Posted on 03/30/2014 5:37:23 PM PDT by expat_panama

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow we'll go on with our--.

Open invitation continues always for input on ideas for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket.

======================

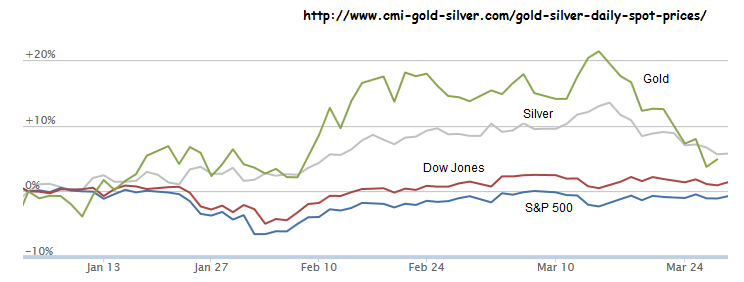

Year to date trends with stocks'n'metals--

--along with 'end-week' articles:

Amid signs that many technology and biotech stocks may have peaked -- the Nasdaq fell 3 percent last week -- markets will look to this coming Friday’s U.S. March employment report for support. The rout in tech and biotech stocks last week has some investors worried that a bubble has indeed [...] Forbes

This Fool sees a limb to go out on. And another. And another. Motley Fool

Stocks discussed on the in-depth session of Jim Cramer's Mad Money TV Program, Friday March 28 . 11 Things to Watch In The Week Ahead: CarMax ( KMX ), Monsanto ( MON ), Buffalo Wild Wings ( BWLD ), Micron ...Seeking Alpha

:-)

I am seeing more and more that the jobs report does not impact the markets as much as they used to. 80% of the financial community already knows the government is lying anyway.

+192K vs +195K Est

6.7 % vs 6.6% Est

Feb revised up from +175K to +197K

Participation rate climbs to 63.2% from 63.0% in February

Health care added 19,000 jobs, food service added 30,000, and construction added 19,000.

U.S. private-sector employment hits all-time high of 116,087,000

--and we know there's more to it than that.

"The government" is like "Judaism" or "the Black race" that some like to think acts like a unit but we know is made up of a lot of very different people and smaller groups. We get some econ numbers from the BLS, some from the Census Br., the BEA, the Fed., etc. etc. and each agency has a some party hacks and some good professionals. It's our job to piece it all together and in the case of the BLS there's plenty of info behind the mindless headlines.

Kind of the old saw, figures don't lie but liars figure. mho.

This is actually a bit of a trend-shift. I'm seeing population going up and employment increasing more --lowering the emp/pop ratio, all keeping the U rate level.

In the past it never seemed to go that way...

It’s like they’re having a clearance sale today.

NASDAQ & Russel 2000 both dropped back to the bottoms they had last week so we may end up w/ IBD declaring “market-in-correction” again. Then again DJIA & S&P500 are only off modestly...

NYSE MAC DESK MID-DAY MARKET UPDATE:

DOW 16,502 (-70 points), S&P500 1875 (-13 handles), Brent Crude $106.85/barrel (+$0.70), Gold $1,304.70/oz. (+$20.30)

MARKET DRIVERS: (Stocks are trading modestly lower following this morning’s March payroll report as traders look to take some profits off the table heading into the weekend.)

• It’s Jobs Day: Nonfarm payrolls increased by a seasonally adjusted 192,000 in March; coming in slightly below consensus. In addition, January and February payrolls were revised up by a combined 37,000; and the nation’s unemployment rate held steady at 6.7% as more people found work and more people joined the labor force.

• German manufacturing orders climbed 0.6% in February, above the expected unchanged reading for the month, on strong domestic demand. The data adds to indications that economic growth is beginning to gain speed.

• The IPO parade continues; with three new IPOs opening on the NYSE floor this morning:

a) Online food delivery service GrubHub (GRUB) priced 7.4 million shares - more than expected - at $26, above the $23 to $25 range. The stock opened at $40/share!

b) IMS Health (IMS), a healthcare data and consulting services provider, priced 65 million shares at $20, in the middle of the $18 to $21 range. The stock opened at $22.18.

c) Opower (OPWR), which provides cloud based software to the utility industry, priced 6.1 million shares at $19, at the high end of the $17 to $19 range. The stock opened at $25…

• Tech the worst performer with the S&P Information Technology Index (1.5%)

o Internet space underperforming with the QNET (2.3%), continuing its move lower from yesterday when it fell ~2.5%. P (4.3%), NFLX (3.8%), SINA (3.2%), GOOG (3.1%) and AKAM (3%) the laggards. P continuing its sell-off from yesterday, when it fell >5% after releasing March audience metrics. OPEN +1% and ADS +0.6% the notable outperformers. The former continuing its move higher from yesterday after it was upgraded at Citi.

o Semis underperforming with the SOX (1.2%). Space still outperforming this week, with the index up ~1.9%. RBCN (5.3%), ATML (3.9%) and TQNT (3.4%) leading the way lower today. SNDK +0.8%, AMD +0.8% and MRVL +0.8% topping gains.

o Software underperforming. BLOX (3.5%), JIVE (2.5%), TIBX (2.5%), FTNT (2.2%) the notable performers to the downside. SYMC +0.2% and SAP +0.2% the only notable gainers.

o Other notable performers: CIEN (3.5%), NTAP +0.8%. Pacific Crest was positive on NTAP following meetings with management, citing strong y/y growth in new customer design wins and the company’s new ONTAP software.

• Consumer discretionary underperforming with the S&P Consumer Discretionary Index (0.8%)

o Retail underperforming with the S&P Retail Index (1%). AMZN (3.2%) the laggard today. Recall the stock fell ~2.4% yesterday as well, now down >19% ytd. A few analysts have said Amazon’s Fire TV is underwhelming. Apparel space outperforming, led higher by ANN +3%, CHS +1.4% and ARO +1%. ANN was upgraded at Macquarie, which believes the stake held by Golden Gate Capital increases the probability that the company will either aggressively buyback shares or explore strategic alternatives. BONT +2.6% leading the department stores to the upside. CE space mixed. GME (1%) despite and upgrade at BofA-ML, citing improved risk/reward. BBY +2.5% the notable gainer. BBBY +1% the notable performer among the housing-related names.

o Restaurants underperforming. SONC (2.3%) the laggard following a downgrade at Buckingham. BWLD (1.6%) and DPZ (1.4%) the other notable decliners. THI +1.1% and DRI +0.5% outperforming.

o OTAs led lower by TRIP (3.7%), PCLN (2.6%) and OWW (2.5%).

o Homebuilders topping gains with the XHB +0.7%. Note Bloomberg ran an article pointing out the increased bullishness in the space amid prospects for a spring recovery in the housing market following a harsh winter. Cost of call options on the index the highest relative to puts in 2 1/2 years. HOV +2.9%, BZH +2.3%, and RYL +2.2% the notable gainers.

o Other notable performers: NTRI (5.2%), AHC (4.1%), DECK +3%

• Financials relatively outperforming with the S&P Financials Index (0.3%)

o Online brokers continuing their move lower from yesterday amid concerns about rebate payments to brokers from exchanges to attract business and increased attention towards high-frequency trading following Charles Schwab’s comments that it is a “growing cancer that needs to be addressed”. ETFC (6.6%), SCHW (3.6%) and AMTD (3.6%). Recall ETFC and AMTD both fell >5% yesterday as well.

o Credit card processors underperforming, with V (2.9%) and MA (2%).

o Banks lower with the BKX (0.4%). Rally in Treasuries following this morning’s payroll report cited as a headwind. The WSJ ran an article pointing out the weak earnings expectations for Q1 in the space. C (1%) and BAC (0.7%) leading the money-center space lower. Investment banks holding up better, with GS (0.3%) and MS (0.3%). Regionals underperforming with the KRX (1.5%). SNV (1.7%) the notable decliner. WFC +0.1% outperforming.

• Industrials outperforming with the S&P Industrials Index (0.2%)

o Building materials broadly higher. M&A speculation probably helping the space, after Holcim confirmed it is in talks with Lafarge to merge. Note Bloomberg ran an article pointing out bullish sentiment for the group. CX +5.3% leading while EXP +3.2%, MLM +2.5% and TXI +2.2% outperform as well.

o Machinery mixed. JOY +1.1% outperforming, while CR (1.2%), PCAR (1.1%) and TEX (0.8%) lag. Ag machinery higher with AGCO +1.6% and DE +0.3%.

o Multis mixed. ITW +1.2% outperforming. Note the EU cleared Carlyle Group’s acquisition of ITW’s industrial packaging unit. MSM +1.1% and FAST +0.7% also outperforming. ATU (1.6%), WBC (1.5%) and SPW (1.4%) underperforming.

o Transports mixed. Airlines underperforming, giving back some of this week’s outperformance. HA (4.1%), UAL (3.1%) and SKYW (2.4%) lagging. Trucking broadly lower with YRCW (3.3%) and ABFS (1.9%) notable laggards.

• Energy outperforming with the S&P Energy Index +0.2%

o Brent Crude rising for a second day, trading up $0.70 at $106.85/barrel. Natural gas (0.7%).

o Majors outperforming. BP +0.9% and XOM +0.6% leading the way higher, while OXY (1.5%) underperforms.

o Coal rallying. BTU +3.1% upgraded at Cowen. ACI +5.8%, ANR +5.2% and WLT +4.2% other notable outperformers. JRCC (1.7%) lagging.

o E&Ps mixed with the EPX (0.1%). APC +1.1% yesterday announced settlement with US government on liabilities in TROX case; subsequently upgraded at JPMorgan and target increased at Credit Suisse and Bernstein. SYRG +4.2% reported well-received Q2 earnings. UPL +2.6% and WLL +1.9% also outperforming. TAT (1.6%) reported Q1 production below consensus. KWK (1.8%) and COG (1.7%) also underperforming.

o Refiners underperforming, with WNR (2.1%), VLO (1.3%) and TSO (1.2%) leading the way. MUR +0.8% the notable performer to the upside.

• Utilities the best performer with the S&P Utilities Index +1.5%

o Space leading the way today with a decline in interest rates cited as a tailwind. EXC +2.7%, PEG +2.3%, ETR +2.2%, AES +2.2%, PCG +2.1% and TEG +1.8% the notable performers. PPL +1.2% relatively underperforming following a downgrade at Macquarie, which wouldn’t embed any further benefit related to potential M&A activities around PPL supply.

Looks contradictory/disjointed. Times like this I'm glad I diversified so I could just muddle along as timing sectors seems even harder than timing trends in general.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.