We have a longs ways to go before we can meet domestic needs since we are still hugely dependent on imported crude oil.

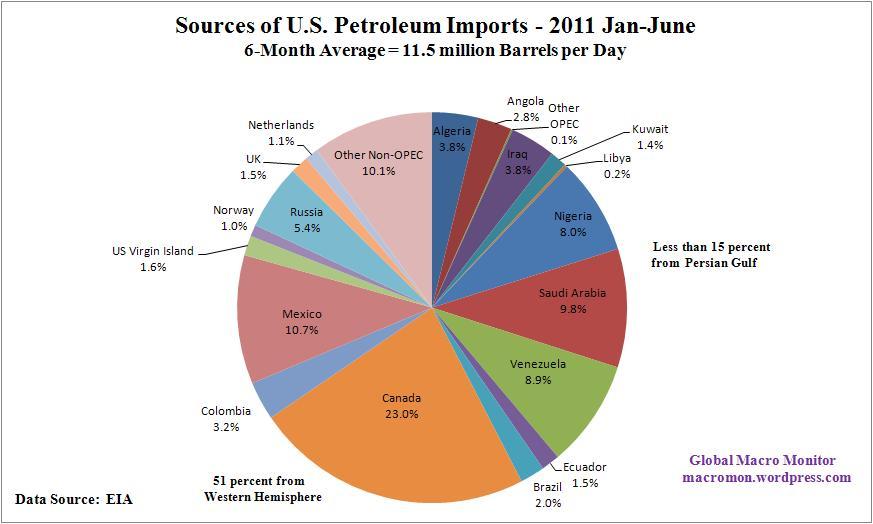

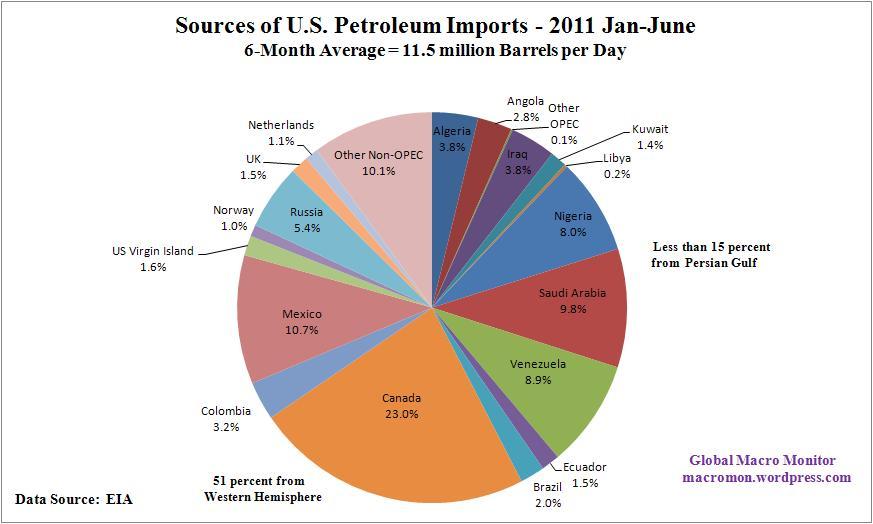

An just for grins, where our imports come from.

Posted on 04/01/2014 5:08:21 AM PDT by thackney

The oil industry’s leading trade group on Monday cast exports of U.S. crude as an economic win for consumers, fighting against criticism that selling the fossil fuel overseas would mean higher prices at home.

The American Petroleum Institute commissioned a study by ICF International and EnSys Energy predicting lower gasoline prices, domestic job growth and other economic benefits if the United States lifts its 39-year-old ban on exporting U.S. crude.

“Consumers are among the first to benefit from free trade, and crude oil is no exception,” said API Vice President Kyle Isakower told reporters in a conference call Monday. “Gasoline costs are tied to a global market, and this study shows that additional exports could help increase supplies, put downward pressure on the prices at the pump and bring more jobs to America.”

The new study finds that oil exports would reach 2 million barrels per day by 2017 — nearly a quarter of current production — if the trade restrictions were lifted.

The big beneficiaries would be domestic oil producers, who would see U.S. crude prices climb closer to global benchmark, Brent crude.

Lower gasoline prices

The study determined that, if crude oil exports were allowed, gasoline prices in the United States would cost 1.4 to 2.3 cents less per gallon between 2015 and 2035, measured in 2011 dollars. Lower overall costs for gasoline, heating oil and diesel could yield an extra $5.8 billion in annual consumer savings, ICF International and EnSys Energy found.

Critics of easing the export ban, including Sen. Ed Markey, D-Mass., have argued that by sending domestic oil prices higher, gasoline costs would inevitably climb.

API’s Isakower said the ICF report was “the most detailed analysis available” on the wide-ranging economic effects of potential crude exports, though at least three other studies are currently in the works, including one from the U.S. Energy Information Administration.

Refiners profits

But the margins for domestic refiners would be squeezed if the export ban were lifted, because they would pay more for crude oil even as the price of the resulting gasoline dips slightly, ICF said.

If exports were allowed, “the increase in domestic crude prices is much larger than the reduction in world crude oil prices, and so the average cost of crude to U.S. refineries goes up more than do refined product prices,” the study said. “This is the major reason why refinery margins decline.”

ICF’s discussion of how oil exports would shake up U.S. refining puts new numbers behind the sector’s apprehension on the issue. Under the current dynamic, refiners are able to freely export gasoline, diesel and other petroleum products, even though the U.S. largely blocks exports of raw, unprocessed crude. The scenario ensures they have been exporting record amounts of the refined products and enjoying relatively high margins, as domestic oil production surges.

“The lower prices for U.S. oil, a result of surging production, improve U.S. refinery margins but do not reduce gasoline or diesel prices,” the study said, because refiners “have the ability to export these products at global market prices.”

With the prospect of oil exports threatening that dynamic, some small, independent refiners have formed a coalition to fight changes to the 39-year-old trade restrictions.

Oil industry leaders say exports also are needed to help resolve a mismatch between domestic production of light, sweet crude, and U.S. refineries optimized for processing heavier varieties.

“Often, it makes sense to export a surplus of expensive, light oil from one region and import cheaper, heavy oil in another, rather than ship more expensive oil cross-country,” Isakower said. “This is especially true in the absence of sufficient infrastructure to efficiently transport crude to the refineries that could use it. But export restrictions effectively insulate consumers from the positive benefits of efficient markets.”

Benefits of exports

The report also predicted that expanding crude exports would:

spur as much as $70.2 billion in additional investment in U.S. oil exploration, development and production between 2015 and 2020. put an extra 110,000 to 500,000 barrels online every day in 2020. boost U.S. refinery throughput by 100,000 barrels per day from 2015 to 2035, by ending refinery process bottlenecks caused by mismatched crudes. support 300,000 new jobs across the economy in 2020.

“I have no doubt that Obama’s recent side trip to Saudi Arabia was in response to their request. I’m sure Syria was discussed and very likely the potential damage to their national interests by our rapidly approaching energy independence.”

Very good analysis. Your scenario makes perfect sense. IMO the Saudis desperately want curbs on our oil production and Obama will likely give it to them in exchange for other considerations. Its all a big trading game.

When leaders make trips for personal “talks” like this that’s when the raw issues are discussed. Extremely sensistive issues and deals that can’t be done through normal channels.

While the new techniques harvest the shale oil, the ANWR development needs to start now, to bring that production online in five to ten years’ time. Thanks thackney.

We have a longs ways to go before we can meet domestic needs since we are still hugely dependent on imported crude oil.

An just for grins, where our imports come from.

Increasing supply usually DOES lower prices.

So in other words a drop of between one third and two thirds of one percent. Like that’ll happen.

Will the consumer see the benefit? The price of oil may fall, but then congress will want to heap more taxes on it.

ok gotcha!

We are working on a clause that prohibits unions in government, parties in politics, and requires all elected to write out the full Constitution, swear to uphold it, and sign with a statement that they understand that if they use the office they are elected to or appointed to, to abuse the Constitutional rights of any citizen, that it is punishable by a minimum of 5 years in the Republic penitentiary.

A further clause will be added to the oath of office for all members of the Milita and the 1,000 man standing army that says, in part, "uphold and defend this Constitution and the Republic from all enemies domestic and foreign..."

Are you trying to claim the price of gasoline never goes down?

thanks very helpful

I do not think so. The US already refines more product that we use ourselves. We have surplus capacity.

We import more oil than we need for domestic demand, refine it and export the surplus products. Some of that is refinery "leftovers", the bottom of the barrel after higher quality fuels like gasoline and diesel have been separated out. Petroleum Coke and Residual Oil are examples of those.

Actually I think you will find that global refinery production is up and there is a global surplus of gasoline. We actually import gasoline as a result. Adding refineries in the U.S. would increase the availability of Domestic gasoline lowering the price.

Are you trying to claim the global refinery industry is consistently producing more gasoline than is used?

we are a net gasoline exporter. When looking at the data, it is important to include the blending products used to make the different gasoline recipes.

http://www.eia.gov/dnav/pet/pet_move_neti_a_epm0f_IMN_mbblpd_m.htm

http://www.eia.gov/dnav/pet/pet_move_neti_a_epobg_IMN_mbblpd_m.htm

Just a little general info:

Crude oil is subdivided into varying percentages of different hydrocarbons, separated into “distillation fractions”.

If a particular crude oil is “light”, it has more of the more desirable and volatile hydrocarbons, like gasoline. If it is “heavy” is has more of the less desirable hydrocarbons.

“Sour” and “sweet” mean how much sulfur is in the crude oil. More sulfur is harder to refine, and more prone to clog engines, so it is less desirable.

Until recently, nobody wanted to refine heavy, sour crude oil, even though there is a surfeit of it in the world, so it is very cheap.

once again, you have great data. I still think to much of our cost of gasoline is from traders - the recent story about the high speed traders is one more example. People talk about only a penny profit on a trade, but the price of gasoline is often about a penny or less each day.

I think they should wait to export oil until after the USA is oil independent or about 2018,.

What’s the big rush on pushing down worldwide oil prices.

In this case high oil prices works to the advantage of the USA—because high oil prices make it possible to explore hard places with new techniques.

We’re not talking about an indefinite period.

For example, I don’t see why it wouldn’t be wise to hold off exporting for another three years —or enough time to get the costs of drilling in the permian basin and oklahoma.woodford down to where price cuts won’t kill production.

Heck I’m starting to read reports that the amount of oil in the Tuscaloosa basin in Louisiana and Mississippi Rivals that of the baaken but its still expensive to get out.

Please keep in mind the US has upgraded many of our refineries to efficiently run on heavy sour (cheap) crude.

Much of our new oil shale production is light sweet crude.

We can have greater trade balance by exporting more of the expensive oil while importing the cheap.

Otherwise, we become less efficient running the light sweet through refineries designed for heavy sour. It will depress our domestic light sweet oil price below the global light sweet. That makes drilling in the US shale less profitable and more money gets invested overseas.

Lower oil prices will clip Putey’s wings. Its all good.

wouldn’t it be more profitable to simply refit the US refineries to handle light sweet crude instead of the sour crude? US light sweet crude is cheaper than comparable overseas light sweet crude.

Do you know for a fact that US light sweet crude is more expensive when it reaches the US refinery than imported sour crude when it reaches the US refinery.

I would presume that anyone running the numbers would check that price differential (between imported sour crude and domestic light sweet crude) against the cost of retrofitting US refineries to handle light sweet crude.

None of those numbers am I privy to.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.