Posted on 02/06/2011 6:27:17 PM PST by blam

Fed Holdings Of U.S. Treasuries Surpass China's

by: Doug Carey

February 06, 2011

A bit of recent news that hasn't gotten enough press is the fact that the Federal Reserve has surpassed China in total U.S. Treasury holdings and is now the largest holder of Treasuries in the world. As of last week, China held $896 billion of Treasuries while Japan held $877 billion. The Fed now holds $1.108 trillion and it has not even passed the halfway mark of its second round of money printing, which they call Quantitative Easing.

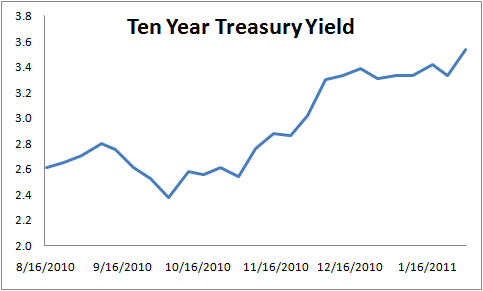

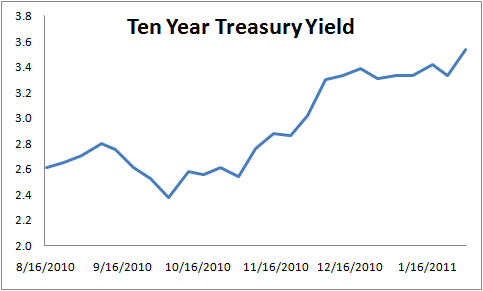

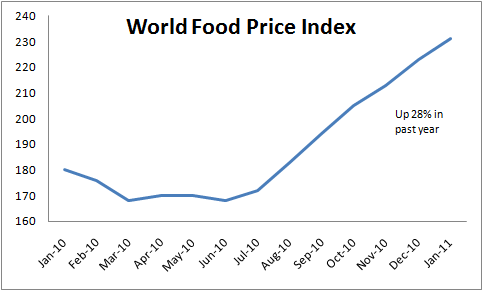

By June the Fed could own $1.6 trillion of Treasury bonds. The experiment that the Fed has embarked upon is simply unprecedented in this country. So far it has been an abysmal failure. Ten year treasury yields are nearly 120 basis points higher since the Fed announced their second round of Quantitative Easing just three months ago. Food inflation is raging throughout the world, even though Ben Bernanke denies any responsibility for it. Speculation is running rampant as to how much inflation the U.S. will export.

This is what fiat currencies and the printing of money bring: Rampant speculation and volatile prices. It is incredibly difficult to predict how the Fed’s printing will impact prices, so speculators are doing what they do: They’re jumping ahead of the curve and buying commodities before they all shoot through the roof.

Sugar is now at a 30 year high and cotton is at a 28 year high. Cotton has risen 100% in the past six months alone. All of this is happening while we’re supposed to be in a deflationary stage due to the credit collapse.

The Federal Reserve has been destroying our currency for nearly 100 years now. The dollar has lost 97% of its value since the Fed’s creation in 1913. But none of the Fed chairmen has been as bold as Ben Bernanke. What he is doing would have been impossible to fathom just three short years ago. It’s bad enough that the Fed is taking money from savers by holding short-term rates so low and giving it to the banks. To add insult to injury, the Fed debases the currency by printing trillions of dollars to prop up the government’s budget deficit. It is a terrible time to be a saver or to be living on a fixed income.

These are frightening times and it is prudent to prepare by owning gold and even stocks of companies that make things we truly need, such as food, water, and energy. The future depends partly on how much faith people lose in the dollar. A serious collapse of the dollar and hyperinflation likely won’t come from the physical printing of money itself. It will come from a breakdown of faith and confidence in our fiat system.

Think about this... nobody but the Fed will buy 40% of the Treasuries at the prevailing interest rates! This is not a market. If the Fed stops buying, wither the Treasury only sells $900 billion and can’t pay its bills or the other $600 billion is sold at higher interest rates which will trickle through the global bond market at lightning speed and raise interest rates to painful levels. YOW!

Somebody other than the Fed bought 100% of Treasuries at the prevailing rate.

If the Fed stops buying, wither the Treasury only sells $900 billion and can’t pay its bills or the other $600 billion is sold at higher interest rates which will trickle through the global bond market

Rates are higher since the Fed started buying the $600 billion.

You don't think the Primary Dealers are guaranteed a profit, do you?

If they could not profit on the trade, they would not trade.

They profit on every trade?

They are not in the business of buying Treasuries to hold or to lose money.

How many Treasuries do they hold in inventory?

If ONE major buyer steps out of the market (like the Fed with its 40% of the aggregate demand)the primaries are stuck holding bonds.

If you want to play in the big leagues, sometimes you get stuck holding bonds.

The Fed is buying up bonds to keep interest rates low not for fun and excitement.

Is it working?

If interest rates continue to increase, bond holders will see continued depreciation in portfolio value unless held to maturity.

I'd hate to borrow overnight to finance long term Treasuries if rates continue to rise.

Per your graph, if the Fed is only slowing the rate of increase in 10 yr rates, then The Comedian needs to post that great photo of the mom and little girl in the roller coaster. If the Fed can’t control interest rates by buying “excess” treasuries from the Primaries, then the rope is slipping through the fingers. I hope you are wrong but I fear you are correct. The Fed, ultimately, cannot control interest rates in a global market without folks like me living in dirt floor huts... Gloom and doom prevails...

Anyone who thinks the Fed can control any but the overnight rates doesn’t know anything about history.

I used to know lots about history. But, nowadays... they keep changing it! If not to influence the 10 year rate, why bother with QE?

They can try....they can hope....doesn’t mean they’ll be successful.

Yup.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.