Posted on 02/06/2011 6:27:17 PM PST by blam

Fed Holdings Of U.S. Treasuries Surpass China's

by: Doug Carey

February 06, 2011

A bit of recent news that hasn't gotten enough press is the fact that the Federal Reserve has surpassed China in total U.S. Treasury holdings and is now the largest holder of Treasuries in the world. As of last week, China held $896 billion of Treasuries while Japan held $877 billion. The Fed now holds $1.108 trillion and it has not even passed the halfway mark of its second round of money printing, which they call Quantitative Easing.

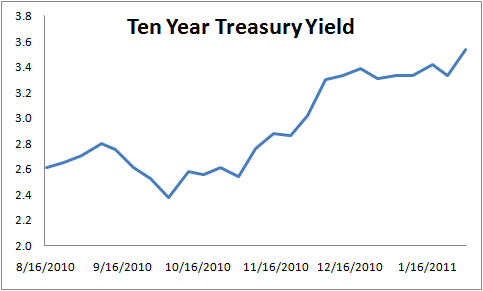

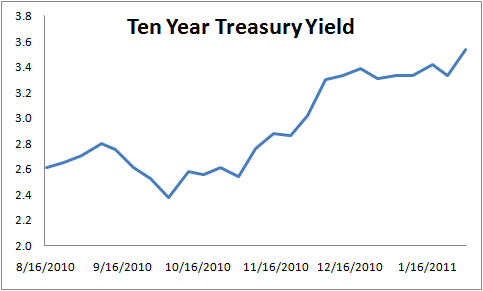

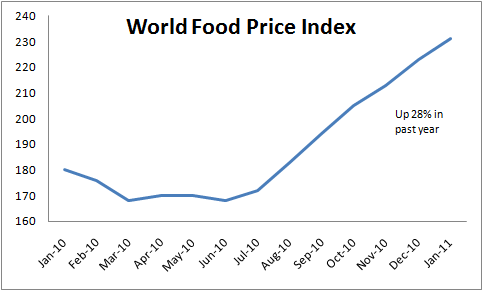

By June the Fed could own $1.6 trillion of Treasury bonds. The experiment that the Fed has embarked upon is simply unprecedented in this country. So far it has been an abysmal failure. Ten year treasury yields are nearly 120 basis points higher since the Fed announced their second round of Quantitative Easing just three months ago. Food inflation is raging throughout the world, even though Ben Bernanke denies any responsibility for it. Speculation is running rampant as to how much inflation the U.S. will export.

This is what fiat currencies and the printing of money bring: Rampant speculation and volatile prices. It is incredibly difficult to predict how the Fed’s printing will impact prices, so speculators are doing what they do: They’re jumping ahead of the curve and buying commodities before they all shoot through the roof.

Sugar is now at a 30 year high and cotton is at a 28 year high. Cotton has risen 100% in the past six months alone. All of this is happening while we’re supposed to be in a deflationary stage due to the credit collapse.

The Federal Reserve has been destroying our currency for nearly 100 years now. The dollar has lost 97% of its value since the Fed’s creation in 1913. But none of the Fed chairmen has been as bold as Ben Bernanke. What he is doing would have been impossible to fathom just three short years ago. It’s bad enough that the Fed is taking money from savers by holding short-term rates so low and giving it to the banks. To add insult to injury, the Fed debases the currency by printing trillions of dollars to prop up the government’s budget deficit. It is a terrible time to be a saver or to be living on a fixed income.

These are frightening times and it is prudent to prepare by owning gold and even stocks of companies that make things we truly need, such as food, water, and energy. The future depends partly on how much faith people lose in the dollar. A serious collapse of the dollar and hyperinflation likely won’t come from the physical printing of money itself. It will come from a breakdown of faith and confidence in our fiat system.

This is nothing but money laundering, a complete and total crime.

Thanks. That sounds more familiar.

All I know is that if this type of fiscal (ir)responsibility continues we'll be suckin' sand.

The Bond Vigilantes will have more control over events than the Fed, just as they did in the ‘70s. Once they decide that too many dollars have been created they will start selling long term Treasuries with a vengeance, sending long term rates soaring. The Fed has only a limited time that they can use their QE tool.

I think Greysard described your friend in post #27.

Yes, but under one of those shells...is nothing. Just like the other ones.

We’re all going to get our own personal unicorn that craps Skittle rainbows.

Why am I skeptical?

If the FED has crap on the books, when (Oh when?) will it be market to market and called speculative junk? ...

...Just curious....

RIGHT.

How much gas at $10 will anyone buy?

A local gas station doubled it’s prices early morning of 9/11. The only reason I know that is because a home health nurse was headed out early morning to see a patient and needed gas. Nobody else needed gas that bad and by late morning the jerks had dropped their prices back to where they were when they were bypassed by everyone else.

That’s about all we have to control prices.

Ah, a fan of Red Dwarf, I see.

Here on the Gulf Coast we have gouging laws for hurricanes. The locals mind their P's and Q's though...we've put local gougers out of business afterwards too, people boycott them.

The locals have actually realized that it is a good time to show that they are a part of the community by helping where they can, like free ice, water and etc during black-outs. One restaurant provided 1/2 off meals for relief workers that come from out of state.

Well... as P.T. Barnum once said... “There’s a sucker born every minute!”

Like a thirsty man drinking his own piss. Ain’t going to work.

Mutual funds and banks, mostly. Think about that. wipe the vomit off your shirt and buy gold. NOW...

Rolls of nickels could very well ave your life. Digital money may disappear but approximately 8-10% of money is paper and coin. Those who have paper and coin will be able to trade. Those with digital money will have to resort to barter or robbing those with paper money and coin. There will be nothing else to use until the next government issues some kind of new money... ugly times. So... rolls of nickels and pennies could save your life. keep the gold and silver for the remonitization.

Yup.

I guess there are many ways to say it, my old poker playing buddies have been saying for a couple years now that 'there's no peaceful way back from here.'

It does for a little while.(Same as this)

A bag of dried beans will get ya something.

A bowl of bean and bacon soup with corn bread, sliced fresh tomatoes and a glass of sweet Southern style tea will get you even more.(prepare now)

Hire bodyguards and a food taster.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.