Posted on 03/30/2014 5:37:23 PM PDT by expat_panama

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow we'll go on with our--.

Open invitation continues always for input on ideas for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket.

======================

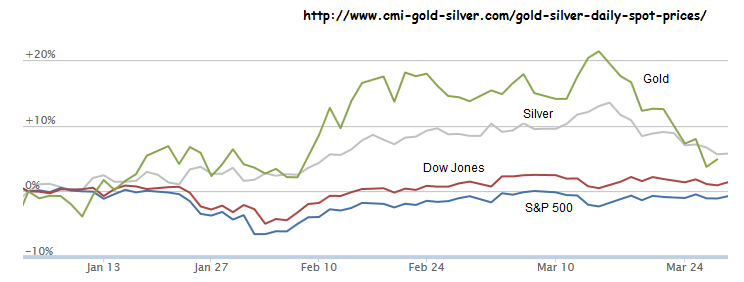

Year to date trends with stocks'n'metals--

--along with 'end-week' articles:

Amid signs that many technology and biotech stocks may have peaked -- the Nasdaq fell 3 percent last week -- markets will look to this coming Friday’s U.S. March employment report for support. The rout in tech and biotech stocks last week has some investors worried that a bubble has indeed [...] Forbes

This Fool sees a limb to go out on. And another. And another. Motley Fool

Stocks discussed on the in-depth session of Jim Cramer's Mad Money TV Program, Friday March 28 . 11 Things to Watch In The Week Ahead: CarMax ( KMX ), Monsanto ( MON ), Buffalo Wild Wings ( BWLD ), Micron ...Seeking Alpha

I bought the book also. It does seem to me to be a bit of hyperbole though. Saying the entire market is “rigged” I think is an exaggeration. Scaring the general public into staying out of the market over basically rounding errors I don’t think is good. I usually use limit orders so I don’t see how they are hurting me. That’s just my opinion though.

That's an accurate appraisal. During the '08 debates Obama was asked why he favored gains tax hikes even when they lowered revenue, and he said flat out "it's a question of fairness!"

That's what the guy was saying on Rush just now, but it just doesn't make sense. My "intent" simply does not exist until the instant I mash 'enter' and by then it's no longer an intent-order, it's a buy-order. OK, so maybe they're anticipating people's trades beforehand by watching market trends but that's exactly what we're all doing. Finally, the only way they can sneak in and confiscate my order is when they offer me a better price.

That's supposed to make me feel 'cheated'?

NYSE MAC DESK MID-DAY MARKET UPDATE:

DOW 16,465 (+142 points), S&P500 1873 (+16 handles), Brent Crude $107.20/barrel (-$0.87), Gold $1,288.40/oz. (-$5.40)

MARKET DRIVERS: (Stocks are sharply and broadly higher on the final trading day of Q1 as traders react bullishly to comments from Fed Chair Janet Yellen; a disappointing Chicago PMI report and dampened geopolitical tensions surrounding Ukraine.)

• Federal Reserve Chair Janet Yellen said “considerable slack” in the labor market is evidence that the central bank’s unprecedented, “extraordinary” accommodation will still be needed for “some time” to put Americans back to work.

• The Institute for Supply Management-Chicago Inc. said today its business barometer decreased to 55.9 in March from 59.8 in February - well below the 66.6 recent-high in October and also failing way short of the Street’s consensus of 59.9.

• Euro-zone inflation has fallen to its lowest level since late 2009; slipping to 0.5% on year in March from 0.7% in February and undershooting forecasts of 0.6%. The slowdown is likely to strengthen concerns that the euro-zone is sliding towards deflation and could add pressure on the ECB to further ease policy at a meeting on Thursday.

• Japanese industrial output slumped 2.3% month-over-month in February after rising 3.8% in January; badly missing consensus for growth of 0.3%.

• The U.S. and Russia agreed Sunday to resolve the situation in Ukraine without escalating tensions, but there remains lots of uncertainty.

In what appears to be a very strong ‘final lap’ for Q1, traders were quick to note that the relative calm status in Ukraine combined with new expectations of further central bank easing in the euro-zone got the Bulls on track for a positive start to the day. However, stocks really put the pedal to the metal about 20 minutes into the session when the text of Janet Yellen’s speech was released. Here are a few snippets which had the Bulls taking offers and had the shorts running for the hills: “There is still considerable slack in the labor market.” – “This extraordinary commitment (by the Fed) is still needed and will be for some time, and I believe that view is widely shared by my fellow policymakers at the Fed,” -— “The recent decision to slow QE purchases is not a ‘lessening’ in the Fed’s commitment”, she added — “it’s only a judgment that the recent progress in the labor market means our aid for the recovery need not grow as quickly.” One market-watcher called it “one of the most dovish speeches ever given by a Fed Chair.” While another market dude snidely remarked, “This looks like a further attempt to backtrack from the tongue slip in her FOMC statement.” Whatever you want to call it, the Fed Chair’s comments have helped push the S&P 500 to within 4 points of its all-time closing high. The bottom-line is that employment is nowhere near the level it needs to be, while the latest inflation numbers are making some Fed officials uneasy, too… Q1 scorecard update: S&P +1.4% and the Dow -0.67%. Let’s call it a quarter of healthy consolidation following a year of ~30% gains… One interesting factoid: Investors exited Treasury ETFs by pulling $10.3B in March, the largest amount withdrawn since December 2010… Finally, an earnings note: For Q1 2014, 93 companies in the S&P 500 have issued negative EPS guidance and 18 companies have issued positive EPS guidance. (Just a quick heads-up)… Moving on, the Dow remains just off session-highs, and volume is light, with ~230M shares on the tape at this time… Internally, breadth is bullish across the board. Advancing Issues: 3175 / Declining Issues: 1044 — for a ratio of 3.0 to 1. New 52-Week Highs: 185/ New 52-Week Lows: 18… Meanwhile, in the trading pits, The yield on the 10-year Treasury note ticked up to 2.743% from 2.712% late Friday. In addition, gold is furthering losses to a near seven-week low… A lot of floor buzz about Michael Lewis’ book and the piece on 60 Minutes yesterday. If you have questions or concerns feel free to shoot me a note. This topic, and the topic of equity market structure in general is right in my wheelhouse… Once again, March Madness does not disappoint! Every game was absolutely incredible to watch this weekend… Should be an amazing Final Four, and I am pulling for the underdogs… Have a tremendous day!

Nope. You actually place the buy order and in the milliseconds it takes to actually process and execute the order the HFT’s are already buying thereby driving up the price and they are profiting on the spread difference.

The guy said they built their own fiber optic line from New Jersey to Chicago that was a few milli-seconds faster than the normal route. In those milli-seconds they buy up the available shares and sell to you at a slightly increased price. I don’t know how they accomplish all this but it looks like an interesting book.

So we'll see...

All of my trades and virtually all exchange trades are limit orders; I see a bid price, I sell at that bid price, and often I see it executed at a few thousands of a penny above that other guy's bid. Same thing with limit sell orders in reverse. What Mr. Flash did was scour the market for a better deal and then he pocketed the bulk of the spread --minus that fraction of a penny he gave me.

First, any way you cut it I end up with more money.

Second, if I really want all that spread money that Mr. Flash is scarfing up then I'm free to move to New York and spend a hundred grand on equipment, software, and a better connection. Given that I've chosen to pass on that option, I'm in no position to belly ache about Mr. Flash's obscene murderous unpatriotic dishonest profits that have been making me better off.

Sure, I wouldn't mind my broker offering some kind of 'flash option' on my account, but I'll first need to know how much in fees we're talking about. In the mean time I guess I got to look forward to next family dinner hearing my socialist brother-in-law tell me that he thinks flash trades are proof that capitalists are dishonest.

--so 812 miles at $21,700/mile = $17.6 million. I want one!

The retail traders like me and you aren’t the issue (I don’t know about you but I’m not doing millions of trades a day). Hedge funds and other institutional traders, not to mention the prime brokers, are being impacted. The 60 Minutes piece had Einhorn on there and he has backed the answer you mention. The RBC trader who discovered the isue has started his own exchange and they rout the trades to the multiple exchanges in NJ to get there at the same time so there is no time arbitrage opportunity. Also they have a mechanism that routes HFT trades through 60km of fiber looped in their facility to slow those trades down. Pretty ingenious stuff.

I love Lewis’s work. Should be a good read.

I guess I don’t need to read the book. They got it all hashed out over here.

Is the U.S. stock market rigged?

http://www.freerepublic.com/focus/f-news/3139390/posts

60km of fiber looped in their facility to slow those trades down

--but that's not illegal. OK, so this is--

18 U.S. Code § 1343 - Fraud by wire, radio, or television

Whoever, having devised or intending to devise any scheme or artifice to defraud, or for obtaining money or property by means of false or fraudulent pretenses, representations, or promises, transmits or causes to be transmitted by means of wire, radio, or television communication in interstate or foreign commerce, any writings, signs, signals, pictures, or sounds for the purpose of executing such scheme or artifice, shall be fined under this title or imprisoned not more than 20 years, or both. If the violation occurs in relation to, or involving any benefit authorized, transported, transmitted, transferred, disbursed, or paid in connection with, a presidentially declared major disaster or emergency (as those terms are defined in section 102 of the Robert T. Stafford Disaster Relief and Emergency Assistance Act (42 U.S.C. 5122)), or affects a financial institution, such person shall be fined not more than $1,000,000 or imprisoned not more than 30 years, or both.

--and so far nobody's saying that this has happened.

Sometimes when there's a lot of mindless hype, the polititians lean on the AG to harass someone until they can trump up some charge. Typically it involves constant questioning day after day until they find the slightest discrepancy, then the charge is lying to the investigator. That's how they put Scooter Libby and Martha Stewert in jail. It's a politically perverted miscarriage of justice.

99% of the people on that thread who say it’s rigged have no idea what the issue even is. Par for the Free Republic course...

Some of my bestest opinions are totally uninformed.

LOL! I think that’s true for everyone :-)

--and while that last 1% can be worth the lurk the rest is entertainment you can't buy!

So the first quarter ended with modest gains with both stocks and metals --and this morning seems like more of the same at least according to futures traders. A few headlines:

U.S. Stock Futures Point Slightly Higher Victor Reklaitis takes a look at the markets, including three stocks to watch today. Photo: Getty Images. WSJ LiveShould You Be Selling Your Stocks Right Now? If you have a $500,000 portfolio, you should read the latest thinking on the markets by billionaire investor Ken Fisher's firm. Learn more here!

Soda sales in US decline at faster pace NEW YORK (AP) — Americans cut back on soda at an accelerated pace last year, extending a slow retreat from the category that began nearly a decade ago. Associated Press

Just how dovish was Yellen's speech? Just how dovish was Federal Reserve Chairwoman Janet Yellen's speech? Economists are emphasizing different parts. MarketWatch

LOL! I think that’s true for everyone :-)

Exactly! Somehow an issue seems clear to me when it first comes out but the more I look into it the less I understand it.

CNBC fight between Katsuyama and BATS Exchange President O’Brien. It pretty much shut down the NYSE trading floor as traders looked on the debate. Fantastic stuff:

http://www.cnbc.com/id/101544772

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.