Posted on 06/19/2010 1:44:27 PM PDT by SeekAndFind

Foreign governments have been getting in on the recent gold rush, driven by continued fears about Europe's debt crisis and the pace of the global economic recovery.

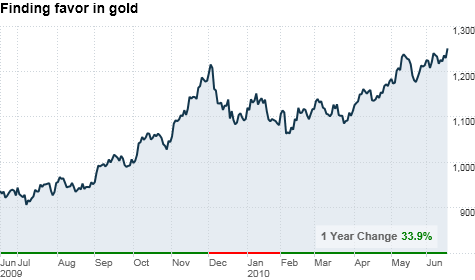

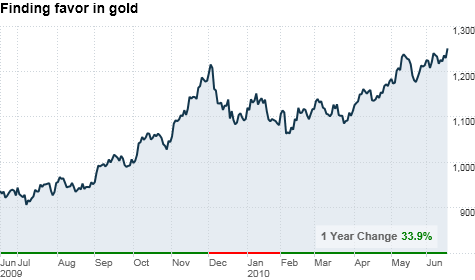

Those concerns have been propelling the precious metal to record highs over the past 18 months. In fact, gold posted a new intra-day high Friday, when it reached $1,260.90 an ounce. A day earlier, it reached a fresh record high closing price of $1,248.70 an ounce.

Last year, foreign central banks were net buyers of gold for the first time since 1997. India, China and Russia have been the biggest buyers. And more recently, the Philippines and Kazakhstan jumped into the fray with big purchases of the precious metal during the first quarter, according to data released by the World Gold Council Thursday. What's behind the buying binge?

Each country has its own unique reasons, but there are a few broad trends that unite them all, said Natalie Dempster, director of government affairs for the World Gold Council.

Like many individual investors, foreign governments prefer to spread their wealth around to decrease their risk.

The U.S. dollar is typically the main reserve asset because it's considered to be more stable than other holdings, while the euro comes in as the second most popular reserve currency. But gold is not far behind. The precious metal plays an important role as a hedge against inflation, which could devalue paper currencies.

Unlike paper currencies, gold has a tangible value and that value is not dependent on any one country's economic policies.

(Excerpt) Read more at money.cnn.com ...

Cue the silly “ya can’t eat gold” comments....

I am willing to bet someone will recommend buying guns and bullets instead. Everytime the subject of gold price is mentioned, this ALWAYS come out.

Never have understood the emotional reaction to an investment position.

You know what would be funny as all get out? If after years of trying to do so, somebody actually figured out an inexpensive way to separate gold from seawater. Like those bright boys who have figured out how to make large, gem quality diamonds in garbage can sized machines.

And then they quietly built up a reserve of hundreds of tons of gold.

Of course, if anyone knew about it, the price of gold would plummet. So they would have to trickle it out.

Goldbug ping

Mail me to get on or off the Free Republic Goldbug Ping List.

Many years ago I read a short science fiction story on exactly this phenomenon. At the end of the story, after the big chase, the machine falls out of a boat in the middle of the ocean. The all-knowing "voice" of the story informs us that somewhere at the bottom of the sea, the pile of pure gold particles slowly grows and grows.

Up until now, this has been impractical, because there are only a few molecules of gold in seawater. A much better place to look is in river deltas, since ordinary dredging can often turn up substantial amounts (relatively speaking) of gold.

Already, a new class of water filter has been made with nanotubes just large enough to pass single molecules of water, using far less energy than typical osmosis.

So what would be needed would be to use a series of passive filters. That would only pass molecules smaller than Rhenium.

Placed on the bottom of the ocean, the natural pressure would force a great deal of water through the first filter, with Rhenium and larger molecules blocked and precipitating. Once they were concentrated, sorting them out into the valuable elements would not be much hassle at all.

The biggest problem would be filtering out organic matter which would clog the system.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.