Skip to comments.

With lawsuit, Barack Obama pushed banks to give subprime loans to Chicago’s African-Americans

The Daily Caller ^

| 9/3/2012

| Neil Munro

Posted on 09/03/2012 10:30:55 AM PDT by middlegeorgian

President Barack Obama was a pioneering contributor to the national subprime real estate bubble, and roughly half of the 186 African-American clients in his landmark 1995 mortgage discrimination lawsuit against Citibank have since gone bankrupt or received foreclosure notices.

As few as 19 of those 186 clients still own homes with clean credit ratings, following a decade in which Obama and other progressives pushed banks to provide mortgages to poor African Americans.

The startling failure rate among Obama’s private sector clients was discovered during The Daily Caller’s review of previously unpublished court information from the lawsuit that a young Obama helmed as the lead plaintiff’s attorney. [RELATED: Learn about the 186 class action plaintiffs]

Since the mortgage bubble burst, some of his former clients are calling for a policy reversal.

“If you see some people don’t make enough money to afford the mortgage, why would you give them a loan?” asked Obama client John Buchanan. “There should be some type of regulation against giving people loans they can’t afford.”

(Excerpt) Read more at dailycaller.com ...

TOPICS: Business/Economy; Crime/Corruption; Extended News; News/Current Events; Politics/Elections; US: District of Columbia; US: Illinois

KEYWORDS: alteredtitle; barackobama; chicago; fanniemae; housingbubble; liz; obamaacorn; obamasubprime

Navigation: use the links below to view more comments.

first 1-20, 21-28 next last

To: middlegeorgian

I believe Obama was on the team representing ACORN.

2

posted on

09/03/2012 10:37:21 AM PDT

by

OrioleFan

(Republicans believe every day is July 4th, Democrats believe every day is April 15th.)

To: middlegeorgian

This is why some of the mess The Won (and the rest of us) is in can be directly attributed to him.

3

posted on

09/03/2012 10:37:42 AM PDT

by

DuncanWaring

(The Lord uses the good ones; the bad ones use the Lord.)

To: middlegeorgian

4

posted on

09/03/2012 10:37:42 AM PDT

by

MNJohnnie

(Giving more money to DC to fix the Debt is like giving free drugs to addicts think it will cure them)

To: middlegeorgian

“There should be some type of regulation against giving people loans they can’t afford.”Especially if your IQ is to low to recognize it.

"Nobody told me I couldn't afford this house....It's not my fault that I didn't make but one payment".

5

posted on

09/03/2012 10:39:00 AM PDT

by

blam

To: middlegeorgian

“There should be some type of regulation against giving people loans they can’t afford.”Especially if your IQ is to low to recognize it.

"Nobody told me I couldn't afford this house....It's not my fault that I didn't make but one payment".

6

posted on

09/03/2012 10:39:11 AM PDT

by

blam

To: middlegeorgian

“There should be some type of regulation against giving people loans they can’t afford.”Oh, like credit cards ?

7

posted on

09/03/2012 10:43:18 AM PDT

by

UCANSEE2

( Lame and ill-informed post)

To: middlegeorgian

8

posted on

09/03/2012 10:55:40 AM PDT

by

traditional1

(Don't gotsta worry 'bout no mo'gage, don't gotsta worry 'bout no gas; Obama gonna take care o' me!)

To: middlegeorgian

This was brought up before the last election. Somewhere around here I have a pdf of the original suit with Obama’s name on it.

9

posted on

09/03/2012 10:56:15 AM PDT

by

MarkeyD

(Obama is a victim of Affirmative Action)

To: middlegeorgian

then turned around years later, suing said same banks for giving the loans. ( after giving them billions in bailout money)

Hence:

Citi = 590 million fine settlement ( which obama's firm and obama brought suit in the first place to provide the loans)

Wells Fargo = 175 million

GFI Mortgage Bankers = 3.5 million

BOA = 335 billion (maybe)

Mellon = 8.5 billion (maybe)

10

posted on

09/03/2012 10:56:19 AM PDT

by

stylin19a

(Obama -> Ransom "Rance" Stoddard)

To: middlegeorgian

> With lawsuit, Barack Obama pushed banks to give subprime loans to Chicago’s African-Americans

RACIST!

11

posted on

09/03/2012 10:56:51 AM PDT

by

Jyotishi

(Seeking the truth, a fact at a time.)

To: All

Then-pres Clinton aided and abetted the mortgage debacle. Read on.

THE BIG FISH THAT GOT AWAY WITH A BUNDLE

The Office of Federal Housing Enterprise Oversight’s report says that F/M CEO Franklin Raines---a Clinton appointee---and other Fannie Mae bigwigs, deliberately and intentionally manipulated financial reports to artificially hit earnings targets in order to trigger multi-million dollar bonuses for senior F/M executives.

Ex-Fannie CEO Franklin Raines should be behind bars for life. He is a crook of the first order. This thief Raines cooked the FM books precipitating losses of $9B (that we know of) for the single purpose of creating bonuses for himself and other F/M insiders. The SEC said Raines broke accounting rules by playing with risky derivatives.

RAINES COOKS THE F/M BOOKS---WALKS AWAY A MULTI-MILLIONAIRE After Raines was fired and exposed as a fraudster for cooking the govt books, Raines walked away w/ $90 million dollars, a $26 million parachute, PLUS..... Raines gets a MONTHLY pension of $116,300 for life. Raines had already collected $4.87 million in "special performance" shares. Raines owns options giving him $5.8 million in net profit after redemptions, plus another $8.7 million in deferred compensation for his six years at the F/M helm. There's more.

Raines keeps $5 million of paid-up life insurance. He and his spouse get free medical and dental benefits for life, worth over $1 million. NOTE: Raines earned $20 million in salary, bonuses and stock awards (that we know of) in one year.

To keep Raines happy within philanthropic circles, Fannie Mae will match Raines' charitable contributions by $10,000 a year.

After he was fired, Raines told the F/M board that he's entitled to get paychecks until June 22 giving him another $600,000, which triggers a $2,000 monthly raise in his lifetime pension. He also said he's entitled to disputed options with a gross value of about $5.6 million.

========================================

GENESIS OF THE F/M BILKING--- Clinton appointee. Fannie Mae CEO Franklin Raines' Letter to Shareholders--excerpted from 2003 Fannie Mae Annual Report

Excerpt ...Ten years ago the typical conforming mortgage required a down payment of 10-20%, and low-down payment mortgages were considered too risky. But then we helped to standardize the 3-5% down payment loan, brought it to global capital markets, and made it available to lenders and communities nationwide. Now low-down payment loans are commonplace. And we just adopted a new variance in our underwriting standards that will make the $500 down payment loan widely available as well...

In 1994, we pledged to provide $1 trillion in capital to ten million underserved families by the end of 2000. Thanks to our housing and industry partners, we met that goal early.

Then in 2000, we launched our American Dream Commitment, a pledge to provide $2 trillion in capital to 18 million underserved families by the year 2010, including $400 billion targeted specifically for minority families (later raised to $700 billion in response to President Bush’s Minority Homeownership Initiative). After four of the strongest years in housing and mortgage finance history, we’ve already surpassed the top-line goals of this commitment. But our work is far from complete.

So in January 2004, we announced our Expanded American Dream Commitment and pledged significant new resources to tackle America’s toughest housing challenges. Our new commitment has three main goals.

First, we will expand access to homeownership for six million first-time home buyers in the next ten years, including 1.8 million minority first-time home buyers.We also will help raise the national minority homeownership rate from 49 percent to 55 percent, with the ultimate goal of closing it entirely.

Second, we will help new and long-term homeowners stay in their homes through a series of initiatives, and commit $15 billion to preserve affordable rental housing and $1.5 billion to support the revitalization of public housing communities.

Third, we will increase the supply of affordable housing and support community development activities in at least 1,000 neighborhoods across the country through our American Communities Fund, and through targeted investments like Low-Income Housing Tax Credits that help finance affordable rental housing.

It is because of initiatives like our Trillion Dollar Commitment and our American Dream Commitment that we have exceeded our HUD affordable housing goals for ten consecutive years. (End Raines excerpt.)

12

posted on

09/03/2012 11:07:58 AM PDT

by

Liz

To: All

FANNIE-MAE--THE DEMOCRATS' CRIMINAL ENTERPRISE / By Michelle Malkin

Fannie/Freddie are centerpieces of the criminal enterprise called the Democrat Party-—where Dem cronies and collaborators loot the organization, get cushy jobs, bonuses, and the like.

Fannie Mae’s political machine dispensed campaign contributions, gave jobs to friends and relatives of legislators, hired armies of lobbyists (even paying lobbyists not to lobby against it), paid academics who wrote papers validating the home ownership mania, and spread “charitable” contributions to housing advocates across the congressional map.

Fannie Mae serves as an industrial-sized patronage factory — sharing profits with political allies, spreading taxpayer funds to voting blocs——like ethnic groups-——and doling out jobs to left-wing academics, Washington has-beens and back-scratching buddies.

Obama insider Fannie Mae exec Jim Johnson got sweetheart loans from shady subprime Countrywide. Pols raked in six-figure salaries as F/F engaged in Enron-sstyle accounting, plunged into debt and helped usher in the subprime housing meltdown through cockamamie lending practices.

Bill Clinton appointed Franklin Raines, Daley and Rahm Emanuel just as the quasi-governmental F/M engaged in rampant book-cooking so that F/M insider could help themselves to massive bonuses. The Chi/Tribune exposed how Emanuel’s “profitable stint” was low-show w/ no work involved. Emanuel was not even assigned to committees, according to company proxy statements.

Immediately upon joining the board, Emanuel and other insiders qualified for $380,000 in stock and options plus a $20,000 annual fee, public records indicate.

W/ Wall Street Rahm Emanuel at F/M, accounting tricks were used to mislead shareholders about outsize profits F/M reaped from risky investments. The goal was to cook the books to keep fraudulent earnings on the books, to make Freddie Mac look profitable on paper-——AND to fraudulently obtain humongous annual bonuses for political insiders.

13

posted on

09/03/2012 11:12:15 AM PDT

by

Liz

To: All

REFERENCE Cuomo's Social Engineering as HUD Chief Contributed to Subprime Crisis / originally published on Examiner.com Have those New Yorkers, residents of one of the highest taxed states in the union, voting for Andrew Cuomo to be their next governor allowed their ideology to trump sound reasoning? As many Americans across this great land continue to struggle with the loss of their homes, savings and retirement resources, those that were complicit in not regulating the government sponsored enterprises (GSEs) in the second market namely Fannie Mae and Freddie Mac causing the subprime loans to detonate are jockeying for power.

Sadly, we are giving those same culprits the honor of office through our votes. Note: the use of the term 'we' and 'our' is a reference to the electorate and not suggestive of the voting record of the author.

In 1993 President Bill Clinton appointed Andrew Cuomo to the Department of Housing and Urban Development (HUD) as Assistant Secretary.In 1997 Cuomo took over as HUD chief replacing Clinton appointee Henry Cisneros. During Cisneros tenure he championed Clinton's goal of social engineering within the housing market forcing lenders to issue loans to those that would not financially qualify for the lending.

Cisneros left office in a scandal involving lying to the FBI over payouts to a mistress, Cisneros subsequently pleaded guilty to a misdemeanor and though never sent to prison received a pardon from Bill Clinton in 2001.

Andrew Cuomo took the HUD reins and not only furthered Cisneros and Clinton's policies but greatly expanded them.

Henry Cisneros moved the GSEs toward a requirement that 42 percent of their mortgages serve low and moderate income families. Andrew Cuomo raised that number to 50 percent and dramatically hiked GSE mandates to buy mortgages for the "very-low-income."

These bad loans were purchased and sold throughout the secondary market and the pyramid grew and the bottom collapsed resulting in the subprime crisis we are still reeling from today.

In 2008, the Village Voice published a compelling report detailing Andrew Cuomo's policy decisions "that gave birth to the country's current crisis."

The report touched on how Cuomo's 187-page rules "opened the door to abuse." The rules explicitly rejected the idea of imposing any new reporting requirements on the GSEs. In other words, HUD wanted Fannie and Freddie to buy risky loans, but the department didn't want to hear just how risky they were.

Many New York voters are failing to see the actual harm to the minority community directly caused by Cuomo's policies...matter.

Cuomo's top HUD aide said, "We believe that there are a lot of loans to black Americans that could be safely purchased by Fannie Mae and Freddie Mac if these companies were more flexible."

Andrew Cuomo doubled down and had this to say about his HUD standards, "GSE presence in the subprime market could be of significant benefit to lower-income families, minorities, and families living in underserved areas."

How's that working out for the minority community, where foreclosures and unemployment rates have hit the hardest as a result of such failed policies and blatant social engineering?

SOURCE http://voices.yahoo.com/cuomos-social-engineering-as-hud-chief-contributed- 7077218.html

14

posted on

09/03/2012 11:19:23 AM PDT

by

Liz

To: middlegeorgian

Review of previously unpublished court information from the lawsuit that a young Obama helmed as the lead plaintiff’s attorney.

The Daily Caller found the info,wonder what the MSM was doing all this time?,cover up?.

15

posted on

09/03/2012 11:25:31 AM PDT

by

Vaduz

To: AdmSmith; AnonymousConservative; Berosus; bigheadfred; Bockscar; ColdOne; Convert from ECUSA; ...

16

posted on

09/03/2012 11:38:05 AM PDT

by

SunkenCiv

(https://secure.freerepublic.com/donate/)

To: middlegeorgian

" Uhhhh, that's not ours either! "

---Weiner, Obama, Perry, Pelosi, Frank, Pritzker and Associates, LLLP.

Follow the....

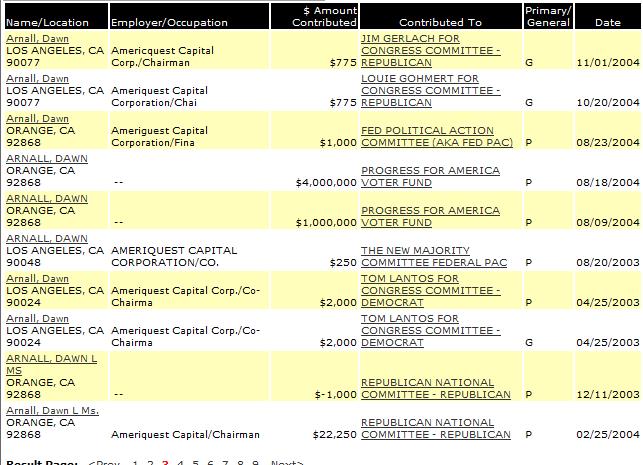

http://www.campaignmoney.com/finance.asp?type=in&cycle=08&criteria=pritzker&fname=penny

Billionaire business mogul Penny Pritzker is a member of one of America’s richest families and was the Finance Chair for the presidential campaign of Barack Obama. It was Pritzker that led the prolific, and illegal, fundraising that helped power Barack Obama’s presidential campaign. She was the chair of Chicago-based Superior Bank’s board for five years. Pritzker was into subprime lending before it became all the rage starting in around 2000. Prtizker's chairmanship was to concentrate on sub prime lending, principally on home mortgages, but for a while in subprime auto lending, too, after the Pritzkers' bank acquired its wholesale mortgage organization division, Alliance Funding, in December 1992.

Back then they called it "predatory lending." Superior Bank went belly up in 2001 with over $1 billion in insured and uninsured deposits; 1,406 depositors lost much of their life savings. This collapse came amid harsh criticism of how Superior’s owners promoted sub-prime home mortgages.

On Nov. 1 [2002] the Federal Deposit Insurance Corp. pointed the finger at Ernst & Young, Superior’s auditor, in a fraud suit filed in federal court here. But that action came two months after a group of Superior depositors accused the bank’s owners and directors, including two members of the Pritzker family, of racketeering.... |

|

[snip]

...Pritzker is chairman of Classic Residence by Hyatt, luxury senior living communities in 11 states; chairman of The Parking Spot, which owns and operates off-airport parking facilities in nine cities; chairman of the credit data company TransUnion and chairman of Pritzker Realty. She also sits on the board of Global Hyatt and plays a role in numerous non-profit groups, including serving as chairman of the Olympic village portion of Chicago’s bid to win the 2016 Summer Games.

Nudge nudge nudge...

17

posted on

09/03/2012 11:42:08 AM PDT

by

OldEarlGray

(The POTUS is FUBAR until the White Hut is sanitized with American Tea)

To: Liz

18

posted on

09/03/2012 11:53:38 AM PDT

by

OldEarlGray

(The POTUS is FUBAR until the White Hut is sanitized with American Tea)

To: stylin19a

In addition, the FED from 2007-2010 loaned banks $16Trillion for bailouts. Citi got $2.5Trillion...here is the Link:

http://www.sott.net/articles/show/250592-Audit-of-the-Federal-Reserve-Reveals-16-Trillion-in-Secret-Bailouts

While Citi paid a paltry fine, it received a massive “bailout” that it will never pay back, like the others.

Our 5 biggest banks have $227T in credit derivative liabilities according the office of the Comptroller of the US. Their collective liquidation value is about $7Trillion. Since their obligations consist of a lot of highly leveraged long term debt (up to 30 years, with 5 year short term financing), there are 5 more bailout requiring refinancing rollover periods of 5 years to go before maturity of the derivative obligations.

The US has not gotten thru the first 5 year “bailout” period measuring from the crash of 2008....there is still the rest of this year all the way to the end of 2013 to go. No debt principal has been paid off at all, just refinancing interest obligations have been met. Europe and the US have not squeaked by at all. There is much more to come, and $16T is mere pittance of what is ultimately due over the next 26 years measuring from 2008, just for bank bailouts, forget US debt and unfunded mandates on top of it all.

19

posted on

09/03/2012 12:02:05 PM PDT

by

givemELL

(Does Taiwan eet the Criteria to Qualify as an "Overseas Territory of the United States"? by Richar)

To: middlegeorgian

There WERE regulations against giving loans to people who couldn’t afford them. More precisely, there were no regulations FORCING banks TO give loans to people who couldn’t afford them. Then your liberal plantation masters bullied the banks into believing that actually checking credit scores was raciss.

}:-)4

20

posted on

09/03/2012 12:02:42 PM PDT

by

Moose4

(...and walk away.)

Navigation: use the links below to view more comments.

first 1-20, 21-28 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson