Posted on 10/22/2011 5:07:48 AM PDT by Kaslin

You know, we're really not sure why so many people seem to be surprised that new, seasonally-adjusted, weekly jobless claim filings persist in clocking in at levels above 400,000, or that the adjusted values for the previous weeks tend to be revised upward.

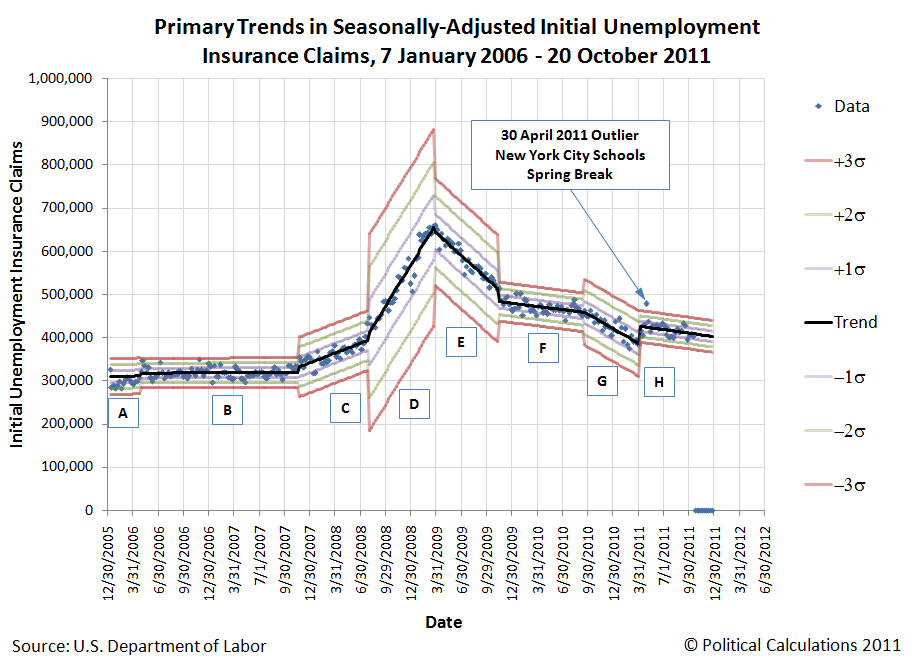

In fact, based upon the trend that has been established since 9 April 2011, that's exactly what we can expect somewhat more than half the time throughout the rest of 2011, provided the current trend continues to remain in effect:

We can arrive at that forecast by following the trajectory of the mean trend line, which is shown as the heavy black line on the chart. Based on the existing trend, we can expect the number of new jobless claims filed in future weeks to be above this line 50% of the time, or below it 50% of the time.

And since that slowly downward trending line is currently projected to stay above the 400,000 level through the end of 2011, we can therefore expect that there is over a 50% probability that the number of new, seasonally adjusted initial unemployment claims will be above the 400,000 mark through the end of the year.

In fact, what we can expect as we go forward in time is that we'll see an increasing number of times in the weeks ahead where the number of new jobless benefit claim filings will fall below the 400,000 mark, as the number of layoffs from U.S. employers each week continues to decline gradually.

At present, that would put the number of layoffs each week in the U.S. on track to reach the average level of 317,000-318,000 that it recorded throughout most of 2006 and 2007 in another 2.6 years. A slight improvement from the 2.7 year figure we projected just two weeks ago, as nothing has happened in that time to significantly affect the overall trend.

Meanwhile, for those of you joining us in progress, here's a look at the primary trends that have characterized the seasonally-adjusted initial unemployment insurance claim filings in each week since 7 January 2006, along with the specific events that we've been able to determine initiated them:

The table below describes the events that altered the trajectory of U.S. layoff since 7 January 2006:

| Timing and Events of Major Shifts in Layoffs of U.S. Employees | ||||

|---|---|---|---|---|

|

|

Period | Starting Date | Ending Date | Likely Event(s) Triggering New Trend (Occurs 2 to 3 Weeks Prior to New Trend Taking Effect) |

| A | 7 January 2006 | 22 April 2006 | This period of time marks a short term event in which layoff activity briefly dipped as the U.S. housing bubble reached its peak. Builders kept their employees busy as they raced to "beat the clock" to capitalize on high housing demand and prices. | |

| B | 29 April 2006 | 17 November 2007 | The calm before the storm. U.S. layoff activity is remarkably stable as solid economic growth is recorded during this period, even though the housing and credit bubbles have begun their deflation phase. | |

| C | 24 November 2007 | 26 July 2008 | Federal Reserve acts to slash interest rates for the first time in 4 1/2 years as it begins to respond to the growing housing and credit crisis, which coincides with a spike in the TED spread. Negative change in future outlook for economy leads U.S. businesses to begin increasing the rate of layoffs on a small scale, as the beginning of a recession looms in the month ahead. | |

| D | 2 August 2008 | 21 March 2009 | Oil prices spike toward inflation-adjusted all-time highs (over $140 per barrel in 2008 U.S. dollars.) Negative change in future outlook for economy leads businesses to sharply accelerate the rate of employee layoffs. | |

| E |

|

28 March 2009 | 7 November 2009 | Stock market bottoms as future outlook for U.S. economy improves, as rate at which the U.S. economic situation is worsening stops increasing and begins to decelerate instead. U.S. businesses react to the positive change in their outlook by significantly slowing the pace of their layoffs, as the Chinese government announced how it would spend its massive economic stimulus effort, which stood to directly benefit U.S.-based exporters of capital goods and raw materials. By contrast, the U.S. stimulus effort that passed into law over a week earlier had no impact upon U.S. business employee retention decisions, as the measure was perceived to be excessively wasteful in generating new and sustainable economic activity. |

| F | 14 November 2009 |

|

11 September 2010 | Introduction of HR 3962 (Affordable Health Care for America Act) derails improving picture for employees of U.S. businesses, as the measure (and corresponding legislation introduced in the U.S. Senate) is likely to increase the costs to businesses of retaining employees in the future. Employers react to the negative change in their business outlook by slowing the rate of improvement in layoff activity. |

| G | 18 September 2010 | 2 April 2011 | Possible multiple causes. Political polling indicates Republican party could reasonably win both the U.S. House and Senate, preventing the Democratic party from being able to continue cramming unpopular and economically destructive legislation into law, bringing relief to distressed U.S. businesses. Fed Chairman Ben Bernanke announces Federal Reserve will act if economy worsens, potentially restoring some employer confidence. The White House announces there will be no big new stimulus plan, eliminating the possibility that more wasteful economic activity directed by the federal government would continue to crowd out the economic activity of U.S. businesses. | |

| H | 9 April 2011 | Present | Rising oil and gasoline prices exceed the critical $3.50-$3.60 per gallon range (in 2011 U.S. dollars), forcing numerous small businesses to act to reduce staff to offset rising costs in order to prevent losses. After this initial shock, as oil and gasoline prices have fallen back to lower levels, so has the number of new jobless claims, but at a less steep pace than before the shock, confirming the reduced optimism of employers for a more strongly improving business climate. | |

Provided the established trend remains in effect, the number of seasonally-adjusted initial unemployment insurance claims filed each week in the U.S. is perhaps the easiest economic statistic of all to forecast.

A brilliant deduction made when October is over half done.

Yes, I think even I could say that unemployment will continue through 2011.

I have an idea it will probably last through 2012 too.

OK, so here’s my question:

The US economy is adding a paltry amount of private-sector, non-farm jobs each month; most of us believe even those numbers are cooked to boost perception.

We have been seeing 400K new filings each week for a long time now, so one could assume we’re still bleeding 1.6 MM jobs per month (new losses).

Considering our job growth has been nowhere near able to offset the new job losses, there has got to be a big damned pile of unemployed out there.

How come we hear little about this?

If the chart is divided into two periods (the first six moths and the remaining 4 months) the current trend shows increasing unemployment - not slowly declining unemployment.

The problem here is the public sector, poor public sector, losing jobs left and, well, left. Private sector is doing fine, but being dragged down by the public sector.

We have become a European socialist state. Unemployment levels will just get worse and stay there. 10% unemploymen has been considered the normal in Europe for 40 years.

This is the new normal, unless we change back to a free economic system.

Maybe we could pass some more “Free Trade” agreements, I am sure that the easier we make it for Corporations to produce their products offshore using slave labor in third world countries and then allow them to import those products “TAX FREE” will have a positive affect on the Economy./S

Could it also be that unemployment benefits last sooo long? MANY that I know that have been on unemployment think of it as a paycheck and just live as on vacation applying at jobs they would not take if they were really looking on the same level that they had.

Twenty somethings that are unemployed think of it as a vacation paycheck. When I was unemployed in my 20’s I think it was a 6 month maximum now over a year.

Unlimited unemployment benefits are precisely in line with the European socialist state model that I was talking about.

That's what Harry Reid said.

WTF does NYC Schools spring break have to do with new unemployment claims? Are the teachers and students collecting two weeks of unemployment for their vacation?

Yes. I think if you got rid of extended unemployment, all these people would magically find some sort of employment.

Let’s see, can I make a product on my land here, in the middle of nowhere, and deliver it to points of sale? No? Zoning law doesn’t allow that? Then starve, while we all rough it for awhile. I can’t help you.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.