Skip to comments.

Investment & Finance Thread (Apr. 27 edition)

Daily investment & finance thread ^

| 04/27/2014

| Freeper Investors

Posted on 04/27/2014 4:06:29 PM PDT by expat_panama

While we've all been asking 'which way' for the past few weeks all we've been getting is 'nowhere in particular'.

|

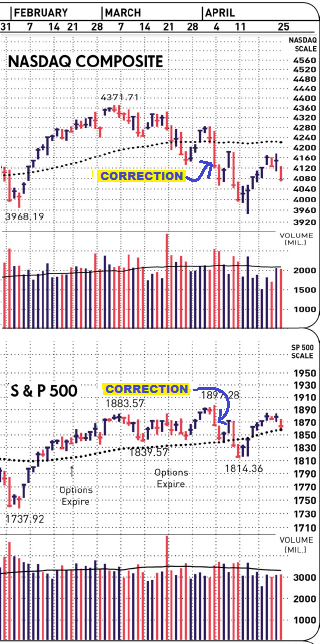

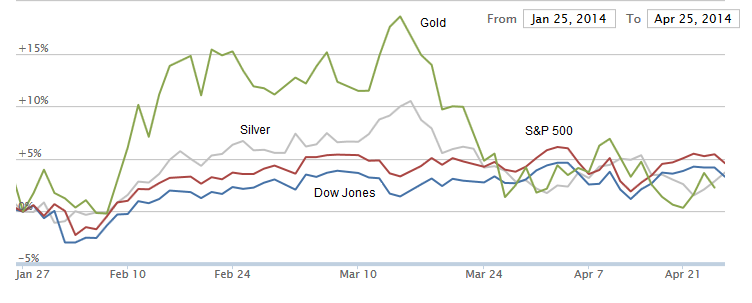

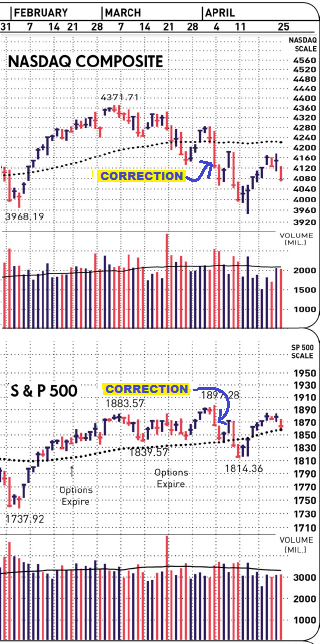

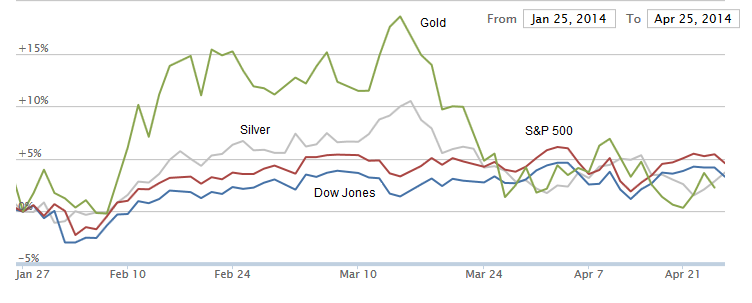

OK, so in the past 3 months we've seen everything leap up but then they all flop back to next to nothing just sitting there for a few weeks. Seems IBD called it right by saying the correction began 3 weeks ago with no 'uptrend' so far. Major indexes have given us new lows and descending highs --with volume on the bearish side. We got all kinds of pundits predicting all kinds of directions, but imho the "usually reliable" signs say we may as well get ready for more of the same. Unless we get a follow thru day tomorrow. 8P btw, IBD's clear on that follow-thru stuff saying it's no guarantee of things to come. It's just that (like they say) while not every FTD brings in a good uptrend, we know that every good up trend has had a FTD. |

|

|

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-116 last

To: catfish1957

Yeah I’m not buying that either...

To: Wyatt's Torch; catfish1957

Yeah, this smells just like yesterday's "Obamacare tax hikes saved the recovery".

To: expat_panama

Yeah, this smells just like yesterday’s “Obamacare tax hikes saved the recovery”.

Ummmm, what?

To: Wyatt's Torch

Yeah, this smells just like yesterday’s “Obamacare tax hikes saved the recovery”.Ummmm, what?

The ACA (AKA 'obamacare') was found to be constitutional because it is a tax. The Whitehouse said that the reason 2014 Q1 GDP was positive was the ACA (from here):

...The report also shows the positive impact of the implementation of the Affordable Care Act which, together with continued slowing in health costs, helped strengthen the economy in the first quarter. The President will do everything he can either by acting through executive action or by working with Congress to push for steps that would raise growth and accelerate job creation, including fully paid-for investments in infrastructure, education and research, a reinstatement of extended unemployment insurance benefits, and an increase in the minimum wage.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF ECONOMIC ANALYSIS

1. Real gross domestic product (GDP) rose 0.1 percent at an annual rate in the first quarter of 2014, following the 3.4 percent annual pace in the second half of 2013. Looking at the various components of GDP, consumer spending grew at a rapid pace, mainly reflecting sharp increases in health care ...

To: expat_panama

“Looking at the various components of GDP, consumer spending grew at a rapid pace, mainly reflecting sharp increases in health care ...”

LOL! I suppose we saw a major spike in consumer spending on April 15th also.

To: expat_panama

Yeah it’s a pretty flawed system when you force tax hikes and that is an improvement in GDP... Absolutely zero wealth effect from that money being pissed down the government drain.

To: Wyatt's Torch; Lurkina.n.Learnin

a major spike in consumer spending on April 15th alsoforce tax hikes and that is an improvement in GDP

iirc hurricane Katrina boosted the GDP too. Makes me wonder if next time some wonk will try and keep GDP growth positive by say, nuking Omaha.

To: expat_panama

To: expat_panama

Also goes back to the Milton Friedman/Chinese Dam story.

To: expat_panama

The drab on job growth from government jobs might be over:

To: Wyatt's Torch

huh. Of course if that were a stock chart I’d be looking at how this latest uptick is a lot like the one in Sept. ‘12 that never went anywhere...

To: expat_panama

To: Lurkina.n.Learnin

the difference in M1, M2 and MZMWikipedia has its faults, but imho they did a good job here:

To: expat_panama

Thanks, I’m bookmarking that article. It explained a lot. That’s, what I like about this thread, it even helps clueless me learn some things.

To: Lurkina.n.Learnin

lol! -and the dirty little secret is that everyone’s clueless on some things, only the rest of us just aren’t as openly honest...

To: Wyatt's Torch

That deserves its own thread. It needs broader exposure. Uncertainty isn’t just driven by federal policy. It’s a state, county and local issue poorly understood by decision makers and bureaucrats. We just don’t notice the more local stuff because its effects are limited and localized for the most part. Illinois thought it had a good policy, until now.

116

posted on

05/06/2014 5:07:10 AM PDT

by

1010RD

(First, Do No Harm)

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-116 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson