ABOUT THE AUTHOR:

Mr. Laffer, chairman of Laffer Associates and the Laffer Center for Supply-Side Economics, is co-author, with Stephen Moore, of “Return to Prosperity: How America Can Regain Its Economic Superpower Status” (Threshold, 2010).

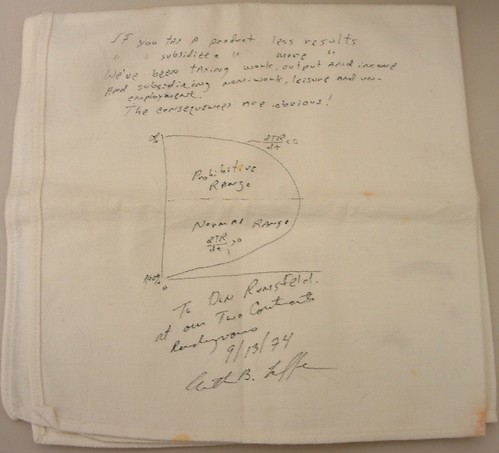

He first gained prominence during the Reagan administration as a member of Reagan’s Economic Policy Advisory Board (1981–1989). Laffer is best known for the Laffer curve, an illustration of the theory that there exists some tax rate between 0% and 100% that will result in maximum tax revenue for governments.

This is why we need to continue to send conservatives to Congress. Once the Congress puts this plan into action, we need to make sure that subsequent Congresses won't get the urge to raise ANY of those rates. Of course, one way to do this would be to write into the legislation creating the 9-9-9 plan, that a vote to raise ANY of the three rates would require a 2/3rds vote of BOTH houses. That will slow them down some. ;o)

Please pass this feedback on to Stephen Moore:

Architect of Cain's 999 plan says he should drop the sales tax.

Thank you.

*

Two things people must keep in mind. First,999 is not written in stone. Second, its 100 times better than our current progressive tax code.

Laffer contributes to the confusion over the business tax when he writes: “a 9% flat-rate tax on net business profits...”

It’s clearly not a tax on business “profits,” and is actually much more like a value-added tax (VAT) because it essentially taxes the value added by each producer in turn as a product makes its way from raw material to final product.

Laffer acknowledges as much when later in the article when he goes into the numbers (which have nothing to do with profits and everything to do with revenues.)

I like the concept, but unless the three taxes were tied together tightly in law so that all three must remain equal, the VAT portion would be too easy to raise. In other words, the law should be written so that if the taxes were raised, they would ALL be, say, 10/10/10. Otherwise, eventually you’ll see 5/25/15, or some such effect, with the sales tax the lower of the bunch.

In fact, this is a good argument for the national sales tax as well, because it will be far harder to raise than the business VAT tax or the personal income tax. While sneaking a raise in for the VAT might be possible politically, requiring the sales tax to go up just as much would probably doom the effort. It’s even possible that you’ll find politicians campaigning on dropping the rates in good times, for that matter.

bttt