Posted on 08/10/2011 9:19:06 PM PDT by NoLibZone

In just four days last week, President Barack Obama’s administration increased the national debt by more in inflation-adjusted dollars than the administrations of Presidents Harry Truman and Dwight D. Eisenhower increased the national debt over the entire decade of the 1950s.

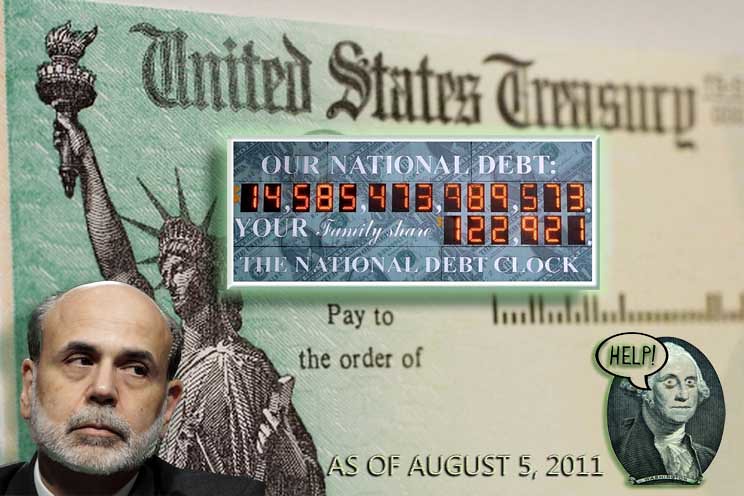

At the start of business on Tuesday, Aug. 2, according to the Daily Treasury Statement, the national debt subject to the legal limit was $14.293975 trillion. Obama signed legislation that day lifting the limit by as much as $2.4 trillion—with an initial and immediate increase in the limit of $400 billion. By the close of business on Friday, Aug. 5, according to the Daily Treasury Statement, the national debt subject to the limit had grown to $14.536130 trillion.

Over just four days, the debt had jumped $242.155 billion.

By contrast, according to the Bureau of the Public Debt, over the ten-year period from the end of fiscal 1950 to the end of fiscal 1960, the national debt grew from approximately $257.36 billion to approximately $286.33 billion—an increase of approximately $28.97 billion.

Using the Bureau of Labor Statistics inflation calculator, $28.97 billion in 1960 dollars equals $220.92 billion in 2011 dollars.

Thus, the $242.155 billion in 2011 dollars that the Obama administration increased the debt between last Tuesday and last Friday is more in inflation-adjusted terms than the combined debt increases of the Truman and Eisenhower administrations in the ten-year period from the end of fiscal 1950 to the end of fiscal 1960

bump

| The US Treasury Department came out on August 5, 2011, with its Debt Position and Activity Report for July. The news is bleak. With the additional $238 billion the Treasury immediately borrowed when the debt ceiling was raised on August 2, total current debt now exceeds the US GDP for 2010! (GDP in 2010 was $14.5265 trillion.) As of July 31, 2011, our debt totaled $14.342 trillion. That was made up of $9.756 trillion held by the public and $4.587 trillion the government owes itself -- intergovernmental borrowing, largely from the Social Security and Medicare trust funds to the general fund. With the Treasury's additional borrowings of $238 billion (the largest one-day bump in history) the total of all debt outstanding has now increased to $14.5807 trillion. That's $54.2 billion more than the 2010 GDP, the last year for which we have final estimates on GDP from the U.S. Department of Commerce. That increase now puts the government close to the new debt limit of $14.694 trillion, It ate up 60% of the $400 billion in space Congress granted the president on Aug. 2. Through accounting 'tricks,' Treasury held the nation under the $14.29 trillion 'ceiling' since reaching that figure on May 16, 2011, while lawmakers debated about how to add more debt and annual deficits. The Republican House had the power to say no to upping the legal debt limit. What a bunch of traitorous scum. They handing over $2 trillion in debt with nothing in return (well, maybe fictitious cuts)... disgusting. With the latest borrowing, the US joined a small group of red ink countries whose public debt exceeds GDP, including Japan (229 percent), Greece (152 percent), Jamaica (137 percent), Lebanon (134 percent), Italy (120 percent), Ireland (114 percent) and Iceland (103 percent), according to figures provided by the International Monetary Fund. So Barack 'Jackwagon' Hussein and his administration's next goal will be to exceed 200%! |

|

By the time the election comes around, we will have a debt hovering at $16 trillion. And if Zer0 isn't stopped, the GDP will continue to head south. We may well be at the 150% mark for debt vs. GDP by then. Yes Jackwagon Obama has been an outstanding Marxist president. We have now run out of other people's money. |

While this is true, it is misleading. The reason the numbers jumped so much immediately after the debt ceiling increase was this was money Geithner used to stay under the limit since May, when we would have crossed the ceiling without budgeting gimmicks.

Whatever happened to the talk that the administration wanted to tap into people’s 401K and IRA savings? I had heard that someone was working on a plan to merge our 401K and IRA accounts with Social Security.

This would do two things — It would give the government an injection of trillions in cash, and theoretically could shore up the finances of Social Security long term. But that’s only in theory. In practice, if they somehow could compel government control of retirement savings, the money would just get spent on something else.

How can the leader of the world’s largest economy be so chummy about depending on nations like China to help us out on our spending spree? Obviously this cannot last forever.

How can the leader of the world’s largest economy be so chummy about depending on nations like China to help us out on our spending spree? Obviously this cannot last forever.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.