Posted on 02/06/2011 6:27:17 PM PST by blam

Fed Holdings Of U.S. Treasuries Surpass China's

by: Doug Carey

February 06, 2011

A bit of recent news that hasn't gotten enough press is the fact that the Federal Reserve has surpassed China in total U.S. Treasury holdings and is now the largest holder of Treasuries in the world. As of last week, China held $896 billion of Treasuries while Japan held $877 billion. The Fed now holds $1.108 trillion and it has not even passed the halfway mark of its second round of money printing, which they call Quantitative Easing.

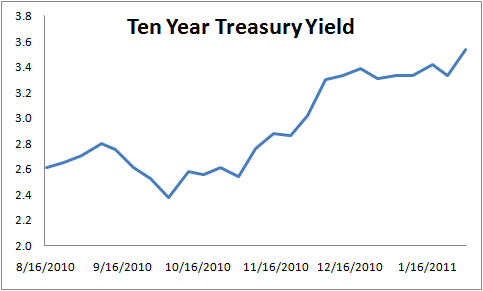

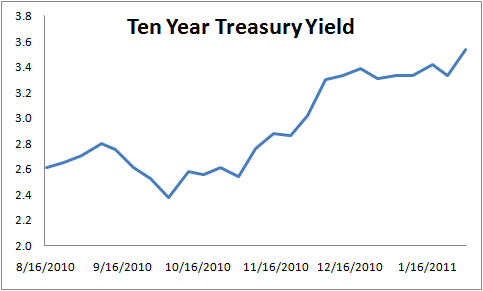

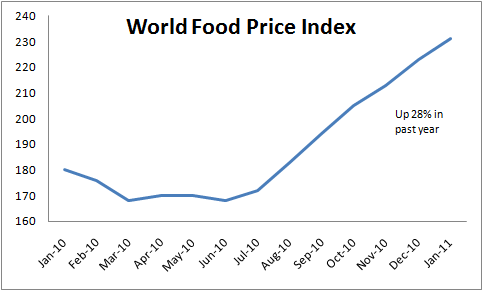

By June the Fed could own $1.6 trillion of Treasury bonds. The experiment that the Fed has embarked upon is simply unprecedented in this country. So far it has been an abysmal failure. Ten year treasury yields are nearly 120 basis points higher since the Fed announced their second round of Quantitative Easing just three months ago. Food inflation is raging throughout the world, even though Ben Bernanke denies any responsibility for it. Speculation is running rampant as to how much inflation the U.S. will export.

This is what fiat currencies and the printing of money bring: Rampant speculation and volatile prices. It is incredibly difficult to predict how the Fed’s printing will impact prices, so speculators are doing what they do: They’re jumping ahead of the curve and buying commodities before they all shoot through the roof.

Sugar is now at a 30 year high and cotton is at a 28 year high. Cotton has risen 100% in the past six months alone. All of this is happening while we’re supposed to be in a deflationary stage due to the credit collapse.

The Federal Reserve has been destroying our currency for nearly 100 years now. The dollar has lost 97% of its value since the Fed’s creation in 1913. But none of the Fed chairmen has been as bold as Ben Bernanke. What he is doing would have been impossible to fathom just three short years ago. It’s bad enough that the Fed is taking money from savers by holding short-term rates so low and giving it to the banks. To add insult to injury, the Fed debases the currency by printing trillions of dollars to prop up the government’s budget deficit. It is a terrible time to be a saver or to be living on a fixed income.

These are frightening times and it is prudent to prepare by owning gold and even stocks of companies that make things we truly need, such as food, water, and energy. The future depends partly on how much faith people lose in the dollar. A serious collapse of the dollar and hyperinflation likely won’t come from the physical printing of money itself. It will come from a breakdown of faith and confidence in our fiat system.

Oh wait, so we are the largest holders of our own debt and not the Chinese? No one is in jail yet? /s =.=

I'm pretty sure wages in Zimbabwe didn't rise to meet their hyperinflation; didn't keep them from seeing hyperinflation.

I was being sarcastic.

So we stimulated jobs overseas with QE2 so we can have unemployment AND inflation here? What a brilliant idea. Actually, this is exactly what was expected to happen by some here. Sadly the MSM wont talk about it. They want to carry the election theme that Obama 'did all the right things'.

When the government eventually defaults on their obligations, these fools are going to lose more wealth than anyone in the history of mankind. It's going to make the credit default swap collapse look like a day on the beach.

The "target" interest rate is whatever it takes to sell them.

who will buy those bonds from the Fed?

The Fed can hold the bonds until maturity.

But food and energy, the things we can't do without? Yep, they're climbing

Full disclosure: I'm long on wheat.

Excellent advice I agree I check my change and set aside the valuable coins. I did a little work for a fellow who paid me in silver I saved every bit of it. I have a collection :) so to speak for bad times and a store of food and supplies. Paper/digital money can also disappear rapidly in a crisis situation so I think people would be wise to keep some on hand and should be prepared to defend themselves.

Right now alot of the dollars swimming out there blam are going to stocks, bonds, some to commodities, but mostly to speculators. The consumers aren’t seeing those dollars in their hands.

When it’s going to get serious is when money starts coming out of other markets and from foreign govts with large trade surpluses with the U.S. to go into commodities. That will start the spiral.

Then it’s up to the Fed. If they keep printing, inflation goes out of control. If the cut the money supply, that will kill it, but kill the economy too. One way or the other, the average joe will get the shaft out of it.

We had one of those loans too but I also remember CD’s were paying 20%.

Ben Bernanke’s ‘70s Show

http://freerepublic.com/focus/f-news/2669869/posts

“Is Federal Reserve Chairman Ben Bernanke stoking inflation? Of course he is. Anyone with common sense knows that if you give $600 billion cash to the banks with no qualifications — as he did with the second round of quantitative easing — they will use it to speculate in the markets. JPMorgan Chase (JPM) just bought $1 billion of copper.”

http://freerepublic.com/focus/f-news/2669868/posts

True. Wonder how long they could keep the lid here on if we have hyper price spikes in necessities?

Yep. Primary dealers are front-running the Fed, and us taxpeasants are the bag-holders.

Hyperinflation will occur when the “Full Faith and Credit” of the US Government becomes as valuable as the “Full Faith and Credit” of Bernie Madoff.

The hyperinflation the Weimar Republic experienced was sort of “medium”, as hyperinflations go.

They went through a period of about six months during which prices picked up a “0” on the end every three to four weeks.

At that rate, oil goes from $100 per barrel to $1,000,000 per barrel in less than four months. Gasoline goes from $3 per gallon to $30,000 per gallon in the same time.

There’s no way to keep a lid on that.

They simply credit bank accounts. It amounts to the same thing, though.

The question in my mind is whether the treasuries held by the Fed are considered part of the national debt.

But then, on that day, the Treasury will have to redeem the bonds at face value. Whereupon they will have to either get some money from the tax payers or borrow some money from folks interested in buying new bonds or sell new bonds to the Fed if all of the other bond buyers are demanding an interest rate that is outside of where the Treasury needs it to be.

Yes, the Treasury has to pay off bonds when they mature. Same as it ever was.

Whereupon they will have to either get some money from the tax payers or borrow some money from folks interested in buying new bonds

Yes, same as it ever was.

or sell new bonds to the Fed

The Treasury doesn't sell bonds directly to the Fed.

if all of the other bond buyers are demanding an interest rate that is outside of where the Treasury needs it to be.

You keep saying that. It doesn't matter what the Treasury "needs rates to be". They sell say $32 billion in 3 year Notes (tomorrow) and they may prefer rates stay near 1.25%, but if the bids are all at 1.5%, that's the rate.

All true. The Treasury does not sell the bonds to the Fed, it sells them to the Golemansax. The Golmemansax is not in the business of funding the Federal deficit so it resells the new bonds to its customers for a spread (as it is not an eleemosynary institution). The customers take the new bonds at the Golmansax price. But... The Ben Bernank is one of the customers and if the Ben Bernank doesn't show up and buy the new bonds from the Golmansax, the Golmansax is stuck with the new bonds because the Chinese, Russians, oilers and other investors won't take the new bonds at the bid plus spread interest rates. So... without the Ben Bernank buying the new bonds, the Golemansax is, well, to be profane... Skreeewed. they would become the funder of the American deficit if they can't sell the bonds at a profit.

Or any of the other Primary Dealers.

BNP Paribas Securities Corp.

Barclays Capital Inc.

Cantor Fitzgerald & Co.

Citigroup Global Markets Inc.

Credit Suisse Securities (USA) LLC

Daiwa Capital Markets America Inc.

Deutsche Bank Securities Inc.

Goldman, Sachs & Co.

HSBC Securities (USA) Inc.

Jefferies & Company, Inc.

J.P. Morgan Securities LLC

Merrill Lynch, Pierce, Fenner & Smith Incorporated

MF Global Inc.

Mizuho Securities USA Inc.

Morgan Stanley & Co. Incorporated

Nomura Securities International, Inc.

RBC Capital Markets, LLC

RBS Securities Inc.

SG Americas Securities, LLC

UBS Securities LLC.

So... without the Ben Bernank buying the new bonds, the Golemansax is, well, to be profane... Skreeewed.

Since the Treasury is going to sell over $1.5 trillion in new debt this fiscal year and the Fed is only planning on buying $600 billion, I guess 60% of the buyers are skreeewed.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.