 Eurodollar contract.

--and is still going strong, or is this going to be even more curtailing along with the old curtailing?

Regulators regulations (what?) have eased but the banks are scared about DOJ prosecution for their loans. This was a very consistent theme repeated over and over again at the Zelman housing conference. Repeated calls for the DOJ to clarify the rules about what the banks could be punished for. Until that happens the banks will continue the incremental credit overlays.

Great chart. Really highlights it.

Boy the way it’s going today when they get to verbulating they are going to have to ease harder.

That's probably what the pundits will say, but to us it's looking more and more like our downtrend is just confirming its ranges and settling in:

Yeah, and thanks for finding it! No Kidding, I'd stored it a while back so today to find the URL I gooogled the image and hit your FR post where you'd originally shared it.

Just heard on the news investors are shorting the S&P 500. Remember months ago when Soros started messing with it? He put tons of money in. Pump and dump?

I know what shorting is but don't have enough grip on it to do it.

That's my thinking too. My plan is to buy back in when indexes punch up through the topside resistance level proving that there's a general upside change in direction.

...know what shorting is but don't have enough grip on it to do it.

Or maybe we understand to too much to be willing to leap in. Looking again at index patterns in post #52 it gets real easy to see how uptrends are steady and downtrends are chaotic. For me that makes buying on the rally a LOT easier than trying to make sense w/ shorts during a correction.

But the individual got it all back when they shorted Lehman's all the way down. Last I talked to him, he plays just one company, daytrading, sometimes just one trade a day, sometimes more. He said and I mentioned before, know your company inside out, trends, especially know what the market makers are doing. That last thing, I don't understand at all except I can watch the spreads between bid and ask is all.

Nice play if you know what you are doing. For now best to try to pick winners rather than losers.

Nice little rally on some stocks now B4 closing. Not too much has flipped to green though. Closing down 331. JCP down in the $7 range but BBRY is holding its own around $9.

I'm still learning where to find info. On ST, for each stock when you get to its own page it has the number of shorts that are outstanding.

I will watch the indices; thanks for that chart; I saved it but understand it will change every day. Definitely trending on the downside for all. So I don't necessarily see Soros hand in this today.

ROFLMAO!

I haven't been in the market for about 6 years, but still watch some individual stocks and enjoy reading about it from time to time, especially on a day like today. Good luck to all speculators. All out.

Bkmk. Thank you.

--and a very merry Friday morning to all! Status:

| Friday, October 10, 2014 | |||||

| Markets | yesterday | today | |||

| metals | continuing a four day rally up 3% | Futuress -0.78% | |||

| stocks | ...gave back all of the big gains from the previous session as worries about Europe's economic situation intensified. The Nasdaq dropped 2%, while the S&P 500 lost 2.1%... (Investor's Business Daily) | Futures @ 4 hrs. before opening. -0.13% | |||

Reports: Export Prices ex-ag, Import Prices ex-oil, Treasury Budget

Crash? More of a fender-bender, imo.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.