My thinking was that if the current stock correction's now six weeks old, how old would that be if I could prove I was a cocker spaniel?

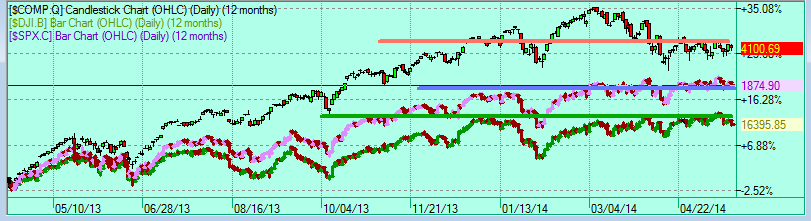

fwiw, we're still inside both these trendlines and these too.

Posted on 05/18/2014 5:35:14 PM PDT by expat_panama

My thinking was that if the current stock correction's now six weeks old, how old would that be if I could prove I was a cocker spaniel?

fwiw, we're still inside both these trendlines and these too. |

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket. |

Do I dare picking a short-term bottom here? I’m tempted.

Somehow when I look at how prices have been going---

--I'm a bit hard pressed to see that we've had any bottoms or tops at all since Dec. '13. For some reason or other everything just got perched and won't move. Maybe it's all waiting for a decisive trend in the '14 election, maybe stocks have decided to build a super strong'n'stable base to launch the next 3-year bull market, or maybe nobody knows nuttin'. My take is that while it's real easy to make money during a solid uptrend, and that lots of folks make money on shorts during a down trend, and some even can profit during back & forth volitility --I've never known how anyone can profit when nothing happens. Anyone?

OK, so at least we don't lose money here...

My take is that while it's real easy to make money during a solid uptrend, and that lots of folks make money on shorts during a down trend, and some even can profit during back & forth volitility --I've never known how anyone can profit when nothing happens. Anyone?

The options to hedge your bet/investment is called a "straddle."

No, I'm not going to explain the margins, dynamics, etc. right now. Maybe someone else can.

5.56mm

ah.

thanks.

[more homework tonight...]

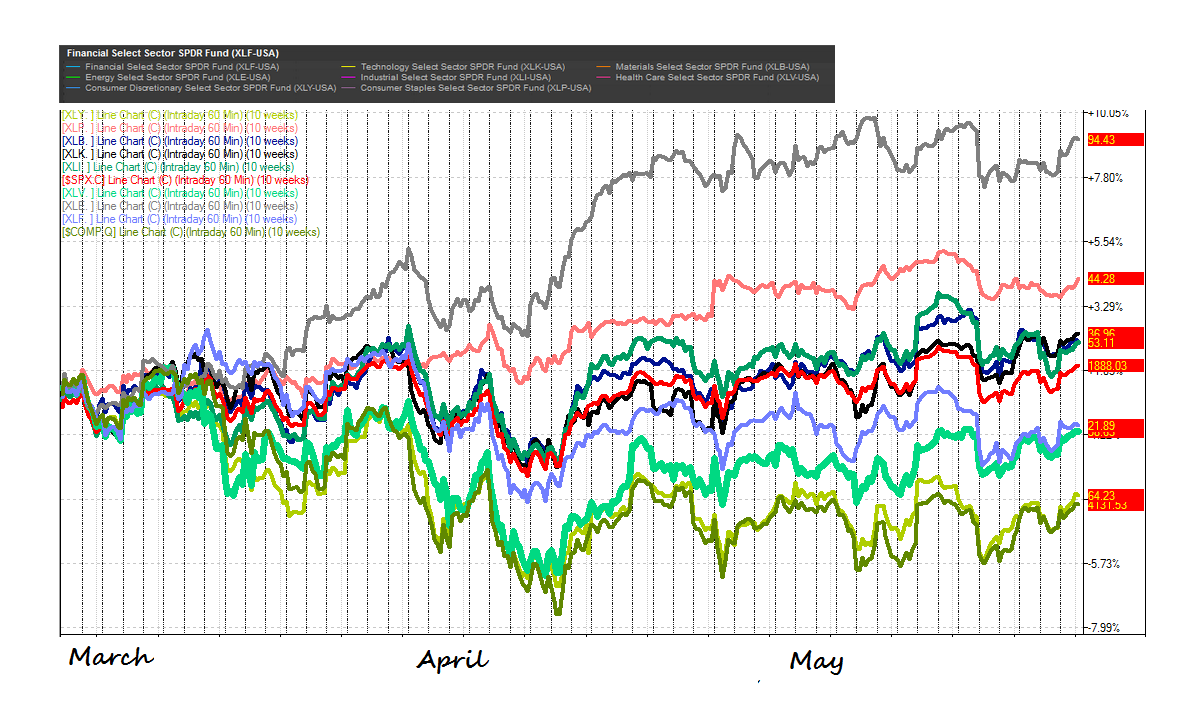

Where the heck did you find those sector graphs. I MUST HAAAAVE!!!!!!!

On my Twitter Finance list:

https://mobile.twitter.com/bpjauburn/lists/finance

Can’t remember who posts them but it’s pretty much every day. This is a pretty good list of traders, Econ people, finance journalists, banks, etc.

Happy Mid-week; stocks still within ranges (down but not too bad yesterday + today's futures upbeat)

Retail stocks lead selloff on Wall St. after earnings Reuters India - May 20, 2014 NEW YORK (Reuters) - U.S. stocks fell in a broad selloff on Tuesday, with major indexes hitting session lows in afternoon trading, led by losses in the retail sector after disappointing results from Staples and TJX Companies.

- Fed minutes to focus on rate-hike timing USA TODAY - an hour ago It's all about timing on Wall Street. The timing of interest rate hikes by the Federal Reserve, to be precise. As expected, when the Fed met in late April, it cut its bond purchases to $45 billion a month.

- Gold bar and coin demand slumps to 4-year low Demand for gold bars and coins slowed dramatically in the first quarter an industry report showed on Tuesday. CNBC

- Dennis Gartman: A correction is coming A divergence in the Dow, Russell and Nasdaq indices is cause for concern in the S&P 500, Dennis Gartman says.

Please help me out torch, I’ve wandered thru twitter & the link, I’ve searched the image, but I still can’t find where you’re generating the chart.

I didn’t generate it. Someone in my finance list on Twitter did yesterday.

Working on a different on in FactSet for intraday

come to think of it, probably be something in the ‘research’ tab of a broker or IBD...

Probably. I’ve got it built in FactSet so I’ll post after lunch.

WT ... Thanks for the link. Was afraid you had to be a SPDR investor to get it. Will definitely bookmark. Sector performance is one of my benchmarks to guess where the market is going.

Hi guys! So we got stock futures drifting down into minus land (slightly) after yesterdays rebound in lighter trade. Like we were saying --that even if there may be no big direction in general there's always direction bigtime in individual market sectors. Time to focus on which one. fwiw. claims & home sales today. Here's what's got my eye this AM:

High Frequency Hyperbole - Part II - Asness, Brown, Mendelson, Mittal, RCM

We Haven't Seen a Bull Market, Yet - Russell Redenbaugh/Jim Juliano, RCM

Is a Bond and Stock Correction On the Way? - Michael Gayed, MarketWatch

China's Vulnerability to Bad News - Philippa Malmgren, International Econ.

We're in a stock 'correction right now': Gartman And "there's more selling to come,' closely followed investor Dennis Gartman tells CNBC. CNBC

No, stocks aren’t wildly overvalued: Citi strategist finds hole in Shiller’s CAPE Tobias Levkovich says the Nobel-winning professor committed a critical error in constructing his cyclically adjusted P/E valuation model. Daily Ticker

Looks like we got energy on top & consumer discretionary on the bottom...

Thanks expat and WT.... Is there a “link” so I can personally use this, and massage the graph parameters for my research?

I found what looks to be a “tools” section at the SPDR site that requires registration. (and subscription?). Are y’all subscribers, or is there some magical link to the graphing tools?

I use FactSet (buy side terminal) which is subscription based like a Bloomberg.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.