Posted on 03/05/2012 6:41:53 PM PST by U-238

The next time you drive to the gas station, only to find prices are still sky high compared to just a few years ago, take notice of the rows of foreclosed houses you'll pass along the way. They may seem like two parts of a spell of economic bad luck, but high gas prices and home foreclosures are actually very much interrelated. Before most people were even aware there was an economic crisis, investment managers abandoned failing mortgage-backed securities and looked for other lucrative investments. What they settled on was oil futures.

An oil future is simply a contract between a buyer and seller, where the buyer agrees to purchase a certain amount of a commodity -- in this case oil -- at a fixed price [source: CFTC]. Futures offer a way for a purchaser to bet on whether a commodity will increase in price down the road. Once locked into a contract, a futures buyer would receive a barrel of oil for the price dictated in the future contract, even if the market price was higher when the barrel was actually delivered.

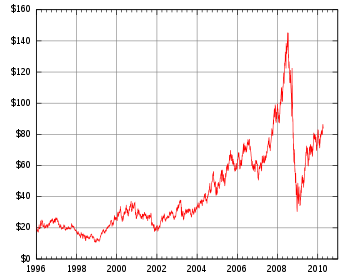

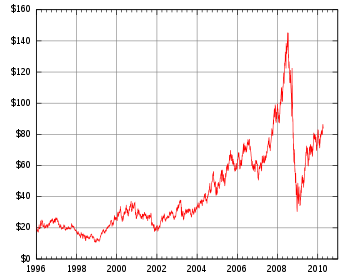

As in all cases, Wall Street heard the word "bet" and flocked to futures, taking the market to strange new places on the fringe of legality. In the 19th and early 20th centuries it bet on grain. In the 21st century it was oil. Despite U.S. petroleum reserves being at an eight-year high, the price of oil rose dramatically beginning in 2006. While demand rose, supply kept pace. Yet, prices still skyrocketed. This means that the laws of supply and demand no longer applied in the oil markets. Instead, an artificial market developed

(Excerpt) Read more at money.howstuffworks.com ...

A lot of oil in tankers is bought and sold many times before it is unloaded.

In 1974 I missed making 4 million on a tanker of oil by 15 minutes because I couldn’t get ahold of the one person that could, would buy it that I knew in time.

If you don’t think the futures market drives prices look at what happened in India today. They banned the export of cotton. That immediately drove up the Cotton Futures. The remaining cotton markets just got richer today because their cotton became more valuable since there’s less of it in the world for sale. There are already a lot of $200 and up pair of jeans on the market like True Religion. Watch the price top $400 a pair in the next couple of months. Until Iran is tamped down for good expect fuel price fluctuations.

Lol. A few years ago, India started a rice crisis. They made it illegal for most Indian rice to leave the country. In October 2007, they blocked exports of all non-Basmati rice. Thus turning a rice surplus into a rice crisis. Idiots.

“How does oil speculation raise gas prices?”

It doesn’t. Speculators, OTOH, do lubricate and hasten the price-discovery process. This is nothing more than deflection from the real culprits — governments that stand in the way of supply increasing to match demand.

good point. Who is the biggest speculator of all? The Us Government that’s who. They have the strategic reserve, regulate most trading, control the currency that oil is traded in, control the military that keeps the sea lanes open, and controls the regulatory apparatus that keeps oil scarce by prevent drilling and pipeline construction.

Of course the government will blame the few people who actually risk their own money in trading oil.

Some of our memories are not so short as to fail to recall just what occurred in the wake of the last bizarre runup in 2008.

SemGroup was found to have controlled well over half of all oil futures for speculative purposes, never planning on taking physical delivery. The CFTC at that time estimated that over 80% of the price of a barrel of crude was due to speculation, with a barrel changing hands on an average of 27 times prior to delivery.

But, don’t just take my word for it, articles and data didn’t just get swept down the memory hole from less than four years ago, here’s one detailing the failure of the aforementioned SemGroup:

http://www.bloggingstocks.com/2008/07/25/has-semgroup-caused-the-recent-oil-runup-and-selloff/

Thank you RegulatorCountry for posting the link. I will bookmark it.

:)

A speculator can make as much money if the commodity price is falling as if it’s rising. It has no long term affect on price. This idea that speculation makes prices rises is pure garbage.

You’re welcome.

Deep-pocketed speculators acting in accord can make even more money with higher volatility, yes? Run it up, ride it down. There are very few games in town to provide any sort of rate of return, and the hedgies have resorted to manufacturing instability for their own benefit, in my opinion.

Again. Just as in 2008.

Hear hear. It works (i.e. fails) the same way on the way down as well. I posted this earlier today on another thread:

“...Goldman Sachs significantly readjusted in August of that year [2006] the GSCI’s gasoline weighting. Index products tracking the GSCI, and representing an estimated $60 billion in institutional investor funds, were forced to rebalance their portfolios resulting in an unwinding of positions. Originally, unleaded gasoline made up 8.75 percent of the GSCI as of 6/30/2006, but this was changed to just 2.3 percent, representing a sell-off of more than $6 billion in futures contracts.

“As a result, gasoline fell 82 cent in the wholesale market over a four-week period, an unprecedented move; and crude oil, which in July 2006 traded over $79 per barrel for August delivery—at the time an all-time record—subsequently fell to around $56 by January 2007.”

http://www.marketoracle.co.uk/Article4526.html

It is a matter of historical fact that these are the two biggest peaks and collapses in the oil market, both happening in the past six years, and have been directly and solely caused by speculators.

Some see a means of assuring victory in the 2012 elections, and while I certainly support preventing a second term for the Obama administration, I'm just not going to throw my lot in with what has every appearance of being a lie.

Others seem to be cheering it on due to having skin in the game.

That is merely a statement of the simplest textbook example of supply and demand economics possible.

I have yet to be challenged on two timely posts on two other threads in this matter in two days. In fact, discussion more or less immediately halted:

http://www.freerepublic.com/focus/f-news/2854740/posts (see my #18 there)

and

http://www.freerepublic.com/focus/f-news/2854450/posts (see my #20 and #24 there)

This guy has no clue how the wholesale market works. It is simply a way to distribute commodities efficiently. He is in the hedge market which is basically insurance for the wholesale distribution market. He pulled that 60% number out of his ear and would love to see how he accounted for it.

Pray for America

It’s very simple. Speculators cannot hold up the price of oil - they can only push it up for a short time, but then it becomes time to take delivery, and the price crashes, since they have no use for the oil. Happens every time.

Don’t blame him, journalists are not the brightest bulbs on the tree.

Sounds like more tnan just Bernanke boned up on their Great Depression playbook.

I agree

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.