The Coming Ponzi U.S. Treasury Bond Market Crash

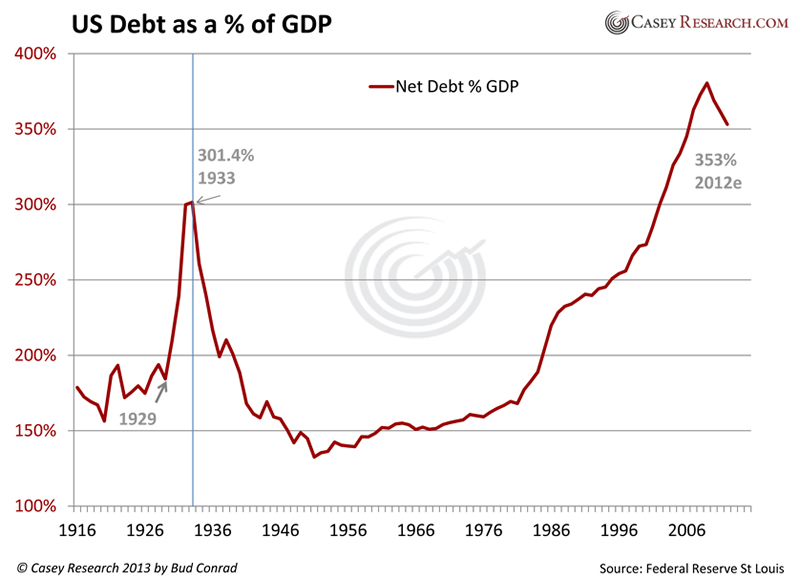

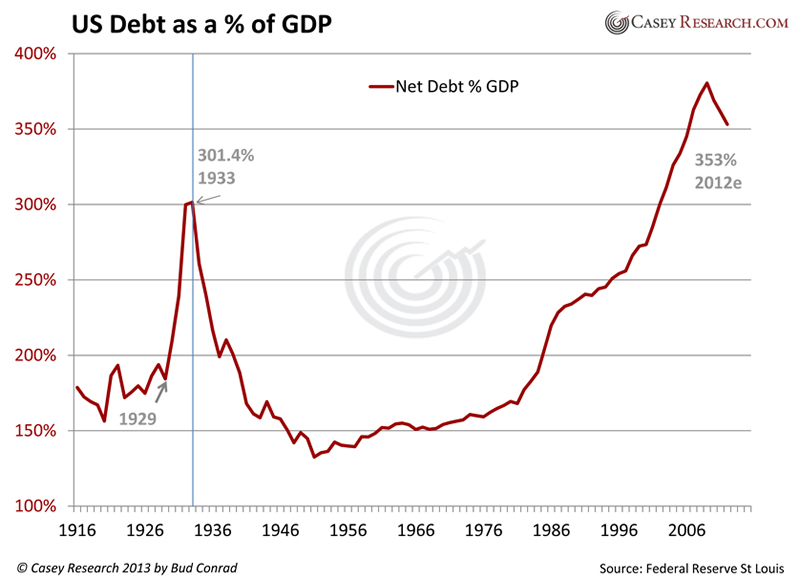

"It is my contention that the 70-year debt supercycle has come to an end."

Posted on 03/10/2013 10:12:03 AM PDT by blam

SIEGEL: Here's Why The Dow Can Get To 18,000 By The End Of Next Year

Joe Weisenthal

March 10, 2013

The Dow made new highs this week, ending Friday at an all-time closing high of 14,397.07.

One of the most well-known stock market bulls is Wharton professor Jeremy Siegel, who is known for his long historical analysis of stock market returns.

Siegel and his assistant Jeremy Schwartz (who is the research director at the ETF company WisdomTree, which Siegel is involved with) are the subject of a Barron's piece this weekend about how high the Dow can get in the next couple of years.

Their answer? 15,000 this year looks easy. The 16,000-17,000 range is also possible. And there's a 50/50 chance of Dow 18,000 by the end of next year.

How do they arrive at these numbers?

Basically Siegel and Schwartz take Dow returns going back to 1871, and chop up the market into rolling 5-year periods. The median return over any 5-year period is 9.41 percent. The worst return is 15.6 percent. As of this year, despite the 4-year bull market rally, the current 5-year return has been in the lowest third of all 5-year periods. Then in the 2-year period of returns following the lowest of all 5-year periods, the median return is 14.59.

The final math ... drum roll ...

To apply that 14.59 percent to the Dow, we first subtract 2.48 percentage points for dividends, leaving a median price return of 12.11 percent a year. Grow the Dow at 12.11 percent from the March 5 close of 14,254 — the final number in our last five-year interval — and you get 17,915 within two years.

Voila!

(Excerpt) Read more at businessinsider.com ...

I can’t believe that can happen.

The final math ... drum roll ...

*********

$17 Trillion dollar (nominal) national debt, or about $150,000 per taxpayer and rising rapidly. That math is problematic for the market.

Wasn’t I reading stories about Dow 20,000 right before the bubble burst?

The twit author is a shill for the Democrats. Editor of the Financial Insider at the New York Times...what would you expect him to say? The market will be down?

With the Fed pumping in a bunch of printed scrip to the market at a tune of TENS OF BILLIONS per month for the last umpteen months, why wouldn’t anyone wonder why the “market is doing well?”

It ain’t doing well for the common everyday long term investor. It is now at or a little above what it was in the summer of 2008....boy, I’d like to get that kind of effing return....boy howdy!....

Don’t believe this great market news. We’re now informed that computers are going to be replacing humans on the floor...that’s gonna work out fine.....

The only people getting rich are the insiders and the government creeps as well as asswipes like Weisenthal that purport to know something about free enterprise. Ha.

I don’t buy the hype. CNBC recently claimed gold could reach $5000. It’s now dropped to near 52 week lows. Even the radio ads have switched from gold to silver. It smells the same for the market.

As for stocks, bring up the Dow financial page and expand it to the full history. Look at the pattern. It’s approaching the time interval, slope and peak of the last 2 massive drops. If you move back in time from the highest peaks to the early 90’s and before, look at the peaks and drops there, it still has a similar pattern. I am not sure when the next big drop will occur but things are aligning for it to happen again. Could be a week, or a year. When It goes, it will be quick and deep like the other times.

I don’t trust any financial news that predict massive good news. That always happens to push the bubble higher so the major investors can exit before the crash.

Speaking of that, do a search on those investors and see where they are putting their money into. It’s not stocks at this point in time. They are quietly exiting the market.

Let’s see ... devalue the dollar about another 50% .... 25K in 10 years or less.

certainly - Bernanke has been flooding the market with worthless monopoly money for a long time. When it comes to an end, what happens??

Are they trying to sucker more fools into putting more money into the Stock Market just so that they can loose it all when the market finally explodes.

I would get my money out of there now.Let the finance houses and the banks play with the market.Hopefully they will only blow up there own money.

There were stories about Dow 20,000 and 35,000 and I seem to remember seeing one saying 100,000. I knew then to start pulling back from the markets. By the time the bubble burst I was almost entirely in cash after some very nice gains — laughing all the way.

When everyone starts talking about higher and higher highs it is time to start pulling out, not a time for jumping in.

“Wasn’t I reading stories about Dow 20,000 right before the bubble burst?”

My thoughts EXACTLY!

What’s the old saying ... “Sell in May and go away”.

I see a big pop coming.

FYI.

My own less famous opinion is that he's wrong, but who cares what I think?

I have been telling people this and they are not believing me. Calls me a liar in fact. Ugh!

Some FReeper said the other day that he wished Don Ho was the Fed Chair because tiny bubbles are preferable to huge catastrophic bubbles LOL

Well, yes. The funny money supply could continue to increase much. Some of the money from stocks will whoosh into bonds, when they want oil down and the dollar up (maybe spring). Then it will whoosh back into stocks, when they get too afraid of declining activity (maybe fall or winter). Back and forth, the debt regime continuing to bloat on funny money.

It will stop, when many real, foreign and domestic investors get too afraid (bond collapse). Thing is, they have to put their money somewhere. That could be a while. Could be a couple of years or more. We’ll see.

In the long run, the dollar will fall, and oil will rise. Then, when oil hits the wall of real, bit deflation, it will fall. The dollar will be adjusted really low. Real recovery will happen with American peasants building small shops enough to give us a large manufacturing base again.

That’s my macro-macro- guess, but I’m unqualified, uncertified, unlicensed, un-degreed and unapproved.

Corruption at the highest level & they've got the people caught in their web. All that it takes is for the Fed to stop QE & have the banks in a short position & this corrupt entity rids them of the middle class. Game over. If these so-called American companies which are so much foreign invested & where their profits are coming from why would they care to prop up this nation. Get the market as low as can (while shorting) then rape the 401's. Easily done. Buy up all equity & euthanize the elder via ObamaCare, the unleash all of the stored energy we have & the elites start the process over again with a much greater accumulation of wealth.

The Coming Ponzi U.S. Treasury Bond Market Crash

"It is my contention that the 70-year debt supercycle has come to an end."

It’s real value would still be less than it was 4 years ago. Hyperinflation has started and the value of our dollars are much less than they were.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.