Skip to comments.

Wisconsin: State urging online buyers to pay tax

Milwaukee Journal-Sentinel ^

| 2/5/12

| Marissa Evans

Posted on 02/05/2012 4:09:11 PM PST by Jean S

Letter, new form reminding taxpayers of their obligation

Wisconsin taxpayers could find themselves digging through more receipts than usual this tax season as the state Department of Revenue makes another effort to collect taxes on out-of-state purchases.

In a letter, the department is asking taxpayers to look through their records from 2007 to 2010 to find any taxes on out-of-state purchases that may have been overlooked and send in payments by Feb. 17.

"The real mission is to help make sure (taxpayers) understand tax law and to remind taxpayers about their responsibility to pay the use tax," said Jennifer Western, executive assistant at the Department of Revenue.

Western also said the goal of the annual letter is to gain more voluntary compliance when it comes to paying sales and use tax. This latest effort comes simultaneously with a modified state income tax return. The new form notes that taxpayers are required to pay tax in cases where sales taxes were not collected at the time of purchase from an online retailer.

When a consumer makes an online purchase but is not charged sales tax at the time, they owe a use tax because they will be using the product in Wisconsin. A report from the Wisconsin Legislative Fiscal Bureau estimates there will be about $62 million in uncollected use tax for 2012.

(Excerpt) Read more at jsonline.com ...

TOPICS: News/Current Events; US: Wisconsin

KEYWORDS: taxes; wisconsin

Navigation: use the links below to view more comments.

first 1-20, 21-30 next last

In a letter, the department is asking taxpayers to look through their records from 2007 to 2010 to find any taxes on out-of-state purchases that may have been overlooked and send in payments by Feb. 17. As a responsible citizen of Wisconsin, I'll be cooperating fully, not.

Do they think we're really that stupid?

1

posted on

02/05/2012 4:09:25 PM PST

by

Jean S

To: Jean S

I have a better idea. Government rolls back to where it can fund itself with fees for use and 1% sales tax.

We're drowning in government.

/johnny

To: Diana in Wisconsin; Hunton Peck; TaMoDee; P from Sheb; Shady; DonkeyBonker; Wisconsinlady; JPG; ...

Ping to Wisconsin Freepers.

3

posted on

02/05/2012 4:14:59 PM PST

by

Jean S

To: Jean S

“Do they think we’re really that stupid?”

No, but the cost of the letters is probably more than made up for in the tiny bit of compliance they get. Where it gets nastier is what other states are starting to do - which is make you declare on your state income tax form that you have indeed paid all sales and use tax owed.

...then it will just be a matter of getting Amazon’s records and seeing just how honest a given taxpayer has been.

Not as easy to do here in Texas (LOL) as we don’t have an state income tax, and thus we don’t have a way to declare anything.

4

posted on

02/05/2012 4:28:20 PM PST

by

BobL

(I don't care about his past - Newt will BRING THE FIGHT to Obama)

To: Jean S

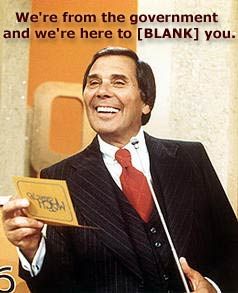

...the department is asking taxpayers to look through their records from 2007 to 2010 to find any taxes on out-of-state purchases that may have been overlooked and send in payments by Feb. 17. Just a friendly gesture for the state of Wisconsin in recommending an appropriate response to this.

BITE ME!!

5

posted on

02/05/2012 4:32:12 PM PST

by

EGPWS

(Trust in God, question everyone else)

To: All

6

posted on

02/05/2012 4:32:45 PM PST

by

musicman

(Until I see the REAL Long Form Vault BC, he's just "PRES__ENT" Obama = Without "ID")

To: Jean S

Personally, I don't think it should be taxable in the first place. Use taxes pay for government services, presumably some of which were used in selling the product - from police services for the store, fire services, etc.

Whereas an out of state purchase encounters none of these services. I could possibly see an argument made that if the item is purchased from a particular state, they can charge sales taxes on the item even if it is shipped out of state. No one wants to do that, because as soon as a state does it, online stores will flee it in droves in favor of a state that doesn't charge such taxes.

I wish state legislatures would pay even half as much attention to embezzlement by public employees through high benefits, high salaries and bonuses as they pay towards the ‘capture’ of taxes they feel they are owed. Job one should be the care of the people's money - then maybe you can start worrying about tax evaders.

7

posted on

02/05/2012 4:35:27 PM PST

by

kingu

(Everything starts with slashing the size and scope of the federal government.)

To: AdmSmith; AnonymousConservative; Berosus; bigheadfred; Bockscar; ColdOne; Convert from ECUSA; ...

8

posted on

02/05/2012 4:42:39 PM PST

by

SunkenCiv

(FReep this FReepathon!)

To: Jean S

I’d be glad to pay the sales tax if the state will pay my shipping.

9

posted on

02/05/2012 5:01:26 PM PST

by

freedomfiter2

(Brutal acts of commission and yawning acts of omission both strengthen the hand of the devil.)

To: Jean S

Dear government: urge THIS

10

posted on

02/05/2012 5:04:28 PM PST

by

relictele

(Green energy is neither)

To: Jean S

Jean S: “Do they think we’re really that stupid?”

Two thoughts...

1) Paying taxes that are due is the moral thing to do.

2) An unenforced tax that relies on voluntary compliance both penalizes the moral and encourages the dishonest.

11

posted on

02/05/2012 5:04:28 PM PST

by

CitizenUSA

(Bad? Bad is easy. Anyone can be it. Being good? Now that's something special!)

To: Jean S

What about those taxes on stuff I bought at garage sales? More taxes means more tax evasion and the black market.

12

posted on

02/05/2012 5:06:01 PM PST

by

grumpygresh

(Democrats delenda est; zero sera dans l'enfer bientot.)

To: Jean S

I am sure the Wisconsin paupers will do it as a token to their Marxist overseers.

13

posted on

02/05/2012 5:20:02 PM PST

by

ully2

To: CitizenUSA

Are you for real? Would you mind explaining what is so moral about a “use tax”?

To: Jean S

15

posted on

02/05/2012 5:24:57 PM PST

by

Timber Rattler

(Just say NO! to RINOS and the GOP-E)

To: CitizenUSA

1) Paying taxes that are due is the moral thing to do. Explain. Is handing over your wallet to the robber the moral thing to do, or simply the prudent one?

16

posted on

02/05/2012 5:43:59 PM PST

by

chesley

(Eat what you want, and die like a man. Never trust anyone who hasn't been punched in the face)

To: Jean S

It beats NYS’ method of ASSUMING you bought stuff on which you didn’t pay sales/use tax and just charge use tax based upon income....

We moved from NYS in 2010 and are filing for the last part of unemployment/severance pay and they want $68 use tax... we can’t get out of it...ARGHHH

I’m so glad this is the LAST year we have to file NYs tax!!!

To: BobL

...then it will just be a matter of getting Amazon’s records and seeing just how honest a given taxpayer has been.

Just remember that as a part of obamcare, the fed govt will be given your bank and credit card information, it will then be shared with the states.

18

posted on

02/05/2012 5:58:01 PM PST

by

PeterPrinciple

( getting closer to the truth.................)

To: chesley

Yes. I’m for real. I didn’t say the Wisconsin Use Tax itself is moral. I think use taxes are very bad law, because they aren’t enforceable, penalize those who comply because they believe in following the law (or fear getting caught), and reward those who choose not to pay and aren’t held to account for it.

As far as complying with the law, I give unto Caesar that which is Caesar’s. In other words, I comply with use taxes even though I don’t agree with them, probably wouldn’t get caught if I ignored them, and would certainly vote to eliminate them.

19

posted on

02/05/2012 6:31:18 PM PST

by

CitizenUSA

(Why celebrate evil? Evil is easy. Anyone can do it. Good is more work but worth it!)

To: RebelTXRose

Count yourself lucky if you only have to pay $68. I’ve heard worse horror stories from ex-Californicate residents who have moved to Texas or other non-income tax states.

20

posted on

02/05/2012 6:35:04 PM PST

by

RetiredTexasVet

(There's a pill for just about everything ... except stupid!)

Navigation: use the links below to view more comments.

first 1-20, 21-30 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson