Posted on 09/26/2012 4:28:02 PM PDT by blam

The Fed Is Trapped, Gold Is The Exit

Stock-Markets / Credit Crisis 2012

Sep 26, 2012 - 05:45 AM

By: Darryl R Schoon

47% of US investors dependent on the Fed believe they are victimized by government, who believe they are entitled to enough liquidity to profit when risk is laid-off onto others, to society, to you-name-it…

On September 13th, the Fed announced QE3, a policy of open-ended bond purchases which would add $1 trillion annually to the Fed’s balance sheet. The Fed’s decision to provide liquidity ad infinitum, i.e. QE etc, was framed in reasonable and carefully chosen language:

…These actions, which together will increase the Committee's holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative…

http://www.federalreserve.gov/newsevents/press/monetary/20120913a.htm

The measured wording gave the Fed sufficient cover to mask its increasingly desperate condition, i.e. how to keep its fatally-wounded credit and debt ponzi-scheme functioning while searching for a solution that doesn’t exist.

CAPITALISM’S CONSTANTLY COMPOUNDING DEBT IS THE DEVIL’S WHIP OF GROWTH

In capitalist economies, capital, i.e. money, is introduced by central banks into the economy in the form of loans; and because interest constantly compounds, economies must constantly expand in order to pay down and/or service those loans. This is why economists in capitalist systems are obsessed with growth.

Capitalism is, in actuality, a smoke and mirrors shell game where credit and debt have been substituted for money; and, as long as capitalism expands no one is the wiser because the fraud is so subtle. Capitalism, however, is no longer expanding. It is contracting.

Capitalism reached its peak in 2008 when Greenspan’s historic credit bubble burst. What investors believed was a finely-tuned balancing act between credit and debt orchestrated by Fed Chairman Alan Greenspan turned out instead to be a speculative bubble fed by Easy Al’s easy credit from the Fed’s 24/7 discount window.

While Greenspan presided over the greatest credit expansion in the history of capitalism, Greenspan also presided over two of its largest speculative bubbles—the 1996-2000 dot.com bubble and 2002-2007 US real estate bubble. Greenspan would later refer to evidence of these bubbles as ‘froth’; to those who lost homes and fortunes, it was blood.

THE 1990 JAPANESE NIKKEI – THE MOTHRA OF ALL BUBBLES

The collapse of Greenspan’s two massive bubbles followed the spectacular collapse of the Japanese Nikkei. The catastrophic crash of Japan’s stock market in 1990 was the world’s largest since the US stock market had collapsed in 1929.

In Time of the Vulture: How to Survive the Crisis and Prosper in the Process, I wrote: …fueled by excessive amounts of liquidity, [the price of Japanese real estate and stocks] exploded upwards. Japanese real estate prices increased 70 times over and stock prices increased over 100-fold, with the Nikkei reaching a market top at 38,992 in January 1990.

As with all speculative bubbles, the Nikkei collapsed—and the collapse of the Nikkei in 1990 unleashed deflationary forces not seen since the Great Depression of the 1930s. Prices of stocks and real estate in Japan began a long and steep multi-year descent.

Commercial real estate lost 80 % of its value in the next decade and the Nikkei fell from 38,992 in 1990 to 8,237 in 2003. Deflationary cycles are long and protracted and if not stopped will become deflationary depressions, an economic phenomenon for which there are no ready answers.

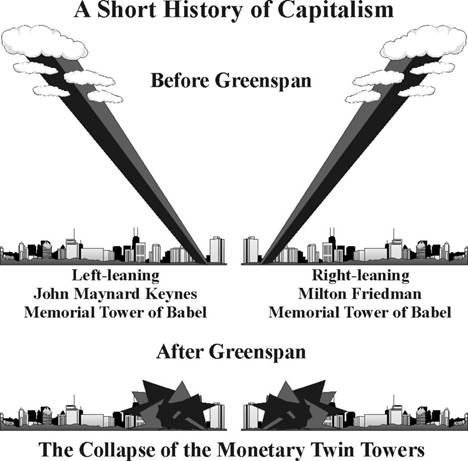

In 1990, Japan escaped a complete deflationary collapse only because Easy Al’s credit bubble was underway in the West. Rising credit-driven Western demand combined with Japan’s high savings rate helped slow Japan’s inexorable descent into deflation. Nonetheless, after 1990, Japan would need to borrow increasingly large amounts of money in order to survive and borrow it did.

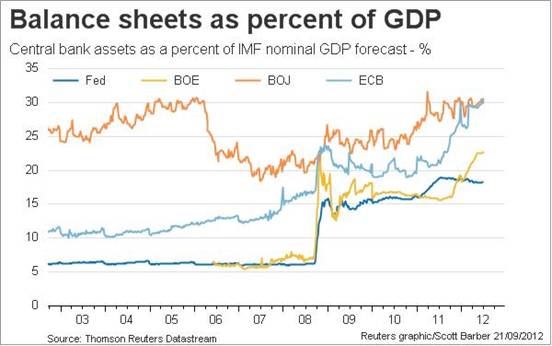

After the 2008 economic rendering, the central banks of the US, the UK and Europe have joined Japan in the desperate need to constantly increase money-printing to keep their economies afloat; and while reviving growth is their announced goal, the unspoken intent is to avoid a fatal deflationary collapse in demand.

As Credit Suisse recently noted: …Japan’s titanic struggle with private sector de-leveraging has spread to the rest of the developed world. Rapid succession of asset bubbles (at least 12 since 1980) led to the global private sector de-leveraging causing deflationary “winds”, regularly stalling global growth and leading to waves of expansionary public sector response.

While the extent of an asset price collapse in Japan was far more severe than either the Dot.com or Subprime crises, the basic dynamic of subsequent response (i.e., private sector moving from borrowing to net lending, forcing public sector into stimulatory monetary and fiscal policies) was essentially the same in Japan in the 1990s as it has been in the US, the UK or Eurozone since 2008.

https://www.credit-suisse.com/conferences/aic/2012/doc/web/20120511_japan.pdf

The Fed, the Bank of England, the European Central Bank and the Bank of Japan are all having to print more and more money to keep their economies functioning

CENTRAL BANKES ARE NOW PRINTING MONEY AD INFINITUM

EVERYTHING ENDS; EVEN AD INFINITUM

On September 18th, Ambrose Evans-Pritchard’s commentary in The Telegraph UK was titled Japan launches QE8 as 20-year slump drags on. Evans-Pritchard noted that QE8, Japan’s latest round of quantitative easing, i.e. money-printing, is only the latest of Japan’s serial attempts to avoid a deflationary collapse.

Although Japan has survived deflation’s endgame for over 20 years, the US, the UK and Europe will not be so lucky—nor, this time, will Japan. With all major economic zones deflating simultaneously, the West’s demise will be far quicker than Japan’s protracted agony; and when the West collapses, this time Japan will collapse with it.

The US, Japan, and Europe are all trapped in deflation’s ever-widening net, i.e. a constantly expanding liquidity trap.

We’re trapped too—unless we own gold and/or silver.

QE3: THE BANKERS’ MONETARY DEATH MARCH

In 1949, the Austrian economist Ludwig von Mises wrote in Human Action:

The wavelike movement affecting the economic system, the recurrence of periods of boom which are followed by periods of depression, is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion. There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved

Von Mises words, written in 1949, are being played out today. In the intervening years, bankers did not abandon credit expansion. They did the very opposite. After WWII, bankers continued expanding credit until what von Mises called a crack-up boom occurred—where excess credit and money drive valuations to all time highs (from 1982-2000 the Dow rose from 777 to 11,723, a increase of 1400% in 18 years).

The collapse of financial markets in 2008 signaled the beginning of the end; and ever since then, central bankers have been printing more and more money hoping to stave off a final collapse.

Money-printing, however, will not prevent capitalism’s systemic collapse. It will, in fact, do the opposite. Collective central bank money-printing will trigger a final and total catastrophe of the currency systemas von Mises predicted.

In August 2008, in Gold and the Collapse of Paper Money , I wrote:

We are about to see a variation of [the Great Depression], except this time it will be worse because this time sovereign monetary defaults will accompany the defaulting of debt and the contracting of credit. This time money itself will be a victim. Fiat paper money systems have always ended in failure. This time is no exception.

QE3 is the beginning of the bankers’ monetary death march. Central banks in Japan, the US and Europe are now openly engaged in massive monetary debasement, printing more and more money in the futile hope they can reverse the deflationary collapse now in motion. They can’t.

They can, however, in trying to do so, instead destroy the currency system.

My video, Wake-Up! The Crisis and the 2-Party System, is especially timely. Shot on October 29, 2011, it discusses today’s relevant issues months before they happened.

Buy gold, buy silver, have faith

This, confused, seems to be a standard state of affairs for me as well.

Gold is an exit in an inflationary spiral.

The very mixed signals we've been seeing since 2008 are the result of massive stimulus applied unevenly. Where the stimulus has reached, prices have increased. Where it has not, deflation reigns.

Stimulus has reached sources of presumed return on investment. Things that have a reliable demand. Even so, there have been spikes and crashes even there. Uncertainty makes for scared money and volatility. Speculation does, too.

People on the whole are deleveraging, meaning they're shedding debt. Some by choice, some out of necessity. Virtually interest free mortgages have barely nudged real estate in most of the country. Prices in free fall seem to have slowed if not abated, with pockets of slight appreciation in areas of traditionally tight supply.

I wouldn't turn my nose up at precious metals as a hedge against disastrous inflation, but I wouldn't bet the farm on it either.

Like I posted before, capitalism isn’t a “system”. It is, like gravity, a physical law. Even under Marxism, or any other “ism” folks are still under it’s influence. They have just traded one thing for another. Just like trading money for carrots they have traded freedom for “security”. Like Ben said, they deserve what they get.

+1

Deflation is not uniform. What we have now is inflation for essential items (food, energy), but flat prices in discretionary, non essential items. We have massive wealth destruction right now because of reduced economic growth caused by government interference- high taxes, regulation, and government overspending with misallocation of resources displacing the private sector.

The best model that fits our situation is the stagflation of the late 70s and 80s.

Bartering is ineffective. You have to find someone who both has what you want, and wants what you have. Those usually are not the same person. That’s why people invented money 5,000 or so years ago, and have been using it ever since.

Before the WWII all-out assault on the Japanese mainland, residents hoarded gold. Of course with enough gold they could buy anything they needed or wanted. NOT. A lot of people had a lot of gold - worthless, as there was nothing to buy (and what little there was, was of course more valuable than gold then).

Some will have their gold, others will have food and supplies. After a few days the former will trade a great deal for a little of the latter.

The purpose of gold in a crash is to hold value through to the recovery.

That’s right “fraud”, phony NON-collateral phony “securities”.

“We are about to see a variation of [the Great Depression], except this time it will be worse because this time sovereign monetary defaults will accompany the defaulting of debt and the contracting of credit. This time money itself will be a victim. Fiat paper money systems have always ended in failure. This time is no exception.

QE3 is the beginning of the bankers monetary death march. Central banks in Japan, the US and Europe are now openly engaged in massive monetary debasement, printing more and more money in the futile hope they can reverse the deflationary collapse now in motion. They can’t.

They can, however, in trying to do so, instead destroy the currency system. “

They’re not counting on default. They, and those involved in the 08 failed bailout are going to attempt to secure their obligations by Extorting it, Extortion-Care.

They’ll ratchet up the mandate amounts incrementally, any way they can get in others pockets, attempting to pacify others and stay distant, through threatening edicts called “legislation.”

ping

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.