Freepers, your Contributions make every difference!

Please keep ‘em coming! Thank you all very much!

Posted on 04/12/2013 3:36:18 PM PDT by Obama_Is_Sabotaging_America

Wow, look what I noticed today? The European fiscal crisis must have triggered this..

Gold: $1,478/oz

Silver: $25.95/oz.

Platinum: $1,491.00/oz.

Dr. Roberts: “Well, I think the power of the West has already been lost. When you have off-shored your manufacturing and professional service jobs, you’ve hollowed out your economy. So gold or no gold, the United States economy has been severely damaged and I don’t think it can recover.

Interesting.. So, there is a ‘false market’ of paper precious metals, not backed by physical metals. Shouldn’t the two be tracked independent of one another? This means the physical value gets short-changed by the stated market value.

An acre of good, tillable American farmland in 1913 cost ~1.4 ounces of gold. In 2008 the same acre cost about ~1.6 ounces of gold.

One could argue that gold is slightly off where it should be. In fact, in the 4 years since 2008, land has actually gone up another thousand or so. I read someplace that it is attractive to conglomerates and kings because it is real and it retains its value fairly well and it is possible to put it to work.

On the other hand, they have driven the price up.

Sounds to me like gold is as good an investment right now even with the price down to 1500.

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/4/12_Former_US_Treasury_Official_-_Fed_Orchestrated_Smash_In_Gold.html

"They are trying to get people to sell PMs to kill 2 birds with one stone that is when the sheep sell because of the panic they will keep FRNs propped and further they will buy stocks and keep the stock market going.

When the banksters and friends decide that enough money is in the markets they will then short the markets and collapse the stocks and purchase physical PMs thus making themselves much wealthier and the sheep left without wool as they have been fleeced once again.

This may all happen soon so hang on to your physical as you may need it to survive..."

https://www.kitcomm.com/showthread.php?t=117040&page=2

Agree with post 34. A lot of the money in gold is in ETFs, IAU or GLD, and is quick in and out trading. When there is a downturn, a lot of stop loss sales magnify the drop.

The price will firm up at $1450 and likely go back up gradually. This is a buying opportunity if you don’t already have some gold and silver one ounce bullion coins in your gun safe along with some favorite firearms and lots of ammo.

Here’s one opinion. Bubbles will burst

http://www.marketwatch.com/story/why-gold-and-silver-are-in-the-dumps-2013-04-11

Yes. Manipulated by JP Morgan and others. Google "JP Morgan and silver manipulation" and you'll find plenty online about it.

Some believe the manipulation is also done by per Fed Reserve. If the "official" market price for gold and silver is low, depressed by trades of paper rather than physical, it can make the devalued dollar appear stronger than it really is while the Fed Reserve prints more indefinitely (QE4, 5, 6, etc.). As an added "bonus," depressing the price makes it easier for China to buy more of it.

The sad thing is that some individual investors are duped into selling precious metals in their possession based upon the depressed price of a rigged paper market.

As a practical matter, when you start looking for real precious metals to buy, you'll discover the true market price you'll pay to get physical gold/silver. There's a premium for actually owning it versus having a piece of paper saying you own it.

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/4/12_Maguire_-_There_Is_Absolutely_No_Physical_Gold_For_Sale.html

Former Assistant Treasury Secretary Paul Craig Roberts tells King World News today that the smashing of gold and silver prices is a Federal Reserve campaign to defend the U.S. dollar against a hyperinflationary scenario. "The exchange value of the dollar is threatened," Roberts says, "and if that collapses the Fed loses control over interest rates. Then the bond market blows up, the stock market blows up, and the banks that are too big to fail, fail. So it's an act of desperation because they've got to establish in people's minds that the dollar is the only safe place, it is the only safe haven, not gold, not silver, and not other currencies."

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/4/12_Former_US_Treasury_Official_-_Fed_Orchestrated_Smash_In_Gold.html

Gold and silver on the sale discount rack. Limited time offer. Word to the wise.<<

Bingo!...post of the day.....Buy “insurance” when it’s cheap!

I was a student once too. However, you can examine your change. If you see dimes/coins dated before 1965 put them in your piggy bank.<<<

Good answer!.in fact...it’s a Law.....

http://en.wikipedia.org/wiki/Gresham’s_law

one little known fact in silvers favor...

There is now more physical ounces of gold then silver available in manufactured form...

Do your own DD!!!!!

Goldbug ping.

Bingo!...the powers that be can manipulate the price of PM’s but they cant control demand....If gold went to $1000 id expect the “premium” to be at least $300-$400 per ounce to produce “sellers”

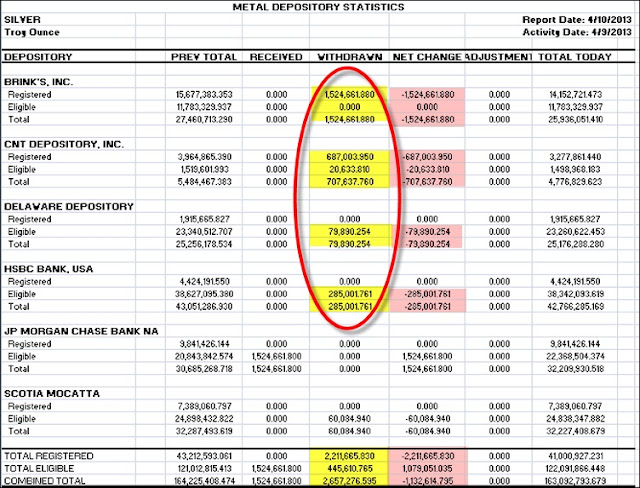

COMEX.Silver. More................from Rico

The Precious Metals tell-tale I recently referred to apparently continues to wave in the breeze.

- Something is 'going on' beneath the surface.

Fully 30% of CNT's Silver bullion inventory has been withdrawn from the COMEX vaults in two days.

For those who get their financial 'news' from MSNBC, CNBC, Yahoo, or the FED, et al:

- In 48 hours, CNT's physical Silver bullion inventory has been reduced by ~one-third.

Every vault (except JPM's, hmmmm...) has seen significant inventory reductions.

[Context: 58 tons of Silver have been withdrawn from COMEX since 01 Jan 2013.]

You and me, both. My investing consists of canned tuna, peanut butter, and lots of dog food for our security team.

The metals boom brought out a lot of nice inventory that is dropping in price. I picked up a roll of uncirculated 1921 Morgan Silver

Dollars with my regular Silver Eagle purchase. Lots of nice vintage Walking Liberties have been hitting the market too. Today there wasn’t a single gold coin left in the local shop by the time I got there.

ABX is at 22 I was shocked! At it’s peak 2008 it was above 50.

April 2011-—ABX at 55 its peak. It hit 50 in 2008

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.