Skip to comments.

The Hidden Motive Behind Quantitative Easing

The Mises Institute ^

| 4/19/2014

| Hunter Lewis

Posted on 04/19/2014 4:36:32 PM PDT by BfloGuy

Foreign individuals and businesses long ago cut back on their purchases of U.S. bonds. Their place was taken by foreign central banks. The central banks simply created money in their own currency and used it to buy our bonds.

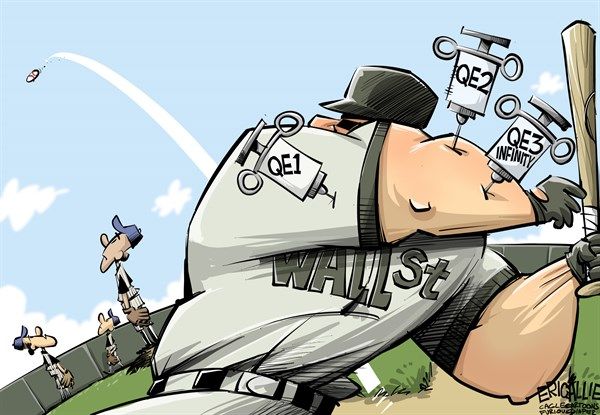

The Federal Reserve always knew that we couldn’t rely on foreign central banks to buy our bonds forever. This may be the main reason it began the program called quantitative easing, in which the Fed created money out of thin air specifically to buy back U.S. debt.

Quantitative easing may have been intended to be a kind of insurance policy. If foreign central bank buying of U.S. bonds collapsed, the Fed would already have a program in place to buy them back itself.

The Fed said that quantitative easing was meant to create U.S. jobs, but this never made much sense. Even a hard core proponent of QE, Fed official William Dudley ( formerly of Goldman Sachs), admitted that the Fed’s own economic models could not explain how creating money out of thin air and using it to buy U.S. bonds would increase employment. Some link to rising stock prices could be demonstrated, if only through the cheap financing of corporate stock buy-backs, but then rising stock prices could not be shown to create jobs either.

One inference from this was that chairman Ben Bernanke, and now new chairman Janet Yellen, were just taking wild stabs in the dark. A more reasonable inference is that they had another reason for QE, one which they did not want to acknowledge.

Viewed in this way, the 2008 bail-out should be viewed not as a bail-out of Wall Street, but rather as a bail-out of Washington. The Federal Reserve feared that the market for government bonds was about to collapse, which would lead to soaring interest rates, and a complete collapse of our bubble financed government.

The Fed did not have the option of creating money and buying debt directly from the Treasury. That would be illegal. The Treasury must first sell its bonds to Wall Street, after which the Fed can then use its newly created money to buy them back. Hence, in order to rescue the Treasury, the Fed felt it had to rescue Wall Street.

This is a simplification of what happened, and only part of the story, but it is the untold part of the story, and in all likelihood the most important part. The Fed was in a panic in 2008, but not primarily about what might happen to Wall Street, and certainly not about what might happen to Main Street. It was in a panic over what might happen to government finance.

This interpretation is strengthened by new information contained in former Treasury secretary Hank Paulson’s recent book. He revealed that Russia tried in 2008 to persuade China to join in a collaborative effort to dump U.S. bonds in order to bring down the U.S. financial system. Although China refused to do so at the time, its government would clearly like to end dollar dominance, and has been paring U.S. bond purchases.

At the moment, Janet Yellen’s worries about finding buyers of government bonds can only be getting worse. For much of last year, foreign central bank purchases of U.S. bonds in aggregate fell. As of October of 2013, they had been negative for three and six months. Then they turned up a smidge, only to fall again, so that the last three months show a decrease of just over 12%.

It is known that Russia withdrew its U.S. bonds from custody of the Fed after the Crimea invasion, and has either been selling or could sell at any time. It will no doubt try again to persuade other countries to join in undermining the U.S. bond market and replacing the dollar as the mainstay of world trade.

Under these circumstances, it should not be surprising that the Fed is today taking only baby steps to reduce its program of creating new money to buy U.S. bonds. This program is probably not just meant to revive the economy, which it has not done and cannot do. It is more likely designed as a desperate and in the long run counterproductive effort to finance the U.S. government and save today’s dollar dominated financial system.

TOPICS: Business/Economy; Constitution/Conservatism; Government; News/Current Events

KEYWORDS: fed; fraud

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-46 next last

I still get push-back on FR from some who insist that the Federal Reserve exists only to "smooth out" business cycles and that my suspicions are but tin-foil delusions.

The Federal Reserve was formed, though, for two reasons: to protect foolish banks from bankruptcy and to ensure that the Federal Government would never have to worry about selling its debt [but that's only payback for the right of ensuring that foolish banks could be protected from bankruptcy].

1

posted on

04/19/2014 4:36:32 PM PDT

by

BfloGuy

To: BfloGuy

Isn’t quantitative easing another way to devalue monies already in circulation, thereby sabotaging the purchasing-power of the average citizen?

2

posted on

04/19/2014 4:39:44 PM PDT

by

OneWingedShark

(Q: Why am I here? A: To do Justly, to love mercy, and to walk humbly with my God.)

To: BfloGuy

It is a hostile takeover of the markets by the federal reserve and the communists. Period. They now have more “wealth” bought up that is more than 1/4th of the entire stock market value. They have performed illegal money laundering and ‘bought’ massive amounts of controlling interests in the markets.

3

posted on

04/19/2014 4:41:36 PM PDT

by

CodeToad

(Arm Up! They Are!)

To: BfloGuy

There were only two purposes behind QE:

1. To fund government deficit spending without raising interest rates

2. To protect the bottom line of Goldman Sachs executives.

4

posted on

04/19/2014 4:43:20 PM PDT

by

Hoodat

(Democrats - Opposing Equal Protection since 1828)

To: BfloGuy

The only function of the FED is to control the US economy and make Trillions of dollars for the super rich that forced implementation of the FED in the first place.

5

posted on

04/19/2014 4:45:31 PM PDT

by

mountainlion

(Live well for those that did not make it back.)

To: OneWingedShark

Isn’t quantitative easing another way to devalue monies already in circulation, thereby sabotaging the purchasing-power of the average citizen?In a word, yes.

But that's just so much collateral damage in their eyes. The important thing is to keep the banking system afloat and to maintain the support of the politicians who use spending to stay in office.

6

posted on

04/19/2014 4:49:02 PM PDT

by

BfloGuy

( Even the opponents of Socialism are dominated by socialist ideas.)

To: BfloGuy

There’s no legitimate reason for the Treasury to issue bonds and sell them for dollars, thus, borrowing dollars, when it has legitimate authority to create dollars.

Dollars get created in either case, but if the Fed creates dollars and Treasury borrows dollars, the govenment, i.e., the taxpayer, has debt. Every dollar created has to be “paid back” out of future taxes.

If the Treasury created its own dollars and the Fed was not allowed to, the Treasury would not have to borrow.

7

posted on

04/19/2014 4:58:19 PM PDT

by

PieterCasparzen

(We have to fix things ourselves)

To: BfloGuy

Interesting article, but there's another angle to this that doesn't get a lot of exposure:

Since QE3, the Fed's program of quantitative easing now involves two separate bond purchases: (1) government bonds, and (2) mortgage-backed securities. This article does a good job of explaining the first part, but doesn't even mention the second. The whole purpose of having the Fed buy MBS debt was to prop up the value of securities that were backed by mortgages on real estate that couldn't be "written down" at all. In other words ... if I buy a home for $500,000 with a $400,000 mortgage and I immediately default on the loan, then the bank takes possession of the home. If the home is only worth $300,000 after my default, then I am out my $100,000 and someone else(the bank or the holder of the security instrument that was created and backed by the mortgage) is out another $100,000. But the problem here is that someone (the prior owner) has the original $500,000 that I paid for the home. I have said for several years now that the whole purpose of having the Fed buy the MBS that was created out of my $400,000 was to restore the original value of the mortgage and "legitimize" the dollars that had been created out of thin air when I took on the mortgage.

8

posted on

04/19/2014 5:05:40 PM PDT

by

Alberta's Child

("I've never seen such a conclave of minstrels in my life.")

To: OneWingedShark

Isn’t quantitative easing another way to devalue monies already in circulation, thereby sabotaging the purchasing-power of the average citizen?Monetization of debt = Theft via inflation.

9

posted on

04/19/2014 5:14:09 PM PDT

by

Rodamala

To: BfloGuy

At the moment, Janet Yellen’s worries about finding buyers of government bonds can only be getting worse. For much of last year, foreign central bank purchases of U.S. bonds in aggregate fell. As of October of 2013, they had been negative for three and six months. Then they turned up a smidge, only to fall again, so that the last three months show a decrease of just over 12%.And now you know why the politicians are so desperate for amnesty. They need the 30 million influx to continue the debt ponzi scheme.

10

posted on

04/19/2014 5:38:32 PM PDT

by

AmusedBystander

(The philosophy of the school room in one generation will be the philosophy of government in the next)

To: BfloGuy

Hey, don’t feel bad.

I’m in the minority re contending a number of things on these matters as well.

The net result is that without the Fed as it exists currently, we might actually have fiscally-responsible government.

What a novel concept.../s

To: BfloGuy

12

posted on

04/19/2014 6:15:12 PM PDT

by

TBP

(Obama lies, Granny dies.)

To: Alberta's Child

But the problem here is that someone (the prior owner) has the original $500,000 that I paid for the home.Why is thaat a "problem"?

I have said for several years now that the whole purpose of having the Fed buy the MBS that was created out of my $400,000 was to restore the original value of the mortgage [agreed]

......and "legitimize" the dollars that had been created out of thin air when I took on the mortgage.

Not sure what you mean here.

13

posted on

04/19/2014 6:21:11 PM PDT

by

expat2

To: BfloGuy

This arguement makes perfect sense.

And the USA would be in very deep trouble.

However, the fracking revolution and the stock market have come just in time.

The deficit is expected to fall again in 2014 from 680 billion to 480 billion.

Probably half of that is the stock market — which the fed is blowing up— but also half of that is from the fracking revolution which is adding another 100 billion to federal revenues annually. That number will double in three years.

The bottom line is that by the time obama is out of office in January 2017 the federal budget will be nearly balanced.

That is absent any outside forces you can expect both the stock market and the oil patch to be adding 200 billion to federal revenues while the republicans keep federal spending in check.

The pubbies will do pretty much the same thing as Newt’s congress did under clinton. They’ll take the heat while Clinton/Obama get the credit for the balanced budget.

I totally agree that people simply will hardly ever know the terrible bullet that the USA dodged.

But it has been dodged.

14

posted on

04/19/2014 6:28:58 PM PDT

by

ckilmer

To: BfloGuy

The central banks simply created money in their own currency and used it to buy our bonds. Japan started out using trade surplus dollars to buy our bonds, but switched to printing. China still uses their trade surplus with us to buy stuff from us, not bonds but hard assets. It is quite a stretch to think that the US would ever recover enough or tax enough to pay those bonds back. Everybody with a slight clue has known that for a decade or two now, but the charade continues nonetheless.

The choices are default, inflation or growth and we have to keep pretending that we are going to grow out of it, yet the very existence of QE is what prevents long term growth.

15

posted on

04/19/2014 6:37:47 PM PDT

by

palmer

(There's someone in my lead but it's not me)

To: BfloGuy; All

16

posted on

04/19/2014 6:41:30 PM PDT

by

musicman

(Until I see the REAL Long Form Vault BC, he's just "PRES__ENT" Obama = Without "ID")

To: OneWingedShark

The term “Quantitative Easing” is in and of itself a fraud being perpetrated on America so that this government can put off collapse until “they” are out of office.

If the federal government spends 4 trillion but takes in 2 trillion they must sell bonds! The buyer of these bonds historically have been foreign government’s and institutions. The fed, under Bernanke, created Quantitative Easing so that the program would be up and running when the US could not sell bonds anymore. The governments and institutions around the world that are willing to buy our bonds are fewer and fewer.

So, get ready! As Peter Schiff said, the shit is about to hit the fan.

17

posted on

04/19/2014 6:46:11 PM PDT

by

Cen-Tejas

(it's the debt bomb stupid!)

To: BfloGuy

The best criticism of the Fed is that it too often does its job poorly, not that it was ill-founded or that it is unnecessary.

A key reason for the creation of the Fed is that without a central bank, the essential function of providing emergency liquidity and acting as lender of last resort must fall to private bankers. Specifically, in the panic of 1907, that role fell to J. P. Morgan and a small group of bankers aligned with him.

Although Morgan was much pilloried during his lifetime, in that instance, he and his allies acted with regard for the public interest and stabilized the US financial system in a moment of crisis. Yet a systemic vulnerability had become clear and made a potent argument for the creation of a central bank.

Notably, in 1932 and 1933, due to a lack of political direction and a lapse in the absence of a new appointed chairman, the Fed failed to perform its duty as lender of last resort. This led to a catastrophic lack of liquidity and the wave of bank failures that aggravated and defined the Great Depression.

It is sometimes argued that there would be no need for emergency liquidity and a systemic lender of last resort if fractional reserve banking were abolished. Unfortunately, that is not the case, because mismatches in maturity between assets and liabilities may arise, or normally sound assets may lose their value in a major financial crisis.

Ultimately, as long as an economy relies on lending, there will be a need for standby emergency liquidity and a lender of last resort. The problem is that such a role may weaken the discipline of free markets in punishing bad lending practices and improvident bankers.

The financial crisis of 2008 stemmed directly from an excess of lending to the US housing sector. The Fed had the power to act against the bad lending practices but did not do so. While the Fed performed well enough during the crisis, their prior errors should not be excused, just as we would not excuse failure to remedy an obvious fire hazard simply because the resulting fire was suppressed just short of total destruction.

To: expat2

It's a problem because the U.S. government created $400,000 out of thin air to lend the money to the bank, the bank extended a mortgage to me to buy the home, and I paid the $400,000 to the previous owner as part of my $500,000 purchase.

If the ultimate holder of the mortgage -- whether it be the bank or the holder of a securitized mortgage bond -- isn't made whole, then someone is out $100,000 (the difference between the $400,000 mortgage and the $300,000 value of the property). It's easy to say they should just swallow the loss, but then they won't be lending money again the next time someone needs to borrow it.

This is where a deflationary cycle begins, and this is what the Fed has been trying to stave off with its QE initiatives.

19

posted on

04/20/2014 7:58:10 AM PDT

by

Alberta's Child

("I've never seen such a conclave of minstrels in my life.")

To: Alberta's Child

This is where a deflationary cycle begins, and this is what the Fed has been trying to stave off with its QE initiatives.

*****************************

What’s wrong with deflation ,, inflation helps the banks and the gov’t but kills the savers and responsible people ,, deflation helps me and you ... why parrot the FED line about deflation? I for one would like to go to the grocery store and pay “2000” prices for my groceries...and maybe a new car..

http://www.zerohedge.com/news/2014-04-19/everything-we-are-told-about-deflation-lie

20

posted on

04/20/2014 8:10:06 AM PDT

by

Neidermeyer

(I used to be disgusted , now I try to be amused.)

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-46 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson