Skip to comments.

Investment & Finance Thread 2014 New Year(Jan. 6 - Jan. 13 edition)

Freeper Investors ^

| Jan. 6, 2014

| Freeper Investors

Posted on 01/06/2014 2:28:44 AM PST by expat_panama

Investment & Finance Thread 2014 New Year(Jan. 6 - Jan. 13 edition)

Anyone want more stuff or less stuff posted here please let me know.

Ping list -- on or off let me know here or via freep-mail. If I missed you then Freep-mail me. The list of everyone's links is here. Open invitation continues always for input on ideas for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket.

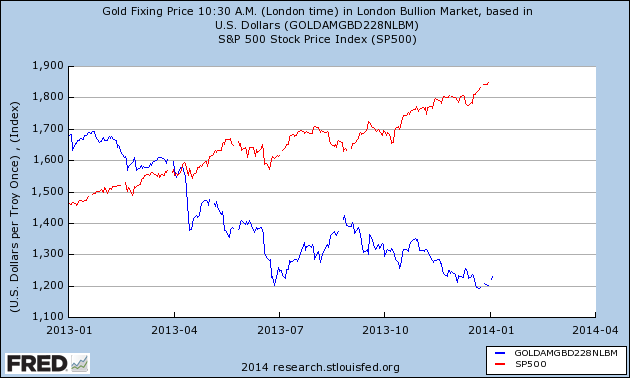

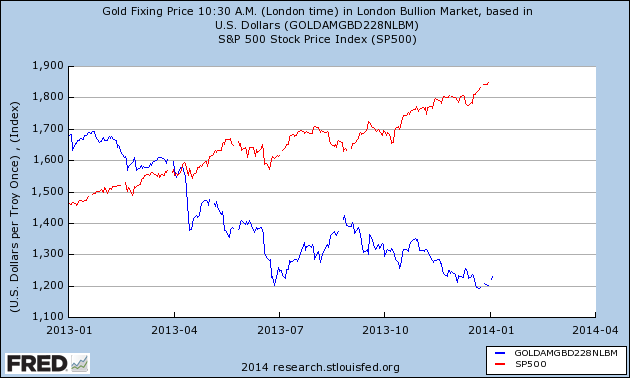

2013 was an amazing year-- stocks up 30%+ w/ metals tanking like 40%. Don't know about you but I spent most of it ready to bail out of stocks finding I never had a good reason. OK, so we made money but I'll be the first confess of being too cautious & missing out on some of the gains I should have gotten. New Year's Resolution #1: No more wimping. Sure, lots of folks are complaining about this past year's stock gains saying it can't last. The thing is that though we've been having a great run on stocks we can't expect it to last forever--- |

|

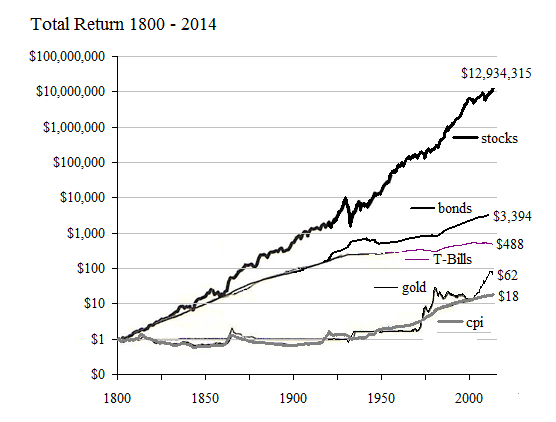

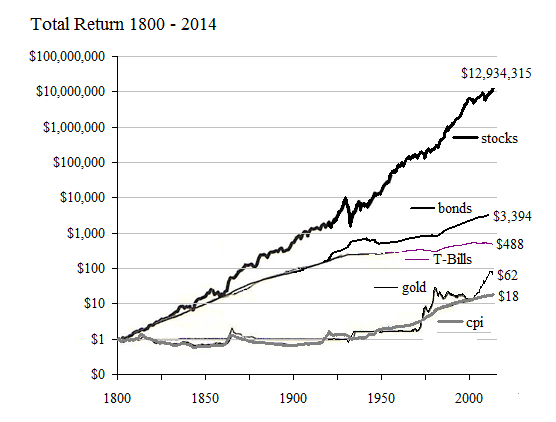

--because the fact that it's been going on for hundreds of years means that stocks are sure to revert to where they were in 1799 any second now. Actually, no. Stock returns are a function of the value of American commerce. America grows. We need to get used to it. The long term pattern is total return on stocks since 1800 has been 8%/year-- that comes out to doubling our money in just over a dozen years. On average. |

|

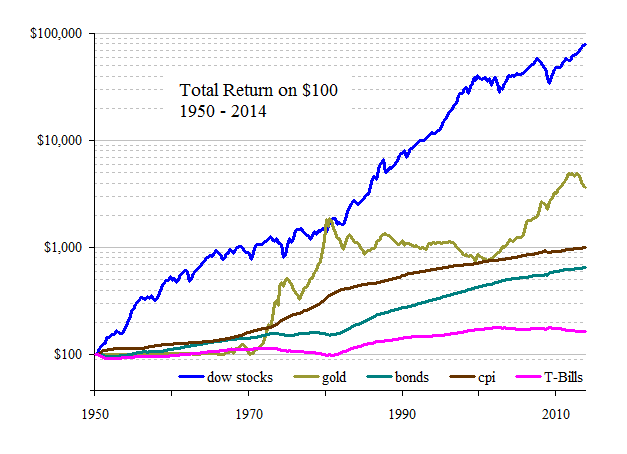

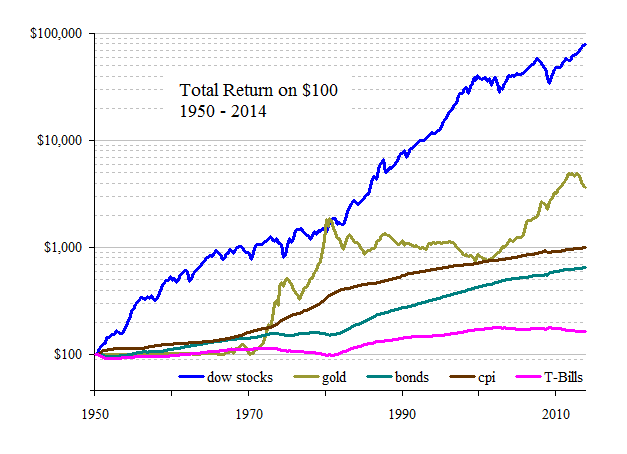

Looking more closely at the past few decades what I'm seeing is the fact that we're apparently leaving the stock perch we've been on for the past decade and a half, and we're seem to be emerging into what a lot of people call a 'secular bull market'. OK, I'm still ready to dump if what I got drops 9%, but I'll put more effort into really checking before I post my sell order... |

TOPICS: Business/Economy; Culture/Society; Government

KEYWORDS: financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-52 last

To: expat_panama; Abigail Adams

Happy Friday, all!

I would add an expense column (which would be a sum of a detailed expense report, i.e. insurance (home, car, umbrella), college, property tax, food, clothes, vet, medical, utility, etc. costs) with an annual increase of 3%. Also, for the sake of being conservative I would use a ROI (return on investment) of 5%. That way if you get 8%, YIPPEE you are ahead of schedule and can retire earlier. : )

41

posted on

01/17/2014 11:11:17 AM PST

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: Chgogal

That actually sounds pretty good; even though 8% is historically reliable the problem is with the fact that the 8% is a long term average while retirement is a short term certainty.

To: expat_panama

43

posted on

01/26/2014 10:12:53 PM PST

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: Chgogal

44

posted on

01/26/2014 10:18:27 PM PST

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: Chgogal

45

posted on

01/26/2014 10:26:42 PM PST

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: Chgogal; expat_panama

Thanks for the news! I’m wondering what’s going on with the markets, and if we are taking a dive if it’s time to get out for a while.

No new weekly threads? Just curious. :-)

To: expat_panama

New Year's Resolution #1: No more wimping. How's your New Year's Resolution #1 coming along?

: )

47

posted on

02/26/2014 10:00:13 AM PST

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: expat_panama; abb; Jumper; Tennessee Conservative; bert; Excellence; kearnyirish2; ncfool; ...

This was a great thread. I loved it. Why not continue it?

48

posted on

02/26/2014 10:06:45 AM PST

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: Chgogal

To: Abigail Adams

Seems that no one else except us two are interested in continuing this thread. : (

50

posted on

02/27/2014 11:57:01 AM PST

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: Chgogal

Maybe some people on the ping list will see this tonight?

To: Abigail Adams

I saw it, am still sitting on the sidelines. Things seem over priced yet the market keeps going up up up after that mini correction.

52

posted on

02/27/2014 3:31:28 PM PST

by

Aliska

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-52 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson