Posted on 06/07/2010 7:40:17 PM PDT by blam

Arthur Laffer Is So Full Of It -- Here's What Tax Cuts Really Do To The Economy

Asha Bangalore, Northern Trust

Jun. 7, 2010, 9:20 PM

In the post below, Asha Bangalore of Northern Trust responds to Art Laffer's WSJ op-ed demanding more tax cuts. The title above, of course, is ours (Asha's far too professional and polite for a title like that). Asha's title is "Missing Elements" of Mr. Laffer's Incomplete Story.

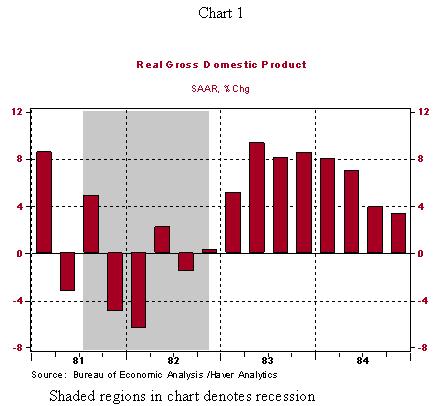

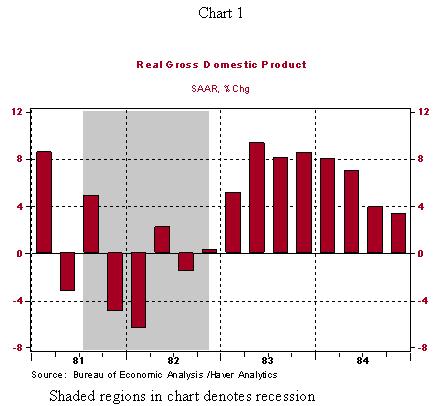

Mr. Laffer illustrates his arguments about tax cuts and the positive impact on economic growth with the Reagan tax cut experience (see chart 1, replication of chart in Mr. Laffer's article) in today's Wall Street Journal (Arthur Laffer: Tax Hikes and the 2011 Economic Collapse - WSJ.com) and he predicts a dire economic situation if the Bush tax cuts are allowed to expire at the close of 2010.

Stepping forward from Laffer's utopic economic era, why did the economy post noticeable growth after tax increases were implemented in 1993? The recession ended in March 1991 and the banking system was beset with issues, which delayed the robust recovery until later. A revival of bank lending led to the self-sustained growth witnessed despite the tax increases instituted in 1993 by the Clinton administration. If Laffer's thesis about tax cuts is valid, why did the U.S. economy record the weakest period of economic expansion following the Bush tax cuts of 2001 and 2003? The evidence from tax cuts is essentially not as strong as Mr. Laffer's leads the reader to believe...

[snip]

(Excerpt) Read more at businessinsider.com ...

The tax increases of 1993 were moderated by a number of factors including stock options and subchapter S corporations. The rise of the internet and continuation of high growth in computing was more than enough to offset tax increases. A tax increase in a growing economy is different than a tax increase in a stagnant economy. It is not just increased taxes now. It is a huge new regulatory burden, global competition on white collar work now, and huge increases in government spending now that were not present in 1993.

Don’t forget that the tax rebates that he bragged about over and over again that put “money in the hands of consumers” expired immediately had no long term effect on the economy except to put us further in debt. Of course they had to keep going back to the well and got multiple rebates because they didn’t work.

Laffer makes sense.

7. Competition with Chinese slave labor companies

Uncertainty kills economies.

Uncertainty kills economies.

You could have saved a little more of your life by not even typing that whine to me.

Two words: media hype. I don't believe the economic gains were real.

Clinton crapped all over that economy in 1999 by sending his energy secretary to Saudi Arabia to "fix" the economy that was booming with $10/barrel oil. Shortly after the visit, oil jumped to $38/barrel. The economy went on the skids. No cheap oil, no booming economy. Screwed up just in time to pass along a crappy result to his successor...George Bush. The attack on the WTC further nailed the economy. It was the Bush tax cuts of 2004 that revived the economy...at least until the Democrats seized the House and Senate in 2006. That was the end of recovery. It has been downhill since.

How DARE you speak the truth in a public forum!

Actually, the effect is already observable. Businesses are limiting hiring in anticipation of the higher tax rates. When they actually expire, the drop in disposable income will cause more layoffs and closings. Those who are still employed right now are making as much hay as possible before the tax hikes screw things up.

Sorry. I'll try to contain myself in the future.

I used to post almost exclusively archaeological/anthropology articles for many years. I took so many 'hits' from the really religious folks that I quit posting for a year and nearly quit Free Republic completely.

I've recently begun posting (again) about economics, finance and investing and frankly don't know much about this area and learn much from the comments that folks post on these threads.(I'm a retired chip-maker)

I do post some articles that some people think are screwy and two minutes later someone is complimenting me on posting such a wonderful article, the same article. (How can that be?)

It is really discouraging when people like you jump up and down and complain when all you have to do is not read the article.

I don't know why or how you benefit by complaining as you do?

If you go over to the UFO threads, you'll never see my name (ever) on one of those threads...even to complain. You see I don't believe in UFO's but, it's okay by me if some people do and I don't feel the need to harrass them about it.

So, will you please stop whining on the threads I post?

Thank You.

(He must have an IQ of at *least* 460...)

Cheers!

SEPTEMBER 22, 2009 - Taxes, Depression, and Our Current Troubles - Arthur Laffer

Tariffs, rising state and federal taxes, and currency devaluation ruined the 1930s, and they could do the same today. http://online.wsj.com/article/SB10001424052970203440104574402822202944230.html?mod=rss_opinion_main

Despite the headlines, the Bush tax cuts frankly were rather puny for ordinary Americans (except large investors in dividend-bearing stocks and a few other politically favored categories). The tremendous malinvestment attendant to the dot-com bubble (peaked 1999) took some time to unwind. People sank huge amounts of money in non-profitable Internet ventures and relied upon the presumption that those investments would not diminish in worth. The economy has been in long-term decline since the 1973 oil bust (seriously).

The economy of 1999-2005 featured all of the following maladies:

* Bursts of price inflation, occasionally severe in 2000 and 2004/2005, interspersed with a period of cratering prices in 2001/2002.

* Energy crises, especially in California, which lacks adequate electricity, and the oil production ceiling in 2004/2005, and in natural gas in the unusually frigid 2000/2001 winter.

* Corporate accounting scandals and scandalously complicated legislation ostensibly intended to prevent them

* Restructuring of employment and skills of the labor force after the end of the dot-com bubble.

* The maturation of the Internet as a communication and commercial tool.

* Upheaval in the telecommunications sector, largely resulting from the Internet revolution and the popping of the dot-com bubble.

* Escalating costs in the overwhelmingly government-controlled education and health-care sectors.

The following factors, then evident, still now continue to drive the economy toward semi-permanent stagnation:

* Increasingly emasculating regulatory state, drastically curtailing industrial production, masked in the 1990s by the dot-com bubble with growth in largely unregulated technologies.

* Demographic trends, especially a lack of children and an excess of elderly. This factor proves especially severe in certain parts of the country. An increasing, youthful population provides a natural mechanism for economic expansion. As children age, they marry, procreate, and form new households, driving demand for goods and services. The elderly, however, increasingly exit the free-market system and find themselves in Medicare and Social Security.

That is so true!

Reagan spent a lot of money in the 1980s to build up the military and push the Soviet Union into oblivion. This raised the deficit. In 1991, victory in the first Gulf War showed the overwhelming superiority of American technology and military might. The Soviet Union collapsed in short order, ending the Cold War and leaving the USA the world’s lone super power, and with a secure source of energy in the ME.

Clinton lucked into this and got to spend the “peace dividend” given to him by Reagan and Bush the Elder.

It ain’t rocket science. Libs like to forget what led up to Clinton’s glory years.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.