Posted on 02/06/2011 6:27:17 PM PST by blam

Fed Holdings Of U.S. Treasuries Surpass China's

by: Doug Carey

February 06, 2011

A bit of recent news that hasn't gotten enough press is the fact that the Federal Reserve has surpassed China in total U.S. Treasury holdings and is now the largest holder of Treasuries in the world. As of last week, China held $896 billion of Treasuries while Japan held $877 billion. The Fed now holds $1.108 trillion and it has not even passed the halfway mark of its second round of money printing, which they call Quantitative Easing.

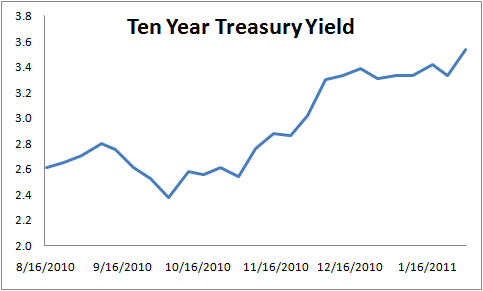

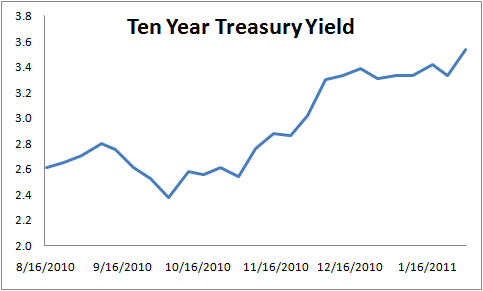

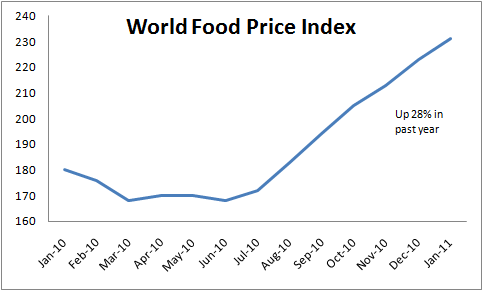

By June the Fed could own $1.6 trillion of Treasury bonds. The experiment that the Fed has embarked upon is simply unprecedented in this country. So far it has been an abysmal failure. Ten year treasury yields are nearly 120 basis points higher since the Fed announced their second round of Quantitative Easing just three months ago. Food inflation is raging throughout the world, even though Ben Bernanke denies any responsibility for it. Speculation is running rampant as to how much inflation the U.S. will export.

This is what fiat currencies and the printing of money bring: Rampant speculation and volatile prices. It is incredibly difficult to predict how the Fed’s printing will impact prices, so speculators are doing what they do: They’re jumping ahead of the curve and buying commodities before they all shoot through the roof.

Sugar is now at a 30 year high and cotton is at a 28 year high. Cotton has risen 100% in the past six months alone. All of this is happening while we’re supposed to be in a deflationary stage due to the credit collapse.

The Federal Reserve has been destroying our currency for nearly 100 years now. The dollar has lost 97% of its value since the Fed’s creation in 1913. But none of the Fed chairmen has been as bold as Ben Bernanke. What he is doing would have been impossible to fathom just three short years ago. It’s bad enough that the Fed is taking money from savers by holding short-term rates so low and giving it to the banks. To add insult to injury, the Fed debases the currency by printing trillions of dollars to prop up the government’s budget deficit. It is a terrible time to be a saver or to be living on a fixed income.

These are frightening times and it is prudent to prepare by owning gold and even stocks of companies that make things we truly need, such as food, water, and energy. The future depends partly on how much faith people lose in the dollar. A serious collapse of the dollar and hyperinflation likely won’t come from the physical printing of money itself. It will come from a breakdown of faith and confidence in our fiat system.

This is the best demonstration of the “reduction” I’ve seen. It’s only a minute and a half long.

http://www.youtube.com/watch?v=Yk_jToBbpWU&feature=youtube_gdata_player

Do they really print cash? I don’t think there is enough paper. We only have up to 100 dollar bills.

Yup. In this article:

That's great... it means we're rich!!! Treasury can use them to pay off the Social Security Trust Fund IOUS.

/s

Thanks, That is outrageously good!

That’s excellent. Very clear.

You are overly optimistic. The change of the value of the dollar has to propagate all the way through the chain, from that gas pump to the workers, to the company's product, to the product's user, to the money source of that user, and so on. If the chain ends as a government purchase then it may take years, and an act of Congress, to change the rates or at least allocate enough money so that the government can buy your product.

If the gas price goes to $10 then most smaller companies will simply close the doors because otherwise they'd be the buffer between low prices upstream and high prices downstream (that includes employees, materials, facilities, taxes and fees, services, etc.)

So today, for example, a container of a weed killer concentrate costs $40. It's expensive, but it's good for a large lawn. If suddenly this same container is now $80 ... guess what, I won't buy it. It's just too expensive. So the manufacturer of the chemical will see reduced sales; not only they can't raise salaries - they may be doing layoffs, since the volume of production is now smaller, and they have no use for so many people. And if every manufacturer raises their prices (what else can they do?) then those two things happen all over the country. Let me name them again:

Today some numbers were flying about Egypt - 40% unemployment and low ($12/day) salaries for those who have work. This is exactly what happens when the financial system starts failing.

“So, the Fed admits they hold more debt than China. Something just doesn’t add up; The US has 14 trillion of debt. According to this link -

http://www.treasury.gov/resource-center/data-chart-center/tic/Documents/mfh.txt

foreign governments hold about 4.5 trillion. that leaves almost 9 trillion. Who holds that?”

?

?

?

Great question!!!

Oh but the media keep saying how wonderful it is that the stock market is up!

Things will not end well.

EndofAmerica39.com

Yeah right and how much of that is actually recoverable?...

Steel has gone up 30%!

A friend of mine is currently fabricating 47k# per day with his contracts going way above that and it’s really smarting!

“Dismantling John Williams’ Hyperinflation Predictions”

The same argument could be said about this fellows motivation he’s just pushing a different product. Last year the Arab nations were talking about de-pegging from the dollar BTW. But I think they are not ready to do that and won’t be for at least a couple of years. Some food for thought...

You can lose your money pretty fast in the stock market and with all the big players using machines and the Feds interference it’s not a free market.

Then there is the hacking and seemingly insider tips to favored players.

Remember all the losses already to investors/pensions funds/401’ks because of toxic MBS’s being bundled in by banks knowingly.

And talk about Conspiracy Theory look at this guy’s...

Obama, Puppet of the Jewish Mafia (Part 1)

http://www.avaresearch.com/article_details-664.html

In either scenario one thing is clear we are going to have inflation the amount and the degree is what seems to be the difference. So if what this guy says would be true cash might be king. Do you remember the high interest rates that followed the inflation of the late 1970’s early 80’s?

I don’t agree with his assessment of our economy either. I think it is worse then he does. Things have changed dramatically with all the job losses and wages. So many have fallen off the unemployment roles and many other’s have only part time low paying jobs now. In the current environment and with most of our manufacturing gone I don’t see that changing for a long time. We are beginning to have quite an underclass of our own.

Since inflation is the common theme of both pieces people would be wise to prepare. I personally believe it will be bad and something this author does not take into account is the unrest spreading around the world. Since we are really broke already and China is not buying our debt anymore how long will the Fed. continue to monetize our debt without tax hikes and cut backs? If they do cut backs and we still don’t have jobs how long before civil unrest here?

Another thing that is very clear is the fact that our government and politicians are corrupt. We won’t change anything until we find a way to elect our own people instead of the people put in front of us by the media. They are all working for somebody else.

Hmmmmmmmmm

Isn’t it still just funny money . . . a vast shell game?

Priming the pump.

There are jobs, they just aren’t here. Commodity demand is coming from outside the country.

Yes. I bought a new house in 1980 with a 13% interest mortgage...my neighbor bought his at 17%.

"Since inflation is the common theme of both pieces people would be wise to prepare.

Thanks. I noticed that too and agree.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.