Posted on 10/19/2011 8:44:03 AM PDT by SeekAndFind

It used to be that the sole purpose of the tax code was to raise the necessary funds to run government. But in today's world the tax mandate has many more facets. These include income redistribution, encouraging favored industries, and discouraging unfavorable behavior.

To make matters worse there are millions and millions of taxpayers who are highly motivated to reduce their tax liabilities. And, as those taxpayers finagle and connive to find ways around the tax code, government responds by propagating new rules, new interpretations of the code, and new taxes in a never-ending chase. In the process, we create ever-more arcane tax codes that do a poor job of achieving any of their mandates.

Republican presidential candidate Herman Cain's now famous "9-9-9" plan is his explicit proposal to right the wrongs of our federal tax code. He proposes a 9% flat-rate personal income tax with no deductions except for donations to charity; a 9% flat-rate tax on net business profits; and a new 9% national tax on retail sales.

Mr. Cain's 9-9-9 plan was designed to be what economists call "static revenue neutral," which means that if people didn't change what they do under his plan, total tax revenues would be the same as they are under our current tax code. I believe his plan would indeed be static revenue neutral, and with the boost it would give to economic growth it would bring in even more revenue than expected.

(Excerpt) Read more at online.wsj.com ...

ABOUT THE AUTHOR:

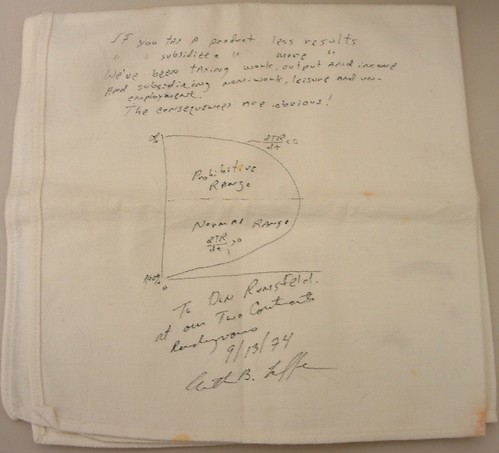

Mr. Laffer, chairman of Laffer Associates and the Laffer Center for Supply-Side Economics, is co-author, with Stephen Moore, of “Return to Prosperity: How America Can Regain Its Economic Superpower Status” (Threshold, 2010).

He first gained prominence during the Reagan administration as a member of Reagan’s Economic Policy Advisory Board (1981–1989). Laffer is best known for the Laffer curve, an illustration of the theory that there exists some tax rate between 0% and 100% that will result in maximum tax revenue for governments.

I hate GWB for removing so many people from the tax rolls.

Funny that Art Laffer would be such a proponent of Cain’s 9-9-9 plan, as he was one of the architects of it. Can you say self interest, lol?

“One of the architects of Herman Cain’s 9-9-9 tax plan, economist Stephen Moore, said the contender for the GOP presidential nomination needs to drop his proposed 9 percent national sales tax. ...

Moore, who developed the plan with economist ARTHUR LAFFER and Wells Fargo wealth manager Rich Lowrie, said he would advise Cain to drop the sales tax, but that the plan was solid otherwise.

This is why we need to continue to send conservatives to Congress. Once the Congress puts this plan into action, we need to make sure that subsequent Congresses won't get the urge to raise ANY of those rates. Of course, one way to do this would be to write into the legislation creating the 9-9-9 plan, that a vote to raise ANY of the three rates would require a 2/3rds vote of BOTH houses. That will slow them down some. ;o)

Please pass this feedback on to Stephen Moore:

Architect of Cain's 999 plan says he should drop the sales tax.

Thank you.

*

How is believing in a proposal you helped create "self-interest"?

I would hope that the architect of a plan such as this would be more than willing to endorse and defend it in public. DUH.

Any substantive comments on Mr. Laffer's analysis? Or do you really think it should just be ignored because Mr. Laffer helped design the plan?

We also need to make the principle that everyone pays taxes in America and all pay the same rate a matter of national pride and patriotism.

This needs to become the new third rail of politics, such that anyone who stands up and says “let’s go back to letting a lot of people paying taxes and making some people pay more,” that person gets shouted down immediately. Or fired if he is a congresscritter.

Baloney. Where did you get that information. I have read nowhere where Moore and Laffer had anything to do with this. As a matter of fact Moore was on Kudlow this week slamming the Nat'l Sales Tax. If Moore had anything to do with this, why would he be ripping his own plan?

Any substantive comments on Mr. Laffer’s analysis? Or do you really think it should just be ignored because Mr. Laffer helped design the plan?

Not to state the obvious, but if one is the creator of a plan, one is indeed bound to sing its praises, yes? Not slam it? Because you are the architect of it? That’s like the creators of Viagra singing its praises in a TV Ad, or a pharmaceutical company singing the praises of Prozac. Think they would say anything bad about their product when they are the developers of it? You don’t find that praise suspect? Geez....

Two things people must keep in mind. First,999 is not written in stone. Second, its 100 times better than our current progressive tax code.

“Baloney. Where did you get that information. I have read nowhere where Moore and Laffer had anything to do with this. As a matter of fact Moore was on Kudlow this week slamming the Nat’l Sales Tax. If Moore had anything to do with this, why would he be ripping his own plan?”

From an article in “The Hill” online:

“Architect of Cain’s 9-9-9 plan wants him to drop national sales tax

By Jonathan Easley - 10/18/11 02:55 PM ET

One of the architects of Herman Cain’s 9-9-9 tax plan, economist Stephen Moore, said the contender for the GOP presidential nomination needs to drop his proposed 9 percent national sales tax.

Cain’s plan would replace the current tax structure with a 9 percent corporate tax rate, a 9 percent personal income tax rate and a 9 percent federal sales tax. But speaking Saturday on Larry Kudlow’s radio show, Moore said the sales tax should be replaced with a 9 percent payroll tax.

“I’ve come to the conclusion that the American people and the voters do not want a national sales tax,” he said. “[Cain’s] going to have to replace that national sales tax with a 9 percent payroll tax. And if you do that, it’s a total winner.”

The plan has been under fire from both the left and the right since Cain’s recent surge in the polls. Democrats say the plan would lower the tax burden on the wealthy while increasing the burden on the middle class, and Republicans say the sales tax opens an additional revenue stream for the federal government to abuse.

“I’m surprised how hostile people are to the sales tax,” Moore continued. “When we designed this plan, I thought people would go along with the 9 percent sales tax. But the point is they won’t. And why not just do a payroll tax? It’s the devil we know.” ...

Moore, who developed the plan with economist ARTHUR LAFFER and Wells Fargo wealth manager Rich Lowrie, said he would advise Cain to drop the sales tax, but that the plan was solid otherwise.

“I want to be very, very clear on this,” he said. “I am not bearish on this plan. If you could put in place the 9-9-9 plan, oh my God, it would be like steroids in the economy. … You would have a million jobs a month if we put this in place. … I love the concept of it … but the American people will not go for a national sales tax. They’re just afraid of it.”

The entire tax code could be written on a sticky note, EVERYONE will pay taxes according to the amount of money they earn at the rate of 12% with NO exceptions, loophole or special favors.

If you earn $15,000.00 per year your tax bill is $1,800.00

If you earn $10, 000, 000.00 your tax bill is $1,200,000.00

Cheating will result in jail time of no less than 10 years and if you own property it will be sold to pay the taxes you owe.

Laffer contributes to the confusion over the business tax when he writes: “a 9% flat-rate tax on net business profits...”

It’s clearly not a tax on business “profits,” and is actually much more like a value-added tax (VAT) because it essentially taxes the value added by each producer in turn as a product makes its way from raw material to final product.

Laffer acknowledges as much when later in the article when he goes into the numbers (which have nothing to do with profits and everything to do with revenues.)

I like the concept, but unless the three taxes were tied together tightly in law so that all three must remain equal, the VAT portion would be too easy to raise. In other words, the law should be written so that if the taxes were raised, they would ALL be, say, 10/10/10. Otherwise, eventually you’ll see 5/25/15, or some such effect, with the sales tax the lower of the bunch.

In fact, this is a good argument for the national sales tax as well, because it will be far harder to raise than the business VAT tax or the personal income tax. While sneaking a raise in for the VAT might be possible politically, requiring the sales tax to go up just as much would probably doom the effort. It’s even possible that you’ll find politicians campaigning on dropping the rates in good times, for that matter.

RE: If you earn $15,000.00 per year your tax bill is $1,800.00

The only beef I have with this calculation is it does not take into account the money already taken away from you via the payroll tax.

If your current gross income from working is $15,000, your real gross income should have been $16,125.00 because the $1125 was TAKEN away from you ( 7.5% payroll tax ).

Since Cain’s 9% income tax DOES AWAY with the payroll tax, your income for the purpose of taxation would be $16,125.00

9% of $16,125 is $1451.25.

$1451.25 - $1125.00 = $326.00 <-— This is in reality, the amount you pay in taxes under 9-9-9 compared to the current system.

Again, the $1125 is the tax that was taken from you under the current system via payroll tax, which is YOURS. It will be yours under 9-9-9 but it will be VISIBLE and TAXABLE.

Which means, you are EFFECTIVELY just paying 2% under 9-9-9 with the above scenario.

It’s clearly not a tax on business “profits,” and is actually much more like a value-added tax (VAT) because it essentially taxes the value added by each producer in turn as a product makes its way from raw material to final product.

I’m not buying this yet. All of this is based off of Moore’s single interview on Kudlow’s Radio show. I listened to it on Sat but must have missed this part when I got out of the car. Until there is more confirmation on this, I am going to not believe it. Why would Cain and Laffer not disclose this? It is far more impressive to say Laffer and Moore designed 999 than to say some dope in OH made it up.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.