Posted on 09/30/2010 3:02:13 PM PDT by blam

Rail Traffic Continues To Rise

by: Todd Sullivan

September 30, 2010

Total North American rail traffic rose to 692.5k cars last week making it the best week in the past two years. When we combine this with what we are seeing in temporary employment trends, the two data points back the view I hold that not only is a “double dip” not likely, but now becoming a highly remote scenario.

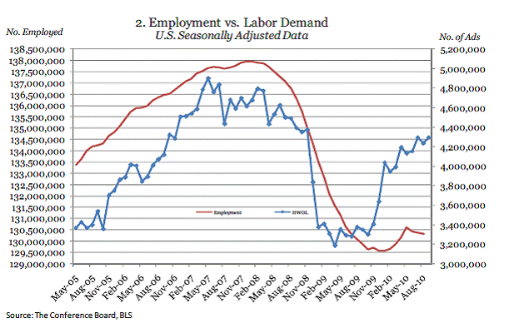

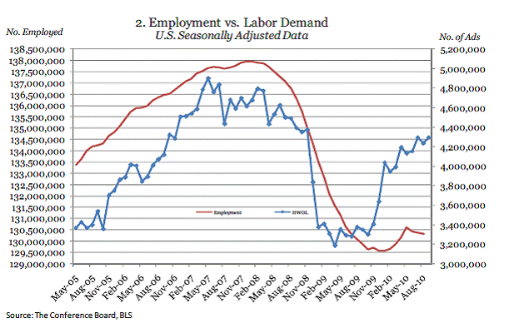

Also, The Conference Board Help Wanted Online Index continues to trend higher with a Sept 2010 gain of 59,900. Fears that the economy is not in recovery or is stalling or is doing something else other than recovering are misplaced with this type of data. Demand tends to start slowly and then it accelerates exponentially until most recognize that the economy has recovered. (Click to enlarge)

The growing gap here may be the unintended consequence of extending unemployment benefits seemingly indefinately. It becomes advantageous in many cases to remain unemployed rather than go back to work.

What could derail the recovery? Trade war, letting all tax cuts expire or large scale natural disaster. In other worlds policy makers do something unfathomably stupid (not totally out of the question) or we get the old “act of god.” So barring a man made or natural disaster, things should continue on a steady but unspectacular path.

Note: Be careful looking at the “rate of YOY change” going forward in economic results. Remember Q3 and Q4 2009 GDP rose 3% and 5%, respectively. While absolute number will continue to rise, the “rate of change” ought to fall. That will make the graphs that measure that data point look like they are going the wrong direction and give the doomsday crowd (Rosenberg, Roubini et al) ammo to tell us everything is going to shit. So I expect the rate of change to fall while the base YOY numbers keep rising. As usual expect slowdown in the fall around Holiday weeks, normal and no need to panic.

I would expect Q3 GDP to be released Oct 29th to be in the 2.25%+ range (I have no idea what the current guesstimates are) simply based on the data I get from these. Import/Export number had a huge effect on Q2 GDP so they are a wild card. If their effect is somewhat normal, things should look pretty good.

Here is the chart:

Rail traffic is probably picking up as stores stock for the holidays picking up goods from the increased deliveries at the ports from (where else) China.

Whether anyone buys is quite another thing entirely.

From today's AAR weekly carloading report:

For the first 38 weeks of 2010, U.S. railroads reported cumulative volume of 10,828,835 carloads, up 7.2 percent from 2009, but down 12.3 percent from 2008, and 8,182,454 trailers or containers, up 14.7 percent from 2009, but down 4.7 percent from 2008.

Choo choo ping.

Meaningless without a breakdown. For example, subsidized ethanol production results in increased rail traffic, moving corn, ethanol, ddgs, etc, but doesn’t make the economy stronger. Cost-cutters may be switching from trucks or airlines to rail for certain items and passengers.

Willie is not interested in private enterprise freight railroading... only passenger highspeed maglevs built with billions of taxpayer dollars.

Grain is early this year and crops are good + exports are at highs due to Russian crop failures, and Canadian pullback in exports. Rail is used to hit ports.

Not saying that this is wholly the reason for the overall increase in volume, but to your point, there are a lot of factors outside economic health, that influence the gross volumes.

It’s one indicator in a basket of indicators - and the devil is in the details.

Willie wants the private invested, tax paying, money making freight rail road companies off their lines for Willie’s Latte sipping, tax eating, for ever subsidized yuppie EuroWeenie trains.

Hmmm, hard to see on the graph how this compares to pre-recession numbers. I would also need to see this in comparison with trucking numbers.

I read the other day that trucking numbers are down. This could simply be a shift from faster but more expensive trucks, to slower but cheaper rail.

I don’t think a lot of consumer goods mover by rail, but I could be wrong. I’d love to know what is filling those cars. Not agricultural, not consumer goods, so what is it? Gravel and coal?

Willie is not interested in private enterprise freight railroading... only passenger highspeed maglevs built with billions of taxpayer dollars.

Freight shipments were a better indicator of economic activity 25~30 years ago when a greater proportion of the service was for domestic shipments for our manufacturing sector.

But there's been a drastic shift in the industry. As our manufacturing sector has been undermined by our dismally self-destructive trade policies, the railway network has also been downsized. I don't have the figures at my fingertips, but I believe that over 40% of our tracks have been shed and abandoned.

Nowadays freight is primarily bulk shipment of imported goods, and shipment of coal to power plants. So rail/freight shipments really don't reflect economic vibrancy the way they once did.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.