Posted on 03/12/2014 3:11:03 PM PDT by SeekAndFind

2014 is the first year most Americans will have to either have health insurance or face a tax penalty.

But most people who are aware of the penalty think it's pretty small, at least for this first year. And that could turn into an expensive mistake.

"I'd say the vast majority of people I've dealt with really believe that the penalty is only $95, if they know about it at all," says Brian Haile, senior vice president for health policy at Jackson Hewitt Tax Service. "And when people find out, they're stunned. It's much, much higher than they would expect."

In fact, "the penalty is the maximum of either $95 or 1 percent of taxable income in 2014," according to Linda Blumberg, a senior fellow at the Urban Institute's Health Policy Center. "For people with higher incomes, it can be much more sizable than $95."

Blumberg says that even for people with more moderate incomes, it's important to remember that the flat-fee penalty will be assessed for every family member who lacks health coverage.

"So if it's a two-adult household and both are uninsured, it's twice $95 — $190," he says. "Then if there are any children in the family that are uninsured, the penalty for each of them is half of the $95."

The flat-fee penalty maxes out at $285 next year. To help people figure out what they might owe, the Tax Policy Center, jointly run by the Urban Institute and the Brookings Institution, just posted an online calculator. And Jackson Hewitt has its own "How much is my tax penalty?" worksheet.

Haile says it's important to remember that even if most of the family has insurance, having just one uninsured member can trigger the penalty.

(Excerpt) Read more at npr.org ...

And if you have nothing, say you’re a chrity case supported by your family, your family must pay the penalty!

I’ll pay nothing. It’s time for gobs of testicular fortitude. This is all a bluff, just like Connecticut. They don’t have the manpower, the will or the jail cells.

I think the article is not comprehending this.

Looks like pretty much everybody can skate on the mandate now.

But I thought the Emperor changed that too... putting off the tax penalty for the individual mandate until after 2016>>>???

Will this lead the sheep to shed their wool and finally stand up to the tyrrany? I hope so, but I doubt it.

Of course it is only subtracted from their already high EIC and other bennies that they get so why would they care. Those of us that have insurance and have to write a check every year it won’t matter.

It’s not a penalty, it’s a tax. Oh wait, it’s not a tax it’s a Shared Responsibility Fee.

Remember, existing law means nothing to these liars.

Expect anything — they legislate from the Oval Office.

Too bad half the American public still has its head up its anal exit aperture, or they would be really upset and demand a change.

Nearly 70% don’t like the law. The RINOs and DEMs get the blame.

Good luck collecting those penalties. If you are not getting a tax refund there’s not much they can do.

all you got to do is fill out a form.....zap, no mandate, no penalty

If you are willing to sign a form “under penalty of Perjury,” yes.

just make sure you aren’t getting a tax refund, they will take it out of there.

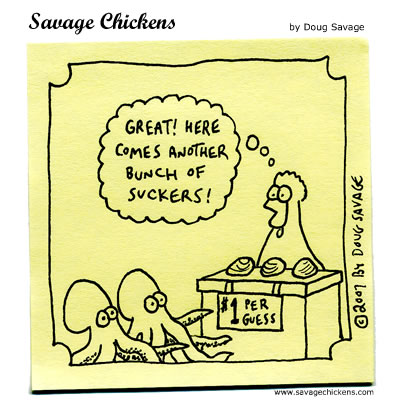

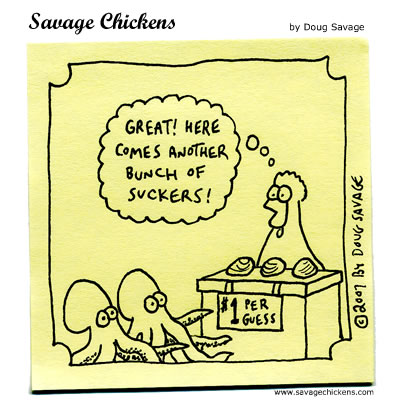

PT Barnum was a prophet.

thanks for the link!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.