New Study Finds Democrats Fully to Blame for Subprime Mortgage Crisis that Caused 2008 Financial Disaster.

Posted on 12/22/2012 2:54:00 PM PST by george76

In his early activist days, Barack Obama the community organizer sued banks to ease lending practices... During his time as a community organizer Barack Obama led several protests against banks to make loans to high risk individuals.

...

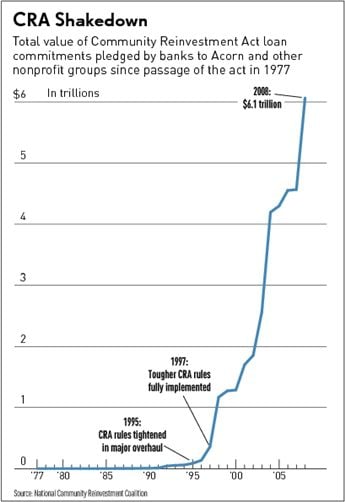

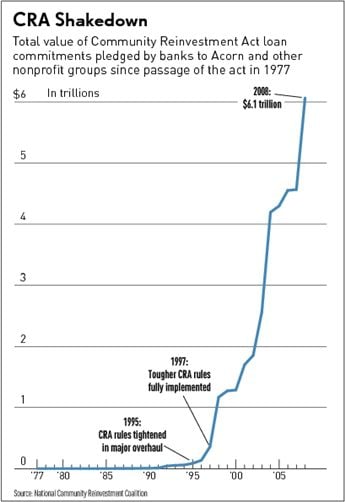

A new study by the respected National Bureau of Economic Research found that Democrats are to blame for the subprime mortgage crisis.

...

Republicans warned Democrats of the impending doom in 2004.

(Excerpt) Read more at thegatewaypundit.com ...

New Study Finds Democrats Fully to Blame for Subprime Mortgage Crisis that Caused 2008 Financial Disaster.

I have known this since at least 2008. Now show me how we can convince the low information voters in this country. Low Information Voters = at least 51% of the electorate.

We knew this would happen before the crash. It was inevitable. You can't just keep giving housing loans to people who won't pay them back - period. The Republicans in Washington said and did nothing. They let the MSM and the far left blame Bush, who tried to get congress to stop it - twice.

The spineless Republicans seriously dropped the ball on this one. They had the democrat party by the balls, but hid under their desks instead of sounding the alarm.

These democrat policies still stand. The housing for freeloaders is still law. We're still being forced to pay most of their mortgages right along with our own. They're setting the U.S. up for another crash down the line, and the Republicans are standing around like idiots letting it happen.

Odd.

I’m not buying it , “commitments” ,, What exactly does that mean? Seriously it’s not hard money or loans. I see it (allowing the ponzi that was the real estate bubble) as more of a payoff to the “banks” and their cronies that oversee them .. an excuse , COVER , for bad loans , known to be bad at inception .. loans that were propped up with phony appraisals and sold of before they were even funded.

The gutless cowards never own up to the damage they cause. Their fellow travelers in the media either ignore inconvenient facts or refuse to report them. Imagine how much they must hate the new media.

Banks that lent money to people who couldn’t pay it back and people who lied on their mortgage applications are not at fault?

***************************************

The banks controlled the process , they implemented the “no doc” policies , they knew the loans were crapola and didn’t care because they had them pre-sold to YOUR PENSION FUND...

Correction: People who “COULD” pay it back but chose not to!

Im in the mortgage biz, banks did not voluntarily give people loans they knew could not afford. They were forced to do so in most instances under community lending guidelines. Most of the loans were still loans that people could afford to pay, even if the rate was adjustable.

Problem is, the people didnt sacrifice the luxuries in an effort to constinue to pay mortgages.

Known this all along. Now, get the talking head sOcIaLisTs to report on it.

Best of luck.

>> Odd.

Once responsible banks were infected with charlatans that administered Congressional requirements. That’s unfortunate, but not “odd”.

It wasn't their choice. The law forced them to. It was written in the Act they couldn't refuse a loan based on income. If they tried not to comply, the left wing tried to sue.

people who lied on their mortgage applications are not at fault? Odd.

They didn't have to lie. Because income didn't matter. The banks couldn't ask. They didn't have to be U.S. citizens, either. That question was deemed discriminatory.

The banks had no choice. They took those forced loans to Fanny and Freddie just to get rid of them. F&F bundled them together sold them on the market as GOOD loans.

SOMEONE had to pay off those bogus loans that weren't getting paid, and it had to be us, the U.S. taxpayer. These were OUR "citizens" that scammed the investors of the world.

Once again, the good people of America had to clean up another democrat disaster. And once again, the democrat base walks away debt free.

They were forced to by the government. It wouldn’t be “fair.”

Personally, I'm a little ticked at myself for not realizing this, and taking that lowball offer we got on our California house in 2006. That house, which we still own now as a rental, is down $275,000 from its 2005 high.

Im in the mortgage biz, banks did not voluntarily give people loans they knew could not afford.

**********************************************

BS! In most cases it was the loan officers modifying (falsifying) the income and expense data on apps/HUD-1’s to get people qualified ... and even if it came from a broker the banks still knew of and failed to stop the fraud because they were only in it for the quick 5% commission or such passing the known bad/fraudulent loan onto the end buyer of the product Wall Street was crafting out of it.

I know of dozens of instances where Mexicans , without SSN’s! churned cheap homes , selling them to relatives over and over every 6-12 months ,, never making even payment number one and dealing with the same broker and/or bank again and again ,, taking a 1100 sq. ft. $60k duplex to over $200k and then fleeing to Mexico with the cash or simply not using that name again ...

WRONG:

All banks expected a payback of thier loans. Nobody loans money to people and then doesnt care if it is paid back?

Now, that does not mean that some of the loan programs offered were “smart” in a business sense because many were not.

The “no doc” loan in therory is a good loan for some people. For instance, many business owners make lots of money but cannot prove all their income because of tax deduction allowance, depreciation of assets, etc. These loans were designed for such people. Also, you had to prove that the income was reasonable for someone in the same career or line of work.

However, over time, the “no doc” loan was used to give anybody a mortgage.

No doc loans were common, but made up only a small percentage of the mortgage market.

The biggest default rates are in the GOVERNMENT sponsored loans such as FHA, which still to this day has the some of the loosest qualifying criteria.

Not is “MOST CASES”, you dont know what you are talking about.

Cry BS all you want. I have been extremely involved in all facets of this induastry for almost 20 years. I have spent time on Capitol Hill and also with GW BUSH regarding mortgage issues. I am also past President of several mortgage industry associations.

I now what I am talking about. You have only your opinion.

I am not stating that FRAUD was not happeneing. But dont use words like “most cases” like you have first hand experience.

Mexicans did get lots of mortgages, but that was the program sir. It was allowed under Fannie Mae.

Loan officers did not set those guidelines.

What you fail to understand is that if a customer qualified for the loans that the FED GOV and Fannie Mae endorsed, you were legally obligated to provide it or you could be sued for discrimination in lending.

The GOV is the problem...

Pardon the typos...

“It wasn’t their choice. The law forced them to.”n

True.

Someone I know would shout about it to me every evening, disrobing in the process, and then going to take a shower to was the stink of it off. Every work night. I was amazed.

There’s a spare ‘n’ in there, but ‘was’ should be ‘wash.’

Oops.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.