Skip to comments.

No Chance of Default, US Can Print Money: Greenspan

CNBC ^

| Sunday, 7 Aug 2011 | 3:15 PM ET

| Patrick Allen

Posted on 08/08/2011 8:21:00 AM PDT by Tulsa Ramjet

Former Federal Reserve Chairman Alan Greenspan on Sunday ruled out the chance of a US default following S&P's decision to downgrade America's credit rating.

"The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default" said Greenspan on NBC's Meet the Press

(Excerpt) Read more at cnbc.com ...

TOPICS: Crime/Corruption; Front Page News; Government; Politics/Elections

KEYWORDS: economy; greenspan; obama

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-53 next last

To: Tulsa Ramjet

I think Andrea Mitchell got to him

21

posted on

08/08/2011 8:42:14 AM PDT

by

hecht

(TAKE BACK OUR NATION AND OUR NATIONAL ANTHEM)

To: Mrs. Don-o

22

posted on

08/08/2011 8:43:22 AM PDT

by

evets

(beer)

To: KarlInOhio

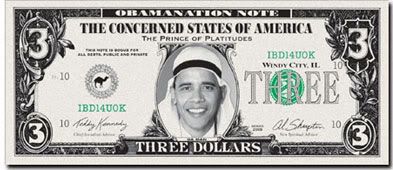

And also print up a few of these. Point is - currency devaluation happens often and eventually, everywhere. How many have we seen in our lifetimes?

23

posted on

08/08/2011 8:49:25 AM PDT

by

PGR88

(I'm so open-minded my brains fell out)

To: Tulsa Ramjet

Greenspan is technically correct, but he should be smarter than this and explain what is going on. When Moody's downgrades as US state or a Eurozone member, they are looking a default risk because these sovereigns can not print money. Moody's knows this... As such, Moody's did not downgrade the US short term debt, only long-term. This indicates to me that Moody's downgraded the debt not based on default, but technical value on the bonds. In other words if the Federal Reserve keeps printing money to monetize the deficit, then value of the bonds decline. The longer the term of the bond, the more inflation devalues the bond. Moody's rating is a function of inflation and devaluation of the bond.

I am sure Greenspan knows this, he is just playing lapdog to the elitist that think they know better than all us commoners.

24

posted on

08/08/2011 8:58:50 AM PDT

by

11th Commandment

(http://www.thirty-thousand.org/)

To: apillar

AND, our creditors will notice they’re being paid with Monopoly money. What a moron.

25

posted on

08/08/2011 8:58:59 AM PDT

by

ChocChipCookie

(Jonah is my patron saint.)

To: Tulsa Ramjet

The only question I have is, how will mortgage debt be handled. When you can easily satisfy the conditions of the loan, what happens to the mortgage holder?

26

posted on

08/08/2011 9:02:00 AM PDT

by

runninglips

(Republicans = 99 lb weaklings of politics.)

To: Berlin_Freeper

He will blame the Tea Party and say we need to spend more to create ‘shovel-ready’ jobs.

To: Tulsa Ramjet

What´s the House say about this loon?

28

posted on

08/08/2011 9:08:58 AM PDT

by

onedoug

To: Tulsa Ramjet

The United States can pay any debt it has because we can always print money to do that.If that is true, why don't we just print $15 trillion and be done with it? Anyone? Anyone? Bueller?

To: Tulsa Ramjet

“The United States can pay any debt it has because we can always print money to do that”

Brilliant!!!!

WHAT A GENUIS!!!!

I think he’s senile.

30

posted on

08/08/2011 9:13:35 AM PDT

by

ZULU

(McConnell and Boehner are the Judas and Ephialtes of the 21st Century)

To: Tulsa Ramjet

....................Our new currency

31

posted on

08/08/2011 9:22:11 AM PDT

by

mandaladon

(PalinGenesis)

To: mandaladon

32

posted on

08/08/2011 9:25:40 AM PDT

by

mandaladon

(PalinGenesis)

To: Tulsa Ramjet

The United States can pay any debt it has because we can always print money to do that."But, honey, how can we be broke? I still have lots of checks....."

33

posted on

08/08/2011 9:25:43 AM PDT

by

OB1kNOb

(Obama will heretofore be known in history as the downgraded President.)

To: Tulsa Ramjet

Cool, so can I print up a few million, too?

34

posted on

08/08/2011 9:26:58 AM PDT

by

bgill

To: listenhillary

Same here LOL ! Of course I would immediately convert to something better like Swiss Franc’s and quit working. I would go live in NZ part time as well.

> Print me a 10 million could ya? C’mon Alan...

To: runninglips

>>The only question I have is, how will mortgage debt be handled. When you can easily satisfy the conditions of the loan, what happens to the mortgage holder?<<

In a hyperinflation, the lenders end up with nothing in the end. It’s the borrowers who win, i.e., the profligate, i.e., the federal government.

Buy Treasury Bonds at 4% for 30 years and see who wins, you or the government. Greenspan’s right; they won’t default, but a $1,000 bond due in 2041 will buy you a pair of shoes in 2041 at 12% inflation. At 20%, a Happy Meal at McDonalds. At 50%, use it for toilet paper, because it will be the cheaper alternative.

36

posted on

08/08/2011 9:32:12 AM PDT

by

Norseman

(Term Limits: 8 years is enough!)

To: Tulsa Ramjet

Greenspan Interpreted:

We can steal it from the citizens by instigating hyper-inflation.

37

posted on

08/08/2011 9:39:57 AM PDT

by

RatRipper

(I'll ride a turtle to work every day before I buy anything from Government Motors.)

To: Tulsa Ramjet

I remember when this man was viewed almost unanimously as a financial genius of the first order. Even Bush’s tax cuts had to have his blessing, to provide poltical cover in case they led to big deficits. Poor Greenspan, his time is past.

38

posted on

08/08/2011 9:45:34 AM PDT

by

juno67

(a)

To: Tulsa Ramjet

If I print funny money, it is called counterfeiting, but when the government prints funny money, it is called Quantitative Easing. The government has nearly carte blanche to print dollars until they are as worthless as Zimbabwe’s bank notes.

39

posted on

08/08/2011 10:04:00 AM PDT

by

TexasRepublic

(Socialism is the gospel of envy and the religion of thieves)

To: evets

It's not even going to be worth stooping over to pick up the bills.

Of course,as a gardener, I can always use the compost.

40

posted on

08/08/2011 10:07:49 AM PDT

by

Mrs. Don-o

(When I grow up I'm gonna settle down/ Chew honeycomb and drive a tractor, grow things in the ground.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-53 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson