This is the Weekly Investment & Finance Thread (August-2013 12-16 edition)----

This is the Weekly Investment & Finance Thread (August-2013 12-16 edition)---- Trying to focus on the markets for today and each day and the economic news

This is where you can exchange some investment opinions and advice

Posted on 08/12/2013 3:14:33 AM PDT by expat_panama

This is the Weekly Investment & Finance Thread (August-2013 12-16 edition)----

This is the Weekly Investment & Finance Thread (August-2013 12-16 edition)----

Trying to focus on the markets for today and each day and the economic news

This is where you can exchange some investment opinions and advice

If you see another FR economic thread you like and want to link to it here, please do

Post your favorite economic site links. Your favorite economic blogs and precious metals blogs and sites

Ping list -- on or off let me know here or via freep-mail. If I missed you then Freep-mail me

I might ping you to other interesting economic threads a few times a week. One per day maybe

Sites that posters have recommended ------

I have listened to Dave Ramsey in the past say you should invest in “high quality mutual funds” but he never says how to figure out what “high quality mutual funds” are. I have heard others say to invest in tax free bonds. I have talked to financial advisers that weren’t much help either.

Three hours before opening bell stock futures are tanking. Everyone ready for another Monday morning?

Stocks Lose Ground, But China ADRs Notch Gains

Japan's Below-Forecast Growth Fuels Sales-Tax Debate

Japan's economy slowed more than forecast in the second quarter as businesses cut investment, undermining gains in consumer and government spending that helped reduce deflationary pressures.

So if the fund goes up it was high quality and if it drops it was bad. Sounds like--

Seriously, what I can figure out is that everyone wants to know what's going to happen over the next few weeks and nobody knows. All we can know is that over the next few decades the population's going to grow, science will advance, and folks will create wealth by making things that they can sell. Stocks go up over decades.

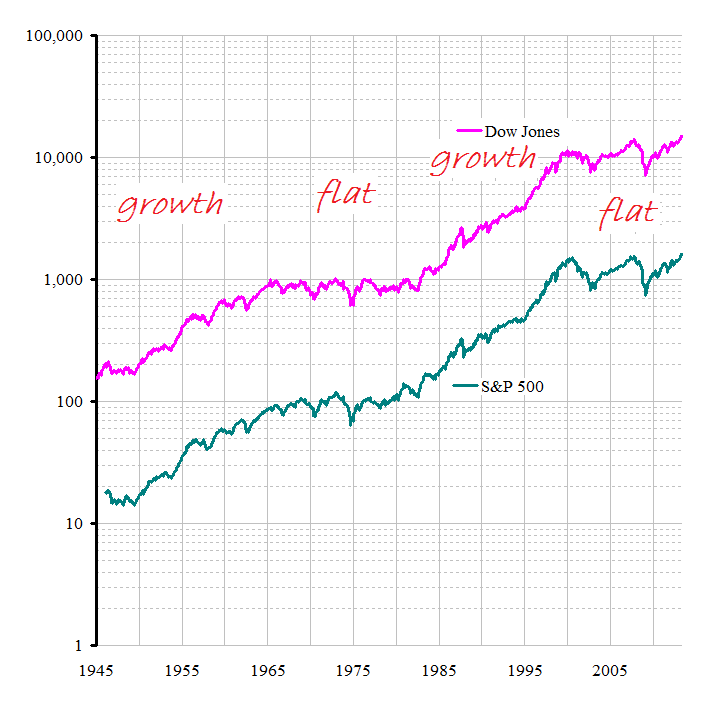

Vanguard 500 Index Inv (VFINX) has done well for me because all they do is put the money in the S&P 500 list which on average has been doubling in value every eight years for the last 70 years.

BBRY “exploring strategic options including sale or joint venture.”

They are dead Jim.

Key Economic Data releases this week:

Aug 13 8:30 am - Retail Sales

Aug 14 8:30 am - PPI

Aug 15 8:30 am - CPI

Aug 15 9:15 am - Industrial Production / Capacity Utilization

Aug 15 10:00 am - Philly Fed Index

Aug 15 10:00 am - NAHB Housing Market Index

Aug 16 9:30 am - Housing Starts/Permits

tx, must mean today’ll be easy maybe...

Have you guys looked at a chart for Netflix lately?? (NFLX)

OMG! It went from $250, all the way down to $50, and is now back up to $250! WOW!

I made money on it during the first run-up... then, I made a GOOD bit of money, shorting it... when they tried to charge people for multiple accounts. Insanely STUPID idea...

I just sort of quit looking at them when they fell below $100. Had no idea they’d recovered SO much. I just looked this weekend when I noticed, they NOW allow MULTIPLE PROFILES on one account.. at no extra charge.

FINALLY, they understand the value of their product. I think this will help them. But, with a P/E now at 300?? I’m not all that tempted to ride them again.

Thoughts?

‘Hindenburg Omen’ hovering over Wall Street again

Jittery Wall Street traders are looking up in the sky and seeing Hindenburgs.

That can be a bad thing for markets, which have suffered in the past when the tripwires associated with the “Hindenburg Omen” get activated.

Market veteran Art Cashin said Monday that the market phenomenon is looming again.

“There have been multiple occurrences of the Hindenburg Omen in the last several weeks,” Cashin, the director of floor operations at UBS, said in his morning note.

http://www.cnbc.com/id/100955925

True, because people selling off can cause a big sell-off. (Duh.) OTOH talking about selling without actually selling is a good thing for stock price growth, because it confirms the existence of pent-up demand waiting on the sidelines --hence the 'climbing a wall of worry' saying.

Personally, all I can see is that we're at a decision point--

---trying to figure out whether conditions justify resuming long term growth or not. Please give me a heads up if you come across any indication whether it's 1973 or 1979.

” Please give me a heads up if you come across any indication whether it’s 1973 or 1979.”

God I hope not. The late 70’s and the 80’s although fun, were hard on me. I don’t know if I could survive them again.

I googled “high quality mutual funds” and Vanguard came up.

Yesterday's pessimism got over taken by folks just wanting to get back to work---

Stocks Muster Mixed Close; Nasdaq Squeezes Out Gain

08/12/2013 06:49 PM ET - Stocks rebounded back from a weak start to finish narrowly mixed Monday. The Nasdaq rose 0.3%, recouping Friday's drop. Apple (AAPL), which is Nasdaq's biggest weighting, rose 3% on reports that its next-generation iPhone will be unveiled Sept. 10. Small caps had a nice day, as the Russell 2000 rallied 0.5%. Meanwhile, the S&P 500 slipped 0.1%. Monday ... More »

--and now this morning's furtures are up a bit. We'll have to see how today's reports (see Wyatt's Torch's post 6) pan out.

iirc toddsterpatriot was able to google-associate 'ass-clown' with 'Paul Craig Roberts', but otoh if the Vanguard folks got their name at the top then they're at least saying it's their goal. For comparing performance of the major funds, a google of "mutual fund performance compared list 1 year 5 years" pops some good lists.

As a matter of fact (aamof?) please tell me which you like, maybe I should include them on the weekly list:

Top-Performing Mutual Funds by Category-Kiplinger

Best Mutual Funds | US News Best Funds

Performance evaluation of mutual funds - SlideShare

Top 10 Mutual Funds for SIP to invest in 2013 | myinvestmentideas ...

Likewise. Mine began with a divorce w/ a loony ex and ended with marrying elsewhere into 30 years+ of bliss. A good era to be from.

Ackman resigned from JCP board today. Stock up 2.5% pre-market.

huh, and this right before this morning’s retail report...

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior | Revised From |

| Aug 12 | 2:00 PM | Treasury Budget | Jul | -$97.6B | -$96.0B | -$96.0B | -$69.6B | - |

| Aug 13 | 8:30 AM | Retail Sales | Jul | 0.2% | -0.1% | 0.2% | 0.6% | 0.4% |

| Aug 13 | 8:30 AM | Retail Sales ex-auto | Jul | 0.5% | 0.0% | 0.3% | 0.1% | 0.0% |

| Aug 13 | 8:30 AM | Export Prices ex-ag. | Jul | 0.0% | NA | NA | -0.2% | - |

| Aug 13 | 8:30 AM | Import Prices ex-oil | Jul | -0.4% | NA | NA | -0.3% | - |

Good times, good times.

I like the first two. BTW, did you link the MarketWatch top mutual fund site that had the Holdings option? The one I put a link to on a thread.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.