Madeline Schnapp, at TrimTabs Investment Research sent me a quick note regarding that plunge a few days ago.

Posted on 03/16/2012 8:41:56 AM PDT by Kaslin

California Tax Revenue Plunges

Inquiring minds have noticed a huge plunge in California Tax Revenue for the month of February compared to February 2011.

The numbers below represent a 22.55% plunge in spite of the fact that this February was a leap year adding a day to the calendar.

Madeline Schnapp, at TrimTabs Investment Research sent me a quick note regarding that plunge a few days ago.

Madeline writes...

Hello Mish

I came across this little tidbit from the February report from the Comptroller's office of the State of CA.

In Feb 2012 income tax receipts are down $328 million y-o-y, or 16.5%. Ouch!

What about retail sales taxes? CA had a "temporary" sales tax hike of one cent that expired last July. Adjust the data to reflect that change, it looks like sales taxes in February are $400 million y-o-y +/-, a decline of about 12.4%. Double ouch!

That doesn't sound like robust growth to me.

Something About the Economy Doesn't Add Up

In Piecing Together the Jobs-Picture Puzzle, Jon Hilsenrath at The Wall Street Journal wonders "How can an economy that is growing so slowly produce such big declines in unemployment?"

Something about the U.S. economy isn't adding up.

At 8.3%, the unemployment rate has fallen 0.7 percentage point from a year earlier and is down 1.7 percentage points from a peak of 10% in October 2009. Many other measures of the job market are improving. Companies have expanded payrolls by more than 200,000 a month for the past three months, according to Labor Department data. And the number of people filing claims for government unemployment benefits has fallen.

Yet the economy is barely growing. Many economists in the past few weeks have again reduced their estimates of growth. The economy by many estimates is on track to grow at an annual rate of less than 2% in the first three months of 2012. The economy expanded just 1.7% last year. And since the final months of 2009, when unemployment peaked, the economy has expanded at a pretty paltry 2.5% annual rate.

How can an economy that is growing so slowly produce such big declines in unemployment?

Trimtabs thinks the problem lies in the heavily massaged BLS employment data and the highly suspect BEA personal income data.

That said, withholding tax data is also messy and not a perfect measure either, but no matter what I do with the data, I can't get to 200,000+ jobs unless a huge percentage of the workforce is suddenly working for McDonalds

Best,

Madeline Schnapp

Director, Macroeconomic Research

TrimTabs Investment ResearchMany Explanations for the Unemployment Puzzle

There are many explanations for the "miracle drop" in unemployment.

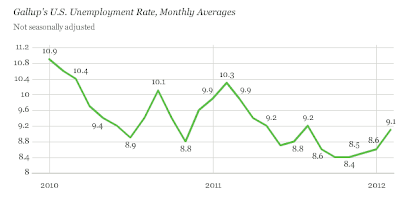

U.S. unemployment, as measured by Gallup without seasonal adjustment, increased to 9.1% in February from 8.6% in January and 8.5% in December.

The 0.5-percentage-point increase in February compared with January is the largest such month-to-month change Gallup has recorded in its not-seasonally adjusted measure since December 2010, when the rate rose 0.8 points to 9.6% from 8.8% in November. So, is the BLS carefully massaging the data, or are their seasonal adjustments simply that far out of line with reality, tax collections, and common sense?

Businesses Exit California in Droves

Madeline and I are not the only ones who noticed the plunge in California. Chriss W. Street on Beitbart discusses the California Exodus behind the drop. Street has the reason: Businesses fed up with high taxes have fled the state.

California politicians seem delusional in their continued delusion that high taxes have not savaged the State’s economy. Each month’s disappointment is written off as due to some one-time event.

The more likely reason tax collections continue falling is that businesses and successful people are leaving California for the better tax rates available in more pro-business states.

Derisively referred to as “Taxifornia” by the independent Pacific Research Institute, California wins the booby prize for the highest personal income taxes in the nation and higher sales tax rates than all but four other states. Though Californians benefit from Proposition 13 restrictions on how much their property tax can increase in one year, the state still has the worst state tax burden in the U.S.

Spectrum Locations Consultants recorded 254 California companies moved some or all of their work and jobs out of state in 2011, 26% more than in 2010 and five times as many as in 2009. According SLC President, Joe Vranich: the “top ten reasons companies are leaving California: 1) Poor rankings in surveys 2) More adversarial toward business 3) Uncontrollable public spending 4) Unfriendly business climate 5) Provable savings elsewhere 6) Most expensive business locations 7) Unfriendly legal environment for business 8) Worst regulatory burden 9) Severe tax treatment 10) Unprecedented energy costs.

Vranich considers California the worst state in the nation to locate a business and Los Angeles is considered the worst city to start a business. Leaving Los Angeles for another surrounding county can save businesses 20% of costs. Leaving the state for Texas can save up to 40% of costs. This probably explains why California lost 120,000 jobs last year and Texas gained 130,000 jobs.

California Governor Jerry Brown’s answer to the State’s failing economy and crumbling tax revenue is to place a $6 billion tax increase initiative on the ballot to support K-12 public schools. He promises to only “temporarily” raise personal income rates by 25% on any of the rich folk who haven’t already left.Taxed to Death

If Brown continues to suck up to the public unions responsible for the mess California is in, expect still more businesses to leave, expect the unemployment rate to rise, and expect a continued plunge in revenue.

No error.

Hundreds of businesses have left Kalipornia since last year.

The number of high bracket taxpayers has fallen sharply as people leave or get poorer.

“California will be our Greece”

California will be bailed out regardless whom is President, just to what degree. Look to GM for what Bambi will do. If your holding Cali bonds, get the hell out of them if you can.

Thanks!

It’s the gamble of whether the Chippy will actually call in the number if he can get close enough to read. If Kallie gets that laser designator/reader stuff hooked to computer, they’ll catch them, but they’re not that smart.

If I were a government official there and still wanted my job, my home and my future, that registration number would scare me sh!tless.

I have always thought that the best measure of the economy is state tax revenue. Based upon my own analysis of year over year growth, Obamanomics has the following record:

09 growth over 08: Best described as depressing -10%

4th quarter -3.1

3rd quarter -11.0

2nd quarter -16.3 (especially bad as 2nd quarter is normally the good quarter)

1st quarter -12.2

10 growth over 09: still running negative -3.1%

4th quarter 7.7

3rd quarter 4.6

2nd quarter 1.9

1st quarter 3.3

11 growth over 10: Just now starting to be positive 0.1%

4th quarter Not available

3rd quarter 5.6

2nd quarter 10.7 (Best quarter recorded so far)

1st quarter 9.5

Average quarter to quarter growth since 1992 through 2007 - 5.3%

Average quarter to quarter growth since Obama / 2008 - 0.1%

Now keep in mind that thes are STATE tax revenues which differ from Federal tax revenues. Most of state revenues are aligned with business such as sales tax, licenses, fuel taxes etc. It does also include state income tax as well.

Another thing to consider is that the tax rates do change with different state administrations but the amount of changes are often relatively small.

My overall analysis is that we have stopped the shrinkage in the economy. But we have not yet made up the ground that has been lost. If you compare 3rd quarter 2008 to 3rd quarter 2011 you will see that State tax revenue is still down by about 3 billion dollars per quarter.

Now the numbers for 4th quarter 2011 are not yet apart of the state tax revenue as published by the Census department. And with the growing cost of fuel, it seems to me that the nation runs the risk that in 2012, the business environment will be down and that tax revenue will once again decrease. The net effect will be to drag this ressession out even further.

Just my thoughts and number swizzling. Based upon Table 2 – Latest National Totals of State Tax Revenue from the Census Department. http://www.census.gov/govs/qtax/

The only thing that can save California is unfettered agriculture. Farm households must be freed from state bureaucrats.

Small towns could come back if farmers and ranchers had free access to free markets and access to water. But alas, the Kalifornicators in the cities are more interested in “rural cleansing” of the (strategically important) countryside and would rather eat soy foods from China.

Asked my state congressman recently, who the hell agreed to these cushy retirement packages? Politicians elected with union campaign money who then sit across the table from the union thugs and say YES to EVERYTHING thier little hearts desire. And when the state congress cut the money going to these pensioners, when it got to the governors desk he reversed all the cuts. Oregon, going the way of CA.

Oregon even re-elected a has been governor just like CA.

My only concern is that these folks will vote the same way they did in CA, which is how they got into that mess in the first place. It happened with people who left MA for NH, I believe. Apparently many of them don’t understand what caused their misery in the first place.

Children learn the tale of the goose that laid the golden egg. I.E. Democrats are stupider than children.

One problem though. Californians are relocating there, and bringing along with them their idiot ideology.

I see ya'all in Texas are still begging for Californian's to move there. I try my best to send them your way.

In fact, if I had the power, I'd send 10,000,000 your way by tomorrow.

You'll love 5,000 unit pink apartment buildings across the wind swept Texas plains, and greedy marts on every corner!

Enjoy!!

You heartless wretch — don’t you care about the stress she endured for all those years? What do you think librarians do?

I would argue that the two things are connected. The conditions in California beget prosperity. Prosperity begets Foolishness. Poor people must make every dollar count. Rich people can afford to believe in stupid things. (At least until their wealth is gone.)

Then they'll need to raise taxes to fill that gap.

That will drive yet more businesses out.

Then they'll need...

Directive 10-289

The same thing happened in North Carolina with relocaters from NY and NJ. NC's been on a steady decline for 20 years now thanks to idiot leftists.

That will be one helluva selling job. I don't see it happening after the 2010 statehouse elections.

That is disgusting. In Ohio a license plate costs 45 dollars, no other taxes or fees, that's all. No matter how expensive or how new the car (or pickup) is.

Do we really need to quote what Pres. Ford essentially told NYC?

(for those in rio linda, it was paraphrased as “drop dead” when NYC wanted a federal handout to prevent bankruptcy.)

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.