Posted on 02/06/2011 6:27:17 PM PST by blam

Fed Holdings Of U.S. Treasuries Surpass China's

by: Doug Carey

February 06, 2011

A bit of recent news that hasn't gotten enough press is the fact that the Federal Reserve has surpassed China in total U.S. Treasury holdings and is now the largest holder of Treasuries in the world. As of last week, China held $896 billion of Treasuries while Japan held $877 billion. The Fed now holds $1.108 trillion and it has not even passed the halfway mark of its second round of money printing, which they call Quantitative Easing.

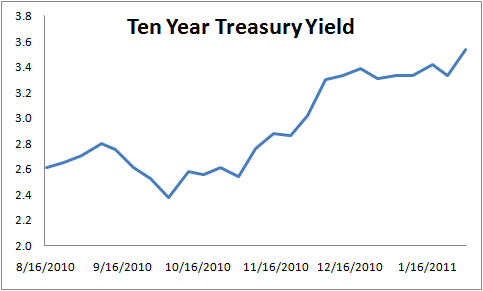

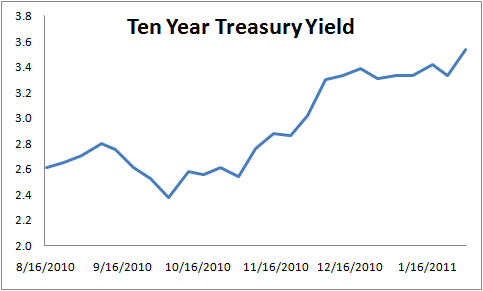

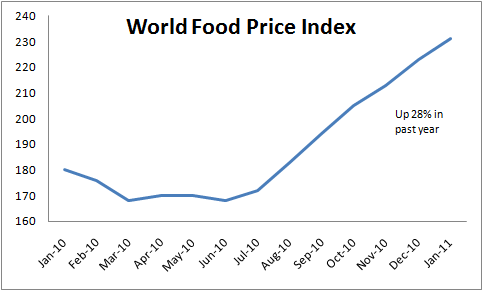

By June the Fed could own $1.6 trillion of Treasury bonds. The experiment that the Fed has embarked upon is simply unprecedented in this country. So far it has been an abysmal failure. Ten year treasury yields are nearly 120 basis points higher since the Fed announced their second round of Quantitative Easing just three months ago. Food inflation is raging throughout the world, even though Ben Bernanke denies any responsibility for it. Speculation is running rampant as to how much inflation the U.S. will export.

This is what fiat currencies and the printing of money bring: Rampant speculation and volatile prices. It is incredibly difficult to predict how the Fed’s printing will impact prices, so speculators are doing what they do: They’re jumping ahead of the curve and buying commodities before they all shoot through the roof.

Sugar is now at a 30 year high and cotton is at a 28 year high. Cotton has risen 100% in the past six months alone. All of this is happening while we’re supposed to be in a deflationary stage due to the credit collapse.

The Federal Reserve has been destroying our currency for nearly 100 years now. The dollar has lost 97% of its value since the Fed’s creation in 1913. But none of the Fed chairmen has been as bold as Ben Bernanke. What he is doing would have been impossible to fathom just three short years ago. It’s bad enough that the Fed is taking money from savers by holding short-term rates so low and giving it to the banks. To add insult to injury, the Fed debases the currency by printing trillions of dollars to prop up the government’s budget deficit. It is a terrible time to be a saver or to be living on a fixed income.

These are frightening times and it is prudent to prepare by owning gold and even stocks of companies that make things we truly need, such as food, water, and energy. The future depends partly on how much faith people lose in the dollar. A serious collapse of the dollar and hyperinflation likely won’t come from the physical printing of money itself. It will come from a breakdown of faith and confidence in our fiat system.

I am confused I thought China/Russia was our federal government?

The ‘reset’ is fast approaching.

Yes, but that is just another way of saying they’ve printed a lot of money. They print money, and they buy treasuries with it.

And THAT, unlike the slow propagation of freshly printed bank notes through the economy, can occur in a matter of hours.

We are so screwed.

FROM ABOVE :"A bit of recent news that hasn't gotten enough press is the fact that the Federal Reserve has surpassed China in total U.S. Treasury holdings and is now the largest holder of Treasuries in the world. As of last week, China held $896 billion of Treasuries while Japan held $877 billion. The Fed now holds $1.108 trillion and it has not even passed the halfway mark of its second round of money printing, which they call Quantitative Easing."

And the MSM says it's world demand driving up prices. Yep, how is our demand going up with so few new jobs being created?

Pardon my economical ignorance on this topic...but idn't this also known as "pumping the cow"?

Or some similar term for increasing the monetary supply by means other than normal.

The wage setting mechanism in America is too rigid. If gasoline went up to $10 a gallon, how long would it take most HR offices to deal with the demands from frantic workers? MONTHS.

Good. Now’s a good time to end the FED.

Your linked article is full of fallacies. Jason Hommel became a gold and silver dealer in order to get more people into that asset, it’s true, but he holds a large personal position in that asset himself, contrary to one of the opening claims. That anyone trades around a core long position does not refute the fact they think prices will be much higher in the future.

Good grief.

Are you talking about the one in post #2?

I posted that because I do want comments about it.

Everyone on this site has always had good things to say about John Williams and his organization (ShadowStats). I'd like comments about that article. Thanks.

That’s what I’m thinking. NIA says 2015. I don’t see how the Marxists in power can wait that long. They MUST make their move before the next election.

United States Free Enterprise, INC.

INVOICE

Capital, Goods and Services stolen and extorted by the Peoples Republic of China

FDI, Intellectual Property, technology, know how . . . . . . . . . . . . . . .$ 2,377,000,000,000.00

Payments received from the Peoples Republic of China . . . . . . . . . . .$ 0,877,000,000,000.00

Amount due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$ 1,500,000,000,000.00

Your Treasury certificates are your payment receipts. Thank you.

So, the Fed admits they hold more debt than China. Something just doesn’t add up; The US has 14 trillion of debt. According to this link -

http://www.treasury.gov/resource-center/data-chart-center/tic/Documents/mfh.txt

foreign governments hold about 4.5 trillion. that leaves almost 9 trillion. Who holds that?

We got screwed 98 years ago when the Federal Reserve was "invented."

Not everyone thinks that is a BAD thing.

It's a certain Community Organizer's fondest dream, to be able to destroy the Great Satan.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.