And then in the last 50 years ... bang-zoom! Can't wait for gov't h/c ...

Posted on 01/01/2011 9:21:45 AM PST by DeaconBenjamin

The United States Postal Service announced this week that all future first class postage stamps sold will be the so-called "forever stamps" that have no face value but are guaranteed to cover the cost of mailing a first class letter, regardless of how high that cost may rise in the future. Currently these stamps are sold for 44 cents, but will increase in price if and when the Post Office hikes rates.

Apart from sounding the death knell of the one cent stamp, the news is interesting on two fronts: it provides insight into remarkably irresponsible government accounting, and it provides investors with the most attractive Federally-guaranteed inflation protected asset available on the market today.

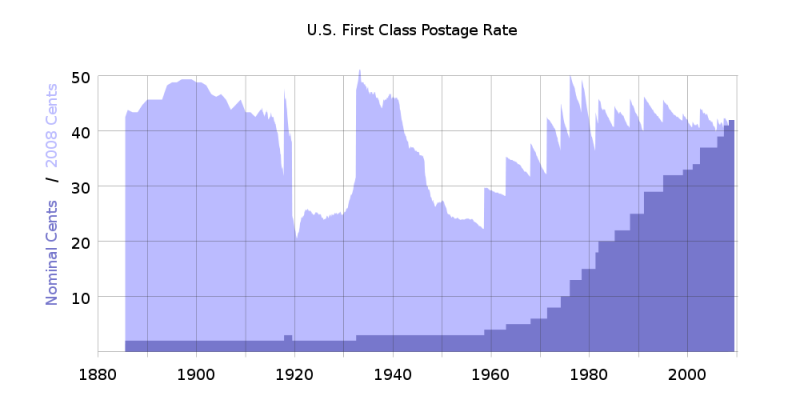

Over the past fifty years, the USPS has raised the rates on first class postage 20 times. During that time the stamp prices have gone up more than 1,100%. Given the increasing frequency of rate hikes (three in the last four years) the Post Office claims it made the move to forever stamps to save money on printing costs and to increase customer convenience. The public seems to appreciate the product and has snapped up a staggering 28 billion forever stamps since they became available in 2007.

But the real reason behind the permanent switch is that it allows the Post Office to hide its insolvency behind phony accounting numbers, setting itself up for a massive taxpayer financed bailout in the not too distant future.

Much the way Greece used phony accounting to qualify for euro zone inclusion, the USPS is using creative accounting to avoid making significant cuts in current wages and benefits. By offering forever stamps, the Post Office moves forward future revenues to pay current expenses. But every forever stamp sold today represents a stamp not sold in the future. The revenues booked now will not be put in escrow to deal with revenue shortfalls that are guaranteed to plague the Post Office in the years ahead. This simply kicks farther down the road any intractable fiscal problems that the USPS can't solve through more conventional means.

The Post Office also ignores that their ability to sell higher priced forever stamps in the future will be restricted. Those individuals and institutions who hoard the stamps now could offer them for sale in competition with the Post Office. Even though the Post Office will not redeem forever stamps for cash, there is no law against reselling them for whatever price the market will bear. How many forever stamps will the Post Office be able to sell at full price if customers can buy them at a discount on Ebay?

On that note, forever stamps provide the most conservative investors with a much more attractive alternative to zero interest checking accounts, low yielding Treasury bonds, or even inflation protected government securities (known as TIPS).

Given these stamps will always be completely liquid, the only way an investor can lose money on forever stamps is if the price of postage goes down. There may not be a single human on the planet who thinks that this is a likely scenario. On the other hand, if postage rates rise with inflation then the stamps are a very, very safe bet.

And unlike Treasury bonds or TIPS, investors do not have to pay a premium above face value for the privilege of buying stamps. While it is true that stamps do not pay interest, the extremely low rate offered by government securities should not fundamentally alter the investment calculations comparing bonds with stamps. More significantly, stamps are backed by an actual tangible service, postal delivery, whereas U.S. Treasury debt is backed by nothing but a printing press.

Forever stamps are about as close to a sure thing as most people will ever get. Over the past 10 years stamps are up 29%, while the S&P 500 is up a measly .1%. With labor and other costs continuing to mount inside the Post Office, there can be little doubt that many price hikes are coming. Minimum investment in forever stamps is just 44 cents, with no brokerage fees. Plus as an added bonus, if you use the stamps yourself, you pay no income tax on your capital gains.

Sure, without a federal bailout there is a chance the Post Office will go under, and those forever stamps will end up lining bird cages. However, given the track record of government bailouts and the clout of unionized postal workers, chances are very high that the Post Office will always get the bailouts it needs. As a result, forever stamps are a better bet than Treasury debt. They also have prettier pictures.

The basis for this is the Postal Accountability and Enhancement Act, which keeps rate increases below inflation. The first forever stamps came out right after President Bush signed it, and this is the way the USPS can tie their fortunes to what they can charge. Many other countries have already gone this route.

It’s not so much a sign of the USPS but of the overall situation. But if you’d bought stamps with a set denomination, that amount would have been victim to inflation and more postage would have been required. You get a better deal now buying a first class stamp than you would have back in the 1970s—or by using old stamps on it (very expensive, as you lose all the inflation benefits).

With inflation adjustments, first-class letter postage is about 10-15% lower in cost than back then.

This is a massive unauthorized LOAN.

You can already buy forever stamps at a discount on Ebay. Shop now (enter "forever stamps") and among other offers you'll find a "Buy it now" price of $2 for 5 stamps with free shipping.

Or decree that the "Forever" stamp is only worth 45 cents when they hike rates again, and force people to buy 1 cent or 5 cent stamps to make up the rate hike.

I think that a well run government should have a government-run postal system that provides security in the form of the US police and military, rather than having to rely on private couriers alone. There should be no complaints about competition from private groups, and no more stupid sponsorships of biking teams, etc., though.

Don’t these stamps represent a future service obligation to the USPS? The stamp you buy today for 44 cents will be valid for postage even if the rate for a first class stamp goes to over a dollar or more. If presumably the rate for a first class stamp is related to the cost of delivery, the USPS would be delivering letters using the forever stamp at a significant loss. Granted the revenue from these stamps could be held in escrow at interest, but the cost of delivery has gone up at rates far above current interest rates.

If it gets so bad that the government puts unique RFID chips tagged to the postage purchaser's history to usage, we've already got chips up our own (pick a creative term here).

“During that time the stamp prices have gone up more than 1,100%”

Still sending a letter under $0.50 anywhere in USA is pretty cheap. USPS has been hit hard by the internet (online billing, emails etc), and the e-commerce hasn’t picked up the slack. They have to use their infrastructure to compete with Fedex and USPS.

Are there any 401K plans with a Forever Stamp fund?

It strikes me that way, of course, but I am conservative in my financial dealings. People are calling for the USPS to operate like a business. Well, a private business is not required to put gift-certificate proceeds into escrow.

In fact, by suggesting people buy postage in large quantities in advance, it increases the chance that some will be lost. Every lost or destroyed stamp is revenue without obligation*, or nearly pure profit, if we figure a replacement stamp will be needed. So "every forever stamp sold today represents a stamp not sold in the future" is not technically correct and I'd be willing to bet that difference is significant.

This was a lame-duck thing from the Republican Congress of 2006 after they were voted out of office, IIRC. It was signed by George W. Bush a little over four years ago.

And the costs of the stupid Sarbanes-Oxley Act are also dumped on the USPS now, just like for businesses. I know how much SOX has bled businesses I work with, so I can only imagine the costs to the USPS.

*I'm not sure if those terms are the appropriate jargon, but I'm not trying to use them in a technical sense--I'm not an accountant, etc..

They reduce handling costs tremendously, and you no longer have to teach people how to count to use them. That task can be left to the public schools and institutions!

I didn't see Mr. Schiff making the point explicitly, but the idea is that the stamps become a commodity that is highly liquid, almost and in extremis an alternate currency.

So the idea will be to hold and trade the stamps, not primarily to use them for postage.

Derivative markets could even be created for the forever stamp. True, there would be a risk of organized markets in these things going south (along with all other organized capital exchange), but this is probably on the same order of risk as the Post Office itself going out of business or repudiating the stamps.

The situation seems exactly analogous to gold and silver coins.

Right. There is no reason for the government to be propping up the post office. My mail is never delivered in the morning and once didn’t get here before 6PM last week.

If the local liberal rag had the franchise, my mail could have been here before daylight in a plastic bag on my lawn.

lol.

The post office spent many millions on magazine sorting machines that sit unused because the unions didn’t want to lose their jobs.

Are you talking back in 1975 for the A-series, or the UK permanent NVIs in the 80s?

BTW, make as much sense as the ONE PRICE PRIORITY MAIL or EXPRESS MAIL cartons.

It's funny that we're gone back to NVIs after so many of us used them in our childhood playing "post office". But with the economy the way it is, it makes sense.

After spending some time there, I'd say that's certainly an interesting category of eBay. There are folks selling single stamps near face value with free shipping. WTF?? And they have thousands of positive feedback transactions so this is definitely legit.

It's amazing to see that long stable time from the 1930s to nearly the 1960s, as inflation slowly dropped the cost of postage.

Can't argue but I would imagine labor costs consume most of the increases - certainly over the last 10 years, probably the last 30.

It's certainly would make sense, as that and fuel and compliance are some of the major increases for similar businesses, I imagine.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.