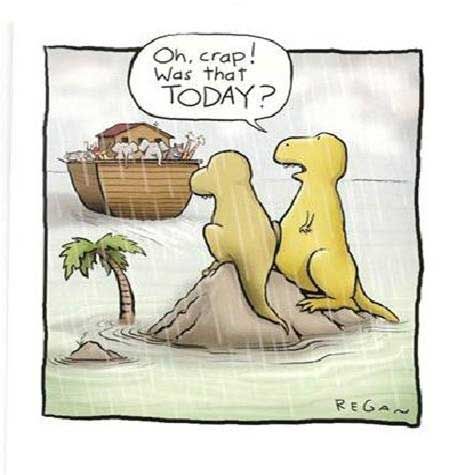

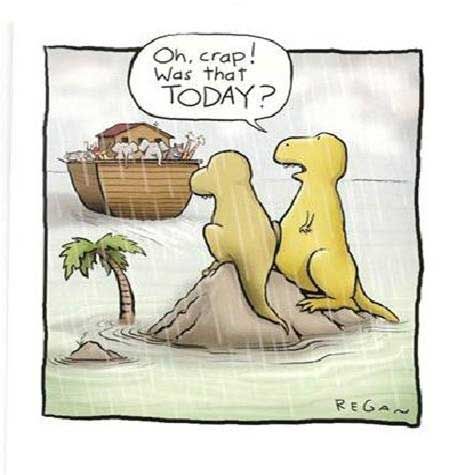

Don’t Miss the Free Republic Boat

Donate Monthly

Sponsoring FReepers leapfrog0202 and another person will contribute $10

Each time a new monthly donor signs up!

Get more bang for your buck

Sign up today

Save Lazamataz

Posted on 05/05/2011 11:54:08 AM PDT by SeekAndFind

Silver is now threatening to fall below $38/oz, which would mark a nearly 22% decline from its bubblicious highs last week.

It's obviously spectacularly volatile, and we don't know how this will end up, but we can think of several threats to silver bulls.

* As the lady in the Lind Waldock (commodities broker) commercials always says, commodities are all a price play. There's no hard metric for anyone to know whether something has gotten cheap or not. There's no P/E level that makes silver a must buy.

* Big, smart money is selling: Soros, Carlos Slim, etc.

* Margin requirements have been going up. Conspiracy theorists like to claim that the silver plunge is owed to the fact that the exchanges are nefariously requiring traders to put up more collateral to trade futures. That is definitely a headwind. If silver is to go back to its hold highs, traders will need to have more money devoted to it than they did before. But on the other hand, the margin hike explanation doesn't explain the carnage across the commodity complex. Have you seen cotton lately? Even oil is coming off.

* Investment in coins and metals has surged in recent years vs. industrial demand, which further reduces the natural floor on the price.

* If the economy falters, people are going to want to raise liquidity, and that means cash, hence the correlation with equities.

* Central banks all around the world are tightening. The cheap money thesis is fading.

(Excerpt) Read more at businessinsider.com ...

After almost hitting $50.00, SLV dropped below $36.00 today, triggering my sell.

Why can’t this happen to oil?

LOL, I said last week was the time to sell, was it you that laughter when I said a bird in hand was worth two in the bush. You did well however.

IMHO this is a perfect opportunity to dump paper silver and buy physical. As on fiat currency after another goes down in flames there is only one long term direction for precious metals....up.

As my friends on ZeroHedge say : BTFD ( buy the f****** dip)

RE: Why can’t this happen to oil?

It IS happening to oil as well. Crude Oil is now BELOW $100/barrel as of this writing !!

Almost all commodities ( Gold, Food Inputs, Coal, you name them ) are TANKING.

Go to this site and see for yourself :

I think it is. The last time I put gas in my car, about 10 days ago, it was $3.88/9.

Today it was $3.69/9.

That’s progress, right?

I think the dollar is getting stronger for some reason. The stock market is dipping, too.

Commodities are volatile. That comes with the territory. I have no doubt that the powers that be are doing everything in their power to force investors out of commodities and back into paper.

I'm fine with that. It allows me to buy at lower prices as I still believe that real assets have real value unlike paper assets in an artificially Fed-inflated market that are only worth the heat they produce when burned.

BTW, the real smart money buys low and sells high. If Soros is selling, it's because he is planning to get back in when the price is lower. Gee, I wonder how he knew the price would go lower? Hmm.

I sold at $45.50

Yes, now a bit below $36. FWIW, Rick Ackerman has a

“hidden pivot” at $35.39 (July silver), which might mark a tradable bottom.

I need 50$ oil for an entry point, but I doubt the latest panic will go below 75$, just my WAG.

I think the dollar is getting stronger for some reason. The stock market is dipping, too.>>>>>>

I’ll bet the Federal Reserve is behind a lot of this. They have an intimate relationship with the primary dealers and can urge them and incentivize them to pile on the shorting of silver gold oil commodities which all jacks up the USD. The Federal Reserve has a permanent interest is having a respectable dollar because dollars are their stock in trade. Gold and silver are not

.

.

.

.

.

List of the Primary Government Securities Dealers Reporting to the Government Securities Dealers Statistics Unit of the Federal Reserve Bank of New York

BNP Paribas Securities Corp.

Barclays Capital Inc.

Cantor Fitzgerald & Co.

Citigroup Global Markets Inc.

Credit Suisse Securities (USA) LLC

Daiwa Capital Markets America Inc.

Deutsche Bank Securities Inc.

Goldman, Sachs & Co.

HSBC Securities (USA) Inc.

Jefferies & Company, Inc.

J.P. Morgan Securities LLC

Merrill Lynch, Pierce, Fenner & Smith Incorporated

MF Global Inc.

Mizuho Securities USA Inc.

Morgan Stanley & Co. Incorporated

Nomura Securities International, Inc.

RBC Capital Markets, LLC

RBS Securities Inc.

SG Americas Securities, LLC

UBS Securities LLC.

WTI crude = $98.5/barrel which is down $10 today

WTI = West Texas Intermediate

I do have physical and I almost sold it 2 weeks ago because I thought I was going to have to buy a house and needed a good down payment.

I’m glad I didn’t and plan to get more, I haven’t bought much since 2008.

Buy some when its up. Buy some when it is down. Ya can’t go wrong. Just buy it all the time. Then keep ahold of it.

People are buying metals for two reasons:

* Precious metals are a store of value. Over time they retain their value unlike the dollar that has lost 95% of its purchasing power since the Fed was created in 1913.

* Precious metals are MONEY. They have been used as currency for 5,000 years and will continue in that role. Paper has been a historically recent and fraudulent experiment designed to steal from the people.

All I need to know in order to understand that even the Left believes that gold is currency is that our first great socialist president, FDR, stole gold bullion from the American people and made its ownership illegal. The last thing he wanted was for Americans to no longer need phony Federal Reserve notes. Without gold, they had no real alternative.

update: $35.01

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.