Skip to comments.

Why I Don't Trust Gold

Wall Street Journal ^

| 05/27/2010

| Brett Arends

Posted on 05/27/2010 6:47:03 AM PDT by SeekAndFind

This is a very sad day for me.

In Part One of this series, when I argued that gold might be about to go vertical, I made a whole bunch of new friends among the gold bugs.

And now I'm going to lose them all.

That's because even though I think gold might be about to take off, I don't recommend you rush out and put all your money into gold bars or exchange-traded funds that hold bullion.

And this is for one simple reason: At some levels, gold, as an investment, is absolutely ridiculous.

Warren Buffett put it well. "Gold gets dug out of the ground in Africa, or someplace," he said. "Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head."

And that's not the half of it.

Gold is volatile. It's hard to value. It generates no income.

Yes, it's a "hard asset," but so are lots of other things—like land, bags of rice, even bottled water.

It's a currency "substitute," but it's useless. In prison, at least, they use cigarettes: If all else fails, they can smoke them. Imagine a bunch of health nuts in a nonsmoking "facility" still trying to settle their debts with cigarettes. That's gold. It doesn't make sense.

As for being a "store of value," anyone who bought gold in the late 1970s and held on lost nearly all their purchasing power over the next 20 years.

I get worried when I see people plunging heavily into gold at $1,200 an ounce. What if the price goes back to where it was just a few years ago, at $500 or $600 an ounce? Will you buy more? Sell?

(Excerpt) Read more at online.wsj.com ...

TOPICS: Business/Economy; Culture/Society; Editorial; News/Current Events

KEYWORDS: currency; gold; goldbuggery; inflation; usdollar

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-116 next last

To: Terry Mross

Silver would be a good semi-liquid investment, gold a better hedge investment, but neither is what you should focus on.

To: SeekAndFind

Gold is volatile. It's hard to value. It generates no income.If you bought gold at $400 an ounce as I did five or six years ago, you're in good shape. I have some vintage gold coins purchased at $1200 on average, now worth over $3000 each. My only regret is that I didn't buy more.

82

posted on

05/27/2010 9:01:52 AM PDT

by

BluH2o

To: OB1kNOb

WW2 Nazi took gold fillings along with all their conquered loot to Switzerland. Gold fillings used to be burial insurance payments. Did they realize a return on their investment?

83

posted on

05/27/2010 9:02:48 AM PDT

by

Broker

(Stranger in a very strange land.)

To: SeekAndFind; sickoflibs; stephenjohnbanker; NFHale; hiredhand

talkin to an ole timer last nite that lived thru the last depression...’nobody had ANY money...even the millionaires were hurtin, they mightve had $10 mil in land [or gold] but it was vitually worthless if nobody could afford to buy it’...

84

posted on

05/27/2010 9:03:50 AM PDT

by

Gilbo_3

(Gov is not reason; not eloquent; its force.Like fire,a dangerous servant & master. George Washington)

To: Anitius Severinus Boethius

Why would a starving man trade you a loaf of bread for your yellow coinIt's not the starving man that would have the loaf of bread to sell. It would be a farmer or a baker. The starving man is the one with no resources to obtain the bread. The Baker would use the gold coin to obtain flour from a farmer and wood or other fuel for his ovens. He'd also want clothing and shoes for his family.

My ancesters, parents, grandparents and some great grandparents, did not starve during the depression. They were farmers. They sold to whover had money, but they ate what they needed first, then sold the surplus.

My paternal grandmother was (effectively) a single Mom with 3 very close together children. But her parents, and siblings were farmers. Her family didn't starve either, but they did work on the family's farms, and she worked in other peoples houses, cooking cleaning and doing whatever they did not want to, or could not, do for themselves.

85

posted on

05/27/2010 9:05:48 AM PDT

by

El Gato

("The second amendment is the reset button of the US constitution"-Doug McKay)

To: Anitius Severinus Boethius

“If there is a complete collapse to the extent that many pushing gold are indicating, then gold will become just as useless as paper money. Food, shelter, and labor will be the modes of trade, not anything with “monetary” value.”

And if things get that bad, your food won’t last that long when the mobs are at your doorstep and your ammo is useless because you’re out gunned.

And paper money never becomes useless, it’s value just gets diluted in an inflationary crisis. Money is still out there, it’s just a matter of who’s hands it’s in, who has it and who doesn’t. You may get a million diluted dollars for your Gold coin, but you’ll never have any problem exchanging it to purchase food or other items.

To: El Gato

Silver would be better than gold in that circumstance. Those that are pushing gold are not talking about the great depression, though, they are talking about a “collapse” where fiat money is worthless.

Your grandparents used paper (fiat) money to survive the depression.

To: highlander_UW

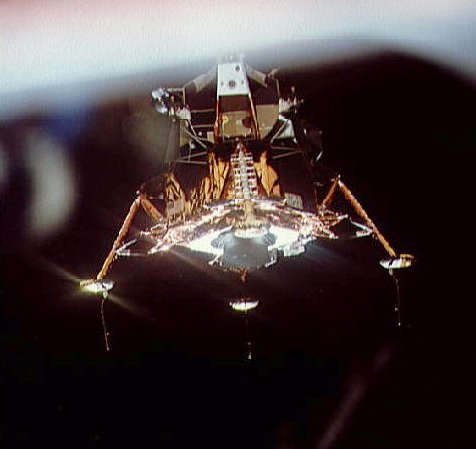

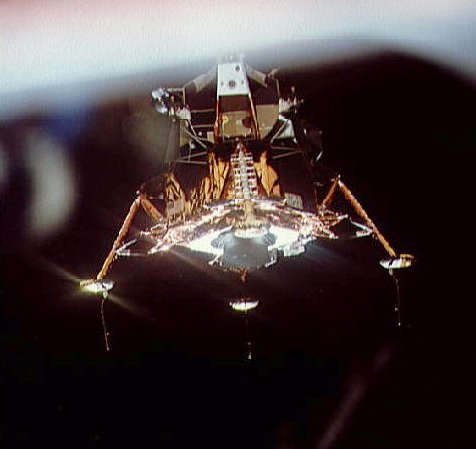

Warren Buffett put it well. "Gold gets dug out of the ground in Africa, or someplace," he said. "Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head." Presumably as they peer around the edges of the gold foil blanket shielding their TEM (Terran Excursion Module).

Gold has lots of industrial uses, as well as being a medium of exchange. It's used in the leads and contacts of microcircuits and switches. It's about the best conductor of both heat and electricity. It's very maleble (all of those are why it was used as shielding on the LEM (Lunar Excursion Module)

88

posted on

05/27/2010 9:18:17 AM PDT

by

El Gato

("The second amendment is the reset button of the US constitution"-Doug McKay)

To: Hacklehead

Not sure of your logic. Under those circumstances a gold coin can buy many loaves of bread as well as other more durable things. After you eat the bread, what do you have?There it is. You caught my irony. My response is that the immediate need might be to survive the day, retail (a loaf of bread); but the yearning of my spirit is to THRIVE many days, wholesale (the gold coin).

You are right. The gold coin buys many loaves, more than I could ever eat before it goes mouldy. Same problem as the farmer, only different. My job with those many loaves is to turn around and sell them to the demand of my neighbors (while still fresh as possible), for which they are willing to give up something of value. I am going to insist on something durable and portable: gold, silver, diamonds, emeralds. And so I thrive. Rinse and repeat.

Yes, I should have answered, "The gold coin, by far"; but first things first; and you not only got my point, you made it.

89

posted on

05/27/2010 9:18:28 AM PDT

by

Migraine

(Diversity is great... ...until it happens to YOU.)

To: Gilbo_3

When everybody is trying to sell you ANYTHING 24/7, don’t buy it.

90

posted on

05/27/2010 9:24:37 AM PDT

by

stephenjohnbanker

(Support our troops....and vote out the RINOS!)

To: Gilbo_3; SeekAndFind; stephenjohnbanker; NFHale; hiredhand

RE :”

talkin to an ole timer last nite that lived thru the last depression...’nobody had ANY money...even the millionaires were hurtin, they mightve had $10 mil in land [or gold] but it was vitually worthless if nobody could afford to buy it’”

My grandmother would eat our leftover food (if it was unspoiled) rather than throw it out because she remembered being hungry during and before the great depression. Even if it was unrealistic she would tell us she would eat it if we hadnt touched it. My sibling even with many debts (a typical american consumer) will throw away whole plates of her kids food everynight and say that it is normal. Thus the consumer nation.

91

posted on

05/27/2010 9:27:43 AM PDT

by

sickoflibs

( "It's not the taxes, the redistribution is the federal spending=tax delayed")

To: Broker

WW2 Nazi took gold fillings along with all their conquered loot to Switzerland. Gold fillings used to be burial insurance payments. Did they realize a return on their investment? The dead didn't, but the Nazi's apparently did.

92

posted on

05/27/2010 9:30:42 AM PDT

by

OB1kNOb

(When injustice becomes law, resistance becomes duty. - Thomas Jefferson)

To: Anitius Severinus Boethius

Silver would be better than gold in that circumstance. Those that are pushing gold are not talking about the great depression, though, they are talking about a “collapse” where fiat money is worthless. Your grandparents used paper (fiat) money to survive the depression. Silver would be better as "carrying around money", but gold is more compact per loaf of bread equivalent. You could always trade some gold for a bunch of walking around money, just as today (or before ATMs) you could take a couple of hundreds and exchange them for smaller denomination bills. (I gave a Blimpies worker a $100 earlier in the week, you'd think I'd given him a 10K note. It was partial repayment of a loan I'd made to my daughter, she in turn had gotten it from she and husband's "boarder" for his share of the rent money.

Actually my grandparents used a lot of barter, and if there had been no paper money, they could have done OK just using barter. (Although buying from the Sears and Sawbuck or Monkey Wards would have been difficult if all you had to trade was a few hundred dozen eggs. Sending in a little gold would not hav been much problem) The problem with paper money is that the government can print more, diluting the value of that which individuals hold. They can't easily get more gold, silver, or any other tangible so as to decrease it's purchasing power. Meaning that paper/fiat money is not so good for maintaining a "rainy day" or "emergency" store of value. Land is not as liquid as gold or other precious metal.

Nothing is perfect, but paper money (or electronic money) puts too much power in the hands of government and it's central bankers.

93

posted on

05/27/2010 10:07:38 AM PDT

by

El Gato

("The second amendment is the reset button of the US constitution"-Doug McKay)

To: SeekAndFind

94

posted on

05/27/2010 10:16:41 AM PDT

by

Alex Murphy

(Pretentiousness is so beneath me.)

To: ryan71

“Food, water, guns, bullets.”

And magazines. gotta feedz the bulletz into the magz, and the the magz into the gunz......

95

posted on

05/27/2010 10:19:27 AM PDT

by

roaddog727

(It's the Constitution, Stupid!)

To: Gilbo_3

talkin to an ole timer last nite that lived thru the last depression...’nobody had ANY money...even the millionaires were hurtin, they mightve had $10 mil in land [or gold] but it was vitually worthless if nobody could afford to buy it’... Of course they were not allowed to own gold after April of '33. Roosevelt took all but minor amounts in jewelry and such at the "official" price.

Could happend again. But BO could take your paper money, he already is, or your land, or anything else you were not willing to shoot his enforcers over.

But I guess many of them did have some cash after that, since my Dad used to ride the trolly to the "rich" part of town to shovel driveways and sidewalks for the rich people who lived there, and he did not do it for free. In '33 he was 11 years old. Interestingly, he recognized the houses when my daughter had her 2003 wedding in one of those that had been converted to a B&B, even though the Alzheimer's was already getting it's teeth into him by then.

96

posted on

05/27/2010 10:23:39 AM PDT

by

El Gato

("The second amendment is the reset button of the US constitution"-Doug McKay)

To: roaddog727

And magazines. gotta feedz the bulletz into the magz, and the the magz into the gunz...... Unless you have revolvers and lever or bolt actions, or other types with internal magazines. If you have a Garand, or a few other types, you need clips.

97

posted on

05/27/2010 10:26:37 AM PDT

by

El Gato

("The second amendment is the reset button of the US constitution"-Doug McKay)

To: El Gato

gotz themz as well. plenty of clipz (for the Garand)

98

posted on

05/27/2010 10:29:24 AM PDT

by

roaddog727

(It's the Constitution, Stupid!)

To: SeekAndFind

99

posted on

05/27/2010 10:49:10 AM PDT

by

two23

(Everything about them is a lie)

To: Anitius Severinus Boethius

Over time, gold always tracks with inflation. Sure, any 5 year period may deviate significantly...and if you are lucky enough to know when to get in and get out, you can make some money...it is a commodity market...but as a long term investment as a hedge against inflation, no so much.

100

posted on

05/27/2010 11:35:38 AM PDT

by

lacrew

(Barack Obama is always the least experienced most condescending guy in the room. (Rush))

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-116 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson