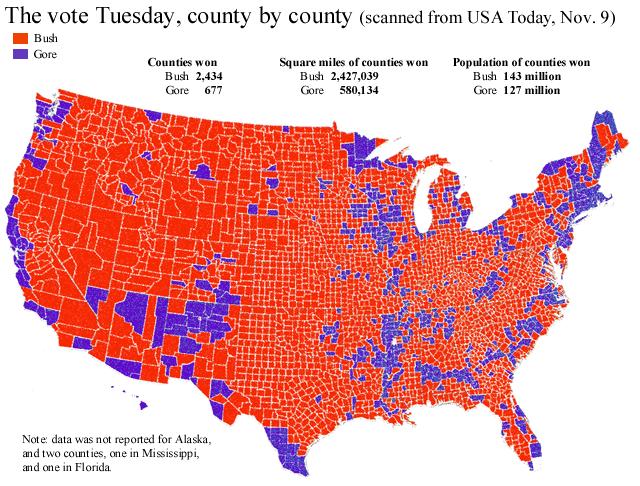

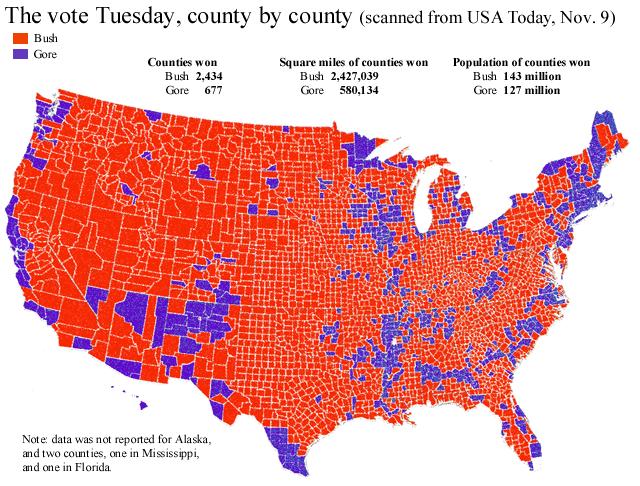

USA Today flipped the paradigm with its county-by-county map of the 2000 presidential election vote.

Posted on 05/23/2012 7:10:01 AM PDT by GLH3IL

When you compare the 50 laboratories of democracy after sorting them based on how their citizens voted in November 2008, only 10 Democratic-voting states are net recipients of federal subsidies, as opposed to 22 Republican states. Only one red state (Texas) is a net payer of federal taxes, as opposed to 16 blue states. One blue state (Rhode Island) pays as much as it gets.

(Excerpt) Read more at reason.com ...

The explanation for this is very straightforward. About 2/3 of all federal income tax is paid by the top 10% in household income. Nearly all of these households are two-income professional couples living in liberal states like NY and California. They mostly vote for the Dems, and set the political tone in their states.

It is these couples who vote against their financial interest, up to a point. If they tried to raise taxes on the $150-400K band substantially, however, there would be pushback.

I have a friend who farms in eastern Washington and actually campaigned against subsidies in the last election. He explained that it is a program out of control and the way it exists now causes everyone to take the benefits because they would not be able to compete without them. The only way to stop it to kill it all in one blow.

“But from what I see in your comment, I don’t understand classifying military bases or highway maintenance as a subsidy.”

Well, try to cut those funds and the states sure as heck act as if it’s a subsidy they’re entitled to.

Military bases and interstate highways are not subsidies true, but maintianing them is still federal spending....al of which is beyond out of control...not just subsidies...

Curbing military bases may be a laudable goal. However, if it compromises our national defense, then the answer is no. Defense spending as a percent of the overall budget is approaching pre-ww II levels which IMO is not good. I agree about farm subsidies. The federal government should not be in the business of giving out farm subsidies just like any other subsidy. As for federal highways, well that’s one I would have to see some more debate on. I would say that the federal government does have a role in interstate highways.

All of this is small potatoes in the overall budget. The big piece of the budget is medicaid, medicare and social security. Until we tackle these three big issues, we won’t get anywhere with getting our budget under control.

I may be wrong...but I seem to recall that, a decade or so back, the MSM had the Dems. as RED and the GOP as BLUE on their maps. I guess the use of red for the Communists was hitting too close to home.

If I’m recalling this incorrectly...never mind and go about your business.

Welcome to the United Soviet States of America..where the Pravda State Media “vet” the candidates to the pleasure and needs of the RinoCrat UniParty.

This “election” will be a non-election...featuring the state approved “candidates”-whose only distinction is whether they are black or white.

The “two-PARTEY” system merely means that the R & D in DC gang up on Flyover Country....and laugh all the way to the bank as they do so

Your memory (and analysis, IMO) is in great shape.

>> I’m amazed there were not 57 labratories identified given that Barry thinks there are that many od ‘em <<

Actually, there are only 56 laboratories, not 57. They are as follow:

1-50: The fifty states

51. Puerto Rico

52. Guam

53. The Commonwealth of the Northern Mariannas

54. American Somoa

55. U. S. Virgin Islands

56. District of Columbia.

Laboratories one and all! Moreover all hold Democratic primaries, and all send voting delegates to the Democratic National Convention.

Now what about the 57th? Unlike the 56 above, it’s not a piece of U. S. territory. And it’s by no stretch of imagination a “laboratory.” Rather, it’s a voting jurisdiction recognized by the Democratic Party and called “Democrats Abroad.” Its rationale is to represent U. S. Democratic voters living in something like 200 foreign countries.

This 57th jurisdiction holds its own Democratic primary and — just like the other 56 jurisdictions — it sends delegates to the Democratic National Convention. For example, it sent 14 in 2008. (Dunno how many they’ll have this year.)

A lot of older people retire to no or low tax states, many red, to escape the high cost of living in blue states.

As for defense, you put the bases where you have the space, the land is cheapest and the location is suitable. I would guess that would be mostly red states.

And finally, like you, I'm not sure how interstate highways are "distributed" and "traveled" (wear and tear) to account for the allocations.

I think most posters here agree, it doesn't matter where the money comes from or goes geographically, it is too much and mostly unconstitutional.

If that were the case, then what would be the point of sending that money to the federal government in the first place? I'm sure it would be more efficient to just keep that money in the state.

The second problem is that with a federal deficit of about 20-25%, more money is spent than is taken in. By necessity then, some (or even ALL) states will get more than they pay in.

The change was made to confuse people and to label conservatives as the bomb throwing radicals. I refuse to use the terms as presently sanctioned by the Left.

Part of Left tactics is to confuse the language so that only the Left can communicate. Words mean what the Left deems them to mean and meanings change often so that people thinking they have a certain opinion about something find out they, according to the Left (including MSM), are credited with an opposite opinion.

USA Today flipped the paradigm with its county-by-county map of the 2000 presidential election vote.

This statistical fluke is in large part attributable to 20 or 30 zip codes in New York, New Jersey, Connecticut and California where a concentration of stupendously wealthy individuals pays a stupendous amount of tax. When a Democrat moans about blue states paying and red states collecting, I remind them of this and say “Surely you are not saying progressive income taxation is bad?”. That usually shuts them up.

Also worth noting is that lots of people earn their money and pay taxes in the North, then retire and collect their Medicare and Soc Security in Florida and Arizona. I fail to see how this is unfair to anyone in any state.

Finally, keep in mind that spending in flyover country benefits the country as a whole more than spending in the big cities. City dwellers benefit from having subsidized agricultural products watered by federal dams and irrigation systems, brought to market on interstate highways, and from military protection based in the heartland. Folks out in the sticks get essentially no benefit from the Big Dig or new housing projects in the big cities built with Federal money.

You beat me to it as far as SS, Medicare and Medicaid spending goes. When people retire, they become non contributors for taxation, and they become mostly recipients via SS, Medicare and Medicaid spending. To the degree that they move to Red states for lower living costs, they tilt the study. Of course, Red state voters would like to privatize SS — so there would be neither tax contributions nor “spending” for it.

As far as highway spending and agricultural subsidies goes, the author of the article misses the point that Red states would be happy to see those disappear as long as taxes were lowered as well, and a free market was allowed to operate. The cost of interstate highways SHOULD be a local expense, as should the cost of farming. As long as there are no price controls, those costs can be paid for by passing them along in the cost of the products.

It is disingenuous to say that agricultural subsidies are “spending” to Red states when it is the Blue state city dwellers that benefit from the lower prices in the supermarket. The same is true of the interstate highways. Good roads lower the prices of goods sold in the cities, whether grown in rural Red states or imported and shipped cross country.

Another point made by some of the posters on the site is valid as well. How many corporations are incorporated in Delaware or some other blue state because that is where their headquarters are (or just better incorporation laws) ? Their corporate taxes will be counted as coming from a blue state even though their operations benefit entirely from spending in red states where their mining, agricultural, or import-export businesses rely on federally maintained infrastructure.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.