Skip to comments.

Obama's Brutal Gaffe: Low Gas Prices Cratered Our Economy

breitbart.com ^

Posted on 10/17/2012 12:32:23 PM PDT by Sub-Driver

Obama's Brutal Gaffe: Low Gas Prices Cratered Our Economy

by Ben Shapiro 17 Oct 2012, 11:48 AM PDT

Last night, President Barack Obama dropped the biggest campaign gaffe of the season – only the media wasn’t watching. It happened during his testy exchange with Mitt Romney over gas prices. First, Obama denied that he’d done anything about denying licenses on oil and gas; he backed off of that shortly. Then he denied that production on federal land was down; he was lying. Finally, Romney hit him with this devastating line:

The proof of whether a strategy is working or not is what the price is that you're paying at the pump. If you're paying less than you paid a year or two ago, why, then, the strategy is working. But you're paying more. When the president took office, the price of gasoline here in Nassau County was about $1.86 a gallon. Now, it's $4.00 a gallon.

Obama’s response was horrendous:

Well, think about what the governor -- think about what the governor just said. He said when I took office, the price of gasoline was $1.80, $1.86. Why is that? Because the economy was on the verge of collapse, because we were about to go through the worst recession since the Great Depression, as a consequence of some of the same policies that Governor Romney's now promoting. So, it's conceivable that Governor Romney could bring down gas prices because with his policies, we might be back in that same mess.

In other words, bringing down gas prices by drilling creates economic recession. That was Obama’s argument.

Does anyone think this president understands basic economics?

(Excerpt) Read more at breitbart.com ...

TOPICS: Business/Economy; Front Page News; News/Current Events; Politics/Elections

KEYWORDS: 2012; democrats; drillheredrillnow; gasprices; nobama2012; obama; obamanomics; obamatruthfile

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-109 last

To: wolfman23601

I'm in the same boat. Economic collapse led to low gas prices was his point. Makes sense in terms that the stock market tanked and gas prices dropped. The market's value is way above the lowest point it hit, with economic growth elsewhere oil becomes more expensive.

Of course denying permits for drilling on our own land and sea don't help to lower gas prices. Giving Canada the finger (id rather get oil from them than russia or saudi arabia, Canada doesn't try to fly our airplanes into our buildings for one) on Keystone XL because some rich enviros that dont worry about their gas prices tell Obama to do so doesnt lower oil prices. I doubt oil futures would remain as high if we permitted drilling everywhere we could. Constantly playing "yes, but" with traditional energy sources in favor of adopting not-yet-realized energy tech nationally doesn't help it either. Also glad for the question about Steven Chu. It reminded people that the president doesn't really care about your gasoline expenses, peons, you should pay a lot so you'll have to er, want to buy a greenmobile (Volt)!

Again, not sticking up for Obama (he's making gas prices worse), but this piece misinterprets his dumb argument. It was easy enough to demolish without doing so. I just did so and I'm not a rocket scientist.

101

posted on

10/17/2012 9:48:57 PM PDT

by

mbennett203

("Bulrog, a tough brute ninja who has dedicated his life to eradicating the world from hippies.")

To: depressed in 06

Actually, I believe your description is the appropriate way to understand what 0bama implied. The writer of the article jumped the shark.

102

posted on

10/17/2012 10:21:18 PM PDT

by

ConservativeMind

("Humane" = "Don't pen up pets or eat meat, but allow infanticide, abortion, and euthanasia.")

To: Sub-Driver

And HOW did Obama KNOW that Crowley had the Rose Garden TRANSCRIPT right there at her desk???? CHEATERS!

103

posted on

10/18/2012 2:28:13 AM PDT

by

Ann Archy

( ABORTION...the HUMAN Sacrifice to the god of Convenience.)

To: ROCKLOBSTER

What is causing the outrageous gasoline prices with crude hovering at 92 bucks? Because you are only looking at WTI pricing and not the average price most refineries have to pay for oil. Keep in mind we import more oil than we produce ourselves.

The price of oil most commonly quoted is West Texas Intermediate delivered to Cushing, Oklahoma. That is a bottlenecked, landlocked point in the delivery system and below the average oil price.

When you look back at the high prices in 2008, WTI was a premium price to imported Brent and corresponding to other imported oil.

These days the WTI is often $20 bucks cheaper than most the oil refined in the US.

In short, comparing the WTI/Cushing price of oil vs gasoline from 2008 to now, is comparing a number that was higher to the average refinery price to one that is lower today. It is not a real comparison.

Too many people want to compare to the spike price that lasted a few hours in 2008. That is not a useful comparison. The average monthly price of oil bought by refineries reached $129/bbl in July of 2008, the average price of gasoline was 4.114/gal at that time.

U.S. Crude Oil Composite Acquisition Cost by Refiners

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=R0000____3&f=M

U.S. All Grades All Formulations Retail Gasoline Prices

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=EMM_EPM0_PTE_NUS_DPG&f=M

The latest monthly data is for August. $100.2/bbl for oil and $3.78/gal for gasoline. The margin is a bit larger than before, but there are more regulations and higher costs associated with refining today then there was in 2008. The labor costs are higher, maintenance cost are higher. But the ratio has not changed greatly.

Source:

http://www.eia.gov/forecasts/steo/report/prices.cfm

104

posted on

10/18/2012 5:35:07 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: Gee Wally

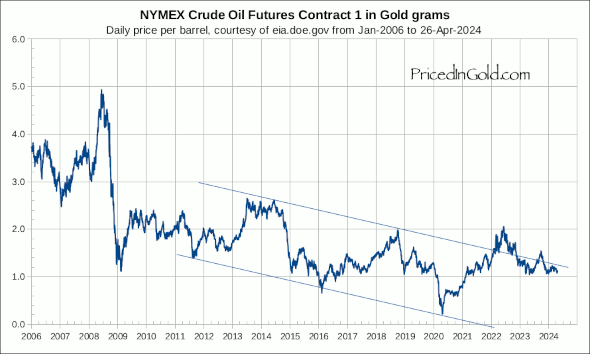

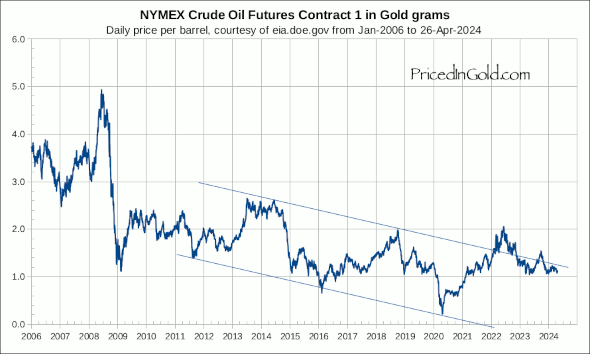

The Fed has been printing money for the past 4 years, big-time. So the real value of a dollar has been diminished, by how much I couldn’t say. Price of Oil plotted against Price of Gold

105

posted on

10/18/2012 5:40:44 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: sodpoodle

You are right, but nothing there is in contradiction to my post.

To: NoLibZone

Times are bad, but the dollar is low too. There are so many variables.

To: Political Junkie Too

"I still think that oil behaves differently because it is globally fungible. As I said earlier, if demand falls in the United States (for whatever reason), the price won't fall because the supply will be adjusted as the oil companies sell their oil overseas instead."A drop in U.S. demand is still a drop in total demand. If the U.S. was only a small part of world demand, it might not be noticeable. But the U.S. is a large part of world demand. And when our economy is off, everyone else's tends to be too.

If the rest of the world increased demand as the U.S. decreased so that total demand stayed the same, you wouldn't see a price change. Usually the rest of the world economies are affected by ours, and their demands drops along with ours.

OPEC is the one spoiler in the whole equation because they can influence supply to manipulate price. But even they typically want the economies running well, because they have other investments now too.

108

posted on

10/18/2012 10:07:27 AM PDT

by

DannyTN

To: DannyTN

109

posted on

10/18/2012 12:19:05 PM PDT

by

thackney

(life is fragile, handle with prayer)

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-109 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson